This page shows you how to fix errors and warnings you may see when preparing, validating or filing a tax return.

If you need help with a warning after pre-populating data into a tax return, see Fixing differences with Inland Revenue data.

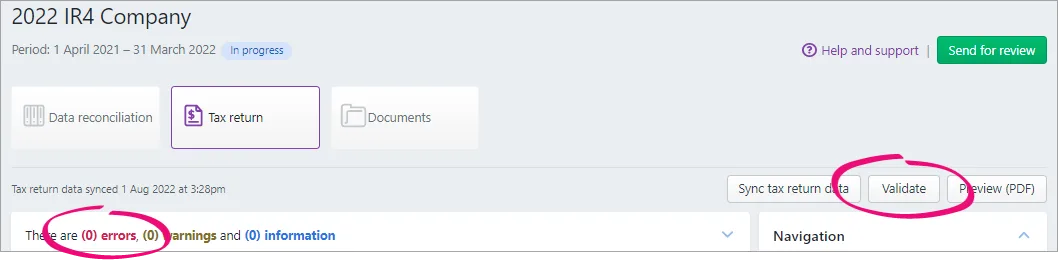

Make sure you validate your return before you file it and after you've fixed any errors.

1. Check for errors

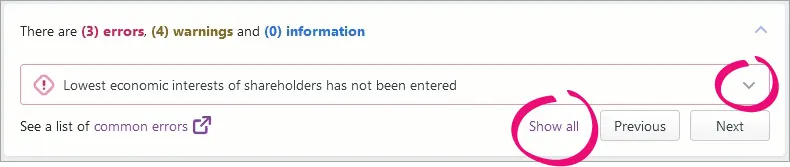

The validation and rejection errors are displayed on top of your tax return. To see more details of the errors, click Show all and click the expand arrow (an arrow pointing downward) next to the error.

You can also click the error message, and when possible, it'll take you to the field where the error has happened.

If you've got a rejected return, make sure you select Send for rework before fixing it.

2. Fix the filing rejections and other errors

Click below to see common errors and how to solve them.

Common errors with solutions

-

To quickly find an error on this page, use your browser's search tool (Ctrl+F) and type the error code or message.

-

The wording in some of these error message may display differently for you depending on the tax year. The wording in these errors is from 2023.

-

Find more tips and info on the Preparing a tax return page.

Error | Reason for error | Solution |

|---|---|---|

Error code: 1 Error message: Authentication failure | Your myIR credentials have expired or are invalid. | Check the following: The correct agency is set for the return in the client’s compliance settings. Your myIR credentials are valid. |

Error code: 4 Error message: Unauthorised delegation | You don't have the correct authorisation to file the return. | Check the following: The correct agency is set for the return in the client’s compliance settings. In myIR, the account type exists (e.g. REB) and the agency is linked for that account type. Your myIR credentials are valid. In myIR, your access is either full account access or File for the agency. Learn more. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | Transfer section is missing information or details aren't entered correctly. | If the transfer is required, check that all fields are completed. If no transfer is required, remove (X) the transfer. If you can't see the refund section: 1. Add a temporary large tax credit amount to create a refund scenario to reveal the refund section. 2. Remove (X) any transfers that you don't need. 3. Delete the temporary tax credit. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | Beneficiary, settlor, shareholder, partner or owner is missing information, or details aren't entered correctly. | If the section is required, check that all required fields are completed. For a trust, check that a valid Date of birth or commencement date has been entered for all beneficiaries and settlors If a section isn't required, remove (X) it. You can't file a return with a section that has no data or incomplete data. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | The entered IRD number isn't valid, or the IRD number hasn't been entered for a transfer, beneficiary, settlor, shareholder or partner. | If you know the IRD number, make sure it is valid. An IRD number must be 9 digits. If the IRD number is only 8 digits, add a leading zero (0). Remove any spaces, hyphens or other characters. If you don't know the IRD number and the IRD number is for a shareholder or partner, or for a beneficiary in a return before 2022, you can enter nine zeros, or copy and paste the following: 000000000 For beneficiaries (from 2022 onwards), settlors and transfers, you must have a valid IRD number and can't use nine zeroes (000000000). |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | IR10 has a negative Other Expenses. | Make sure IR10 Total expenses has been added and Other Expenses is a positive amount. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | IR526 is blank. An IR526 can't be filed if there are no donations. | IR526 is for donation claims. If your client didn't make any donations for the year, don't file the return. If your client made donations, enter the donations before filing the return. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | IR215 is blank. An IR215 doesn't need to be filed if there is no additional income or adjustments to be declared. Learn more about adjusting income for Working for families and student loans. | If there is no additional income or adjustments to report, delete the IR215. If there is additional income or adjustments, complete the relevant fields in the IR215. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | IR1261 is blank. An IR1261 can't be filed if there is no overseas income. | If there is no overseas income, delete the IR1261. If there is overseas income, complete the IR1261 Overseas income summary before filing the return. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | IR1261 Overseas income summary is missing the tax jurisdiction and/or the income type. | Each overseas income row must have an income type and tax jurisdiction entered. If you don't know the income type select Other. If you don't know the tax justification, select Unknown. If a row isn't required, delete it. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | IR7 only If there are many partners with very small percentages being allocated, the tax credits may be negative for a partner. This usually affects the first partner. | Adjust the tax credits so no partner's credits are negative. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | PIE tax credits are negative. For IR3NR, IR4, IR6, and IR7, PIE income and tax credits only need to be included in specific situations. | Remove any PIE data that's not required to be filed. |

