Some of your clients may be eligible for Working for families tax credits, which are payments for families with dependent children aged 18 or under. Payments are calculated based on the number of children, total family income and the number of hours worked. The Working for families package helps with the cost of raising a family.

We calculate the following Working for families entitlements:

Family tax credit (FTC)

In work tax credit (IWTC)

Best start tax credit (BSTC)

Minimum family tax credit (MFTC).

-

This schedule is for information purposes. It doesn't update the main form of the tax return and isn't filed with IR. The total amounts are displayed on the tax statement and may be included on tax notices.

-

IWTC replaces Child tax credits (CTC). We no longer support CTC.

Eligibility for entitlements

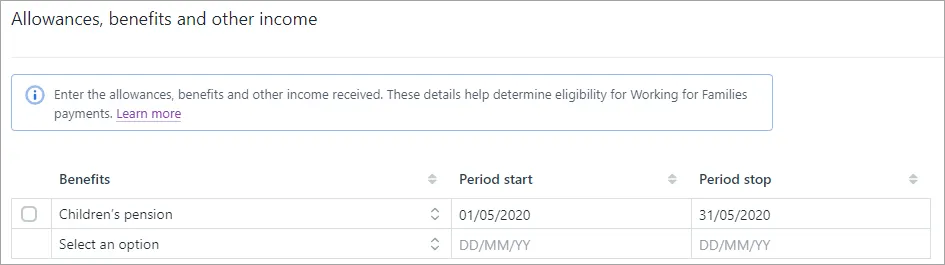

A taxpayer's eligibility for Working for families entitlements depends on the type of allowance, benefit or other income the taxpayer may have received in a period.

Allowances, benefits and other income table

The Working for families schedule has a section for specifying which Allowances, benefits and other income the taxpayer received, and the period that they received it. This period is the exclusion period, which means that the taxpayer isn't eligible for the entitlement in the period that they received the specified benefit.

Y = Yes

Allowances, benefits and other income | Family tax credit (FTC) | In work tax credit (IWTC) | Best start tax credit (BSTC) |

Basic grant and independent circumstances grant | - | Y | - |

Children's pension | Y | Y | Y |

Foster care allowance | - | - | - |

Income-tested benefit | - | Y | - |

Independent earner tax credits | - | - | - |

Orphans' benefit | - | - | - |

Parental leave payment or preterm baby payment | - | - | Y |

Parental tax credit | - | - | Y |

Parent's allowance | Y | Y | Y |

Student allowance | - | Y | - |

Unsupported child's benefit or parent's allowance | - | - | - |

Not in paid employment and not on a benefit | - | Y | - |

Minimum family tax credit (MFTC) uses a different method to FTC, IWTC and BSTC to work out entitlement. There are benefits that impact the eligibility of MFTC entitlement, such as parent's allowance, children's pension and income tested benefits. But rather than using the Allowances, benefits and other income section to work out MFTC entitlement, the benefits impacting MFTC entitlement are considered based on the number of weeks worked, which you indicate by completing the fields in the Minimum family tax credit (MFTC) section. For more information, see To use the Working for families schedule with automatic calculations below.

Using automatic calculations

As you complete the Working for families schedule, we'll automatically calculate the amounts and display them in key fields.

