Each month we release improvements, new features and bug fixes to MYOB Business. Listed below are releases from previous months. If you want to find out about more recent releases, see what's new in MYOB Business.

2025

December 2025

Payroll

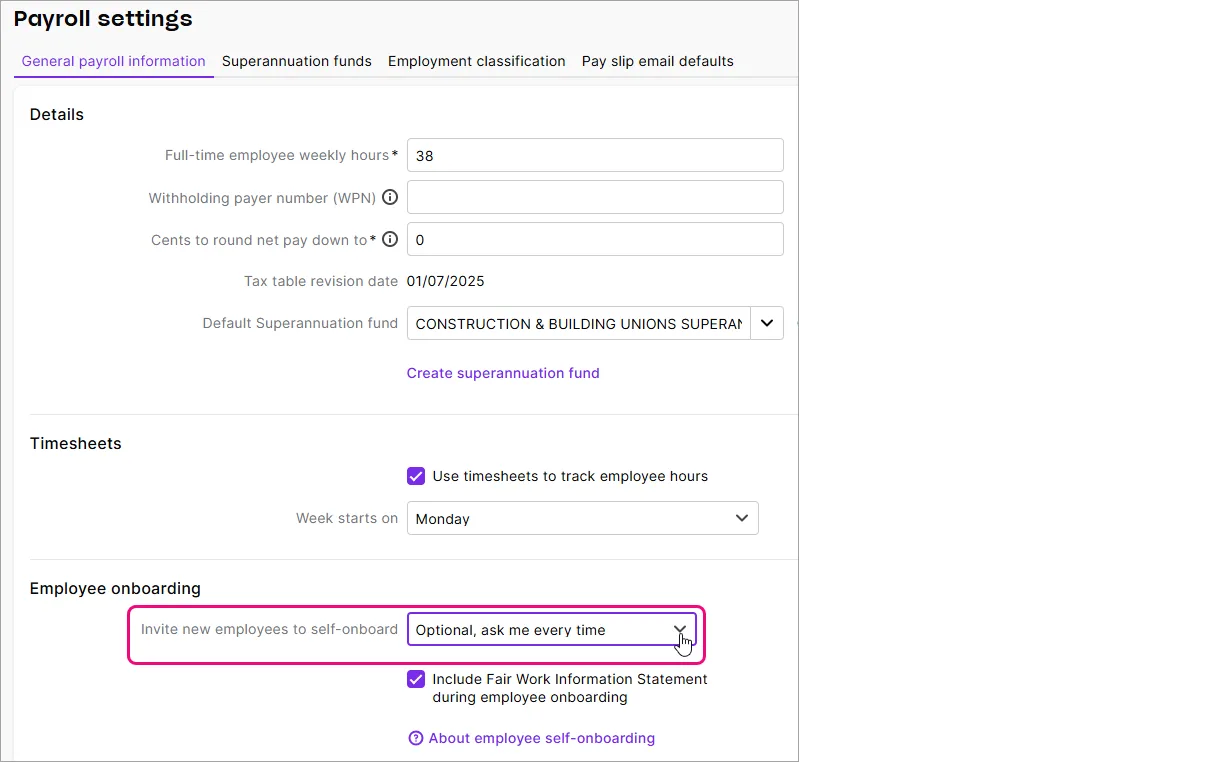

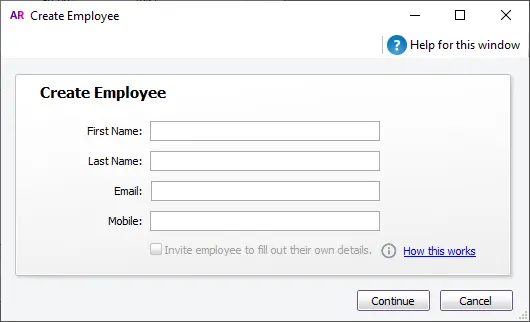

More control over employee self-onboarding (Australia only)

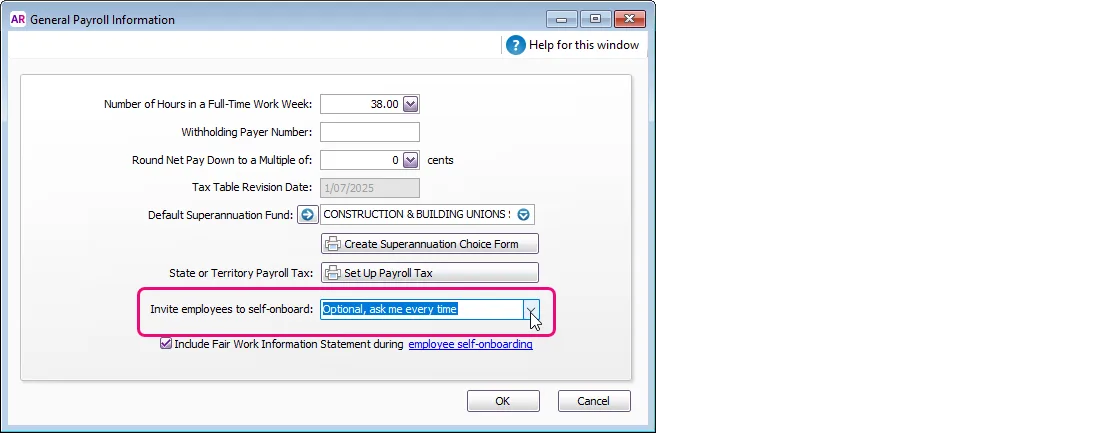

When you set up new employees, by default they'll be sent an invitation to self-onboard to submit their own details into MYOB Business. This means all you need to do is add their payroll info. But if you prefer to manually add an employee and enter all of their details yourself, we've added a new payroll setting you can turn on to allow this (settings menu (⚙️) > Payroll settings > General payroll information tab > Employee self-onboarding). More about self-onboarding

Banking

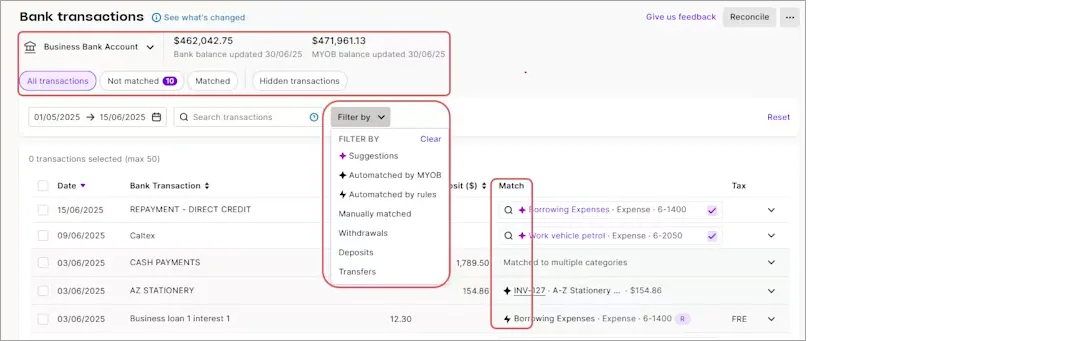

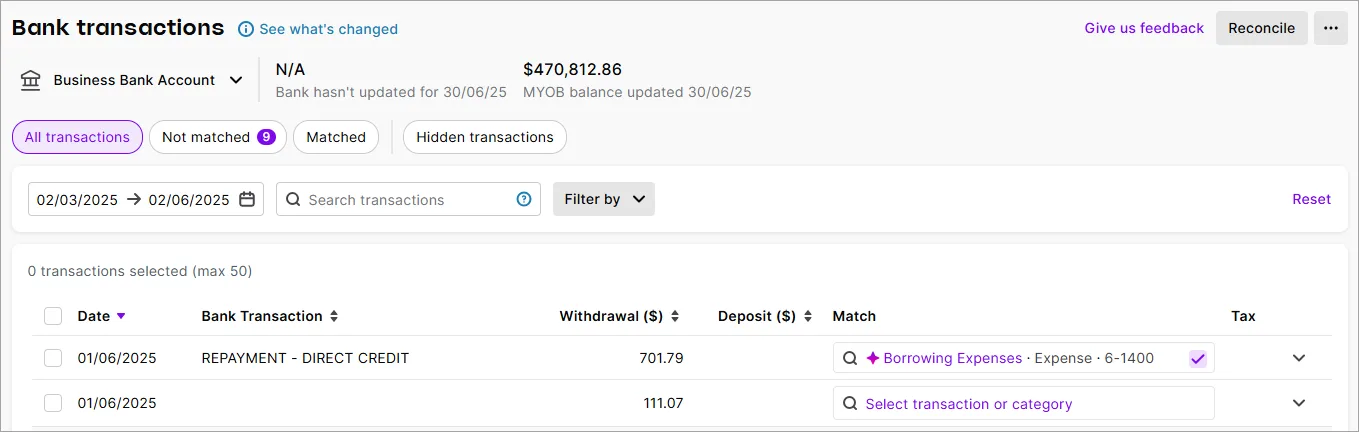

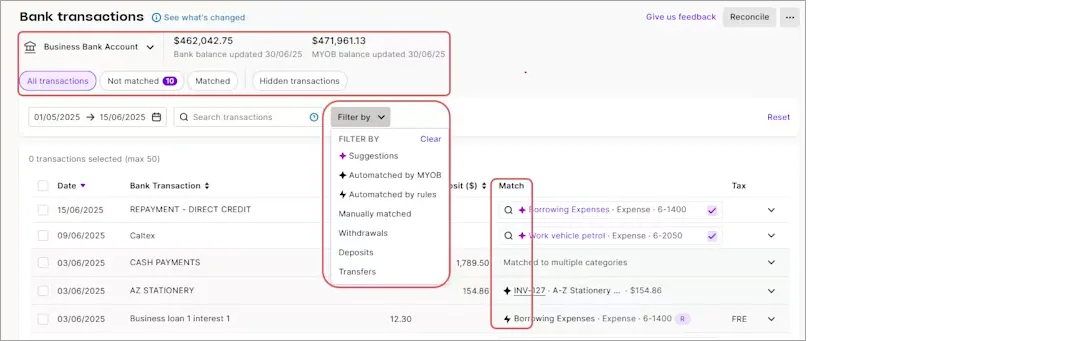

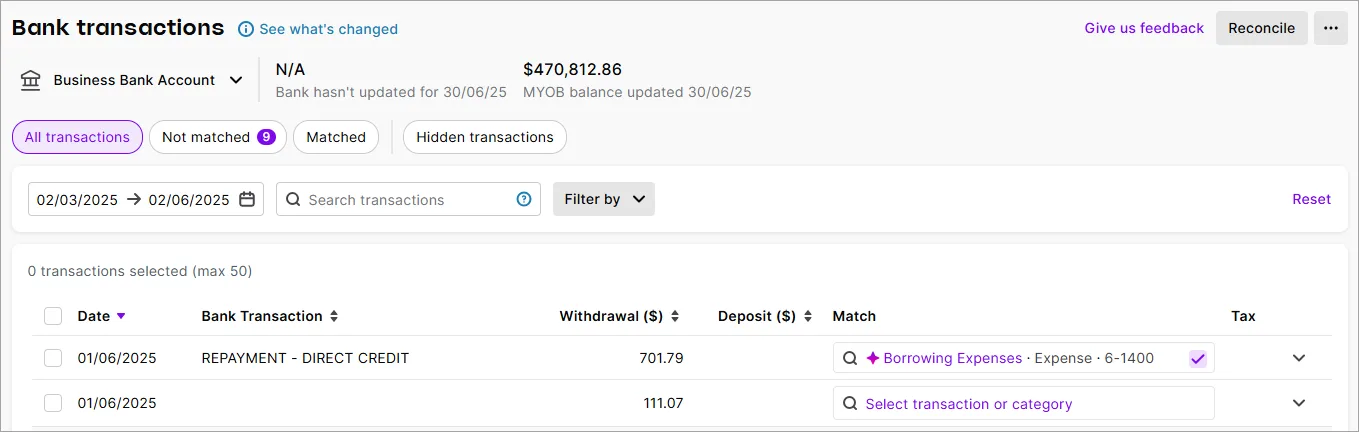

An improved, smarter banking experience

We've finished rolling out the updated Bank transactions page. The refreshed design has several time-saving improvements, like artificial intelligence to learn from how you categorise transactions to help suggest more accurate category suggestions the next time similar transactions comes in. This saves you from searching for a category to match it to. More about working with bank transactions

Get things done faster

We've removed the spinning icon from each line when allocating transactions on the Bank transactions page. There's also more meaningful alerts shown on each line to help you quickly identify and fix any issues as you allocate.

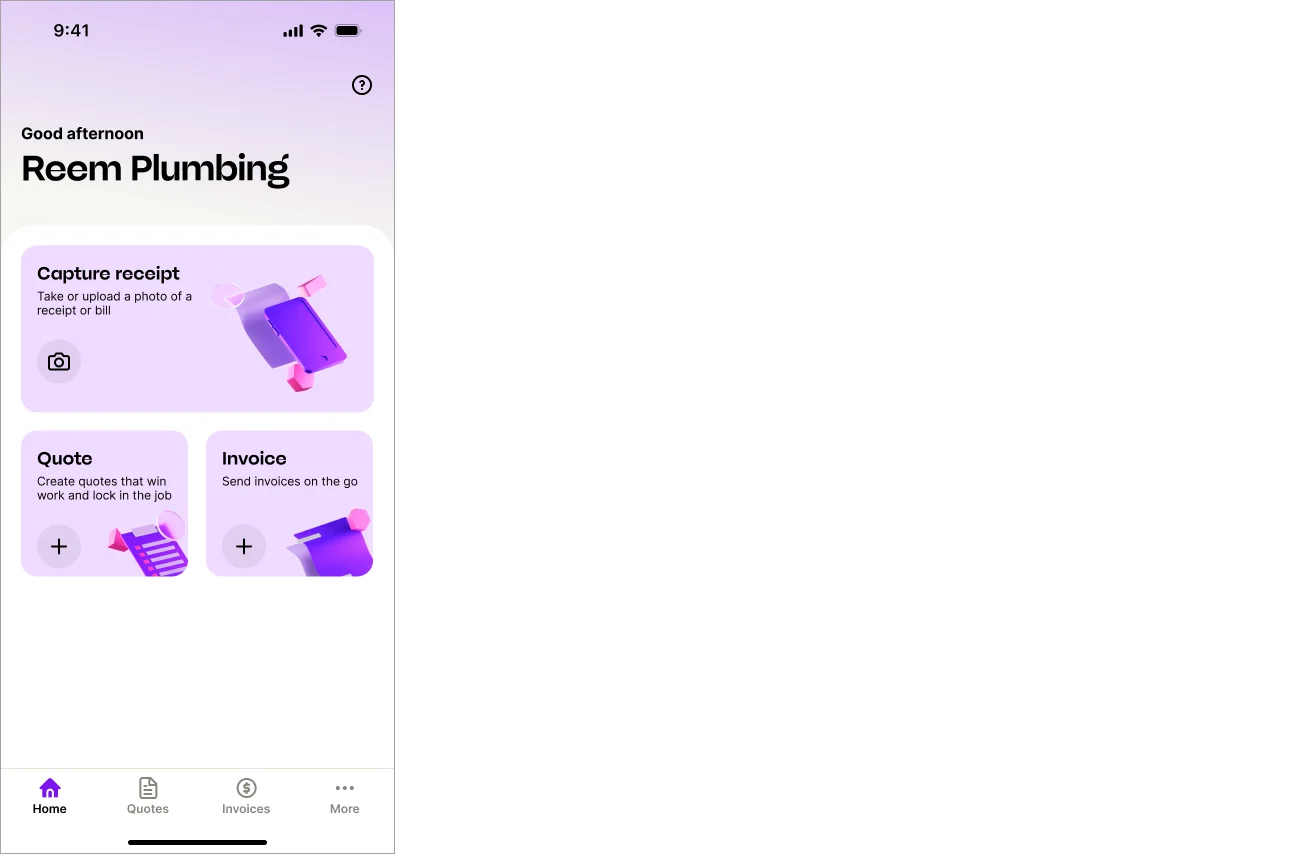

MYOB Assist mobile app

Australia only

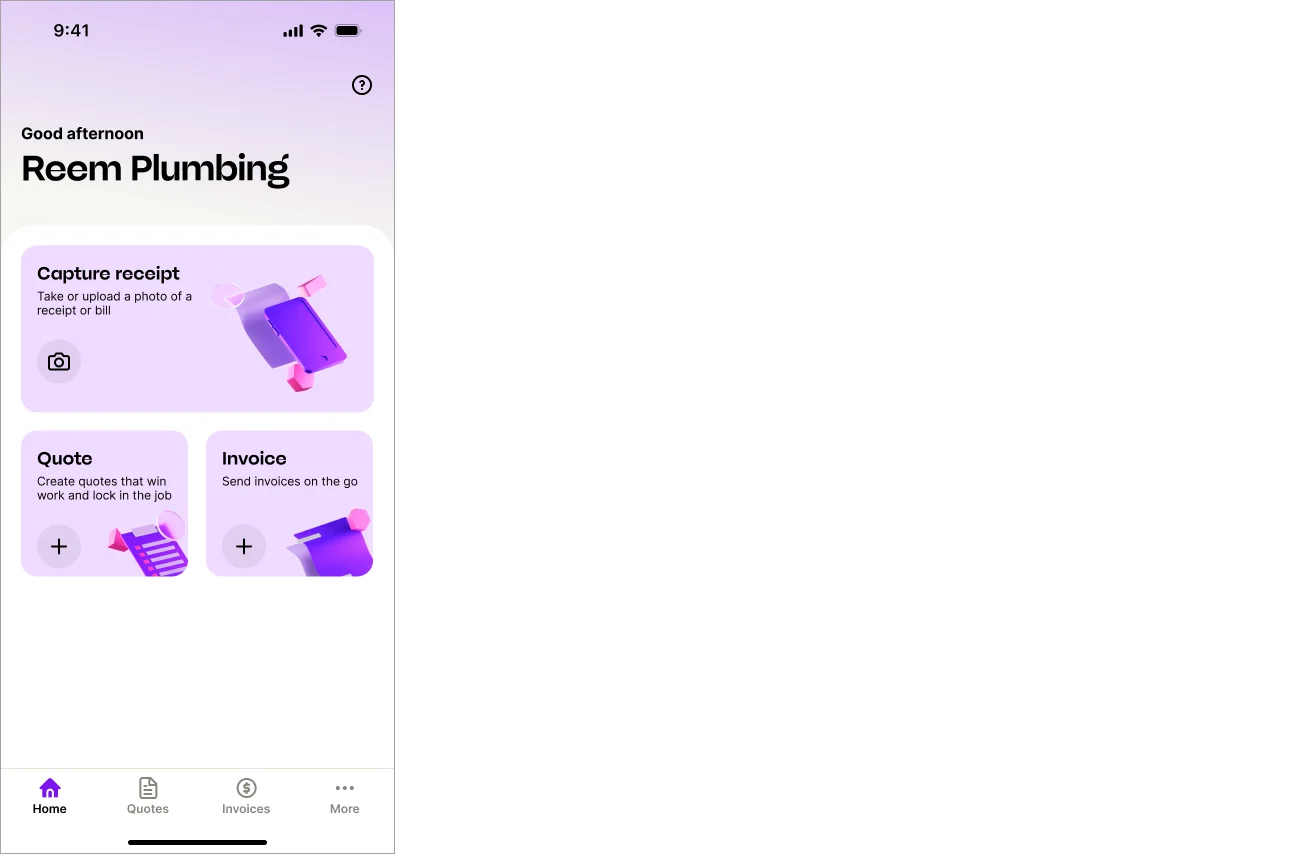

MYOB Assist, the companion app for MYOB Business, keeps getting better.

Quotes are now available

You can now create, send, and manage quotes on the go in the MYOB Assist app. This makes it easier for you to start a job in the field, send a quote straight from your phone, and turn it into an invoice when the work’s approved — all without leaving the app.

