The ATO's Small Business Superannuation Clearing House (SBSCH) will close from 1 July 2026 and you won't have access after this date. More about this closure.

If you're using the ATO's Small Business Superannuation Clearing House (SBSCH) to pay your employees' super payments, do these things before 30 June 2026:

Set up Pay Super – this lets you pay super contributions straight from MYOB Business

Save copies of your super records from the SBSCH – retain these documents for your records

Store your SBSCH documents for each employee in MYOB Business – all your employees' documents are safe, secure and easily accessible in one place

Don't wait until 1 July to get ready

If you pay super quarterly, your super payment for the January-March quarter (due 28 April 2026) should be the last payment made through the SBSCH. The April–June quarter payment (due 28 July 2026) cannot be made using the SBSCH after 30 June 2026.

You don’t have to wait until 1 July to get ready – you can start now.

Set up Pay Super in MYOB Business

Pay Super is included with your MYOB subscription so you can quickly and easily pay contributions to your employees' super funds.

You can make payments after each pay run so you'll comply with the ATO's new Payday Super requirements which starts on 1 July 2026.

Things to know before you sign up

-

Only a business owner or company director who is also a signatory to the business bank account used for direct debits can sign up to Pay Super. They must also be the MYOB file owner or online admin.

-

Have your bank account details handy. You’ll need to enter the account that payments will be made from. You’ll also need to verify your bank account later.

-

Anyone who will create or authorise super payments needs to have already accepted an invitation to access your MYOB file. If someone needs to be invited, learn how to do it.

-

You need an MYOB subscription to sign up for Pay Super.

-

Read the MYOB Pay Super Service Product Disclosure Statement, available on our MYOB Legal Notices page.

To get started, go to the Payroll menu and choose Super payments. Here's all the setup details

Save your super records from the SBSCH

You need to save your SBSCH transaction history before 1 July 2026. After this date, the service will close entirely and you won't have access to your records. You might need your records in the future to respond to audits or employee queries.

For more details on accessing and saving copies of your super records, see this ATO information.

To download and save your super payment transaction history:

Once in the SBSCH, go to the Payment Instruction tab.

Click the Historical tab.

Choose the relevant period (date range) you want to see. The system will display details of the Payment instructions for the selected dates.

Click Print friendly version, then when prompted in your browser, choose Save as PDF (or equivalent) and save the file securely.

Repeat this for each period you need.

You should also download your employees' super fund details so you can set these up in MYOB.

In the SBSCH, go to the Employees tab.

Use the filter to choose All, Active, or Inactive employees, depending on what you need.

Scroll to the bottom of the page and set Results per page to 100 (the maximum). If you have more than 100 employees, use the page navigation to move through each page and repeat the steps below for each page.

For each displayed employee record, select the down arrow to expand and show full details.

Open your browser’s Print menu and choose Print to PDF (or equivalent) and save the file safely.

Store your SBSCH documents in MYOB Business

You can upload your SBSCH documents into your employee's records in MYOB Business. This helps keep all your employee information in one place.

Go to the Payroll menu and choose Employees.

Click the employee.

Click the Documents tab.

If it's the first document you're uploading, drag the file onto the MYOB screen or click browse for files. Otherwise click Upload documents.

Choose the file you want to upload and click Open to upload it.

Click Save.

If you're using the ATO's Small Business Superannuation Clearing House (SBSCH) to pay your employees' super payments, do these things before 30 June 2026:

Set up Pay Super – this lets you pay super contributions straight from AccountRight

Save copies of your super records from the SBSCH – retain these documents for your records

Store your SBSCH documents for each employee in AccountRight – all your employees' documents are safe, secure and easily accessible in one place

Don't wait until 1 July to get ready

If you pay super quarterly, your super payment for the January-March quarter (due 28 April 2026) should be the last payment made through the SBSCH. The April–June quarter payment (due 28 July 2026) cannot be made using the SBSCH after 30 June 2026.

You don’t have to wait until 1 July to get ready – you can start now.

Set up Pay Super in AccountRight

Pay Super is included with your MYOB subscription so you can quickly and easily pay contributions to your employees' super funds.

You can make payments after each pay run so you'll comply with the ATO's new Payday Super requirements which starts on 1 July 2026.