How amounts are automatically calculated

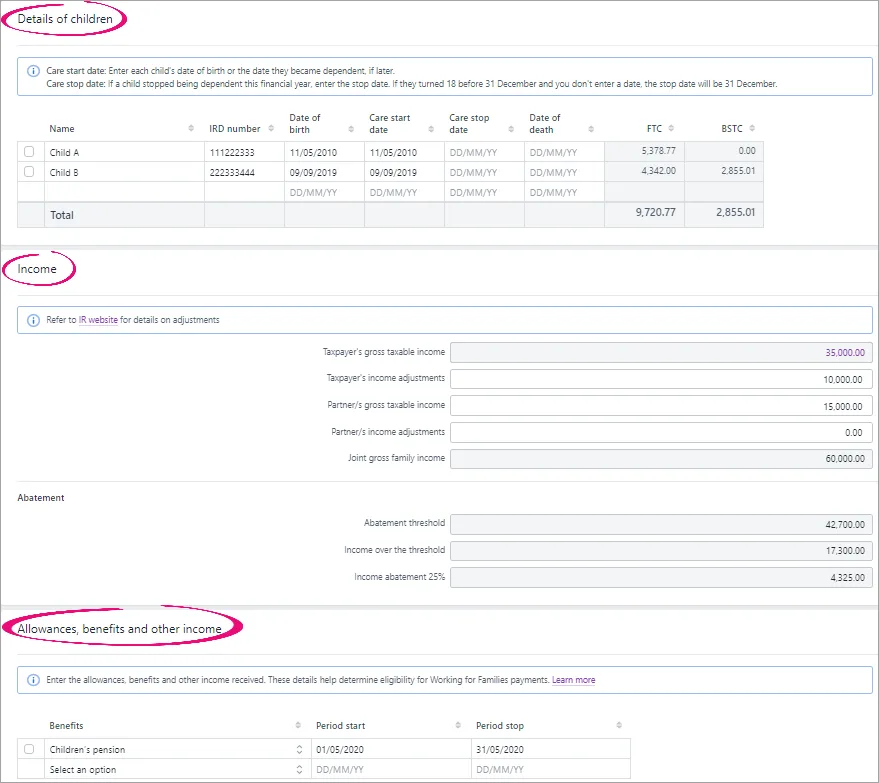

The amounts and totals in the fields throughout the schedule are calculated using the data that you enter in the Details of children, Income and Allowances, benefits and other income sections and the options you select for the entitlements.

Use the Working for families schedule with automatic calculations

Go to the Tax > Compliance list page and open the IR3 tax return.

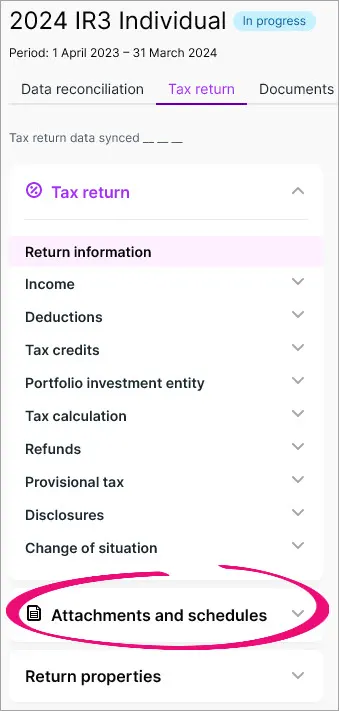

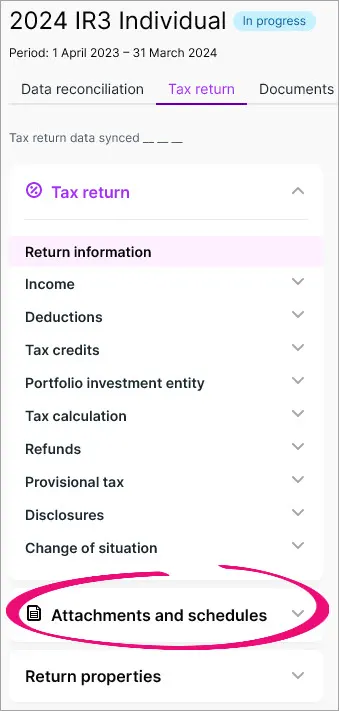

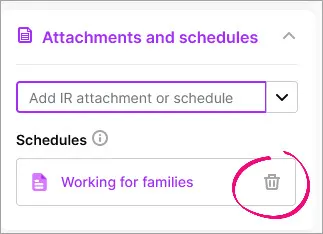

On the Tax return page, on the panel next to the return, click Attachments and schedules to expand the options.

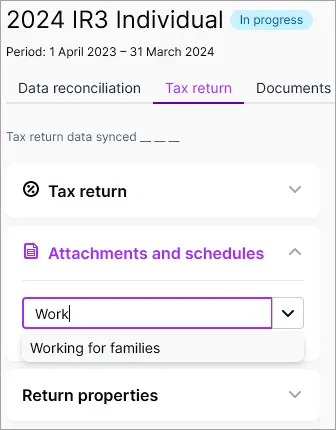

On the panel next to the return, under Attachments and schedules, search for and select the Working for families schedule.

The schedule opens in a new browser tab.

