Data rollover

Creating a 2024 return

A 2024 tax return entry with a Not started status is automatically created if you had a 2023 return for your client created on 31 March

A 2024 tax return entry won't be created if the 2023 return has a Not started status or hasn't been created.

To roll over details from the 2023 return to the 2024 return, click anywhere in the row showing Not started.

You can also manually create a 2023 or 2024 return by clicking Add new. This will roll over data if a return existed in the previous year.

Tax changes

Rate changes

ACC earner levy changes:

the levy rate has increased to 1.53%.

maximum levy payable is $2,132.57.

maximum earnings for levy is $139,384.

Student loan annual repayment threshold has increased to $22,828.

Working for families rate changes:

Family tax credit has increased to $7,121 for the first child, and $5,802 for any subsequent children.

Best start entitlement has increased to $3,632 per child.

Minimum family tax credit has increased to $34,216 (after tax).

IR6 changes

Additional reporting requirements section

Assets now has Beneficiary current accounts and Other assets fields. Total assets is now automatically calculated.

Liabilities now has Beneficiary current accounts and Other liabilities fields. Total liabilities is now automatically calculated.

The Accumulated trust funds section replaces the Equity section. This field is automatically calculated by deducting total liabilities from total assets.

There's a new Other financial metrics section that includes fields for Untaxed realised gains/receipts (previously in the Statement of profit or loss section) and Amounts withdrawn by beneficiaries during the year.

Distributions

The IR6 has a new field in the beneficiary section, to indicate whether a nil distribution has been made to the beneficiary during the year.

You can no longer enter any negative values when allocating beneficiary income.

Beneficiary and settlor IRD number validation

IRD numbers have new validations to prevent submitting the same beneficiary and settlor IRD numbers as those of the trust or another beneficiary or settlor. Submitting the same IRD numbers is invalid and submitting the IR6 with same IRD numbers will give you an error.

See IR's webpage for more information on IRD number errors and other common errors in trust returns.

More pre-populated data from IR

Only Inland Revenue's IR4J or IR8J 2023 closing balance will be used for the IR4J and IR8J attachment and opening balance. The attachment and opening balance will no longer be based on the prior year's tax return attachment.

An IR833 attachment will be created and populated with the sale of property details if IR has the information available. You'll still need to specify whether the sale is subject to the bright-line test.

There are 3 new income types that IR may provide as part of Income with tax deducted from summary of income:

Backdated lump sum payment from Accident Compensation Corporation.

Backdated attendant care lump sum payment from Accident Compensation Corporation.

Backdated lump sum payment from Work and Income.

Other changes

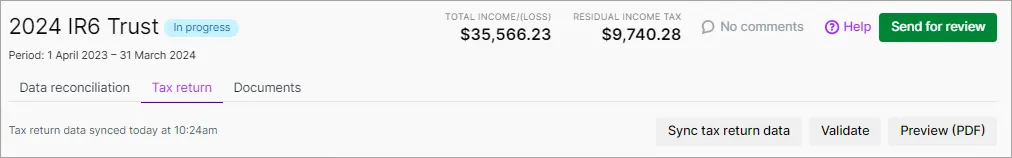

You now have quick visibility to key information in the return. The top of most tax returns will display Taxable income/(loss) and Residual income tax.

Field descriptions in the return let you know which fields are being used to display the information at the top of the return.

For the IR4, shareholders will be printed on the tax statement PDF.