November 2025

Banking

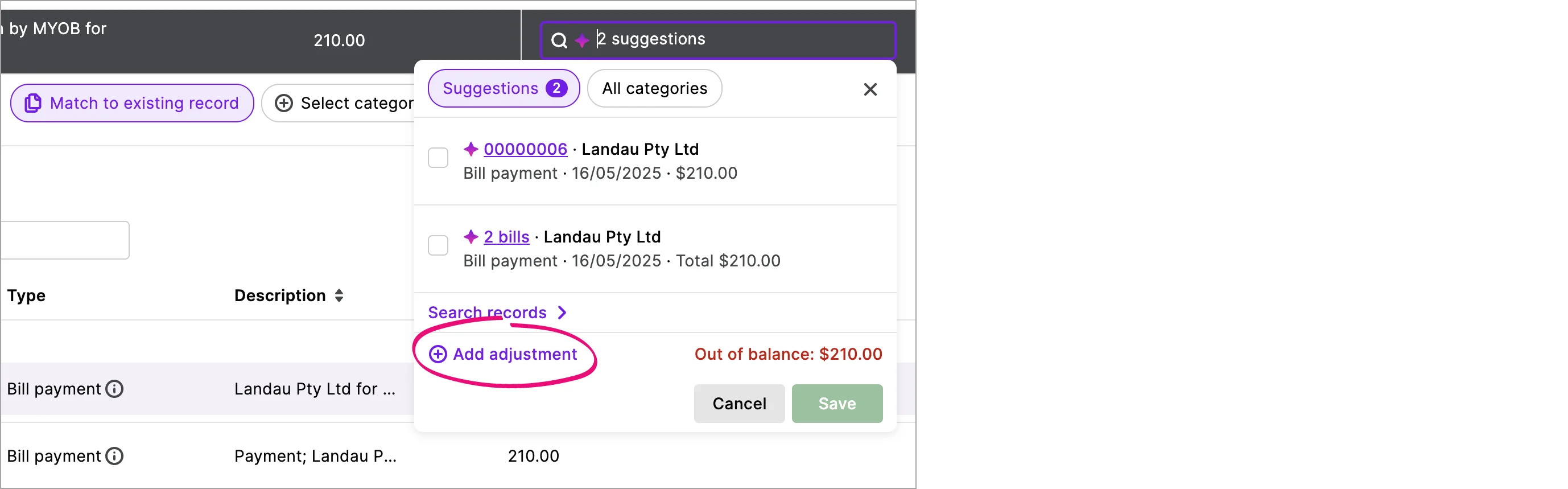

Quickly add adjustments when categorising transactions

When you use the quick dropdown to see suggested matches, you can now easily add an adjustment if transaction amounts don't match exactly.

Save time with more accurate category suggestions

When your transactions come into MYOB Business from a connected bank account, we've improved the category suggestions to make them more accurate and useful.

Smarter matching of money transfers

When you transfer money from one related bank account to another, this will be automatically matched if both sides of the transfer are within 7 days.

Work faster with an improved Bank transactions page

Every moment counts when you're busy – so we've made several enhancements to speed things up. The Bank transactions page now loads quicker, and allocating single line transactions is faster.

Payroll

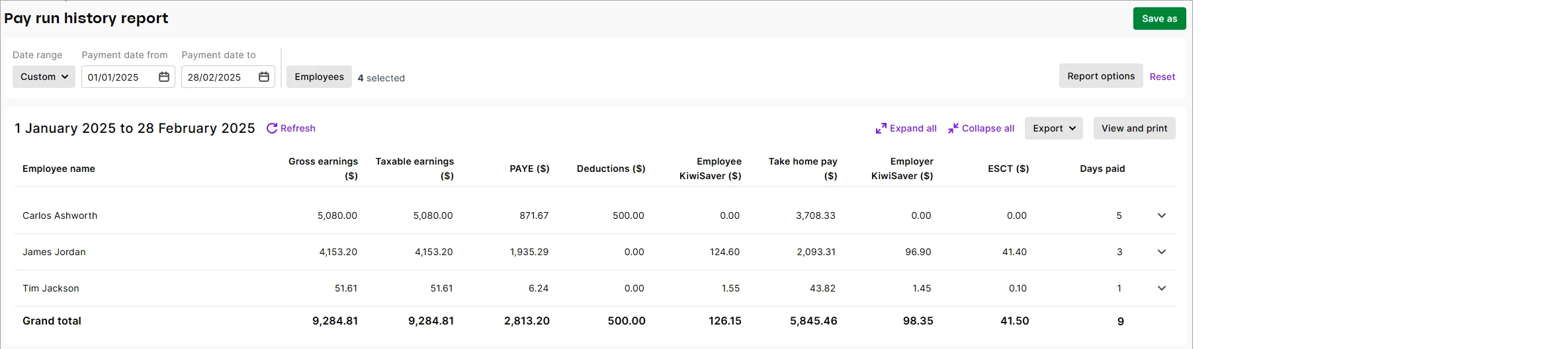

Payroll history at a glance (New Zealand only)

The new Pay run history report gives you details of past pay runs for a specified date range. This consolidated view provides quick access to historical payroll information, making auditing and reporting faster and more accurate.

MYOB Assist mobile app

Australia only

MYOB Assist, the companion app for MYOB Business, keeps getting better.

Let your team upload receipts – without full file access

You can now use the Contacts role in MYOB Business to let team members only capture and upload expenses using MYOB Assist, without giving them full access to your business file. This helps keep your reports, financials and other sensitive data protected. More about managing users

MYOB Business bug fixes

We fixed an issue that could cause duplicated bank transactions to show on the Bank transactions page.

October 2025

MYOB Assist mobile app

Australia only

We're refining the app to make it even easier to use:

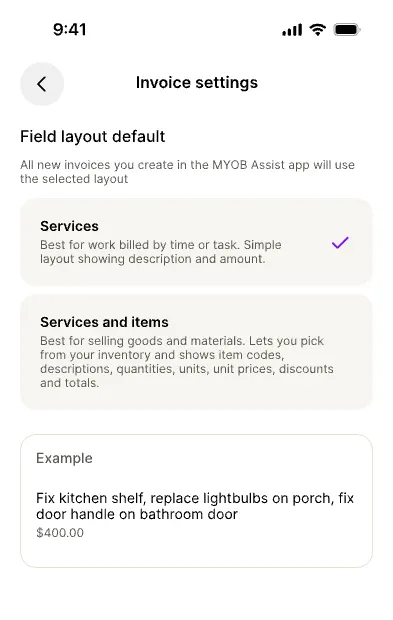

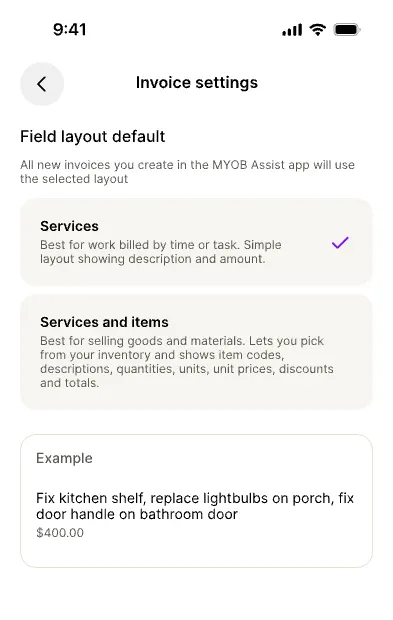

Introducing Service invoices

If your business provides services rather than products, you can now choose a Service layout when creating an invoice. This layout is designed for service-based work, where you bill for time, labour, or descriptions of work instead of items or quantities. These invoices are editable within AccountRight browser and MYOB Business.

Set your default invoice layout (Services or Services & Items) from the More menu.

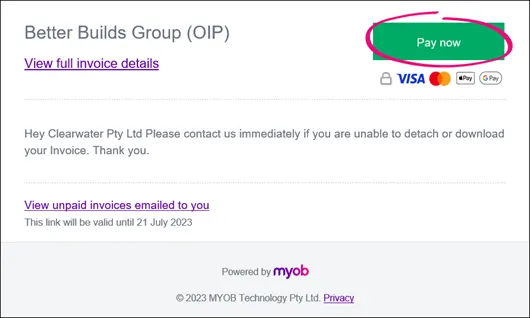

(Online invoicing users) Send invoices with a payment link via SMS

If you use online payments, you can now send your customers a secure payment link by SMS — not just a PDF attachment. This makes it easier for customers to view and pay directly from their phone. You can send the SMS from the Save menu or by turning on the SMS option when emailing an invoice.

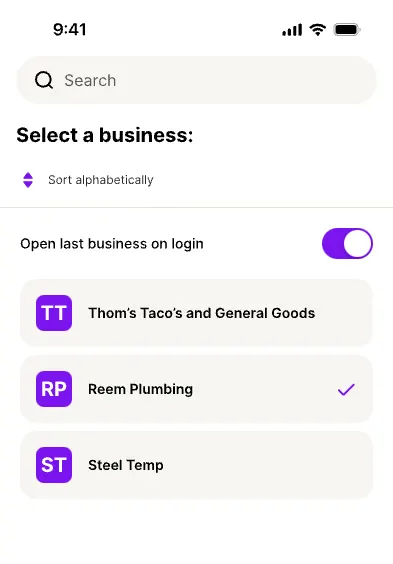

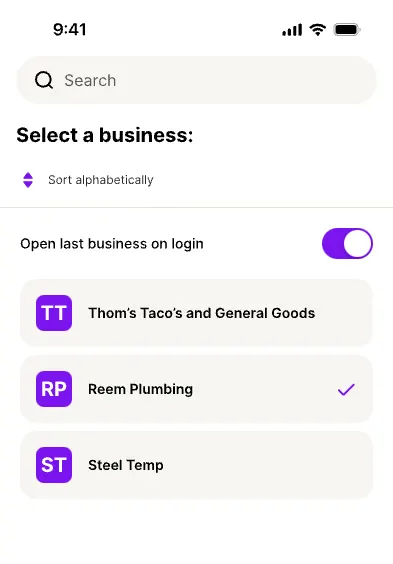

Automatically open your last business file

Save time every time you log in — the app now remembers the last business file you used and opens it automatically. If you usually work from one business file, you no longer need to select it from the list each time you sign in. Just select Open last business on login on the Switch business page, and each time you log in, you’ll go straight into the business file you last used.

You can still switch files anytime from More > Switch business..

MYOB Business bug fixes

We fixed an issue that could cause errors and poor performance when categorising transactions on the Bank transactions page.

We fixed a bug that could result in duplicate transactions when bank transfers are automatically matched.

September

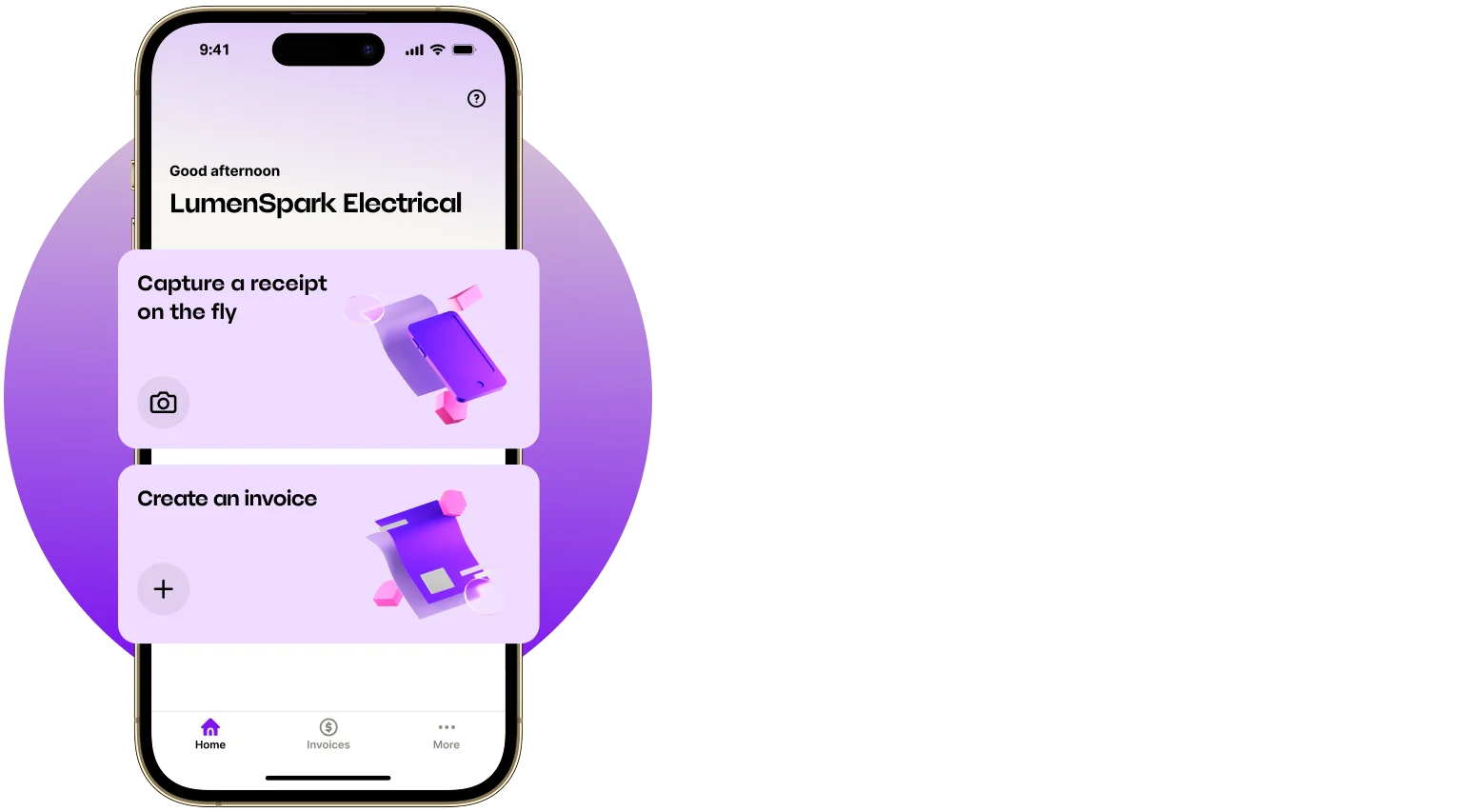

The MYOB Assist mobile app is here (Australia)

This app is now live in Australia and replaces the existing MYOB Capture and Invoice apps. MYOB Assist helps you to unlock better cash flow. With the new app, you can:

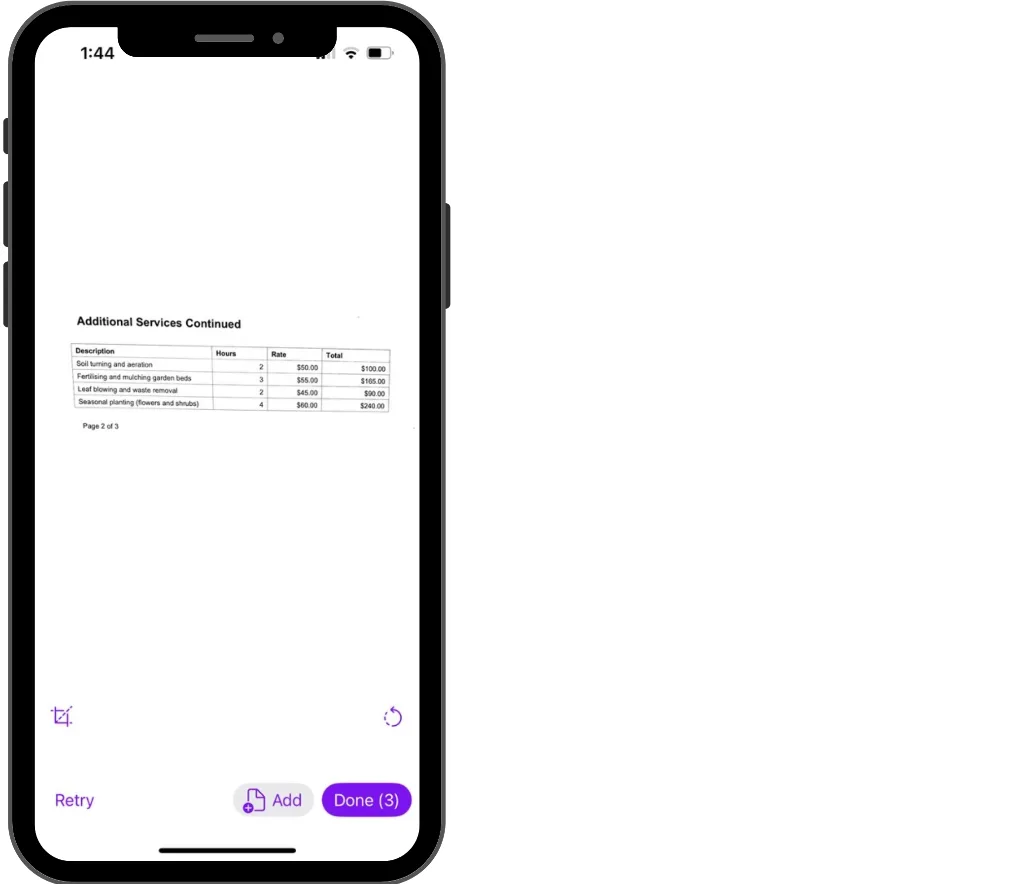

Capture expenses – snap a photo of a bill or receipt and send it straight to your MYOB Business Uploads (or the In Tray for online AccountRight files). Capture single or multi-page documents (up to 20 pages), ready for uploading.

Create invoices – create, edit and send professional invoices in just a few taps – all synced in real-time with your online company file.

Banking

Smarter suggestions

We've improved the suggested matches on the Bank transactions page to make it quicker and easier to match your invoices and bills. MYOB Business now looks for full names in transaction descriptions, not just parts of names, so you get more accurate suggestions.

Improved auto-matching

Auto-matching no longer happens if the date of an MYOB transaction is later than the bank transaction date. Instead, you'll now see a suggestion.

Faster transaction allocation

We've made some performance improvements so that you can allocate transactions line by line faster using hot keys or moving quickly down the page.

Less clutter

We've removed some annoying success messages from the Bank transactions page so you can work with fewer disruptions.

August

Payroll (Australia)

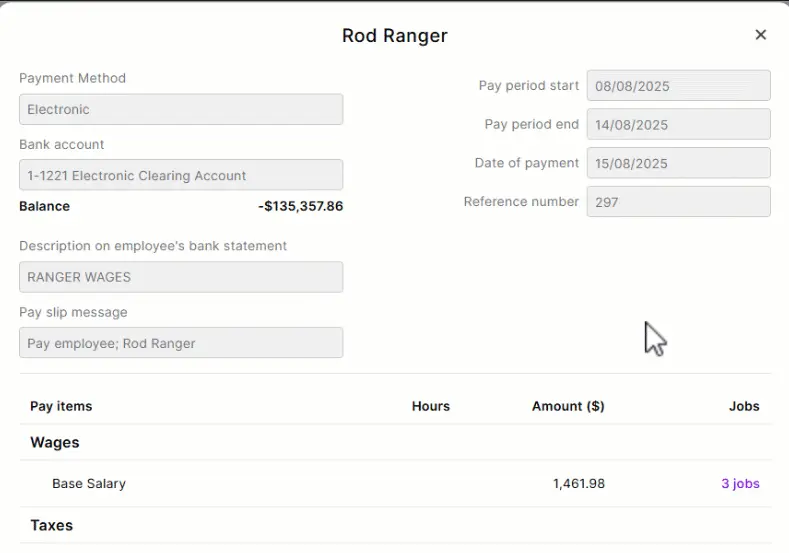

See jobs in past pay runs

When you look at an employee's previous pay, you'll now see if any jobs were assigned and the job allocation.

Banking (New Zealand)

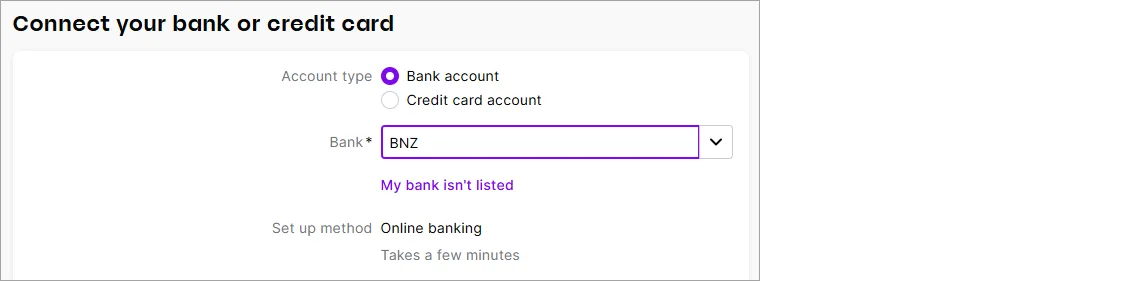

Quicker setup of BNZ bank feeds

BNZ improved how their bank and credit card accounts connect to MYOB. This means you can now connect a BNZ account to MYOB Business faster by applying online. Previously you needed to fill in and submit an application form. Connect a BNZ account

July

Banking

Save time with a smarter Bank transactions page

We’re gradually rolling out changes to the Bank transactions page to make matching faster, smarter and less manual. If you don’t see these changes yet, they’re not far away:

Category suggestions save you time and guesswork MYOB Business uses artificial intelligence to learn from how you previously matched a transaction to a category to suggest a matching category the next time a similar transaction comes in. This saves you from searching for a category to match it to.

You can accept the suggestion with one click (or easily choose another category from the list).

When you accept a category, MYOB Business creates the matching transaction record for you.

Simpler teminology With the introduction of category suggestions, we’ve replaced ‘categorising’ with ‘matching’. Now, you match bank transactions to a category.