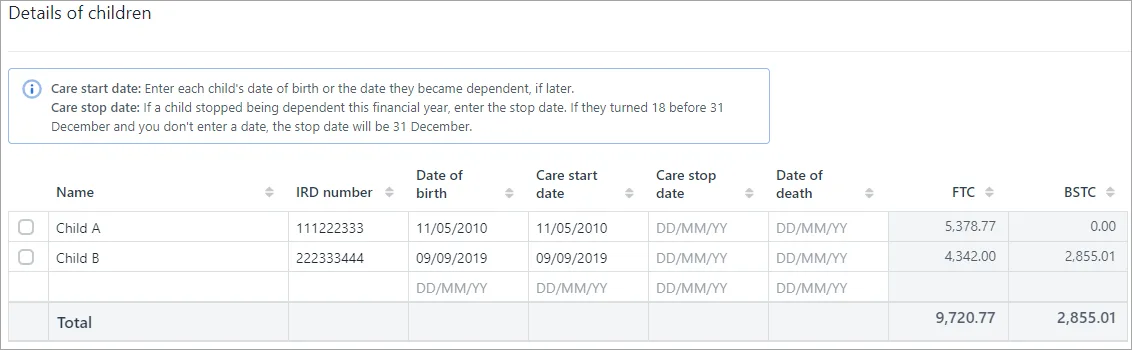

Complete the Details of children table.

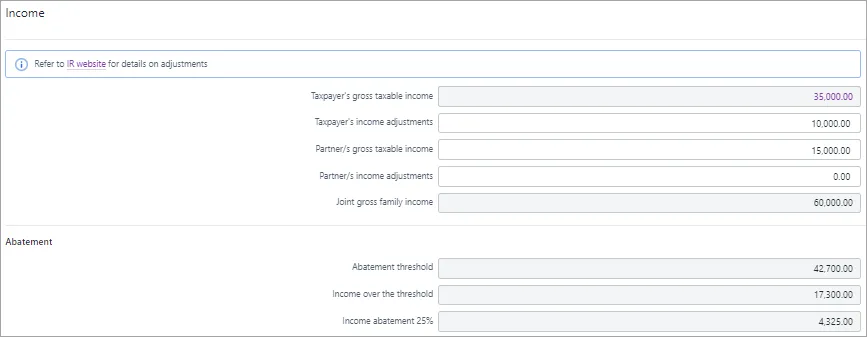

Complete the details in the Income section.

The Taxpayer's gross taxable income field is automatically populated. The amount comes from the Total income/(loss) after expenses amount in the IR3 return.

The Abatement section is automatically populated.

In the Allowances, benefits and other income section, select the benefits that your client received and the dates that they started and stopped receiving the benefit.