Error code: 21 Error message: XML failed. The return can’t be filed due to an error in the return. | At least one of the fields has a space with no other characters. If it's in an area that allows multiple rows, this creates a blank row. This can happen in any return or attachment. For example, income source in an IR1261, an address field in an IR833 or Other payments in IR215. | Add valid details to ensure there aren't any spaces or blank rows. If it’s in an area that allows multiple rows, and the row isn't required, delete the entire row. |

Error code: 104 Error message: Invalid filing period | This can happen if you're trying to file a return for a period that isn't open in myIR. It can happen for any return type, but typically occurs for an IR6 or IR526. | Check if myIR shows the period that the return is being filed. If myIR doesn't show the period, send IR a secure mail to request that the period be generated. After IR has done this, file the return again. |

Error code: 105 Error message: No filing obligations found | IR has set the income tax return to 'not required to file'. | If you believe a return should be filed, contact IR to ask them why they have set the status to 'not required'. |

Error code: 107 Error message: A return for this period already exists | The tax return can't be sent through Tax in Practice Compliance as it has already been filed with IR through an alternative method, including IR's automatically issued income tax assessments. | If the return needs to be amended, you need to file the amendment in myIR. |

Error code: 135 Error message: IRD number failed IR's validation check - it must be valid, 9 digits, and have no other characters | The IRD number entered isn't valid. This could be for a transfer, beneficiary, shareholder or partner. | If it's a transfer, beneficiary, shareholder or partner, check that all fields that require an IRD number have a valid IRD number. IRD numbers can't have hyphens. Enter a leading zero if the IRD number is only 8 digits. If you don't know the IRD number and the IRD number is for a beneficiary (for 2020 and 2021), shareholder or partner, enter nine zeros, or copy and paste the following: 000000000 If a section isn't required, remove (X) it. You can't file a return with a section that has no data or incomplete data. |

Error code: 141 Error message: Invalid attachment type | This can happen when you're trying to file an IR4J for a company that's part of a group. The group's representative needs to file the imputation return for the group. An IR4J doesn't need to be filed by imputation group members. | Delete the IR4J then file the IR4 return again. If you believe an IR4J is required, contact IR. |

Error code: 141 Error message: Invalid attachment type | The company is listed as non-active. | Delete the IR4J then file the IR4 return again. If you believe an IR4J is required, contact IR. |

Error code: 142 Error message: Filing obligation hasn't been met

| This occurs when the return type isn't the return type IR expects. For example, IR expects an IR4 and you’re attempting to send an IR7. | In myIR, check the return type that IR would expect: If myIR has the incorrect information, send a secure mail on myIR requesting that the issue be corrected. If myIR has the correct information, you'll need to update Tax in Practice Compliance. You will need to delete the return, update the client's compliance settings and then add the correct return type. |

Error code: 156 Error message: Transfer amount must be greater than 0 | The credit transfer amount must be a positive number. You can't file a return if any transfers have a blank amount or 0.00 amount. | If the transfer is required, check that each transfer has all fields correctly entered. If no transfer is required, remove (X) the transfer. If you can't see the refund section: 1. Add a temporary large tax credit amount to create a refund scenario to reveal the refund section. 2. Remove (X) any transfers that you don't need. 3. Delete the temporary tax credit. |

Error code: 400 Error message: Bad request | We couldn't connect to IR's gateway services. | Try filing the return again later. |