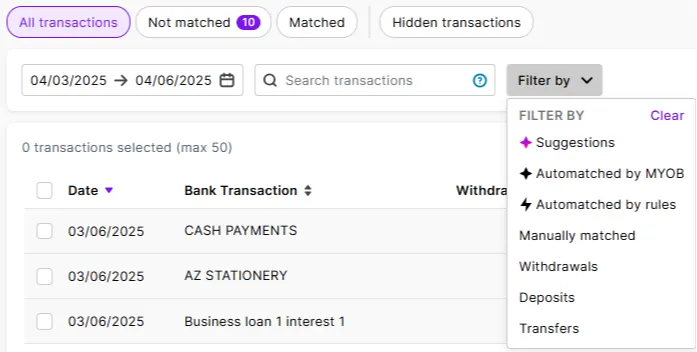

Better searching We’ve simplified and improved the search filters. Use the Not matched filter to show all bank transactions waiting to be matched. You can also filter the transaction list by suggestions, automatches, or transaction types.

These changes are still being rolled out to all businesses, but here's how you work with the new design.

More reliable bank feed delivery times

The daily delivery of transactions from your connected bank accounts now happens by 11am each morning (Melbourne time). This gives you up-to-date banking data sooner, so you (or your automated bank rules) can take care of matching and categorising earlier.

June

Payroll

Reminder: Helping you stay compliant for the 25/26 payroll year (Australia only)

As we mentioned last month, we've taken care of all these changes for the 2025/26 payroll year:

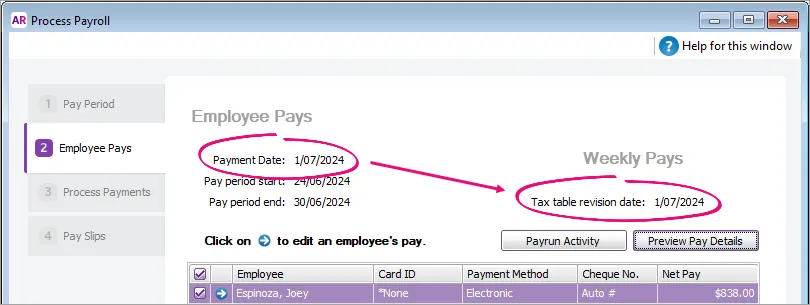

Tax tables – the 2025/26 tax tables have been automatically updated and will apply for pays dated 1 July 2025 onwards. You'll see the new tax table date in your General payroll information after processing your first July pay (settings (⚙️) menu > Payroll settings > General payroll information tab).

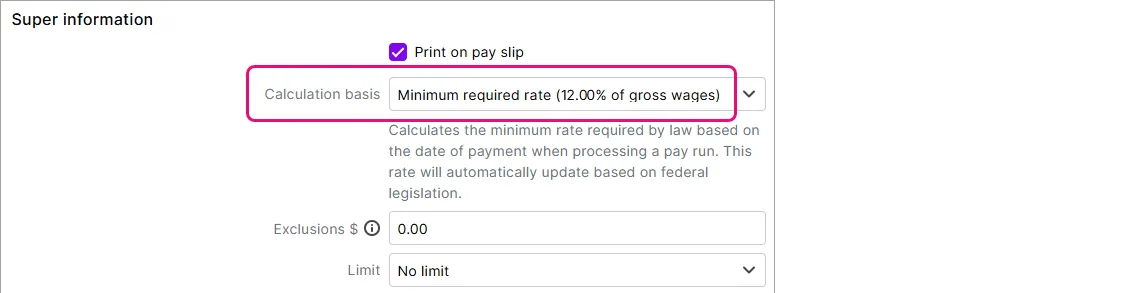

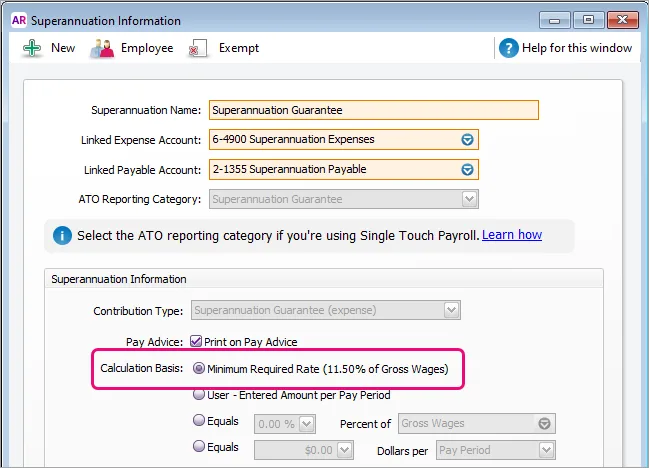

Super rate increase to 12% – the super guarantee rate has gone up to 12% from 1 July, but there's an easy way to make sure this increase happens automatically.

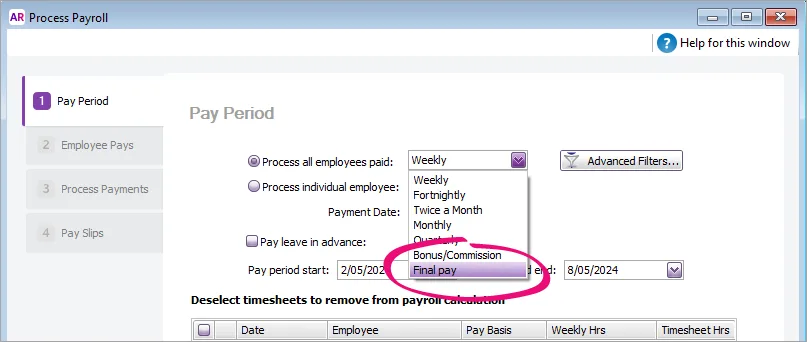

Lump sum E threshold removal – From 1 July, any payment of back pay is considered a lump sum E. Previously this only applied to back pay exceeding $1200.

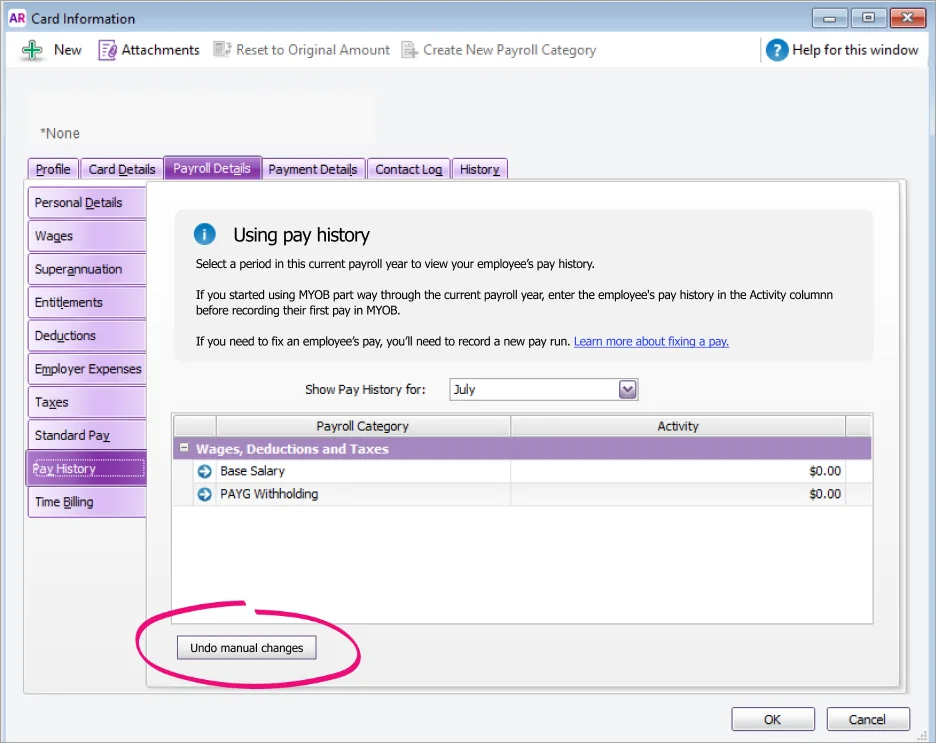

Undo manual changes to pay history (Australia only)

An employee's pay history shows what they've been paid in pay runs, so should never be tampered with. We've added the ability to Undo manual changes in an employee's Pay history to easily remove any changes that have been entered manually (maybe trying to fix a pay). Previously you needed to contact us for help to undo these changes.

New workers compensation report (Australia only)

We're adding a new report that helps prepare wage estimates and declarations required by workers compensation providers. Use the report to generate the payroll information needed when starting or renewing a workers compensation policy. You'll find the report via the Reporting menu > Reports > Payroll tab.

Account management

Easier MYOB account update processes

We've made it easier to update the relationship your business has with MYOB, whether you want to:

Clearer change of details forms and help topics guide you through what to do and what supporting documents you may need to provide.

Bug fixes

We fixed a bug that was preventing the tax amount from showing on general journal transactions in the General ledger report.

May

Payroll

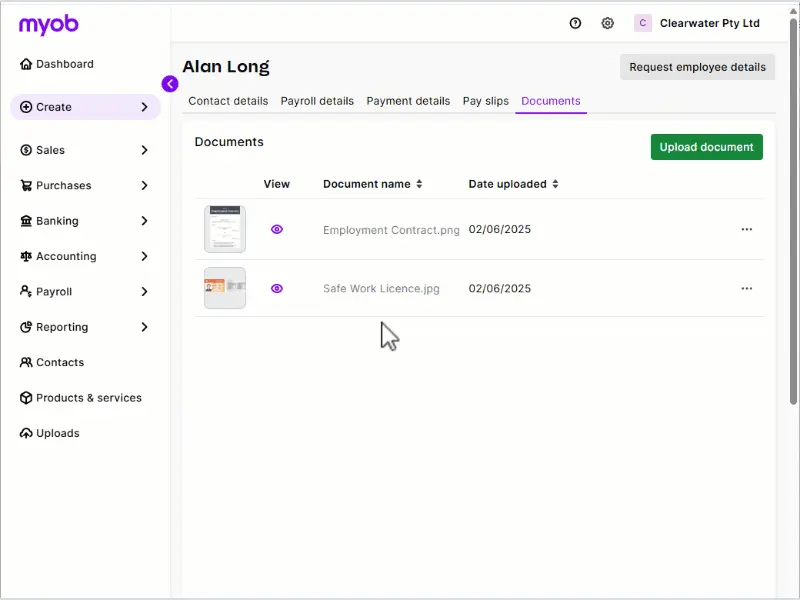

Upload employee documents to stay organised

Store documents, like contracts, licences or certificates, in MYOB Business. This keeps all your employee information safely stored in one place where it's easily accessible. More about storing documents

Helping you stay compliant for the 25/26 payroll year (Australia only)

We've got you covered this EOFY by taking care of all these changes for the 2025/26 payroll year:

Tax tables – the 2025/26 tax tables have been automatically updated and will apply for pays dated 1 July 2025 onwards. You'll see the new tax table date in your General payroll information after processing your first July pay (settings (⚙️) menu > Payroll settings > General payroll information tab).

Super rate increase to 12% – the super guarantee rate goes up to 12% from 1 July, but there's an easy way to make sure this increase happens automatically.

Lump sum E threshold removal – From 1 July, any payment of back pay is considered a lump sum E. Previously this only applied to back pay exceeding $1200.

Improved compliance for self-managed super funds (Australia only)

To pay contributions to a self-managed super fund (SMSF) from MYOB, your STP reports must have been successfully accepted by the ATO. This confirms your business is verified with the ATO and helps ensure SMSF payments are only made by legitimate, registered employers.

Banking

More matches, less admin with smart transaction matching (Early Access Program)

An early access program (EAP) has been launched for changes to the Bank transactions page to make matching faster, smarter and far less manual. A small cohort has been added to the EAP to try this new feature before it's rolled out to everyone.

AI smart-matching – AI will automatically suggest the best match for existing MYOB records or categories. If there's more than one suggestion, select a match, or multiple, from a list of suggestions. AI predictive learning means matching will improve over time based on your behaviour.

"Categorised" is now "matched" – We've simplified how we talk about matching. Bank transactions are now matched to an existing MYOB transaction or matched to a category.

Bug fixes

We fixed a bug that was preventing some users from seeing the dashboard. Previously, users with the Purchases, Banking or Contacts roles were seeing an error stating "You don't have permission to access this page."

April

Payroll

Simplifying STP compliance (Australia only)

When you create a new MYOB Business file, the ATO Reporting Category is now set for you in these pay items:

Base Hourly

Base Salary

Annual Leave Pay

Personal Leave Pay

Overtime (1.5)

Overtime (2x)

This speeds up STP setup and prevents these payments from being reported incorrectly to the ATO.

Helping you stay compliant with super calculations (Australia only)

When you set up a new type of wage payment, like a new allowance, there's a new option to exclude those payments from super guarantee calculations. To help you choose, there's some handy info – just click the blue question mark.

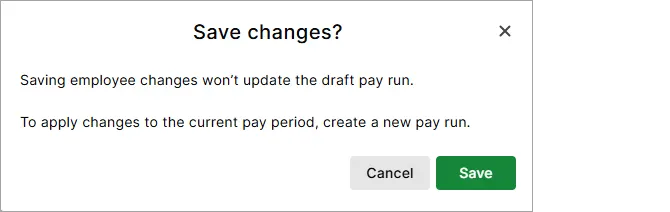

No longer lose a draft pay run when you update an employee (New Zealand only)

If you save changes to an employee who's included in a saved (draft) pay run, the draft pay run is no longer deleted. Instead, after saving the changes (which won't be reflected in the draft pay run), you'll see a message that explains it. It's then up to you whether you continue the draft pay run or create a new one. More about saving and resuming pay runs

Performance improvements

Smarter handling of uploaded documents

We're improving the Optical Character Recognition (OCR) that scans uploaded invoices and receipts to create new bills in MYOB Business. This improves the accuracy and processing times for uploads.

A fresh new colour

We've tweaked the purple colour you'll see in our logo and on images and buttons throughout MYOB Business.

March

Payroll

Helping you stay compliant for the 25/26 payroll year (New Zealand only)

We've updated the required rates and thresholds to keep you in the good books with Inland Revenue (and your employees) for the new payroll year. There's a change to the way extra payments are taxed – and we look after this for you too. See what's changed from 1 April.

More flexible pay distribution (New Zealand only)

You can now split an employee's pay across up to three bank accounts. This gives your employees more control over their funds. An employee can choose to split their pay by amount or percentage and they'll see the split on their pay slip. More about splitting pays.

Sales

Quicker access to online payment settings (Australia only)

Online payments in a popular feature that helps you get paid faster. So we've moved the online payment settings from the bottom to the top of the Payments tab in your Sales settings. This makes it easier to set up and manage online payments. More about online payments

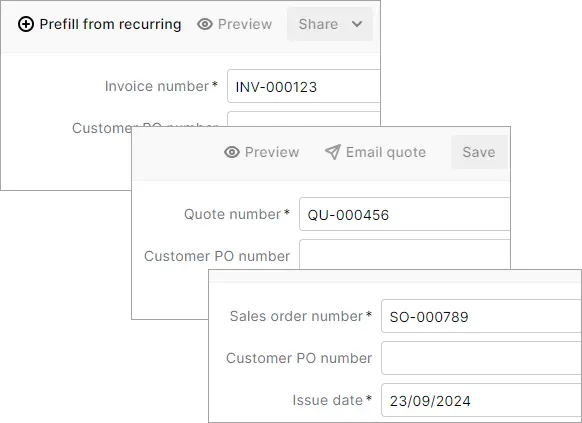

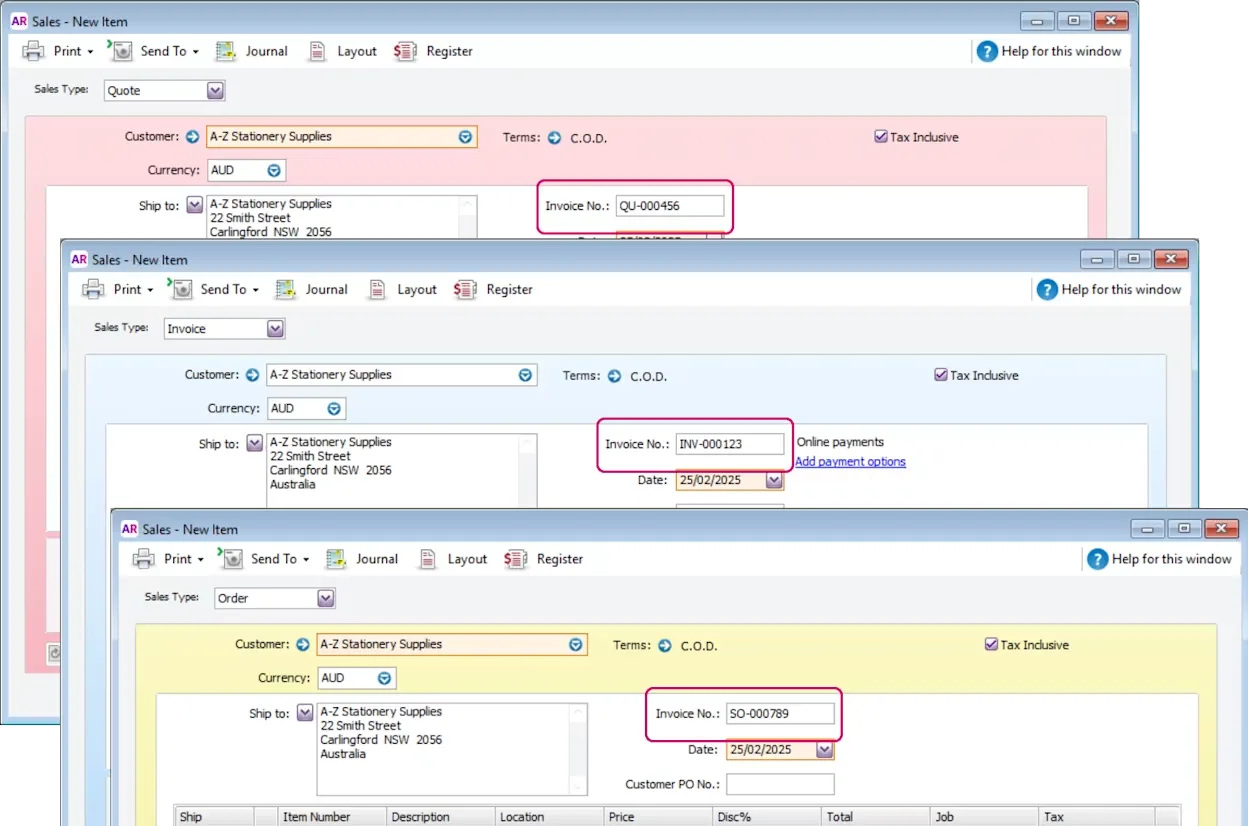

Easier to identify different types of sales

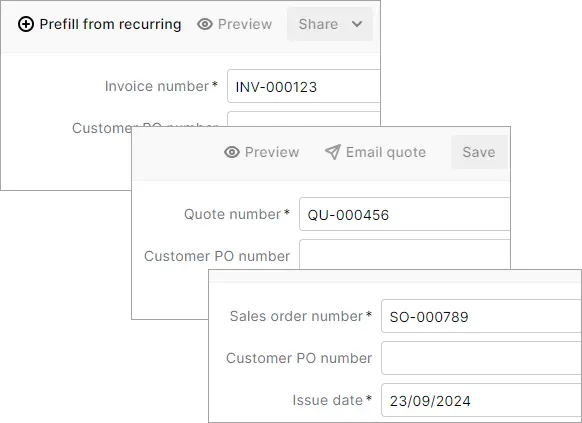

AccountRight browser only

We released this for MYOB Business Pro and Lite last December and it's now available for AccountRight users accessing their online file in a browser. You can set up a different prefix and numbering sequence for your invoices, quotes and sales orders.

Bug fixes

We fixed an issue in the Job profit and loss report that was causing the error "Failed to load the report".

February

Payroll

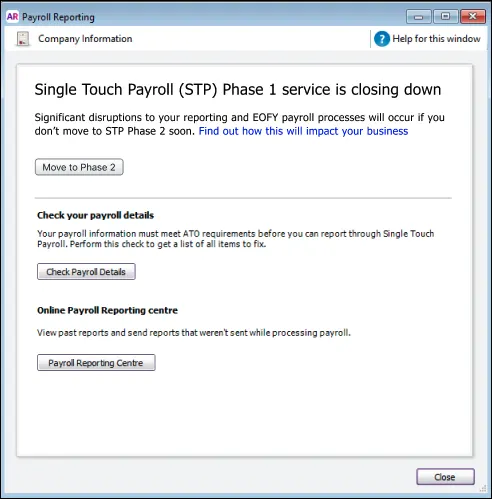

Helping you stay compliant with Single Touch Payroll Phase 2 (Australia only)

STP Phase 1 was switched off 27 February. So, if you haven't switched to STP Phase 2, you need to do so now to continue reporting to the ATO. How to move

See outstanding PAYG withholding at a glance (Australia only)

There's a new widget on the dashboard that shows how much PAYG tax you've withheld from employee pays. This handy snapshot means you no longer need to go searching for this info when it's time to lodge your BAS.

Suppliers

Wise bank account numbers are now supported for suppliers (New Zealand only)

You can now enter a Wise bank account number in the supplier's contact record.