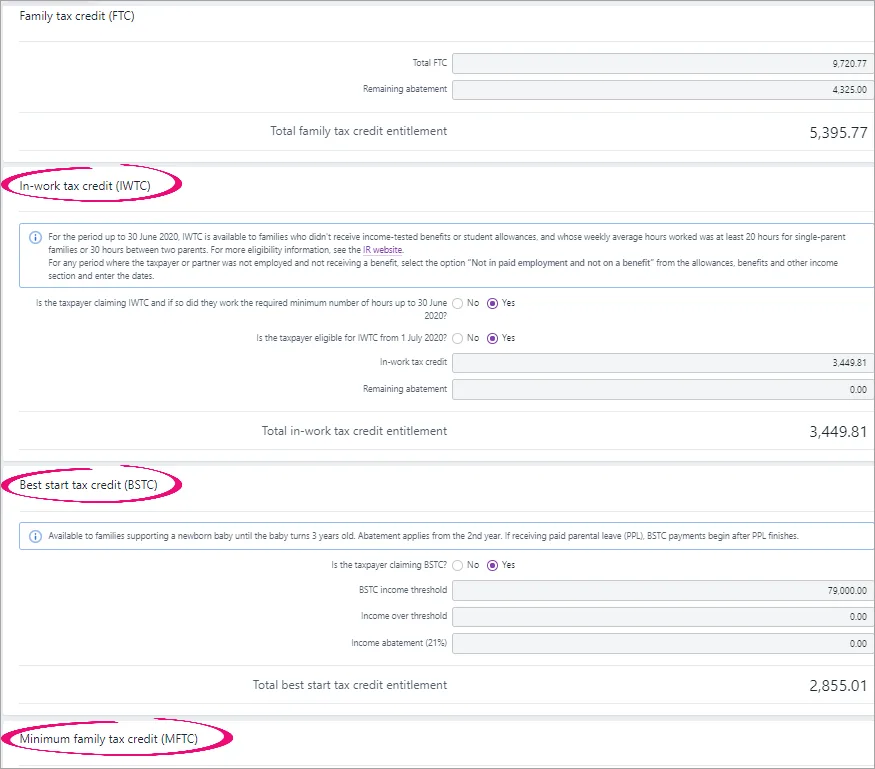

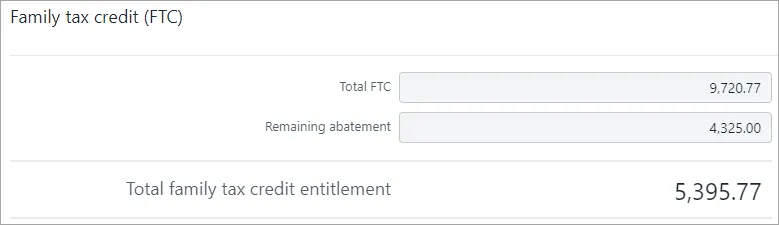

The Family tax credit (FTC) amounts are automatically calculated.

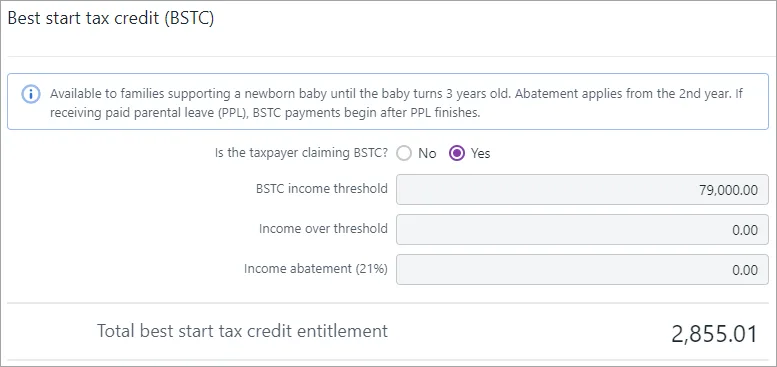

If you're claiming any entitlements in addition to Family tax credit, select Yes in the section for that entitlement. For example, select Yes under Best start tax credit (BSTC).

The amounts and total are automatically calculated.

If you're claiming Minimum family tax credit, complete the fields under Minimum family tax credit (MFTC).

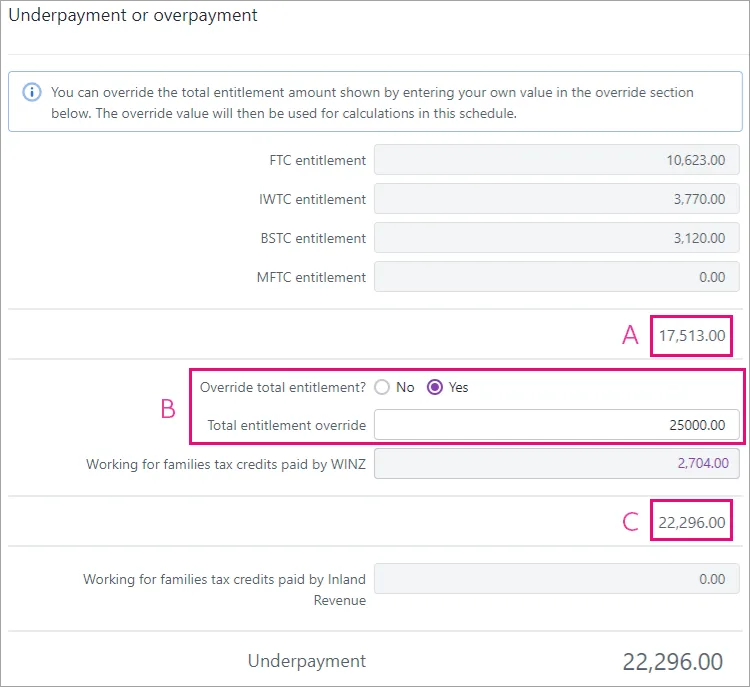

The amounts and totals under Underpayment or overpayment are automatically calculated (A in the image below), but you can override the total of the FTC, IWTC, BSTC and MFTC entitlements (B in the image below) to get a new total (C in the image below). To override the total, select Yes as the Override total entitlement? option and enter the override amount in Total entitlement override.