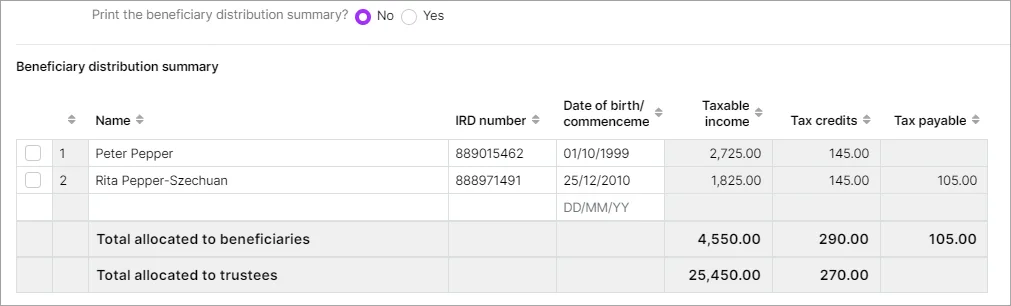

In the IR4, IR6 and IR7, a new distribution summary in the associations section lets you easily see which associations exist and some of their key details. For example, this is the beneficiary distribution summary in the IR6:

You can add, edit or delete from the summary or from the beneficiary, settlor, shareholder, partner or owner section. Changes you make to the fields will be updated in the summary and the relevant section.

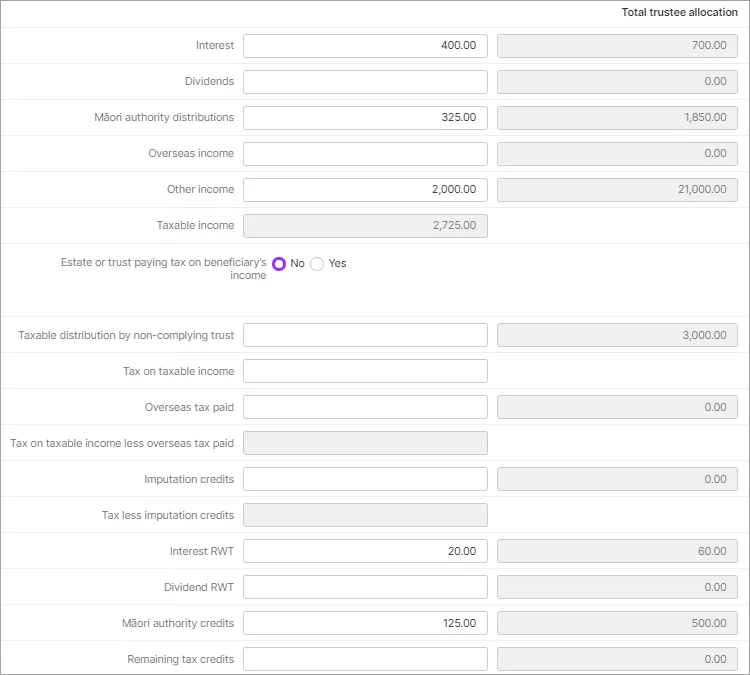

If you select Yes on the print option, the summary is included on the tax statement PDF report before the relevant association's usual list of information. The summary is not filed to IR.In an IR6, there's a Total trustee allocation column to the right of the beneficiary income and tax credits fields. Any amount not allocated to beneficiaries will appear in this column and will be allocated as trustee income. Both KP21 Income allocation fields will now be automatically calculated.

However, if the IR6 is for a foreign or non-complying trust and there are taxable distributions to beneficiaries, they'll also display in the Total trustee allocation column. If you don't allocate the full amount, any remainder won't be allocated as trustee income.

In an IR6, settlors will be pre-populated if the association is present in the client details. You can still add settlors manually or delete any pre-populated ones that aren't required.

In the Rental income statement, the interest claimed reason rate for Loans drawn down prior to 27 March 2021 has been adjusted to 50%.

Validation messages have had various changes and improvements.

One of these improvements is to an IR10 warning. The warning is now based on tax return income rather than only the total keypoints that may require an IR10 to be filed. The IR10 is often entered as whole dollars, so the warning will only display if the difference is more than $1.

Resolved issues

In some situations, after clicking Sync tax return data, the transfers and payments amount could show multiple times. This mainly affected transfers received and the Student loan schedule. We've fixed this for 2024.

Free MYOB webinar

Register to watch the free tax webinar. Discover how to navigate the new IR tax changes and all the ways updates to Tax in MYOB Practice Compliance make EOFY easier.