Invoicing

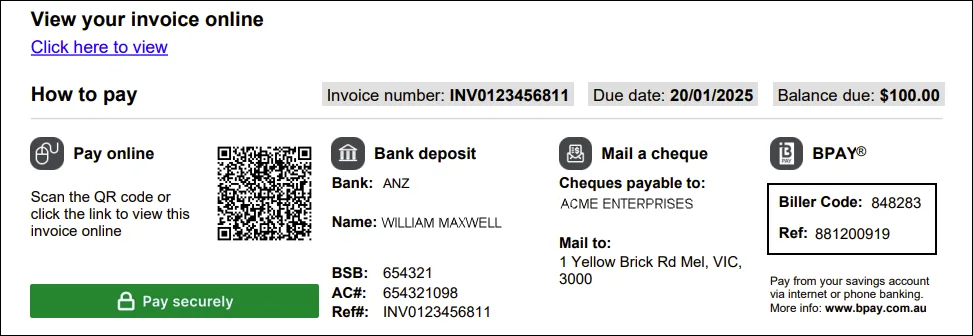

Get paid faster

Payment methods, like bank deposit and cheque, are now shown on customer's statements, making it easier for them to pay your invoices.

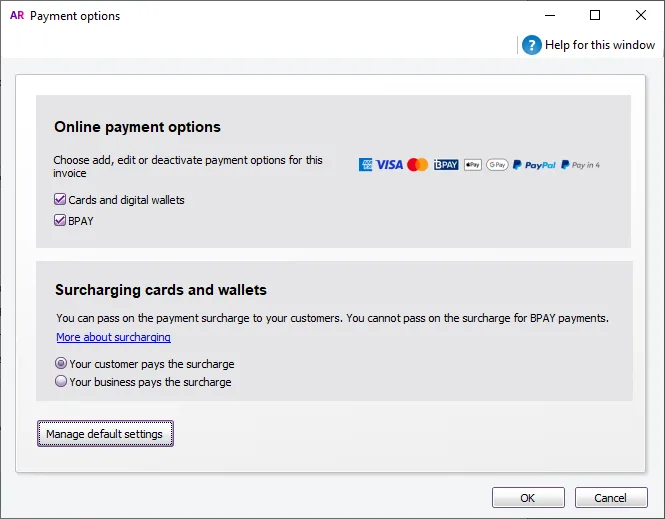

(Online Payments, Australia only) More control over payment methods

You can now enable or disable BPAY payments on recurring invoices.

Bug fixes

We fixed an issue where the bank reconciliation would freeze when trying to reconcile too many transactions. You'll now see a helpful message telling you to choose an earlier reconciliation date to reduce the number of transactions.

January

Payroll

Quicker employee setup (New Zealand only)

If your business is set up for payday filing, new employee details are now automatically sent to Inland Revenue. This means you no longer have to also set up new employees in your myIR portal. There's a new tab in the Payday filing page to see your employee submissions. More about sending employee details to IR.

Security

Helpful nudge in reports before screen locks saves you having to sign back in

Five minutes before the inactivity screen lock, a message will appear at the top of any report you have open. This gives you a chance to resume working before the screen locks.

Banking

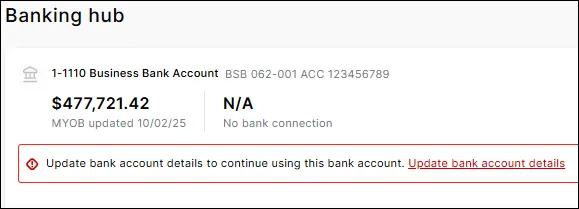

Helping you keep bank details up to date

You'll now see reminders in the Banking hub if any details are missing for your bank accounts, like the financial institution. This helps to keep your account details up to date and provides better visibility of your bank accounts in the one place.

Connect your Great Southern Bank Business + accounts (Australia only)

If you have a Great Southern Bank Business + account, you can now set up bank feeds for it in MYOB Business. You can apply via your internet banking. How to apply

2024

December

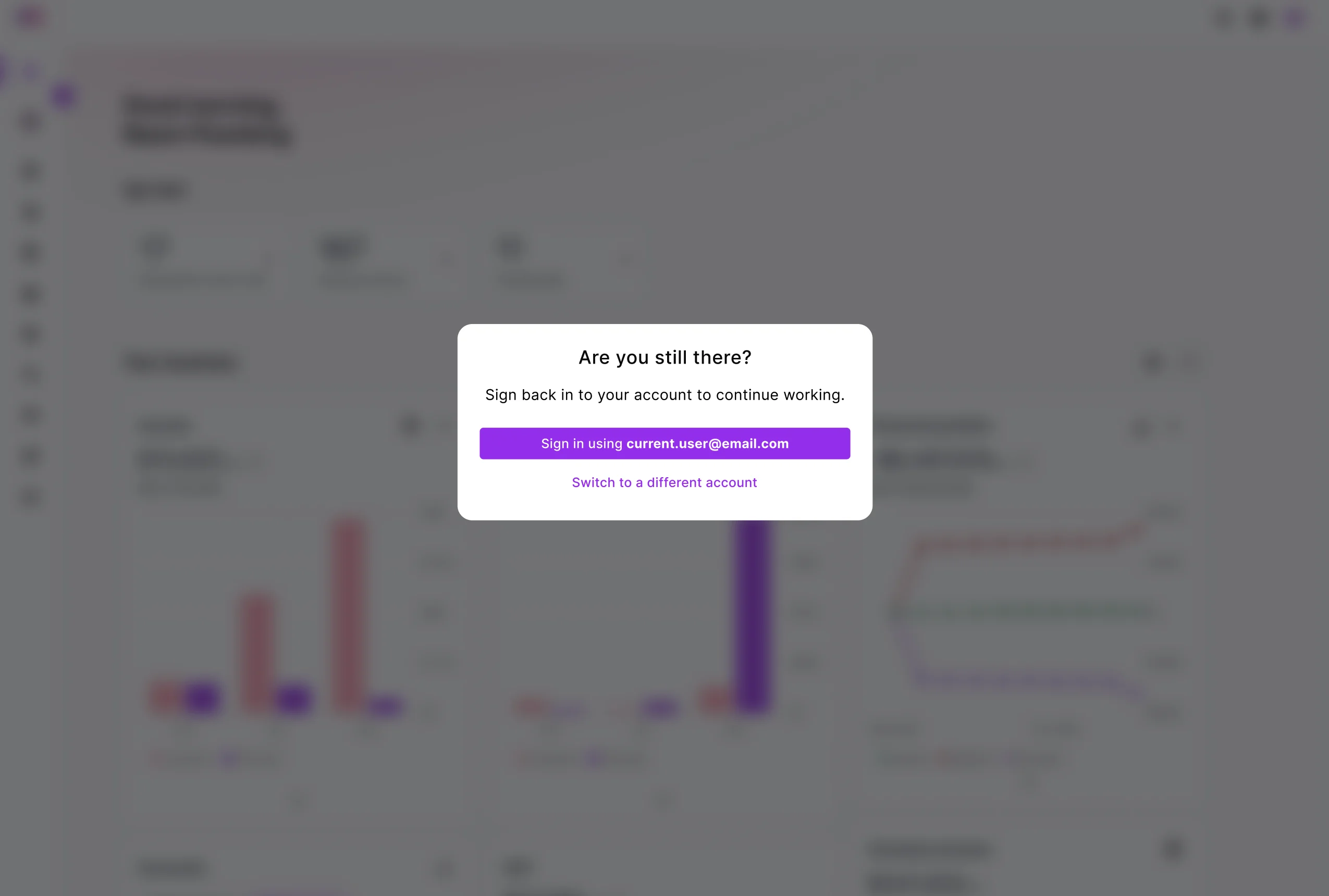

Security

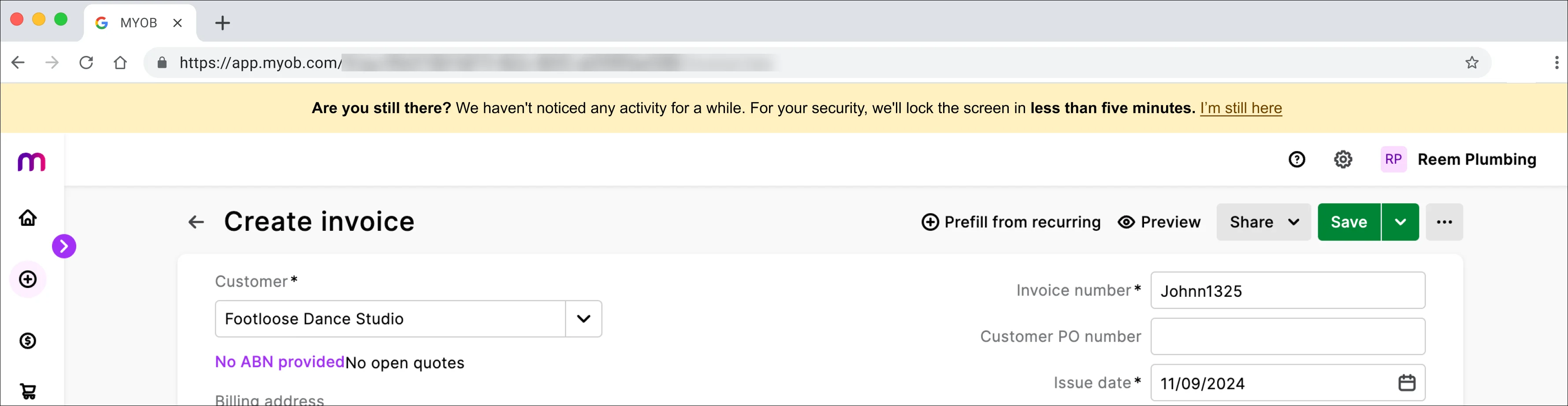

Helpful nudge before screen locks saves you having to sign back in

Five minutes before the inactivity screen lock, a message will appear at the top of any tab you have open. This gives you a chance to resume working before the screen locks:

Sales

Easier to identify different types of sales

MYOB Business Pro and Lite only

You can set up a different prefix and numbering sequence for your invoices, quotes and sales orders.

Banking

Smarter auto-matching of money transfers

If you transfer money from one account to another, the bank transaction will now be automatically matched to the relevant MYOB Business transaction.

Easily reconnect BNZ bank feeds

AccountRight browser users, New Zealand only

BNZ have changed their bank feeds to use a new API-based system. So you can continue using your BNZ bank feeds, we've released the ability to reconnect them.

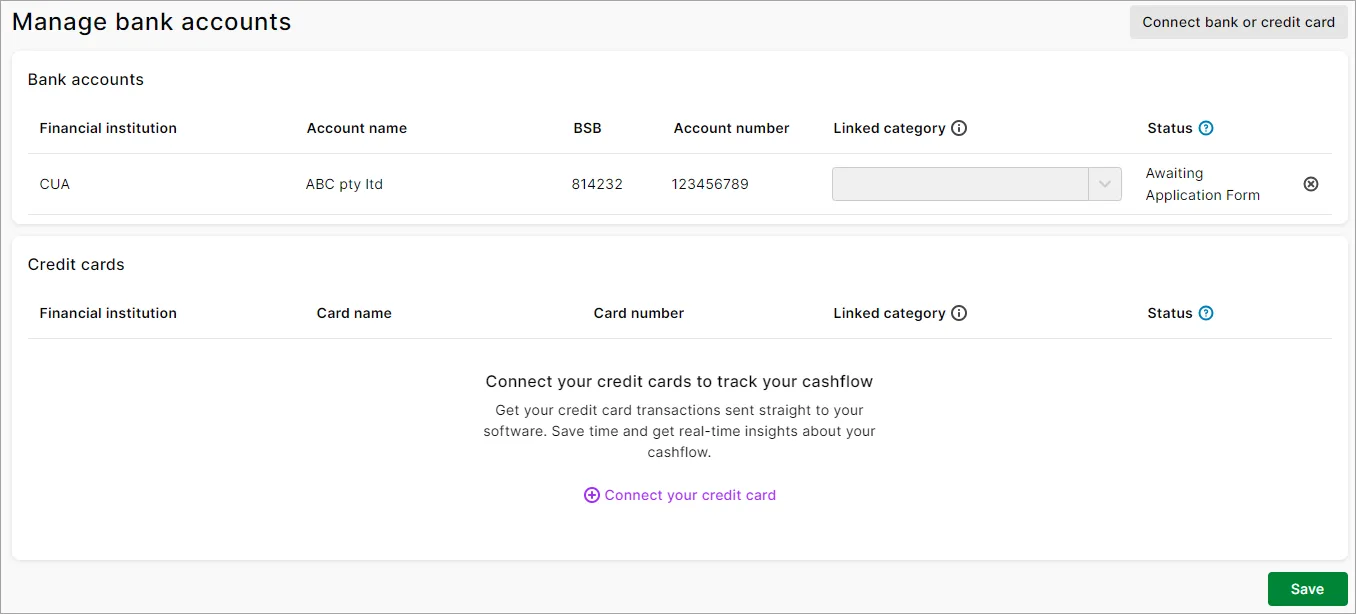

Store more details about your bank accounts

When you create a new category that is a bank account type, you can now indicate what the account is for, like a savings account, and the financial institution. If you haven't entered these details for a bank account, you'll see a reminder in the Banking hub.

November

Security

Keeping your data safe when you're not around

Online data security is a big deal – so after 20-30 minutes of inactivity in MYOB Business, the screen will lock and become blurred. This prevents unauthorised access (and prying eyes) from your valuable business data. To keep working, just sign back in. More about the inactivity screen lock

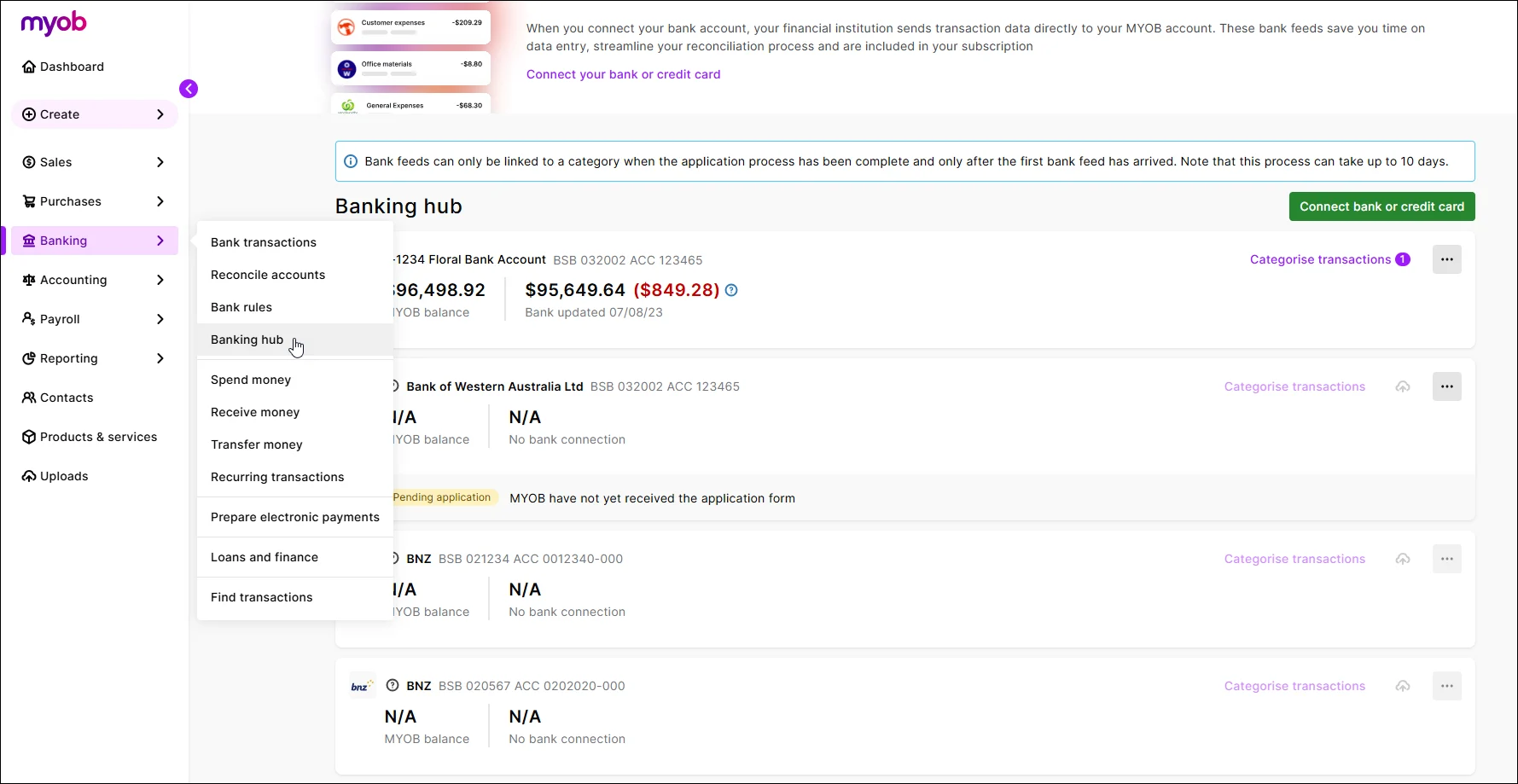

Banking

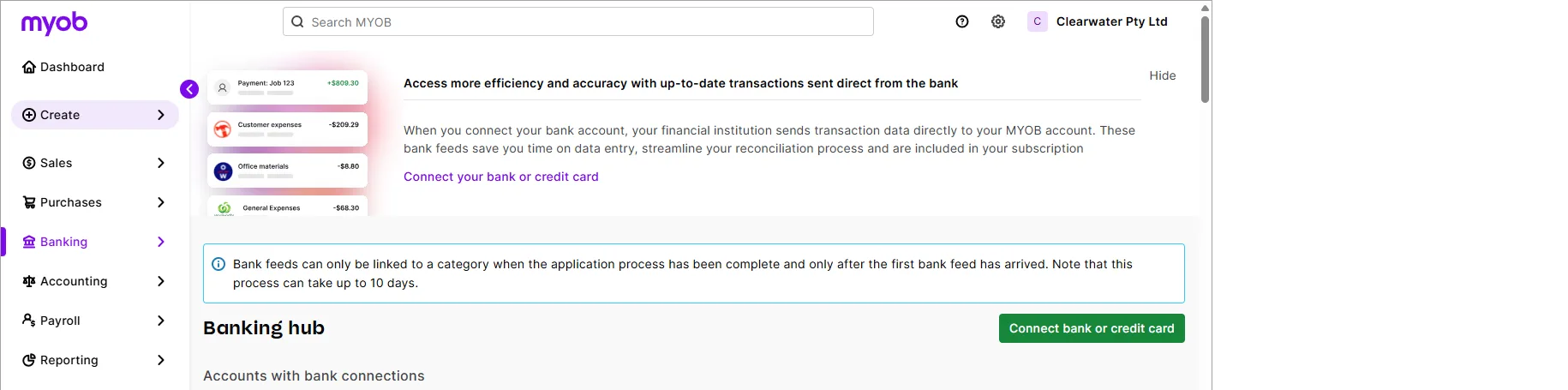

One-stop shop for staying on top of your banking

The Banking hub is your starting point to make sure that your books reflect what's really going on in your accounts. Connect a bank account, manage your bank feeds and see if there are any bank transactions you need to categorise. This replaces the Manage bank accounts page. More about the Banking hub

Smarter auto-matching of refunds

If you give or receive a refund from a customer or supplier, the bank transaction will now be automatically matched to the relevant MYOB Business transaction.

October

Payroll

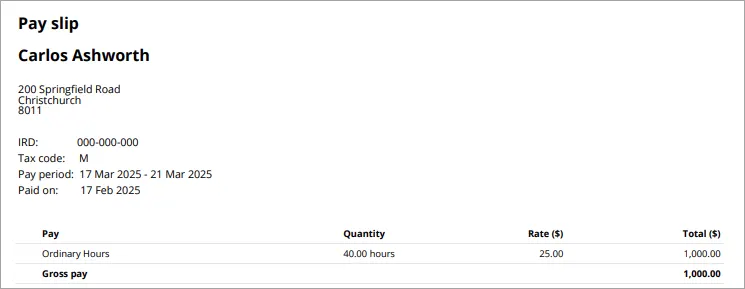

Add your business logo to pay slips

If you have a business logo, you can upload it into MYOB so it appears on all your business documents, including pay slips. Once you upload your logo via settings (⚙️) > Business settings > Brand settings, it'll appear in the top-right corner of all pay slips you generate from MYOB (except the ones you've already saved or emailed).

Banking

Smarter auto-matching of supplier bills

We've improved bank feed automatic matching to use the supplier invoice number in the bank transaction description to match the supplier invoice number entered in the bill payment in MYOB.

Business logo on new files

Making sure your new business file reflects your brand

You're now prompted to add your business logo via settings (⚙️) > Business settings > Brand settings when you start using a new MYOB Business file. This lets you communicate your brand and business details on your invoices, quotes and statements as well as brand your business reports. More about uploading a logo to represent your brand

Usability improvements

Sensible default when creating a new supplier

When you create a new supplier, the option to designate them as a Company or Individual is now selected as Company by default. This reflects that most suppliers are companies.