Error code: 2011 Error message: Portfolio income entity income total tax credits can't be greater than the allowable PIE income total tax credits | IR3 (2020) only The Portfolio incoming entity (PIE) tax credits claimed is greater than allowed. | Adjust the return's credits and file the return again. To calculate how many PIE tax credits your client is eligible to claim, use this formula: [(tax on taxable income/taxable income) x PIE income] Learn more about handling PIE income in tax returns. |

Error code: 2012 Error message: Can't claim both look-through company non-allowable deductions and look-through company prior year non-allowable deductions | The look-through company non-allowable deductions and look-through company prior year non-allowable deductions fields can't both have non-zero amounts. | Adjust the amounts so that only one field has a non-zero amount, or so that both fields are blank. |

Error code: 2013 Error message: Losses claimed this year can't be greater than losses brought forward | The amount in losses claimed is larger than the amount in losses brought forward. | Reduce the number of losses claimed so that it's the same or less than the losses brought forward, and so that the same or less than the current year's total income before losses. |

Error code: 2016 Error message: Customer not entitled for early payment discount eligibility | IR3 and IR3NR only IR has determined that the early payment discount doesn't apply to this client. Learn more about the eligibility criteria. | In the Tax calculation section, change the Entitled to claim an early payment discount option to No. |

Error code: 2019 Error message: Part-year end date must be within the return period | The end date entered for the part year falls outside the start and end dates of the client's financial period. In a 2023 return: For a March balance month client, the dates will need to be between 01/04/2022 and 31/03/2023. For a non-standard balance date, the date range must relate to the actual financial year not the tax year. e.g. a client with a December balance month must have dates that are between 01/01/2022 and 31/12/2022. If the client is deceased, the end date is the date of death. | Check the part year end date entered and update to make sure it falls between the client's actual financial year. |

Error code: 2032 Error message: Dividend income total imputation credits does not equal sum of income attribution share of imputation credits | IR7 only This error can occur when one or more of the imputation credits fields in the Income/(Loss) attribution section have been edited. As a result, the sum of all the imputation credits allocated to the partners or owners doesn't equal the amount in total dividend imputation credits (in the New Zealand dividends section). | Adjust the imputation credits allocated to the partners or owners as necessary to make sure the total matches the amount in the New Zealand dividends section. Alternatively, click reset (a circle with an arrow) to change the edited amount back to the automatically calculated amount. |

Error code: 2039 Error message: The total income attributed must be equal to the total income/(loss) after expenses | IR7 only This error can occur if you've edited any of the income fields in the Income/(Loss) attribution section. As a result of editing the fields, the sum of one or more of the income fields doesn't equal the total of the income field in the corresponding section of the return. | 1. In the return, click Validate. 2. Review the red error messages to establish which income field(s) in the Income/(Loss) attribution section are over or under allocated when compared to the total of the corresponding income field in the return. 3. Adjust the allocation to the partners or owners as necessary. |

Error code: 2050 Error message: Non-resident withholding tax on total interest can't be 0 when total interest resident withholding tax is not 0 | IR3NR only The country of residence selected has more than one NRWT rate for interest. You need to determine the rate that applies. | In the Interest section of the main form at the field Non-resident withholding tax (NRWT) rate, select the relevant option. |

Error code: 2051 Error message: NRWT on total dividends can't be 0 when dividend credits has an amount. Select the applicable NRWT rate for dividends. | IR3NR only The country of residence selected has more than one NRWT rate for dividends. You need to determine the rate that applies. | In the Dividends section of the main form or in the dividend schedule, at the Non-resident withholding tax (NRWT) rate field, select the relevant option. |

Error code: 2053 Error message: Total PIE tax credits allowed can't be more than the NZ tax payable on the PIE attributed income | IR3NR only The Portfolio investment entity (PIE) tax credits entered is greater than allowed. This can occur if you’ve not claimed any loss brought forward, as IR will automatically claim any available losses when processing the return. | Ensure any losses brought forward have been entered in Net losses claimed, if applicable. Adjust the return's credits and file the return again. To calculate how many PIE tax credits your client is eligible to claim, use this formula: [(tax on taxable income/taxable income) x PIE income] Learn more about handling PIE income in tax returns. |

Error code: 2058 Error message: Invalid provisional tax option | IR3, IR3NR, IR4 and IR6 only The provisional tax option hasn't been selected. | In the affected tax return's Provisional tax section, select the provisional tax option. |

