A short history of cool invoices

21st October, 2015

In centuries to come, there may be no evidence of our electronic transactions, but in ancient times, business transactions were recorded on stone or parchments.

I asked my graphic designer friend Joe at Studio 131, to provide an example of a ‘cool’ invoice. He replied with a question: “Can an invoice ever be cool?”

Back through time

Digging back through history, we found a few invoices from about 100 years ago. Here’s a beautiful one from John Danks & Son of 391 Bourke Street, Melbourne, for repairs in 1895 to one Richmond Council fire hydrant. It’s appropriate to that time, explains clearly what they do and celebrates their achievements — medals won at the 1875 Melbourne International Exhibition.

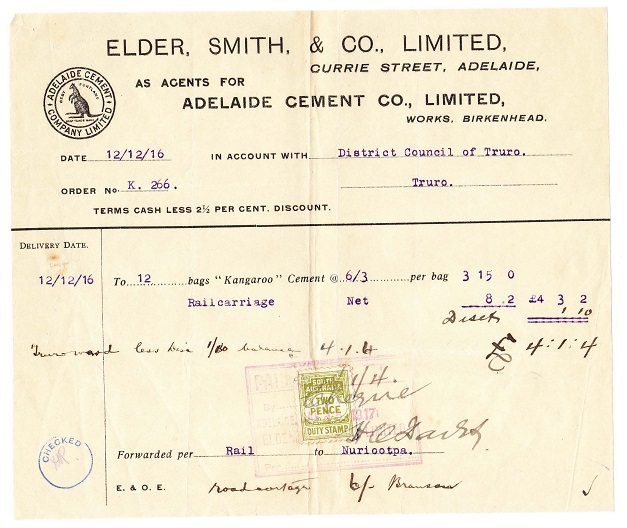

This next one is pretty cool, too. In 1916, in the middle of the First World War, 12 bags of “Kangaroo” cement was sent by rail carriage to the District Council of Truro by Elder, Smith & Co., Limited of Currie Street, Adelaide. Terms offered: 2.5 percent discount for paying cash, and taxes were paid (‘stamp’ duty) of two pence.

For over 100 years, the basics of an invoice haven’t changed. These are invoice templates, printed in bulk and populated manually.

(Want to learn more? Check out MYOB’s six-part series on the history of accounting – from its origins to today, and beyond.)

What do you need in an invoice template?

Templates have been used in many trades and professions to create consistency, or ease of process. Today a template often refers to an electronic document, a basic format or process that can be used repeatedly as a guide or standard.

Many entrepreneurs panic in the moments of initial success, realising they have their first customer, but no invoice set up to send. They race to find a template and pretend it’s not the first they have ever created. It pays to put some thought into not only your invoicing, but your whole financial system.

Do you want a standalone invoice (which could be okay for one or two invoices a month)? Or invoicing software integrated into your financial system? Good online accounting software will allow you to customise an invoice especially for your business.

Ensure your template complies with relevant law and have it ready well in advance.

What are the legal requirements?

In Australia, if a customer asks you for a tax invoice, you must provide one to them within 28 days.

Tax invoices for taxable sales of less than $1,000 must include:

- The words ‘Tax invoice’

- The seller’s identity — usually either a person’s name or a business name — and ABN

- The date that the tax invoice was issued

- A brief description what was sold, including the quantity (if applicable), and the price

- The GST amount payable in relation to the sale and the extent to which each line item on the invoice is a taxable sale

In addition to the above requirements, tax invoices for taxable sales of more than $1,000 must also include the buyer’s identity and ABN (if they have one).

For further information about issuing tax invoices in Australia, as well as some helpful examples, see the ATO website. For information about the legal requirements of invoices in New Zealand, see the IRD website.

Elements of ‘cool’

So what are the elements of cool that apply to invoices? They are pretty much the same today as they were 100 years ago:

- Brand: An invoice is an extension of your brand. It should look and feel consistent with the rest of your brand elements.

- Marketing: An invoice is a marketing touch point. Use the opportunity wisely.

- Design: Employ smart designs, layout and descriptions to make your invoice visually appealing and easy to understand.

- Awards: Celebrate your achievements, award-winning product or five-star rating.

- Facilitate payment: Cash flow is king, so request payment as soon as possible. Deliver your invoice as soon as possible — via email, of course — and perhaps consider offering a discount for early payment.

- Basics: Get the basics right. Ensure the dates, customer details, item descriptions and purchase order numbers are correct, and include clear payment terms and correct application of taxes.

- Help yourself: Get an integrated invoice and accounting system.

- Reduce mistakes and save time: Set your invoice template up in the accounting software.

- Send electronically: Send invoices directly from your online accounting software.

- Make it easy to pay: Set up multiple options for the customer to pay: include direct debit at a minimum. Also consider other options like credit card, PayPal, B-Pay and accepting payments over the phone.

- Add public relations: Include engaging content or offers with your delivery. You can do more now with electronic offers, so use them to your advantage.

Get the details right, make it easy to understand and easy to pay — and add your own sense of cool that is appropriate to your brand. What will your invoices say about your business in 100 years from now?