Bug fixes

Fixed an issue that prevented all lines in a general journal transaction appearing as possible matches in the Bank transaction page > Match transaction tab.

When you select Budget as a report option in the Profit and loss report, the figures in the Budget column are now aligned.

September

Security

Helping you keep your online data safer

Two-factor authentication (2FA) is a key way we keep your data safe. To meet the latest security challenges, we've removed the option to remember your device for 30 days when entering a 2FA code. Instead, you'll now need to sign in and enter a 2FA code at least once every 24 hours. So, if you work in MYOB Business daily, you now need to sign in and complete the 2FA check each day. More about security improvements.

Payroll

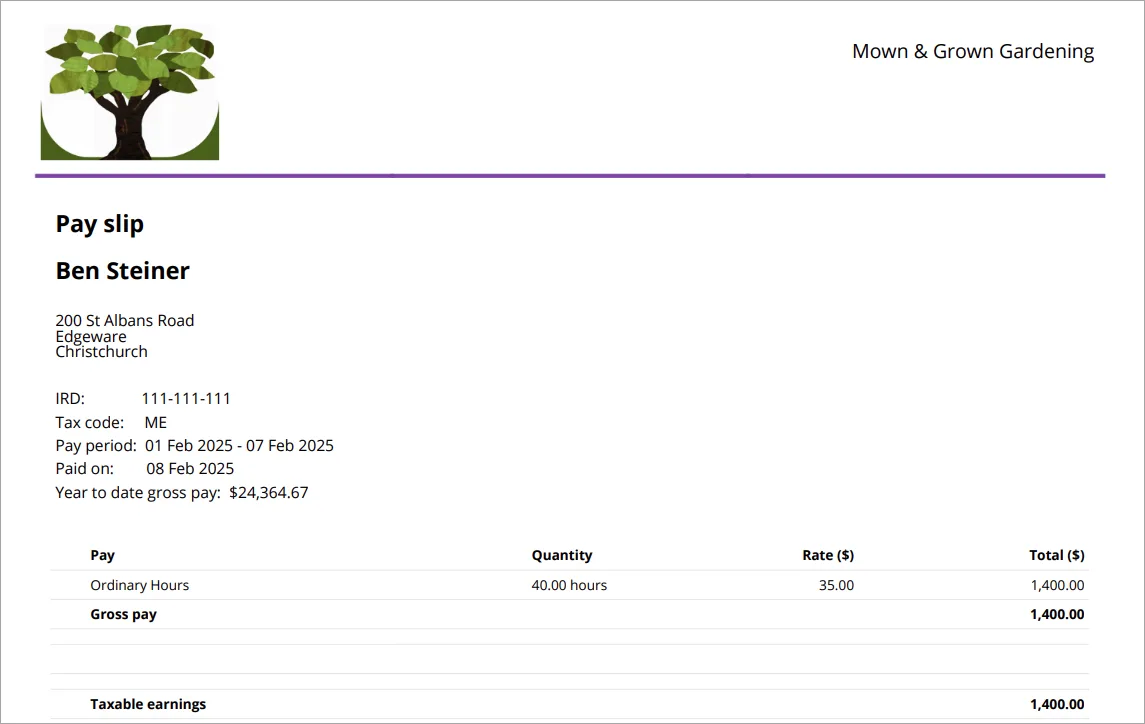

More informative pay slips

The Year to date gross pay field has been added to pay slips. This provides better visibility to you and the employee of their taxable earnings for the financial year. The value includes both the taxable gross payments processed through pay runs and any pay history you might have entered for the employee when you started using MYOB Business.

Bug fixes

We fixed an issue where bank feed transactions were not appearing in AccountRight desktop but they were still appearing in the browser. Bank feeds are now consistently appearing in both the desktop and browser.

We fixed an issue that could have caused an out of balance in the General ledger report. Previously, a debit and a credit posted to the same category sometimes showed incorrectly as a one sided entry.

August

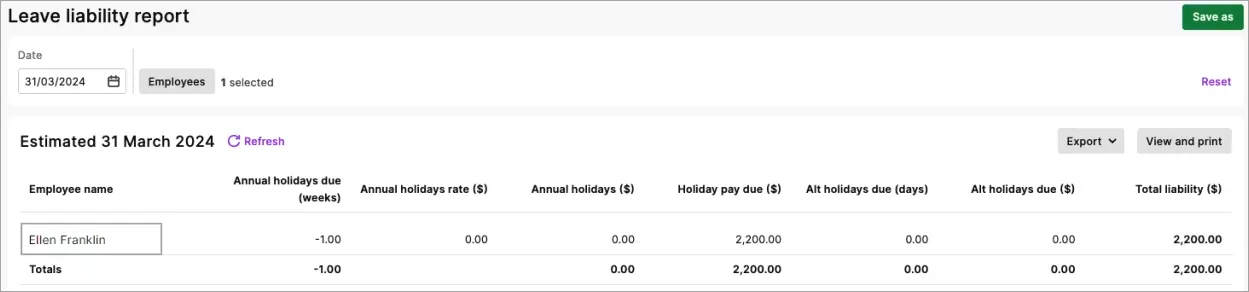

Payroll

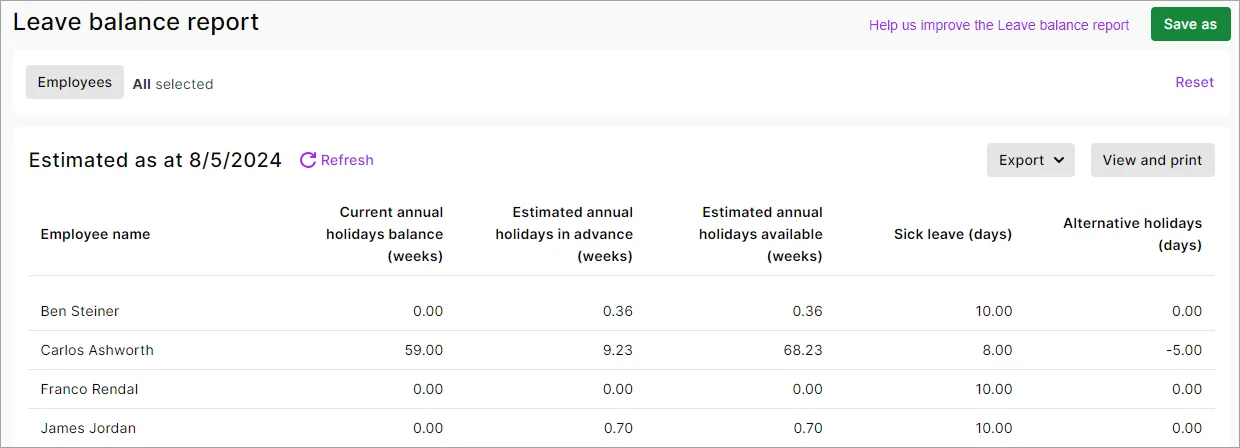

Leave liability at a glance

The new Leave liability report shows the estimated leave owing for employees at a specific date. This is super helpful to check what's owed to employees who are leaving or to see your company’s total leave liability. More about the leave liability report.

Employee address now on pay slips

Seeing the employee's address on their pay slip is a handy way to maintain accurate records. Both you and the employee can see at a glance what address you currently have on record for them.

Sales

More invoice customisation

Change the appearance of your invoices by hiding columns, changing the column headings and adjusting the display order. More about customising invoices.

Banking

Easier to identify bank feeds

We've added a Reference column to the Bank transactions page to show the supplier invoice number or customer invoice number for your bank feed transactions. This makes it easier to identify the MYOB bill or invoice the transaction relates to.Smarter auto-matching

We've improved bank feed automatic matching to use the bank transaction description to match with invoice numbers and customer names more intuitively. There's more improvements to matching coming in future releases – so watch this space.More options for connecting credit cards

When you connect a credit card to MYOB, you can now link it to a liability category in your category list (chart of accounts).More reliable BNZ bank feeds

If you've connected a BNZ account to MYOB, you'll need to reconnect the bank feed to use BNZ's new bank feed service. How to reconnect a BNZ bank feed. It's now also easier to set up a BNZ bank feed via your internet banking.

Bug fixes

Users who are only assigned the Contacts role will no longer see the ‘Something went wrong' error when signing in.

We fixed a bug that was preventing the sales template preview from displaying for new MYOB business files

Because of an issue preventing editing of the Tax code column heading is sales templates, we've turned off the ability to edit that column heading.

July

Payroll

Leave balances at a glance

The new Leave balance report gives a snapshot of your employees' leave entitlement balances as of today. Previously this was only available within each employee's record – but it's now quickly accessible in one convenient place (Reporting menu > Reports > Payroll tab).

Sales

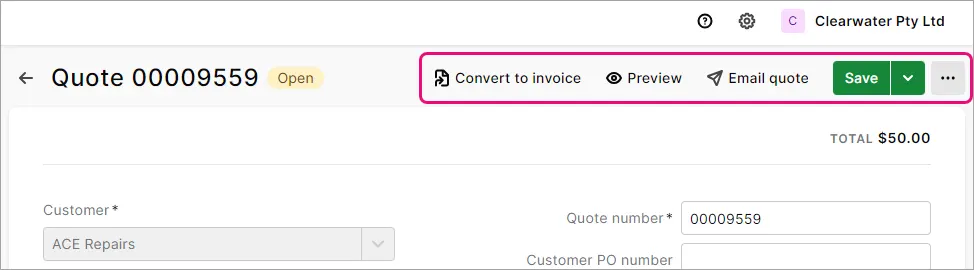

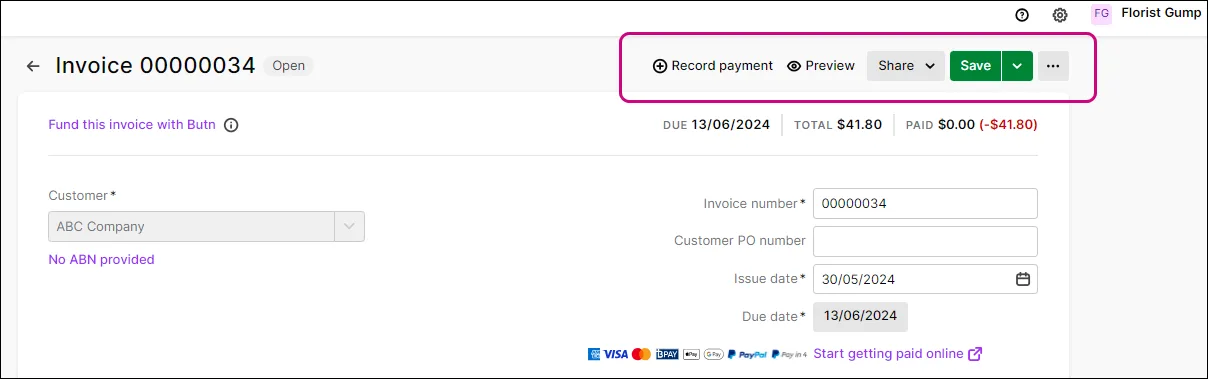

Easier to save and share quotes

We've moved the save and share options in quotes to the top of the screen. This simplified layout helps get your quotes created and sent faster. More about quotes

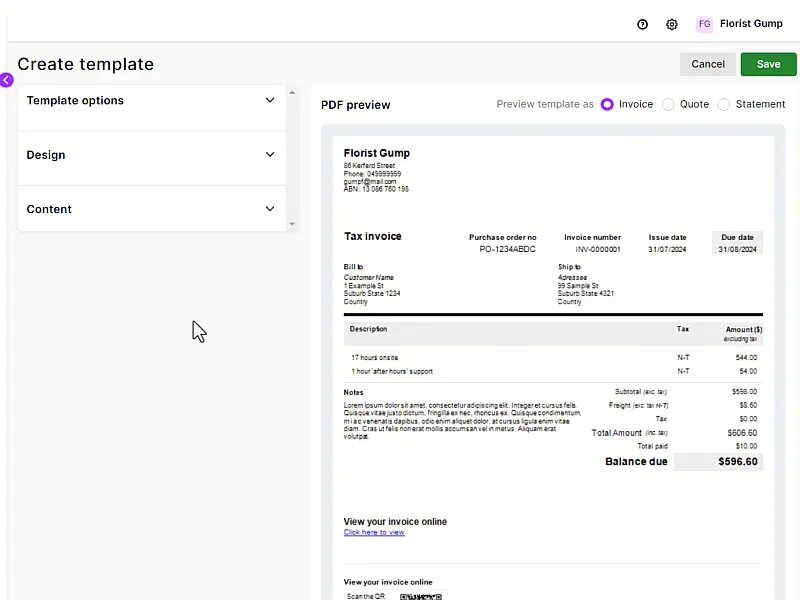

More sales template customisation options

Personalise your invoices, quotes and statements even more with the ability to add your business's terms and conditions. You can now also upload multiple business logos and header images so you can choose different ones for different templates. More about personalising invoices

Purchases

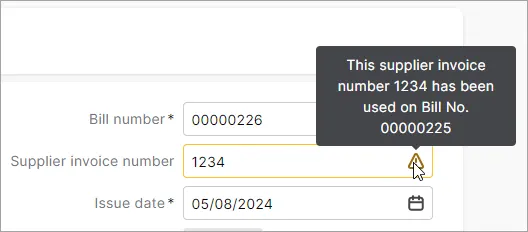

Avoid duplicate bills

If you're creating a bill manually or from an uploaded document, you'll now be warned if the Supplier invoice number has previously been used.

Banking

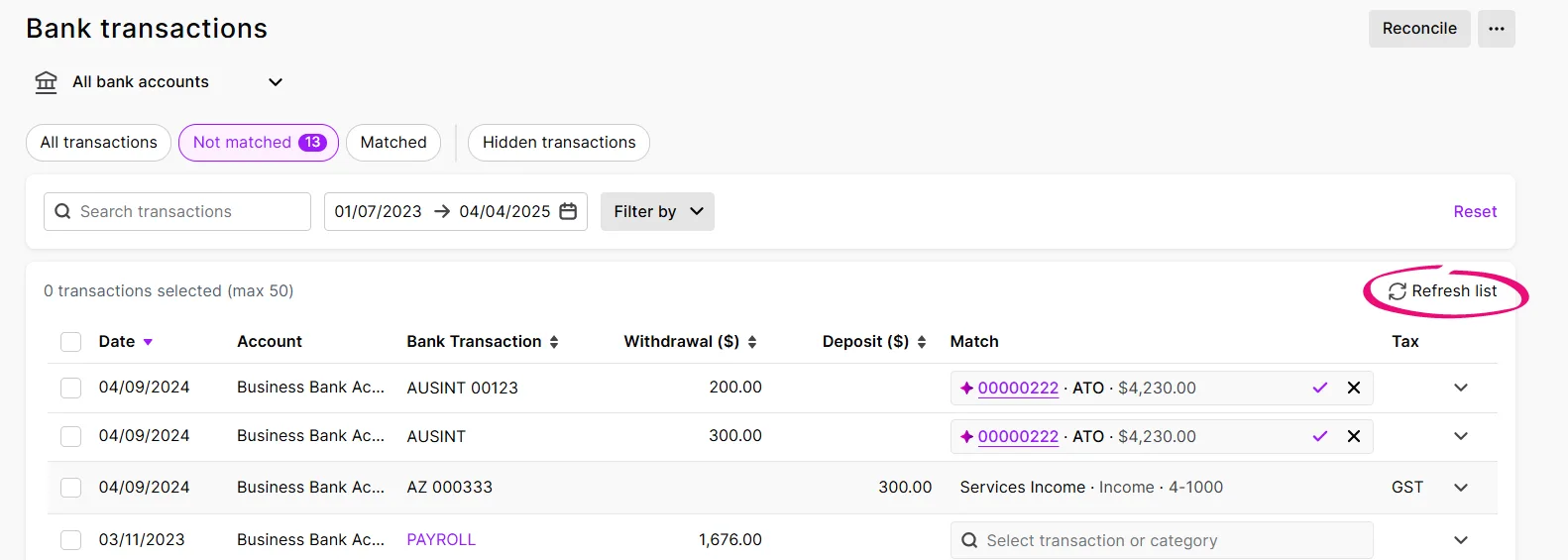

Faster bank transaction categorising

As you're categorising transactions, you can now refresh the Bank transactions page. This reduces the clutter by removing the transactions you've categorised, and leaving the ones you need to focus on.

June

Sales

Easier to save and share invoices

We've moved the save and share options in invoices to the top of the screen. This simplified layout helps get your invoices created and sent faster.

May

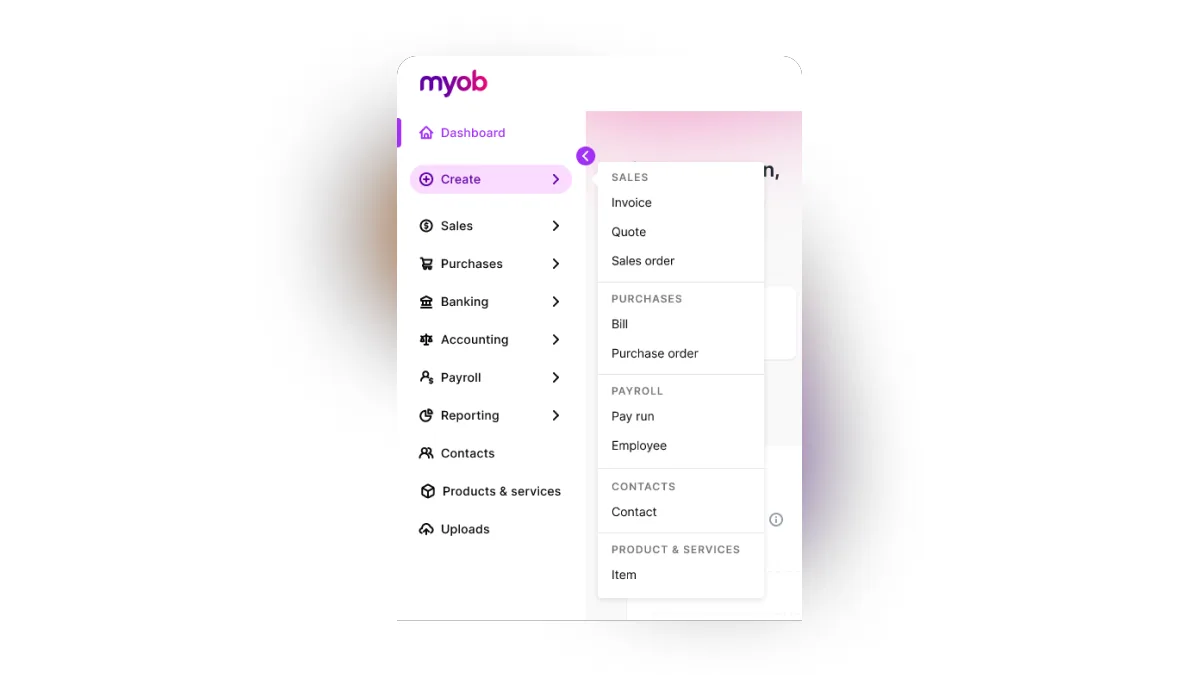

New vertical menu and simplified language

We've moved the menu to the side and used simpler labels to make it easier to find your way around. We've also replaced a lot of technical terms with more familiar words. Discover all the changes.