Error code: 2067 Error message: Total attribution of income must equal 100% | IR7 only The attribution of income between partners or owners needs to equal 100%. | Check the percentage in the attribution of income for each partner or owner. If the total attribution between partners doesn't equal 100%, adjust the return. If it's a nil return, you can delete the partners or owners. |

Error code: 2074 Error message: One shareholder can't have remuneration as well as shareholder loss offsets or subvention payments | IR4 only One shareholder can't have both remuneration, and subvention or loss offsets because of the following: Remuneration can only be paid to a person. Subvention and loss offsets only happen between companies in the same group. | For each shareholder, check which of the remuneration, subvention and loss offsets are valid, and remove the amounts for the fields that don’t apply. |

Error code: 2075 Error message: No is selected for Estate or trust paying tax on beneficiary's income. Remove the beneficiary's Tax on taxable income amount, or select Yes. | IR6 only A beneficiary has an amount in Tax on taxable income, but the Estate or trust paying tax on beneficiary’s income field has No selected, which contradicts this. | For each beneficiary, check that Tax on taxable income has a value. If they have a value entered, check that Yes is selected for Estate or trust paying tax on beneficiary’s income. If the trust isn't paying the tax, remove the value in Tax on taxable income. |

Error code: 2116 Error message: Business or rental income must be 0 on return for agent non-resident insurer | IR1215 only A company that pays insurance premiums to an overseas insurer has two IRD numbers because the insurance premium tax must be accounted for separately to other income. This error occurs if the IRD number for declaring the insurance premium is used for regular company income. | First change the IRD number being used in Tax for the IR4 if it's the 'as-agent' IRD number. Then file an IR1215 in myIR for the premiums paid to the overseas insurer. |

Error code: 2152 Error message: Partner IRD is required when specifying partner donation amounts | IR526 only When some of the receipts are allocated to the partner, the partner's IRD number must be entered. | In the Partner's details section of the IR526 Tax credit claim form, enter the partner's IRD number. |

Error code: 2227 Error message: Residential property income method is required | IR3, IR3NR, IR4, IR6 and IR7 only The Residential property income method hasn't been selected. If your client has residential rental income or deductions, you're required to select the indicator and provide a value. | In the tax return or Residential property income workpaper or schedule, select the Residential income method. |

Error code: 2337 Error message: Select whether a business loss continuity test applies. If there are 'Net losses brought forward' an option must be selected. | IR4 only When there are losses brought forward, regardless of whether the losses are claimed, an option must be selected for the question about the business continuity test in the Losses section. Learn more about the business continuity criteria. | To Have the losses been brought forward from last year under the business continuity test? in the Losses section, select Yes or No to the question as appropriate. |

Error code: 2339 Error message: Settlor commencement date cannot be in the future | IR6 only There must be a valid date for a settlor's date of birth or commencement date for non-individuals. It can't be a date later than today's date. | Check the date of birth or commencement date. If it's in the future, change it to a valid date. |

Error code: 2341 Error message: Settlor IRD number failed IR's validation check - it must be valid, 9 digits, and have no other characters | The settlor IRD number is invalid. | Check that you've entered the correct IRD number for each settlor. IRD numbers can't have hyphens. Enter a leading zero if the IRD number is only 8 digits. Settlors can't have nine zeroes (000000000). |

Error code: 2343 Error message: TIN is required for the selected jurisdiction | IR3NR and IR6 only A Tax identification number (TIN) is required unless the option TIN not required is selected. For more details, see page 5 of the IR3NR guide or page 9 of the IR6 guide. | If the TIN is required, in the Tax identification number field, enter the TIN for the jurisdiction selected. If holding an NZ IRD number or a TIN in another jurisdiction isn't required, select TIN not required. |

Error code: 2344 Error message: The value should be "TINs are issued" for NZ | IR6 only The TINs are issued option hasn't been selected for the question Tax identification numbers (TINs) are not issued by jurisdiction. If you select NZ for the Jurisdiction of tax residency for a settlor, you're required to select TINs are issued. | If the tax jurisdiction is NZ, at the question Tax identification numbers (TINs) are not issued by jurisdiction for a settlor, select TINs are issued. |

Error code: 2345 Error message: The nature of the settlement must be provided when there is an amount in Other. Enter details in Other description. | IR6 only In the Settlement section, when you've entered an amount in the Other field, you need to provide information about the nature of the settlement. | In the Other description field, enter a description for the amount. |