Things to know before you sign up

-

Only a business owner or company director who is also a signatory to the business bank account used for direct debits can sign up to Pay Super. They must also be the MYOB file owner or online admin.

-

Have your bank account details handy. You’ll need to enter the account that payments will be made from. You’ll also need to verify your bank account later.

-

Anyone who will create or authorise super payments needs to have already accepted an invitation to access your file. If someone needs to be invited, learn how to do it.

-

You need an AccountRight subscription to sign up for Pay Super. If you’re on a 30-day trial of AccountRight, subscribe now.

-

If you want to pay self managed super funds (SMSFs) your company file must be online. How to move your company file online

-

Read the MYOB Pay Super Service Product Disclosure Statement, available on our MYOB Legal Notices page.

To get started, go to the Payroll command centre and click Pay Superannuation. Here's all the setup details

Save your super records from the SBSCH

You need to save your SBSCH transaction history before 1 July 2026. After this date, the service will close entirely and you won't have access to your records. You might need your records in the future to respond to audits or employee queries.

For more details on accessing and saving copies of your super records, see this ATO information.

To download and save your super payment transaction history:

Once in the SBSCH, go to the Payment Instruction tab.

Click the Historical tab.

Choose the relevant period (date range) you want to see. The system will display details of the Payment instructions for the selected dates.

Click Print friendly version, then when prompted in your browser, choose Save as PDF (or equivalent) and save the file securely.

Repeat this for each period you need.

You should also download your employees' super fund details so you can set these up in MYOB.

In the SBSCH, go to the Employees tab.

Use the filter to choose All, Active, or Inactive employees, depending on what you need.

Scroll to the bottom of the page and set Results per page to 100 (the maximum). If you have more than 100 employees, use the page navigation to move through each page and repeat the steps below for each page.

For each displayed employee record, select the down arrow to expand and show full details.

Open your browser’s Print menu and choose Print to PDF (or equivalent) and save the file safely.

Store your SBSCH documents in AccountRight

You can upload your SBSCH documents into your employee's cards in AccountRight. This helps keep all your employee information in one place.

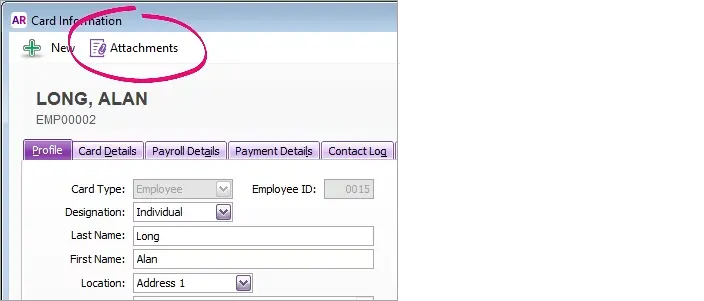

In your online company file, go to the Card File command centre and click Cards List.

Click the Employee tab.

Click the zoom arrow to open the employee's card.

Click Attachments.

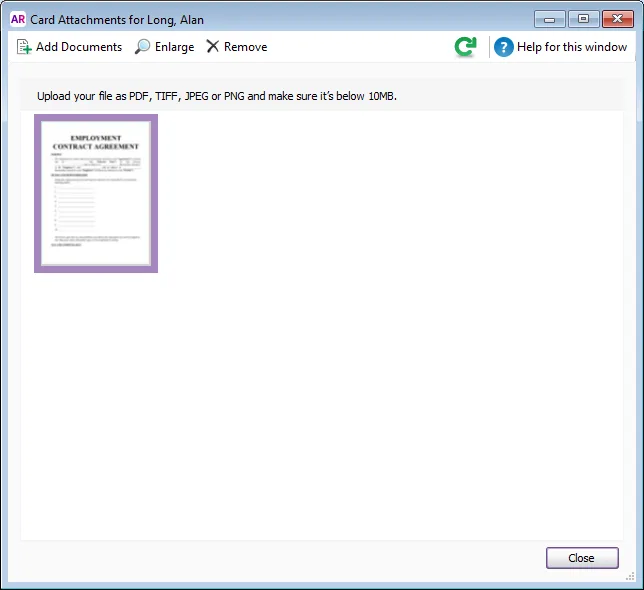

Attach the document by either:

clicking Add Documents to locate and select the document, or

clicking and dragging a document into the Card Attachments window.

Click Close.

Click OK to save the changes to the card.