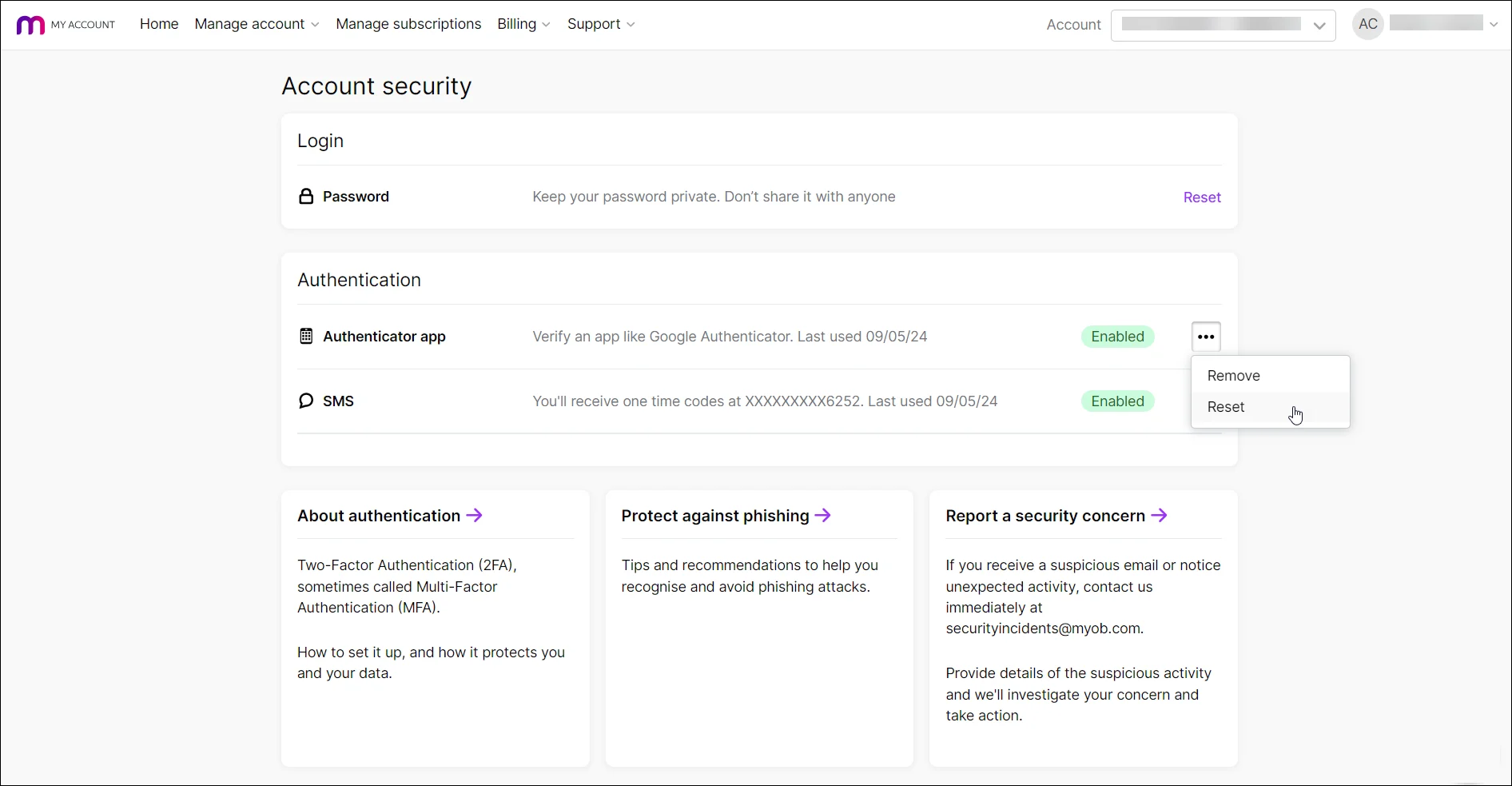

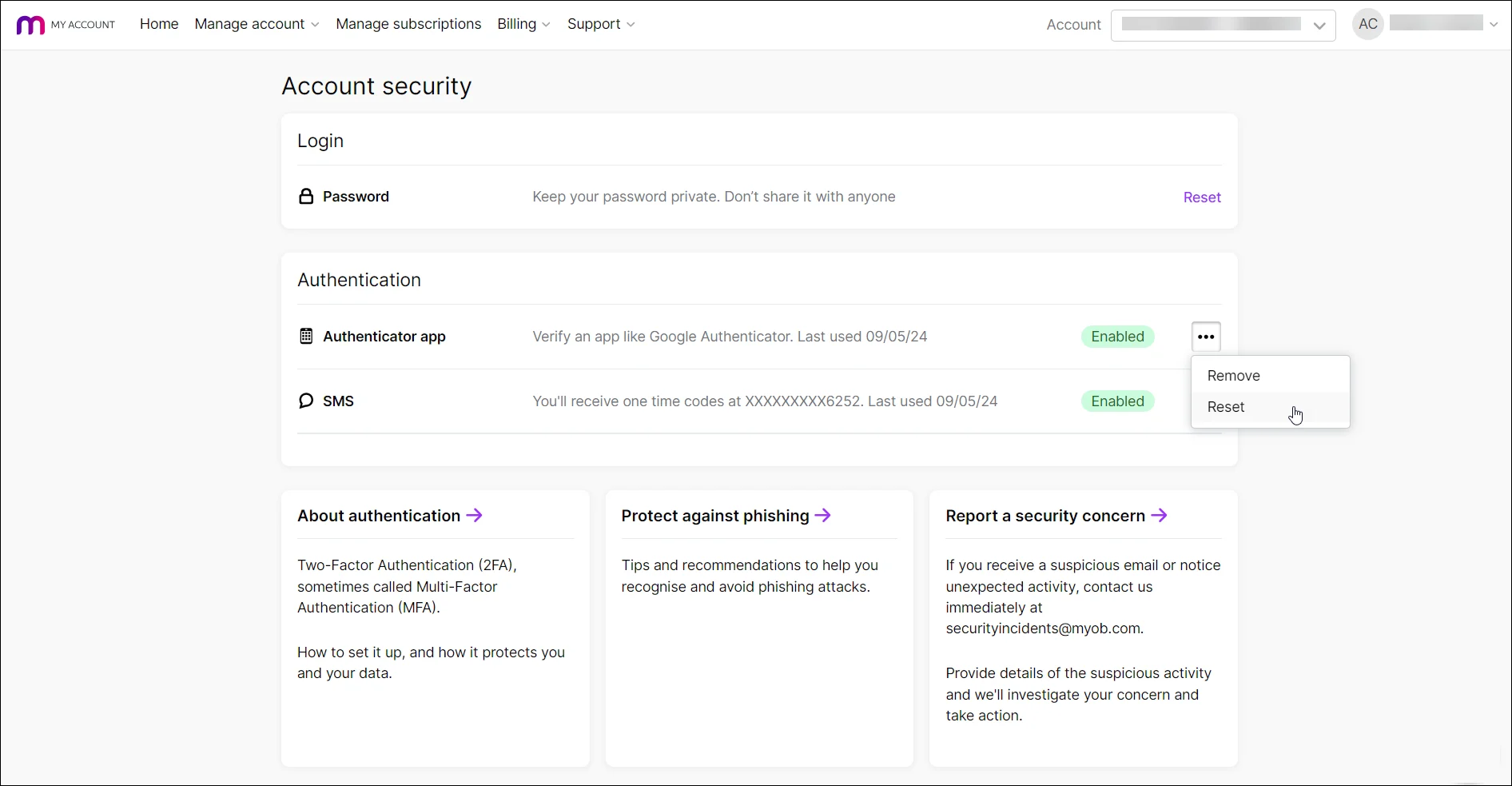

Two-factor authentication enhancements

Avoid getting locked out by setting up another 2FA method

Give yourself more options to sign in by setting up more than one 2FA method. For example, you could set up SMS 2FA on your phone and the 2FA authenticator app on a tablet. Then, if you don't have your phone handy and can't receive SMS, you can still get your 2FA code using the authenticator app on the tablet.

Reset 2FA without having to contact MYOB Support

Once you’ve set up another 2FA method, you’re able to change your 2FA settings yourself:

In the Account security section of My Account, you can easily change your 2FA phone number for SMS 2FA, re-link or change your authenticator app, or set up authenticator app on a new phone.

Banking

A faster way to connect your BNZ accounts

When connecting your BNZ bank or credit card accounts to MYOB, you can now apply via your internet banking, making the setup much faster. Find out how to apply.

Bug fixes

In the Balance sheet report, if you click to view a category's transactions, the report date range is now remembered. Previously the transaction list was being dated from the first day of the current month – which may have resulted in no transactions showing.

When preparing to lodge your GST return in MYOB Business, the total sales and income now matches the GST Return report.

In the General ledger report, inventory adjustments now show both the debit and credit amounts against the inventory asset account.

April

Payroll

Payday filing – helping you stay compliant

When you record a pay, if your business IRD number is missing, you'll see a warning and steps on how to fix it. This ensures the pay includes your IRD number which is required by IR for payday filing.

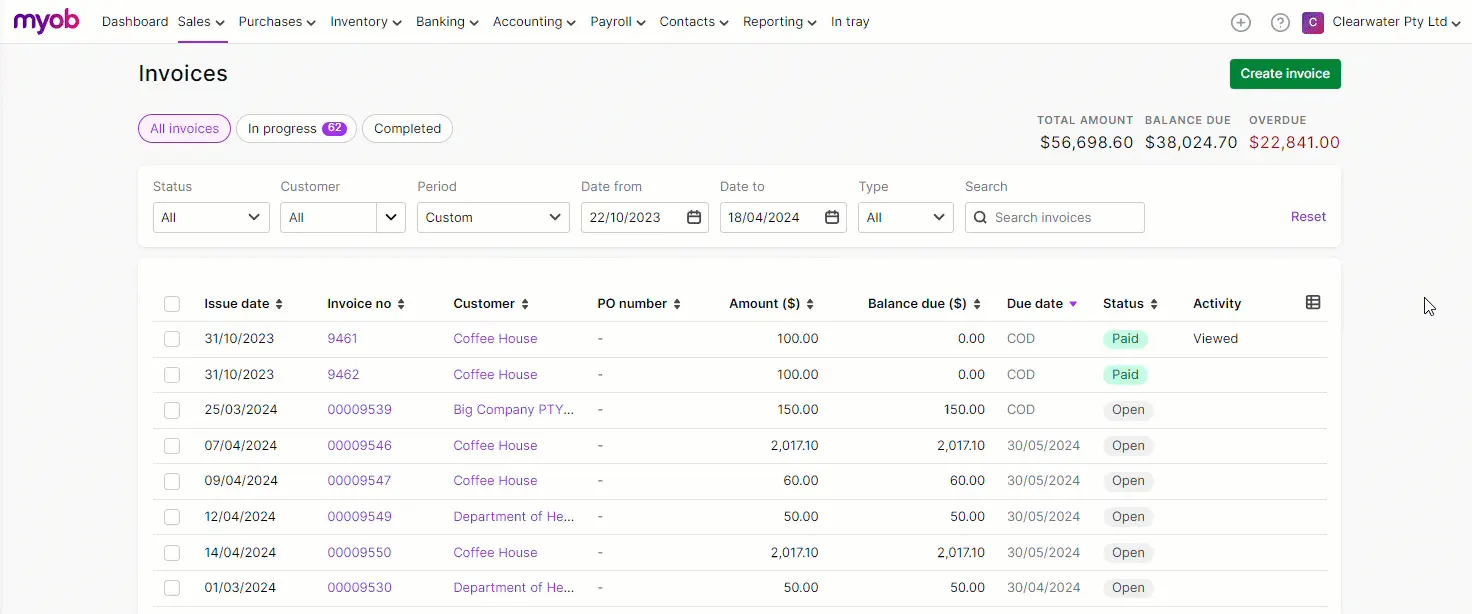

Sales

Customise what you see in your invoice and quote lists

Use the new Column options button to show, hide and rearrange columns. Each user can save their own view so it's remembered each time they go to these pages.

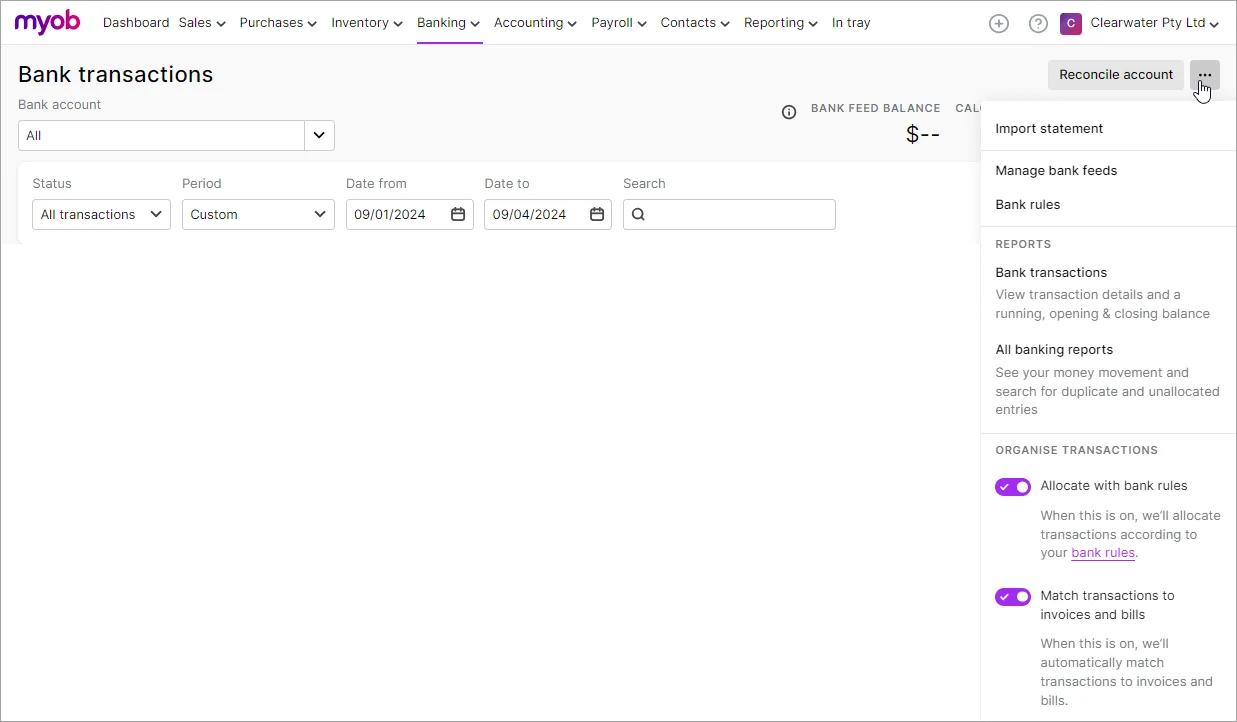

Banking

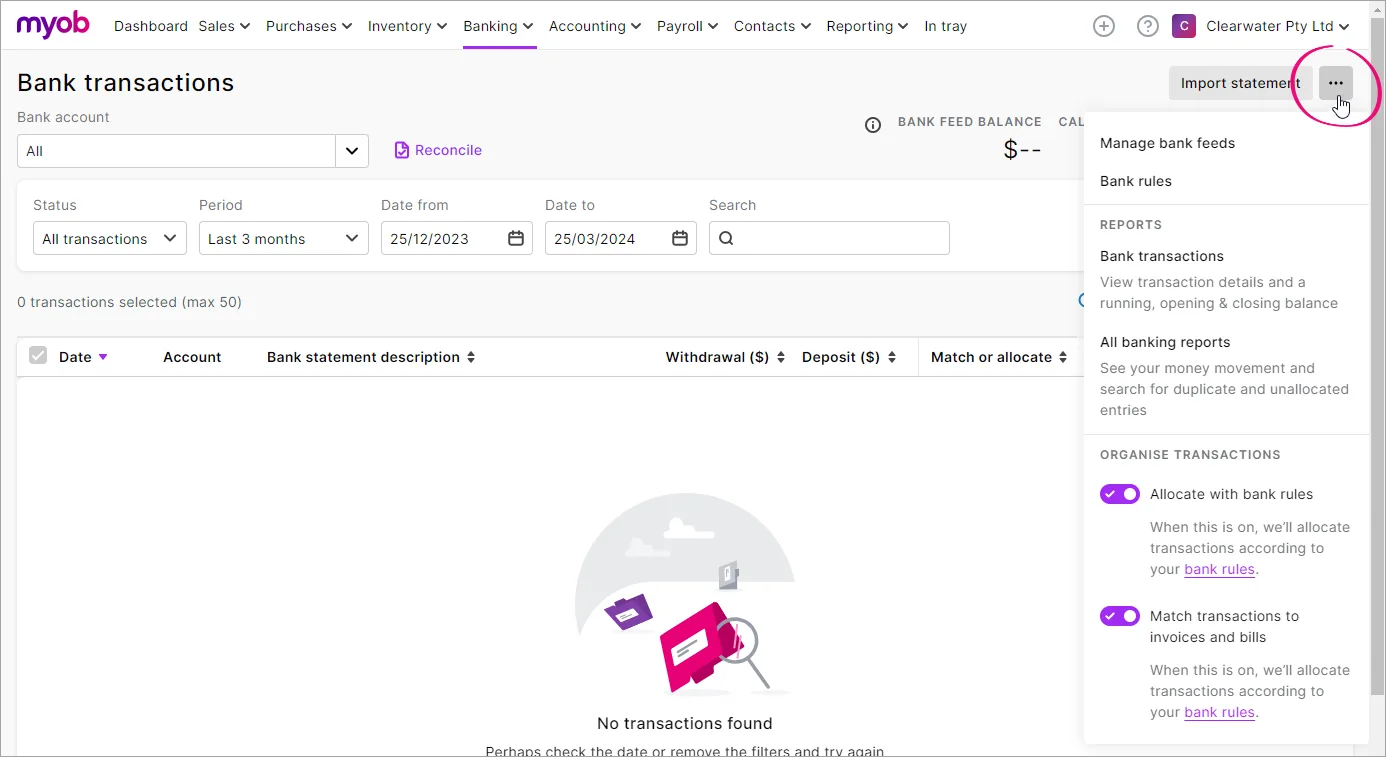

Do more from the Bank transactions page

Many common banking functions, like Import statement and Bank rules, are now available from a quick access menu. Click the ellipsis button (...) to quickly access these tasks from the one place. We've also decluttered the page by moving the Reconcile account button to the top-right corner next to the quick access menu.

March

Payroll

Keeping you compliant for EOFY

You can now enter pays for the 2024/2025 payroll year and the ACC earner levy rate and threshold and student loan repayment threshold have been automatically updated. These changes will apply for pays dated 1 April 2024 or later. Here's all the details.

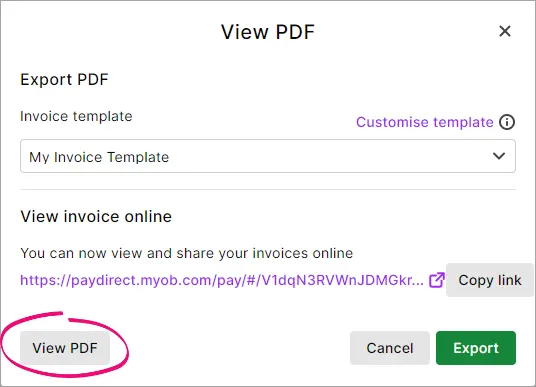

Sales

Preview an invoice before downloading it

When you export or download an invoice PDF, you can now click View PDF to see a preview.

Banking

Quick access to banking features

We've added a quick access menu to the Bank transactions page, giving easy access to bank feed rules and reports. Just click the ellipsis button (...).

More flexible GST returns

Save a draft

If you need to stop doing a GST return report, just click Close to save it as a draft and come back to it later. When you reopen the draft you're prompted to review any changes that have been made that affect it.

Refresh the GST return report

If you make any changes to transactions while you've got a GST return report open, just click Refresh to update the report with your changes.

Usability improvements

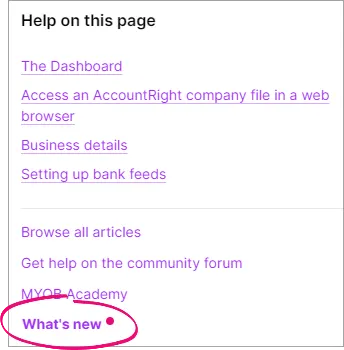

Stay up to date when we release something new

When we've released an update for MYOB Business, you'll now see a red dot next to What's new in the help panel (displayed by clicking the question mark icon in the top-right corner).

Bug fixes

Field 22 in the AIM form now shows the total gross value of salary and wages paid with a payment date within the AIM statement period

February

Bug fixes

We fixed an issue that was causing help links to open on the same browser tab as MYOB Business. Now when you click a help link, it'll open on a new browser tab.

January

Usability improvements

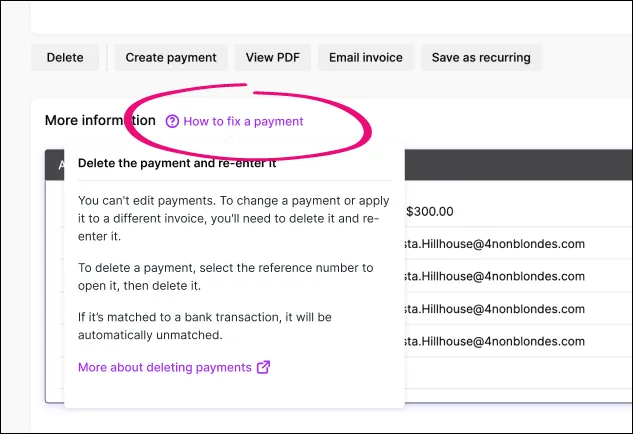

Even more help where and when you need it

We've added more clickable help links where you might need a little extra info, like fixing a pay or an out of balance reconciliation. Look for the blue links with question marks.

Smarter searches

When you click the help icon and start typing a search, we’ve improved the list of keywords that are used to present matches to information or features that you're looking for. You can now open the search results in a new tab or window, which leaves your original search results available.

Clearer GST processes

When you GST return, you'll see we've renamed Finalise to Save at the end. There's now also a clear message that reminds you to lodge the GST return. Also, during the GST return process you'll now see links to view or edit transactions so you can easily check or change things when preparing the reports.

Reports

New bank activity report

We've added the Bank activity report so you can see all transactions that have been allocated to bank or credit card accounts. All transactions are shown in the report regardless of how they've been entered. This is compared to the Bank transaction report, which only shows bank transactions entered via bank feeds or imported bank statements. This is handy if you haven't been using feeds or importing bank statements.

Spend less time filtering reports

We've improved filtering in reports so that the filters you choose are remembered in each report. The filters in one report won't affect the filters in another.