Error code: 2346 Error message: One or more reasons must be selected when residential property interest has been claimed | If any interest is being claimed for residential property interest, a reason must be selected. Check IR's website for more information on interest limitation rules and the reasons for interest claimed. | In the Residential property interest section, select one or more of the available interest claimed reasons. |

Error code: 2347 Error message: No beneficiary name has been entered | IR6 only A beneficiary doesn't have a name. | If the beneficiary is required, check that the name has been entered. If a beneficiary isn't required, remove (X) it. You can't file a return with a section that has no data or incomplete data. |

Error code: 2348 Error message: A beneficiary date of birth or commencement date is required | IR6 only A beneficiary doesn't have a date of birth or, for non-individuals, a commencement date. | Make sure all beneficiaries have a date of birth or commencement date. |

Error code: 2349 Error message: No value has been provided for beneficiary tax jurisdiction | IR6 only A beneficiary doesn't have a jurisdiction of tax residency. | Select the relevant country in the list for Jurisdiction of tax residency for any beneficiary that doesn't have a country already selected. |

Error code: 2350 Error message: The value should be "TINs are issued" for NZ | IR6 only The TINs are issued option hasn't been selected for the question Tax identification numbers (TINs) are not issued by jurisdiction. If you select NZ for the Jurisdiction of tax residency for a beneficiary, you're required to select TINs are issued. | If the tax jurisdiction is NZ, at the question Tax identification numbers (TINs) aren't issued by jurisdiction for a beneficiary, select TINs are issued. |

Error code: 2351 Error message: Beneficiary IRD number can’t be blank | IR6 only A beneficiary doesn't have an IRD number. | A valid IRD number must be entered when the jurisdiction of tax residency is New Zealand, unless TIN not required is selected. From 2022, you can't enter nine zeroes (000000000) for a beneficiary IRD number. |

Error code: 2352 Error message: Beneficiary IRD number failed IR's validation check - it must be valid, 9 digits, and have no other characters | IR6 only A beneficiary IRD number doesn't have the required number of characters or has invalid characters. | Check that you've entered the correct IRD number for each settlor. IRD numbers can't have hyphens. Enter a leading zero if the IRD number is only 8 digits. From 2022, you can't enter nine zeroes (000000000) for a beneficiary IRD number. |

Error code: 2354 Error message: A method must be selected when land has a value | An amount has been entered for Land in the Assets section of Additional reporting requirements, but nothing has been selected for Valuation method for Land. | You need to select a valuation method for Land – historical cost, market value or tax book value. |

Error code: 2355 Error message: A method must be selected when buildings has a value | An amount has been entered for Buildings in the Assets section of Additional reporting requirements, but nothing has been selected for Valuation method for Buildings. | You need to select a valuation method for Buildings – historical cost, market value or tax book value. |

Error code: 2356 Error message: A method must be selected when shares has a value | An amount has been entered for Shares in the Assets section of Additional reporting requirements, but nothing has been selected for Valuation method for Shares. | You need to select a valuation method for Shares – historical cost, market value or tax book value. |

Error code: 2358 Error message: No value has been provided for the tax jurisdiction | IR6 and IR3NR only There's no value for Jurisdiction of tax residency. The jurisdiction must be supplied. | In Jurisdiction of tax residency, select the relevant country in each instance where no country is currently selected. |

Error code: 2359 Error message: One or more of the settlement fields must have an amount | IR6 only For settlements made this year, if No is selected for Zero value settlement in the settlement section of settlor details, then at least one of the fields in the section (cash, financial arrangements, land, buildings, shares and ownership interest or other) must have a value. Learn more about additional trust reporting requirements and also refer to pages 8-10 of the IR6 guide for settlor requirements. | If there was a settlement this year of value, enter an amount in one or more of the settlement fields. If the settlement this year was valued at nil, change the Zero value settlement setting to Yes. |

Error code: 2370 Error message: Overseas income and overseas tax can't both be nil | In the IR1261, each row must have at least one amount entered, including the result in the Overseas income summary. If there are only overseas tax credits, and there's no income or there's a loss, such as for FIF income, then no tax credits are claimable. For info on FIF, refer to page 23 of the 2023 IR3 guide. | Update the amounts if applicable, or delete the row if both the overseas income and tax credits claimable in the Overseas income summary are 0.00. If there's no valid overseas income rows, delete the IR1261 attachment. |

The numerical code for each error matches a particular Inland Revenue rejection error code.

3. Validate again and file the return

Validate the return again, and if there are no errors, you can file the return.

If you find more errors, repeat the process from Step 1.