-

The Working for families tax credits paid by WINZ amount comes from the Total family tax credit from work and income field in the Income with tax deducted from summary of income section of the IR3 return.

-

The Working for families tax credits paid by Inland Revenue amount comes from the Working for families tax type in Data reconciliation.

If you can’t see an amount in Working for families tax credits paid by Inland Revenue, click Sync tax return data in the IR3 return. -

To download a copy of the schedule that you can send to your clients, go to Tax > Compliance list, open a return, click Preview (PDF) on the top right of the page, and choose your options.

-

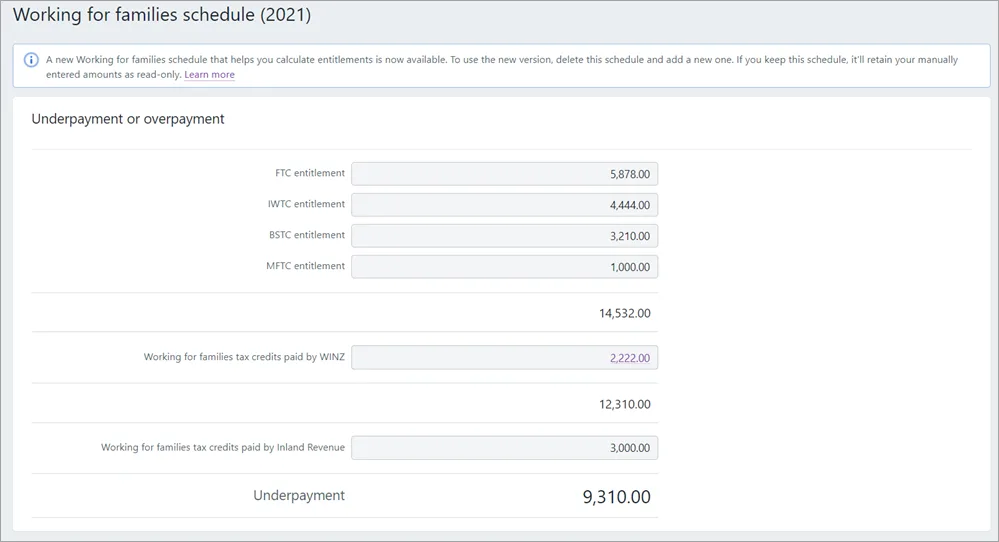

Existing schedules with manual calculations

Before automatic calculations were available, you may have entered amounts based on your own manual calculations.

What happens to previous manual calculations

You can no longer manually enter the tax credit entitlement amounts. If you previously manually entered amounts, they'll remain displayed in the schedule and will override any automatically calculations, but you won't be able to change the previously entered amounts. You'll see a message at the top of the page letting you know that you're viewing an old version of the schedule with manually calculated amounts.

If you want to use the automatic calculations, delete the schedule, then add the schedule again and enter the dependant's details. It's up to you whether you want to keep your manual calculations, or delete the schedule and add it again to receive the automatic calculations.

Before September 20 2021, the Total repayments made to IR and 20xx Total interim repayments made to IR fields weren't automatically populated and could only be manually populated.

-

If you already have manually entered data...

...in the Working for families tax credits paid by Inland Revenue field of an existing schedule, this data won’t be overwritten with data from Data reconciliation transactions. If you want the field to use data synchronised from Data reconciliation transactions, delete the schedule, then add the schedule again and complete any manually editable fields. The automatically calculated fields will already be populated. -

If you have in-progress tax notices...

...where you've added any voluntary adjustments, check the amounts in these tax notices. The voluntary amounts may already be taken into account by the fields automatically synchronised from Data reconciliation. If this is the case, you'll have a duplicated amount from the manual and automatic adjustment.

To fix tax notices with duplicated amounts, remove the voluntary adjustments in the tax notice.

Delete and add the schedule to receive automatic calculations

Go to Tax > Compliance list and open the IR3 tax return.

On the Tax return page, on the panel next to the return, click Attachments and schedules to expand the options.

Next to the Working for families schedule, click the rubbish bin icon.

Click Delete in the confirmation dialog.