When you open the following reports for the first time, the filters are now set to the most commonly used settings, but you can change them if you like, and they'll be remembered:

Account list

Bank transaction report

Coding report

Bank reconciliation report

Statement of cash flow

Cash movement

Category general ledger

Sales

Attach files to sales

You can now attach PDF, TIFF, JPEG or PNG files to the Attachment section of invoices, sales orders, or quotes. Attached files are included if you email the sale.

Bug fixes

We fixed an issue on the Reconcile accounts page that was causing the amounts to be misaligned under Withdrawal and Deposit.

The running balance on the Bank transactions report now matches the last bank feed balance provided by your bank.

If you re-download an electronic bank file that you've already downloaded, it's now downloaded in the correct format. Previously, the files were being re-downloaded as ABA files, which is an Australian format.

2023

December

Usability improvements

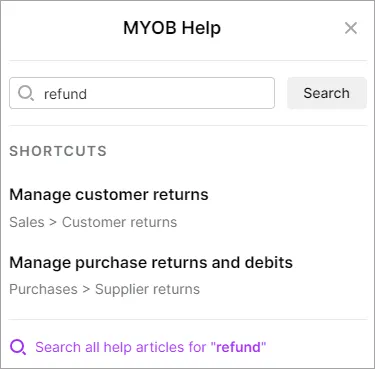

Quickly get to the tasks you need

When you open the help side panel, the search box now lets you go to the place in MYOB Business you're looking for. For example, if you're not sure where to record a customer refund, just type 'refund' in the search box.

If you want to search the help, there's also a link at the bottom of the results.

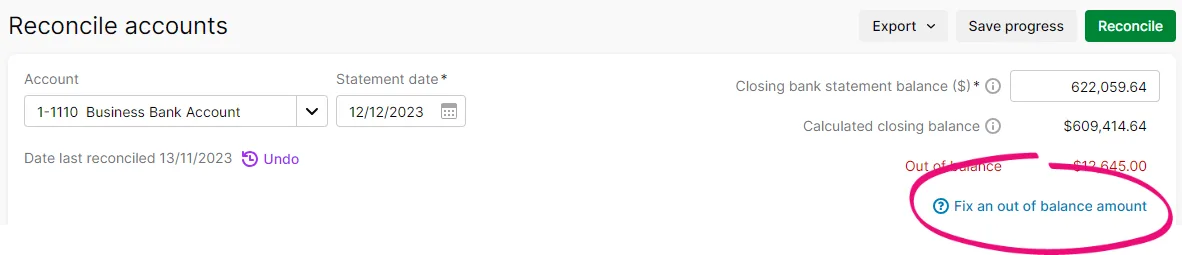

More help where and when you need it

We've added clickable help links in places where you might need more information, such as fixing a pay or an out of balance reconciliation. Look for the blue links with question marks.

Reports

Retain preferred filters on the Coding and Accounts list reports

When you change the filters on the Coding and Accounts list reports, they're now remembered for next time and not impacted by other report filters.

November

Invoicing

Print multiple invoices from one place

The new Print PDF button on the Invoices page lets you print multiple invoices at once. Not available in AccountRight browser

Quickly show all invoices

When viewing the Invoices page, you can now choose All time as the Period to show all invoices without having to set a date range.

Helping you avoid duplicate invoice numbers

When you create an invoice with an invoice number that's already been used, you'll now see a warning.

Dashboard

Choose whether amounts include GST

There's now a Dashboard option to show whether amounts are GST inclusive or exclusive in the Income, Expense and Financial position widgets.

Expanded insights for cash in and out

You can now choose to see the Last 6 months for the Income and Expenses widgets.

Usability improvements

You can now see what's new without leaving MYOB Business

Click the help icon and look for the What's new link at the bottom of the help panel.

Reports

Making sure GST calculates correctly in the Budget management report

If you run the Budget management report (Cash movement type) with Auto-calculate GST selected you'll be warned if the GST Clearing Account is inactive or has been deleted. You'll also see the steps on how to fix it.

Banking

Quicker access to the Bank reconciliation report

When you reconcile an account, you're now prompted to export the Bank reconciliation report from the Bank reconciliation page. Previously, you had to manually run the report and set the filters for the account you just reconciled.

Bug fixes

The GST Return summary now correctly includes the cents. This is in line with IR requirements.

September

Reports

View and print with one click

We've added a View and print button to reports to generate a PDF with a single click.

More meaningful PDF file names

Reports exported as PDFs now have a more meaningful name that include your business name and the report name, like My business Pty Ltd - ProfitAndLossReport.pdf

Usability improvements

We've made some design improvements on the Bank transactions page to make it easier to identify unallocated transactions.

Bug fixes

We fixed an issue that caused the same error to show multiple times when running a customised Balance sheet report outside the current financial year.

August

GST returns

More control over your GST Return reporting

You can now accept or decline the suggested late claims when preparing in your GST Return report.

Bank transactions

Simplified matching of money transfers

When you create a transfer money transaction on the Bank transactions page, it will be automatically matched without needing to refresh the page.

More help at your fingertips

You can now click a link on the Rule type field when setting up a bank rule to display help content explaining the difference between an automated rule and an allocation template.

Keeping you informed about bank feed issues

If there's an issue affecting bank feeds, like a delay in receiving transactions, you'll now see a notification on the Bank transactions page detailing the issue. The notification is updated when the issue is resolved.

Reports

Easier to review trends across financial years in the Balance sheet report

You can now break down the Balance sheet report across financial years to compare data and show trends. Previously, you could only break down the report for one financial year.

Get a clearer break down of leave in the Payroll register and Payroll activity reports

The Payroll register and Payroll activity reports now display leave accrued and taken. Previously, these reports only had one Leave column and it wasn't clear to users what value it represented.

Bug fixes

When you sort the Users page, Remove access and Cancel/Resend invitation now works on the correct user.

You can no longer match or allocate transactions for a new bank feed until you've linked the bank feed to an MYOB Business account.

The Reconcile link on the Bank transactions page now displays correctly when you resize the page.

We've aligned columns in the GST report and General ledger report so that amounts line up with column headings.

Reports that are exported to excel or PDF now correctly show negative numbers in brackets if this option has been selected.

Performance improvements

We have removed an exception alert message that briefly appeared from the top of some reports, like the Balance sheet, Profit and loss and Unpaid bills reports. This will improve the loading time of these reports.

June

Sales orders

You can now email sales orders

Get your sales orders out faster by emailing them when you create them, or later. Just as with invoices, you can add attachments or email to multiple addresses.

Usability improvements

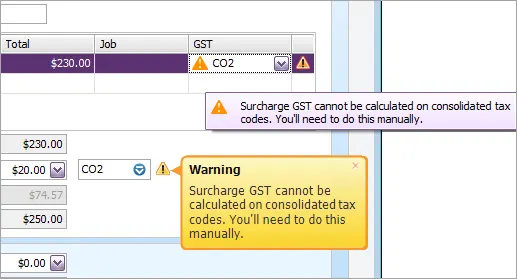

You'll now see a message that customised and consolidated GST codes are not included when preparing the reports for your GST return.

Clicking Overdue invoices in the Up next section on your Dashboard opens the Invoices page, which will now show just your overdue invoices.

Easily identify credit notes on the Invoices page with the new credit note icon in the Amount column.

When scrolling down the Bank transactions page, the column headings now remain visible, making it easier to identify the columns.

We've made the Possible match found text on the Bank transactions page more visible by changing the text to purple.

Bug fixes

The Trial balance report now shows the YTD column instead of the As at date when comparing periods.

We've temporarily removed the KiwiSaver payable and PAYE withholdings payable Dashboard widgets while we investigate why they were affecting performance.

Fixed an issue that was preventing report packs working if they included a Payroll summary or Payroll activity report.

Clicking Possible match found on the Bank transactions page now shows the Match transaction tab with a list of possible matches (instead of the Allocate tab).

Unnecessary horizontal scroll bar no longer appears when you expand a transaction on the Bank transactions page.

When you expand a transaction on the Bank transactions page the headings and contents of each column now align.

Performance improvements

To make the Dashboard load faster, Income and Expenses data for the last 6 months no longer appears.

May

Sales

See the activity of your sales orders

At the bottom of a sales order, you'll now see a More information section, showing the activity on a sales order, like when it was created and converted to an invoice.

GST return

Complete your returns faster with fewer errors

You're now stepped through completing your GST return report and you'll see transactions that were added, edited or deleted in the previous reporting period. These are now displayed in the new Late claims report, to help balance your end-of-year GST reconciliation. Learn more.

Reports

Trial balance report now shows Year to Date (YTD) balances when comparing periods. When comparing periods, YTD debits and credits are combined into a single column.

Bug fixes

When you edit text in the Bank statement description field on the Bank transactions page, the edited description now changes to purple indicating that it's been changed. When you hover over the edited description, you can see the original text.

You'll no longer see an error message when editing header accounts.

Transaction reference numbers that are 13 characters long are no longer truncated when matching on the Bank transactions page.

Created from sales order no longer appears twice in invoice Activity history when you record a payment against a sales order in AccountRight desktop and then convert the sales order to an invoice in AccountRight browser. (AccountRight Browser)

March

The Dashboard

Clearer and more helpful information

We’re rolling out a completely revised and improved Dashboard. In the new Bank accounts section, you’ll see the last-synced bank feed date and unallocated transactions for each account. Cash received and spent is included in the new Income and Expenses sections. And if you’ve upgraded from MYOB Essentials, we’ve brought back some favourites.

Eventually, all MYOB Business and AccountRight browser users will have these and many other enhancements – find out about the new Dashboard.

Sales

Create sales orders to put items and services on order

Use sales orders to create a centralised record of your customer orders that you can pull up at any time, anywhere. When you enter a sales order for an inventoried item, it's marked as committed to customers, helping your purchasing department make informed inventory ordering decisions. You can use sales orders for both goods-based and service-based businesses. Learn more.

Bug fixes

Your chosen GST clearing account now appears on the Cash movement and Budget management reports.

Spend money attachments now show the correct file size.

When you add a new account while you're creating a recurring general journal entry, the new account now appears in the Account field.

February

Bank feeds

Clearer information and guidance when setting up bank feeds

There's more information during the bank feed signup process. When your bank feed is connected, you'll see a notification on your Dashboard telling you to link it to an MYOB account.

Dashboard

Refreshed the look of the getting started tasks you'll follow when setting up a new MYOB Business file.

Bug fixes

Pay run error messages are now displayed correctly.

We fixed an issue that caused some bank feed rules to result in an out-of-balance bank reconciliation.

Refund amounts applied to bills now display correctly in the Job profit and loss comparison report.

January

Bug fixes

Report PDF style templates with the page layout set to Landscape and Compact now display 12 columns correctly.

The Job profit and loss comparison report now only shows transactions related to the specified jobs.

You can now click the cost of sales account in the Profit and loss report to see the related transactions.

The reports in the default Management Report report pack now use the accounting method based on your report settings.

2022

December

Bug fixes

The Balance sheet report now prevents you from using the Breakdown option when in Cash mode, preventing incorrect display of breakdown amounts.

You now receive a confirmation email when an item import has failed.

Trial users are no longer presented with a payroll onboarding task if they've indicated they have no employees.

The Cash movement report no longer displays an error when using the Compare to budget option.

You can now successfully open a copied budget if the Auto calculate bank accounts option has been selected.

The Employer deduction report can now be viewed using Safari and Firefox web browsers.

November

Reports

Clearer options in the Include items filter in the Stock on hand and Item list reports to better indicate what will be shown in the report.

You can now click into inventory adjustment transactions in the Balance sheet report to see details of the adjustment

Bug fixes

The Bank transactions page now allows account numbers to be found if they contain slashes (/).

The GST return and GST report in a report pack now shows the correct accounting method for cash/payments mode.

The General ledger report now shows correct amounts after applying multiple matching payment amounts to invoices and bills.

Users can now only access reports matching their permission level. (AccountRight Browser)

The General ledger report now shows the correct GST codes for invoices or bills containing items that have different GST codes.

The Balance sheet report now shows the correct Variance % when comparing values to last year.

The Balance sheet report now prevents you from using the Breakdown option when in Cash mode, preventing incorrect display of breakdown amounts.

You now receive a confirmation email when an item import has failed.

Trial users are no longer presented with a payroll onboarding task if they've indicated they have no employees.

October

Payroll

You can now pay your employees in MYOB Business

Pay your employees, keep track of leave and stay compliant with PAYE and KiwiSaver. Find out more about payroll.

Easier to expand an employee's pay during a pay run

You can now click anywhere in the row to view or change the details of that employee's pay. Previously you could only click the dropdown arrow to do this.

Inventory

Include all your inventory items in reports

You now have the option to show items with a zero quantity or value in your inventory reports. This gives you a more complete view of your inventory.

An item name is no longer mandatory when creating an item.

The current value of inventoried items is now shown in your items list.

Inventory - account info message has been updated on invoice screen. Account info message has been updated on invoice screen for creating and updating invoices.

Reports

Clearer report names and descriptions

The Receivables with tax and Payables with tax reports are now called the Receivables reconciliation with tax and Payables reconciliation with tax reports. We've also improved the descriptions of these reports, along with the descriptions for the Unpaid invoices and Unpaid bills reports.

Banking

Transactions from the previous financial year will now be included when you import a bank statement.

Bug fixes

If you're missing a linked account and trying to create an invoice or bill, you'll now see a clear message guiding you to set the linked account.

When creating a purchase order via the reorder report, the item name now appears as expected in the Description field of the purchase order.

Fixed an issue in the Banking reconciliation report that was incorrectly assigning cheques and deposits, causing the Expected balance on statement to be calculated incorrectly.

A user with the Purchases role can no longer access the prepare electronic payments feature. This removes the possibility of a user without payroll access seeing employee pay amounts.

Fixed an issue that was causing exports for accountants to include transactions for the day after the specified date range.

Improved the error message shown if you try to delete an inventory item which has stock on hand.

August

Sales

Edit customer note templates directly from invoices

You can now save any changes you make to customer notes while working on an invoice. Previously you could only do this in your sales settings.

Inventory

Export your items so you can update them in bulk

You can now export the details of your items. This is a quick way to bulk update your items by editing the exported file in Excel and importing the changes back into MYOB.Include freight costs in sales and purchases

There's a new Freight field in invoices, quotes, bills, purchase orders, supplier returns and customer credits to record associated freight costs.More streamlined item ordering

When you print or email a bill or purchase order, the Supplier item ID will appear on the PDF (if you've enter it in the item), making it easier for your supplier to identify their item.Quickly duplicate items

If you need to create similar items, duplicate an existing item then customise it as required.Always use the right account for your items

When adding an item to a sale or purchase, the income or expense account you've set for the item will always be used. If you need to change this account you'll need to do it in the item.

GST codes

More flexibility in your GST codes

You can now change the GST type in your GST codes.

Reports

Smarter GST reporting

The GST report and GST return report are now automatically filtered according to the accounting method and frequency chosen in your GST report settings.Improved security

Users can now only see the reports they're permitted to see based on their user access settings.Find the right report faster

The search function in the reports list now looks at report descriptions and not just report titles.Consistent headings in exported reports

When a report is exported to PDF or Excel, the column headings match those shown in the report in MYOB.

Bug fixes

The chosen accounting method now displays correctly in the Balance sheet and Profit and loss reports.

New business files in New Zealand now contain the correct default linked accounts.

Files exported for accountants no longer cause an out of balance when imported.

Fixed an issue in invoice and quote PDFs that caused the Unit column to be missing and the number of units and amounts for lines where the unit price is $0.

Fixed an issue that resulted in incorrect line amounts when changing the Tax inclusive/exclusive option and the tax rate was negative and larger than 100 (such as setting ABN tax code to -147%).

Tax amounts are no longer duplicated in the Customer sales (detail) report where an invoice has multiples lines.

Editing detail accounts no longer changes the parent header account. (AccountRight browser)

July

Banking

Quickly identify hidden bank feed transactions (AccountRight browser)

You can now view bank feed transactions you've hidden in your AccountRight desktop software.

GST codes

It's easier to keep your GST codes list tidy

You can now delete GST codes that haven't been used in transactions, accounts, items or contacts. Find out more

Bug fixes

The Coding report no longer shows duplicates of some matched transactions. The totals on this report now match those on the Bank transactions page.

The Bank reconciliation report now shows the outstanding deposits and withdrawals, as well as the expected balance, for liability accounts like credit cards and loans.

Only the Advisor user from a practice will appear in the Users list after upgrading. Other users from that practice will now always be hidden if they have the same practice email domain name. (MYOB Essentials upgraders)

You can now export the Job profit and loss comparison report as a PDF or Excel file when you choose a single job or select the Consolidate jobs option.

If you invite another advisor with the same email domain, it will no longer be duplicated on the Users page.

When you create an item with the Buying price is option marked as Tax exclusive and include it in a purchase order it now calculates the price correctly.

June

GST codes

Easier to track the taxes that apply to your business

You can now create new tax/GST codes (except consolidated ones) to suit your business needs. Find out more

Reports

Easier to read exported reports. If a report is exported to PDF and has more than one page, the column headings now appear on all pages. Also, wrapped text in longer columns will now start on a new page, to keep the related info together.

More efficient report packs. If a custom report is included in a report pack, the date range for the report pack is used for all reports in the pack – including the custom report.

Quickly identify if the exported Balance sheet is using the Cash accounting method. If you export the Balance sheet report for the Cash accounting method, the report will display Cash mode in the PDF or Excel file.

Contacts

Save time entering CC email addresses every time you email

You can now save one or more CC Email addresses in your customer and supplier contact records.Avoid errors when entering email addresses in contacts

If you accidentally put a space at the start of an email address, this will no longer cause and error. You'll quickly see if you've entered the same email address twice.

Sales

Keep your customer notes list free of duplicates

If you try to create a note that has the same note name or note text as an existing note, you'll see a message and won't be able to save it. This keeps your notes list easier to manage.

Bank transactions

Easier to match bank transactions

If a close match isn't found when matching a bank transaction, you can see other transactions you can match to without having to change the Show filter.

Bug fixes

Fixed an issue where the 3-letter code in an edited GST code wasn't being saved as capitalised.

When you export the General ledger report, the option to display accounts with zero balances now works as expected.

Changes to the Description of transaction for an allocated bank transaction on the Bank transactions page are now saved.

May

Sales

Send all your invoices at once

Select multiple invoices on the Invoices page and email them in bulk. This is great if you use recurring invoices or if you like to send your invoices in a batch on a particular day of the week.

Reports

Helping you avoid errors when running business reports. If you click an account total in the Profit and loss, Balance sheet or Cash movement reports and change the Date from field to before the opening balance date of your business you now receive a warning message.

Bug fixes

When you create a note in a new or existing invoice, unsaved changes to the invoice will not be lost.

You can now add a new line to existing general journal or spend money recurring transactions.

When you click an account total in the Profit and loss report using the Cash accounting method, the opening balance now resets in the first financial year following the opening balance date year and displays accurate beginning and running balances.

When you click an account total in the Profit and loss report using the Accrual accounting method, the opening balance now resets without you needing to start a new financial year and displays accurate beginning and running balances.

When you select all transactions at once when matching banking transactions, the Match amount and Subtotal now show the expected amounts.

April

Electronic payments

Easily identify and add missing account details when creating bank files

You'll see an indicator confirming if the bank details are complete in the account you're paying from. If something's missing, you can easily add it.

Sales

Access customer details straight from the Invoices page. When viewing your list of invoices, you can now click a customer's name to check or edit their details.

Avoid mistakes in customer email addresses. If you enter an invalid email address in a customer's record, you'll see a warning.

Reports

Easily see the accounting method when viewing an account's transactions in the Profit and loss, Balance sheet or Cash movement reports.

Easier transaction review in the Profit and loss, Balance sheet and Cash movement reports. We've added the Tax amount and Balance columns when you expand these reports to view transactions.

Bug fixes

All menu items now show consistently when accessed from the reports area

Exports for accountants in the format of MYOB AE MAS now include quantities

If you've moved to STP Phase 2, the Payrun activity report now shows the correct ATO reporting categories

You can now successfully set or update the linked contact in a tax code

The Balance sheet report, when viewed in cash mode, is now showing correct balances for the GST account if multiple credit or debit notes have been applied to an invoice or bill

You now see the correct Beginning balance when viewing an account in the Profit and loss, Balance sheet or Cash movement reports even if there are no recorded transactions in the selected date range.

The Favourite reports tab now shows your favourite reports when you open it for the first after logging in

Rounding amounts in invoices no longer causes the error, 'An unbalanced transaction may not be recorded'

You no longer receive the error, 'Accounts_IndustryShouldNotBeEmpty', when creating an account on the Bank transactions page or when entering an invoice or bill (MYOB Essentials upgraders)

February

Sales

Email invoice PDFs

When you email an invoice, a PDF version is automatically attached.Set and forget invoice options

MYOB Business remembers whether or not your invoice amounts are tax inclusive and whether you email a copy of the invoice to yourself. Next time you create an invoice, it will use the same settings.Duplicate or email an invoice from a locked period, without having to change lock date settings.

Find your eInvoices quickly (Early adopters only)

Filter by invoice type when viewing the Invoices page.

Reports

Quickly see if you owe money to the IRD, or if you'll get a refund

The GST Return report now shows Payment or Refund in the Total column.Know who owes you money and how much is due

Expand the Receivables with tax report to see the transactions that make up each customer's balance, along with their ageing periods. Reconcile your receivables more easily using the Receivables account and Out of balance amounts.See who you owe money to and how much is due

Expand the Payables with tax report to see the transactions that make up each supplier's balance, along with their ageing periods. Reconcile your payables more easily using the Payables account and Out of balance amounts.

Bug fixes

Clicking Prefill from recurring in a receive money transaction now works as expected.

The beginning and ending balances in the Balance Sheet, Profit & Loss and Cash Movement reports are now correct when viewing in cash mode.

Each month we release improvements, new features and bug fixes to AccountRight desktop software. Listed below are releases from previous months. If you want to find out about more recent releases, see what's new in AccountRight.

2025

2025.11 (December 2025)

Payroll

More control over employee self-onboarding (Australia only - released on 2 December)

When you set up new employees, by default they'll be sent an invitation to self-onboard to submit their own details into AccountRight. This means all you need to do is add their payroll info. But if you prefer to manually add an employee and enter all of their details yourself, we've added a new setting under Setup > General Payroll Information you can turn on to allow this. More about self-onboarding

Banking

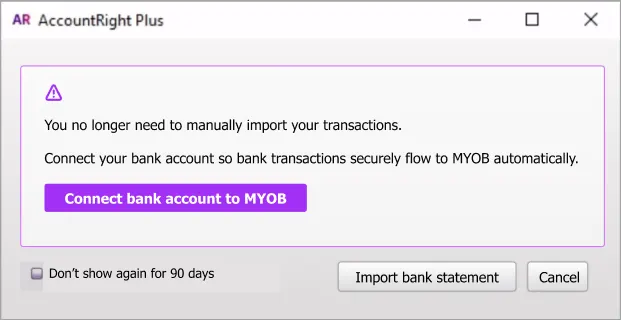

More secure online bank feed connections

To connect a bank or credit card account, your company file must be online. This allows a more secure and streamlined connection process through the web browser version of AccountRight. It all happens in the Banking hub – where you'll also get better visibility of your connected accounts. More about the Banking hub

An improved, smarter banking experience (AccountRight browser users only)

If you use AccountRight in a web browser, we've finished rolling out the updated Bank transactions page in the browser. The refreshed design has several time-saving improvements, like artificial intelligence to learn from how you categorise transactions to help suggest more accurate category suggestions the next time similar transactions comes in. This saves you from searching for a category to match it to. More about working with bank transactions

MYOB Assist mobile app

Australia only

MYOB Assist, the companion app for MYOB Business and AccountRight, keeps getting better.

Let your team upload expenses – without full file access

You can now use the Cards role in AccountRight to let team members only capture and upload expenses using MYOB Assist, without giving them full access to your company file. This helps keep your reports, financials and other sensitive data protected.Quotes are now available

You can now create, send, and manage quotes on the go in the MYOB Assist app. This makes it easier for you to start a job in the field, send a quote straight from your phone, and turn it into an invoice when the work’s approved — all without leaving the app.

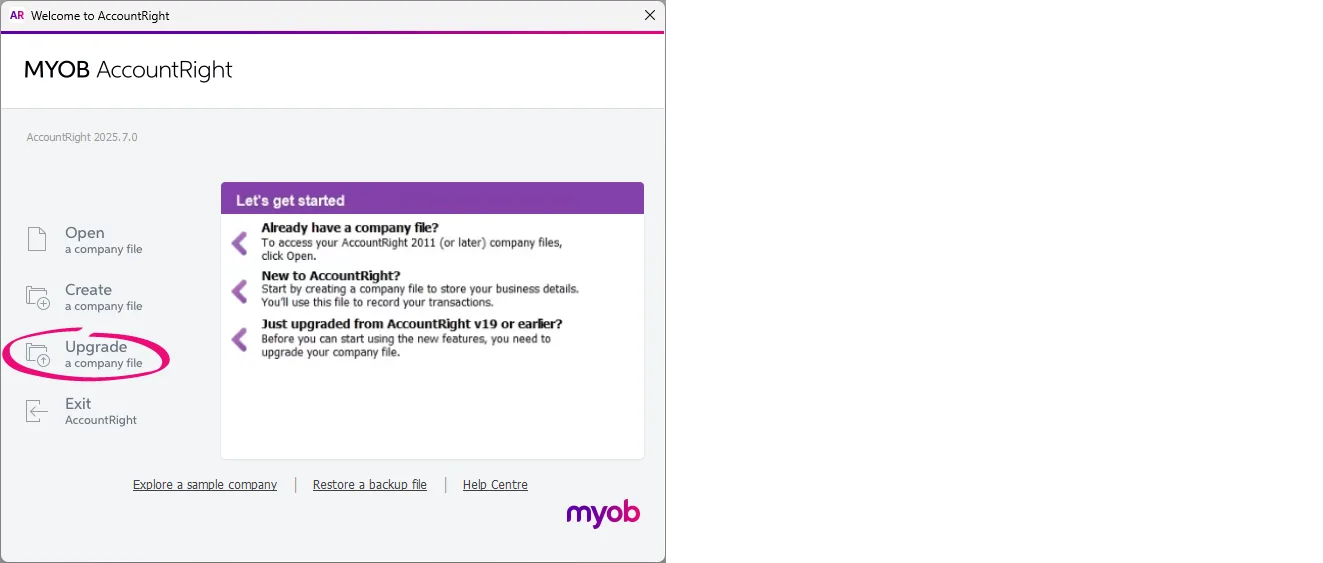

v19 (and earlier) upgrade

As part of the decommissioning of AccountRight Classic (v19 and earlier), we're removing the Upgrade a company file feature from the Welcome to AccountRight window:

If you want to upgrade, you'll need to set up a new MYOB subscription and complete a migration form.

AccountRight bug fixes

(Australia only) We fixed an issue that prompted users to turn on the timesheets option when it was already on.

We fixed bugs that could cause AccountRight to crash when working with invoices and when reconciling or allocating transactions.

We fixed a bug affecting documents automatically attached to sales emails. Attachments that were in JPG, JPEG, PNG, TIFF, or TIF file format couldn't be opened by the recipient.

We've fixed an issue that was causing a blank page to show when clicking the Invoice Reminders button.

Coming soon...

These are some things we're working on that will be rolled out soon:

A smoother, less repetitive login experience is on the way, making it easier to move between browser and desktop without constantly proving who you are.

Backups are getting a refresh – automated weekly backups stored safely in the cloud, with you still firmly in the driver’s seat when it comes to restoring your data.

Invoice reminders are making their return to Desktop with a more intelligent, more personalised experience that lets you tailor messages and follow clear, suggested next steps.

2025.10 (November 2025)

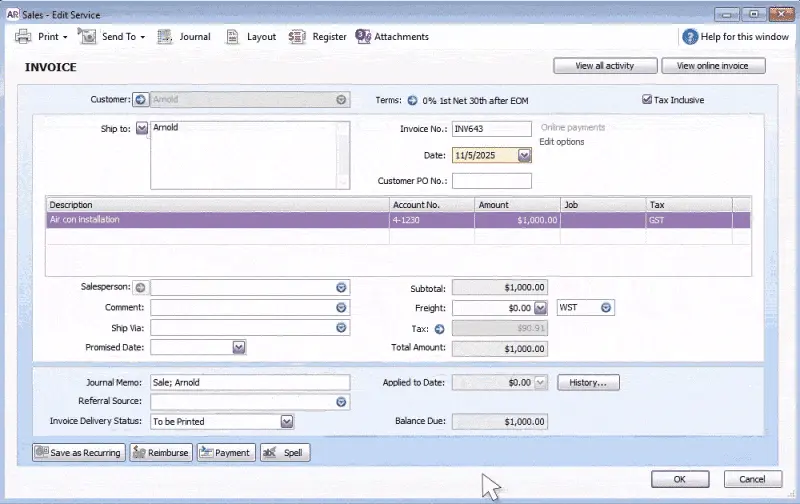

Document attachments, tracked and stored in AccountRight desktop

You can now:

Attach documents to sales and journals

You've always been able to attach documents to bills. You'll now be able to attach documents to sales transactions (quotes, orders, invoices) and general journals. This keeps your documents in one handy, secure space, helping you to meet your record-keeping requirements.Auto-include attachments when emailing a sale

By default, all documents attached to a sales transaction will be included if you email the sale, but you can remove them if you like.Email multiple documents

Attach multiple documents to a sale quote, order, invoice, or purchase bill email (up to 25MB). This means you can include things like an updated price list or promotional material when sending an invoice.

See how easy it is to send attachments when you email a sale:

More about attaching documents

MYOB Assist mobile app

We're refining the app to make it even easier to use. You can now:

Introducing Service invoices

If your business provides services rather than products, you can now choose a Service layout when creating an invoice. This layout is designed for service-based work, where you bill for time, labour, or descriptions of work instead of items or quantities. These invoices are editable within AccountRight desktop and MYOB Business.

Set your default invoice layout (Services or Services & Items) from the More menu.

(Online invoicing users) Send invoices with a payment link via SMS

If you use online payments, you can now send your customers a secure payment link by SMS — not just a PDF attachment. This makes it easier for customers to view and pay directly from their phone. You can send the SMS from the Save menu or by turning on the SMS option when emailing an invoice.

Automatically open your last business file

Save time every time you log in — the app now remembers the last business file you used and opens it automatically. If you usually work from one business file, you no longer need to select it from the list each time you sign in. Just select Open last business on login on the Switch business page, and each time you log in, you’ll go straight into the business file you last used.

You can still switch files anytime from More > Switch business..

AccountRight Bug fixes

Resolved a bug that resulted in an information icon appearing next to Total Received in the Receive Payments window.

Fixed a crash that could occur during bank reconciliation or in purchase transactions.

Coming soon...

You’ll soon be able to create, send, and manage quotes on the go in the MYOB Assist app — using the same Services and Services & Items layouts available in MYOB Business. This makes it easier for you to start a job in the field, send a quote straight from your phone, and turn it into an invoice when the work’s approved — all without leaving the app.

2025.9 (October 2025)

MYOB Assist mobile app

Capture multipage documents

When you take a photo of an invoice or receipt, you now have the option to capture up to 20 additional pages.

Already have the app? Depending on your phone settings, you may need to redownload the latest version of MYOB Assist to get this update (version 1.1.1).

Bug fixes

We fixed an issue that caused AccountRight to crash when removing an attachment from an invoice. This only affected those on the early access program for document attachments.

Coming soon

Document attachments

Document attachments are now available for early adopters and will be generally available soon. This means you'll be able to:

Attach documents to sales and journals

You've always been able to attach documents to bills. We're getting ready to switch on the ability to add attachments to sales transactions (invoices, quotes, sales orders) and general journals. This keeps your documents in one handy, secure space, helping you to meet your record-keeping requirements.Auto-include attachments when emailing a sale

By default, all documents attached to a sales transaction will be included if you email the sale – but you can remove them if you like.Email multiple documents

You'll soon be able to attach multiple documents to a sale or purchase email (up to 25MB). This means you'll be able to include things like an updated price list or promotional material when sending an invoice.

MYOB Assist

In the MYOB Assist app, you'll soon be able to:

Get paid faster by sending an invoice link via SMS (only available if you're using online payments): Send a customer a link to their invoice via SMS directly from MYOB Assist. The link opens the secure online invoice, giving customers a fast checkout experience and helping you get paid sooner.

Create quotes: You’ll soon be able to create quotes in the app. More details to come.

Use service layout invoices: We’re introducing support for service layout invoices in the app, making it easier for service-based businesses to create and edit AccountRight invoices in the app and vice-versa.

2025.8 (September 2025)

The MYOB Assist mobile app is here

This app is now live in Australia and replaces the existing Capture and Invoice apps, MYOB Assist helps you to unlock better cash flow. With the new app, you can:

Capture expenses – snap a photo of a bill or receipt and send it straight to your AccountRight In Tray (or Uploads in the browser).

Create invoices – create, edit and send professional invoices in just a few taps – all synced in real-time with your online company file.

Bug fixes

You'll no longer see a message about online access when removing an offline file user.

Coming soon

Document attachments

Attaching documents to sales and journals

You've always been able to attach documents to bills. We're getting ready to switch on the ability to add attachments to sales transactions (invoices, quotes, sales orders) and general journals. This keeps your documents in one handy, secure space, helping you to meet your record-keeping requirements.Attachments auto-included when emailing a sale

By default, all documents attached to a sales transaction will be included if you email the sale – but you can remove them if you like.Emailing multiple documents

You'll soon be able to add multiple documents when you email a sale or purchase (up to 25MB). This means you can include things like an updated price list or promotional material when sending an invoice.

2025.6 (July 2025)

Account management

Easier MYOB account update processes

We've made it easier to update the relationship your business has with MYOB, whether you want to:

Clearer change of details forms and help topics guide you through what to do and what supporting documents you may need to provide.

Bug fixes

We fixed a crash that could occur when working in the Find Transactions window.

If you upload a document to the browser and then link it to a transaction, the count of documents in the In Tray shortcut in the Banking or Purchases command centres now updates correctly.

We fixed an issue that was causing some buttons to be obscured in transaction windows.

We fixed some crashes that could occur when emailing or printing from AccountRight.

We've removed the Prepare Payment Summaries option from the Payroll command centre menu. With Single Touch Payroll, there is no longer a need to prepare payment summaries.

API improvements

We fixed a discrepancy between AccountRight and the Public API when reporting inventory values involving received items. The current value and average cost calculations are now the same between the two systems.

2025.5 (June 2025)

Payroll

Helping you stay compliant for the 25/26 payroll year (Australia only)

We've got you covered this EOFY by taking care of all these changes for the 2025/26 payroll year:

Tax tables – the 2025/26 tax tables have been automatically updated and will apply for pays dated 1 July 2025 onwards. You'll see the new tax table date when you do a pay dated 1 July or later.

Super rate increase to 12% – the super guarantee rate goes up to 12% from 1 July, but there's an easy way to automate super rate increases.

Lump sum E threshold removal – From 1 July, any payment of back pay is considered a lump sum E. Previously this only applied to back pay exceeding $1200. More about lump sum E payments

Undo manual changes to pay history (Australia only)

An employee's pay history shows what they've been paid in pay runs, so should never be tampered with. We've added an Undo Manual Changes button to the Pay History to easily undo any changes that have been entered manually (maybe trying to fix a pay). Previously you needed to contact us for help to undo these changes.

Bug fixes

We fixed a bug that was affecting some users where the count of In Tray documents on the command centre was inaccurate.

We fixed some crashes that could occur when starting AccountRight or switching between the Banking, Sales and Purchases command centres.

(AccountRight Basics only) You'll no longer see an arrow temporarily appear above the Spend Money button on the Banking command centre.

The Print/Email Statements button no longer temporarily appears too narrow on the Sales command centre.

The Help button in offline company files no longer flickers when you hover over it.

We fixed a visual glitch that could occur on disabled shortcut tiles on the command centre. Previously, if a tile was disabled for a user, a small portion of the tile appeared to be clickable, but clicking it did nothing.

Field validation error messages now display correctly.

Under the hood

We're always working on things behind the scenes that you might not see (or might not see yet), but lead to new time-saving features, better security, or improved performance. Here's an example:

If you access your company file in a web browser, an early access program (EAP) has been launched for changes to the Bank transactions page to make matching faster, smarter and far less manual. A small cohort has been added to the EAP to try this new feature before it's rolled out to everyone. More about this EAP

2025.4 (May 2025)

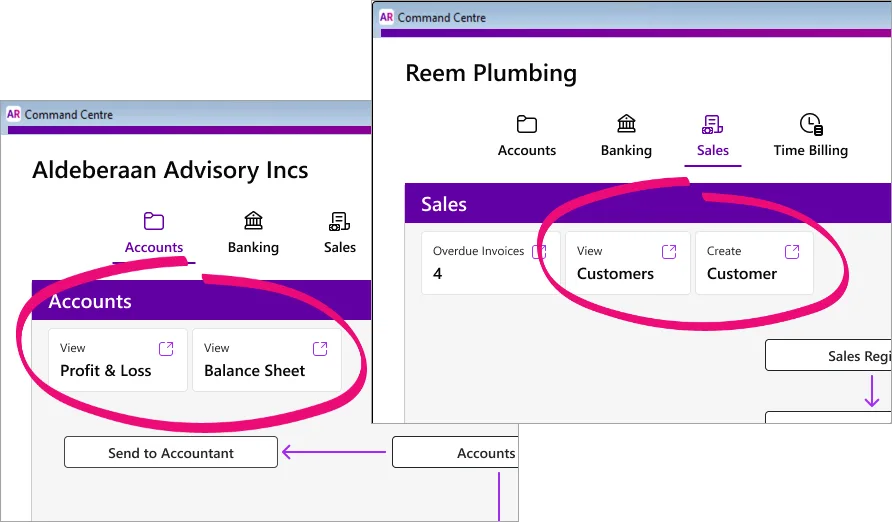

Refreshed command centre (online company files only)

A sleek new look

We've modernised the look for online files but kept the same layout – so there's no change to how you work. The order and placement of the buttons is the same, so you'll still find what you need in the same place.

You won't see these changes in offline company files or backups restored locally or in a network.

Get things done faster

Instead of wondering where to look or what needs attention, you'll now see important updates and tasks at the top of each command centre. This lets you take action without spending time clicking through different screens. If you've taken action, use the refresh button to update the numbers.

Instantly access key info and tasks

No more digging through menus to find key reports or complete a common task. The information you need has been brought to the front, just one click away.

Payroll

Helping you stay compliant with self-managed super funds (Australia only)

To pay contributions to a self-managed super fund (SMSF) from AccountRight, your STP reports must have been successfully accepted by the ATO. This confirms your business is verified with the ATO and helps ensure SMSF payments are only made by legitimate, registered employers.

Bug fixes

We fixed an issue that was preventing the File menu from displaying for some users.

Negative amounts can now be used in general journal entries.

If you use online payments in New Zealand, you'll now see the appropriate payment icons in invoices (Visa, Mastercard, Apple Pay and Google Pay).

When you email a recurring sale from the To Do List, the email variables now work correctly.

Under the hood

We're always working on things behind the scenes that you might not see (or might not see yet), but lead to new time-saving features, better security, or improved performance. Here's an example:

Trying to fix an employee's pay (in Australia) by tinkering with their pay history causes reporting issues and requires a complex resolution. Not ideal – especially at EOFY. (The right way to adjust pay amounts is through a pay run). So we're adding a button to undo manual pay history changes. This means if you've incorrectly changed an employee's pay history, you'll be able to fix it with one click, without needing tech support.

2025.3 (April 2025)

Payroll

Simplifying STP compliance (Australia only)

When you create a new company file, the ATO Reporting Category is now set for you in these payroll categories:

Base Hourly

Base Salary

Annual Leave Pay

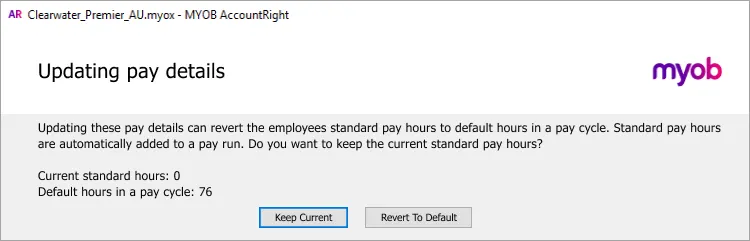

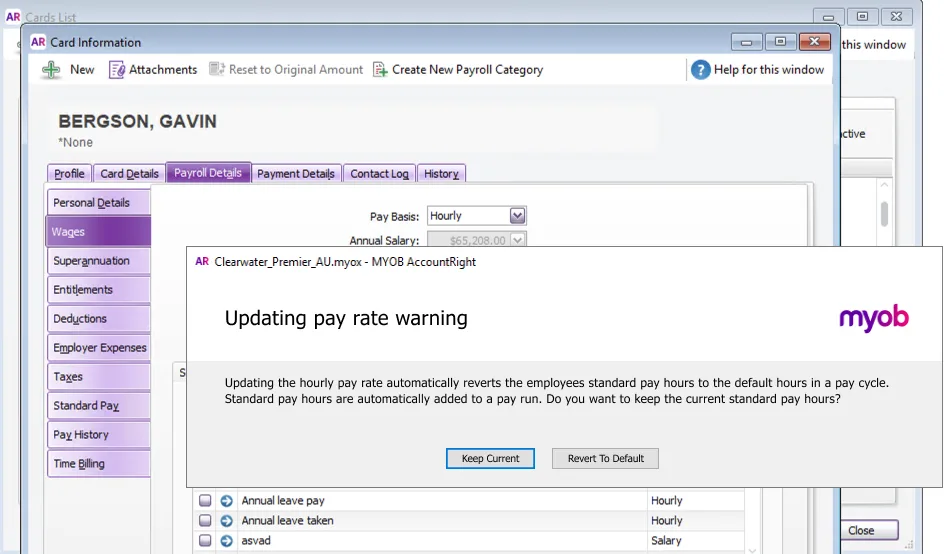

Personal Leave Pay