Sharing data by distributing amounts between tax returns makes preparing a tax return faster by reducing the amount of manual entry and double-handling you do.

What you can distribute

For tax returns before 2024, you can share data by distributing income from an IR4, IR6 or IR7 tax return to an IR3 tax return.

For 2024 tax returns onwards, you can distribute the income of:

shareholders from an IR4 to an IR3

beneficiaries from an IR6 to an IR3, IR3NR, IR4, IR6, IR7, IR8 and IR9

partners or owners from an IR7 to an IR3, IR3NR, IR4, IR6, IR7, IR8, IR9.

Exceptions

Some return types have some exceptions:

IR3NR won't receive overseas income or imputation credits.

You can't distribute from an IR7 Look-through company to an IR4, IR8 or IR9.

You can only distribute between returns in the same tax year.

There may be some other limitations around years and return types. If you find the entity you're trying to distribute to isn't supported, enter the amounts in the receiving return by adding an attachment or schedule, or enter the amounts directly into the main return.

Distribute data

Prepare the return that you're distributing from.

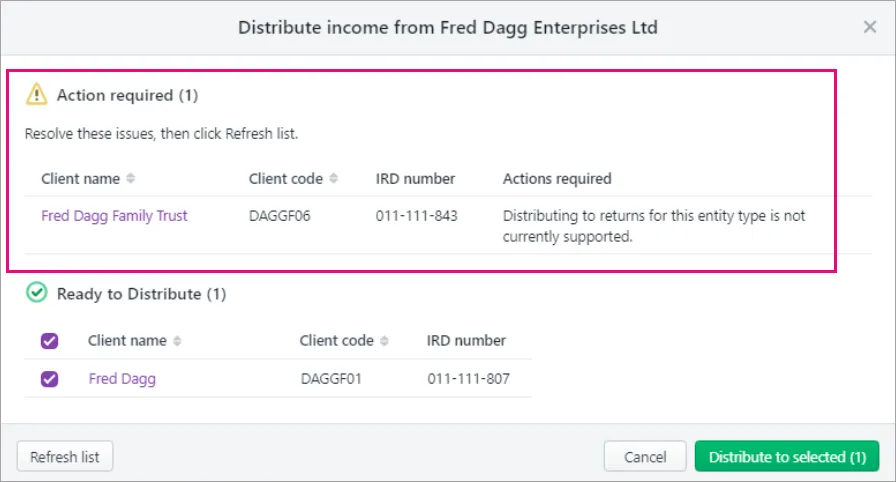

Follow the prompts in the return to distribute or redistribute. In the window for distributing, review the Actions required column and select the returns that you're distributing to.

Tax will automatically create any required schedule.Clicking the client name in the distributions window opens the client's compliance list in a new tab, so you don't lose your spot in the tax return you already have open.

Actions required messages

When you're distributing income, there are a number of Actions required messages you might see.

Actions required descriptions

Action required message | Description |

|---|---|

Compliance job is locked. Send it for rework. | The return that you're trying to distribute to has a status of Ready for client onwards, which means the return is locked for editing. To update the receiving tax return, change the status of the compliance job to In progress by clicking the Send for rework button when you're in the compliance job. If the tax return has already been filed, you'll need to amend this directly with IR. |

Distributing to returns for this entity type is not currently supported | You can't distribute to this client using the Distribute to selected button because the client's tax return isn't a compatible entity. Either add and open a compatible tax return and refresh the distributions page, or manually distribute. To manually distribute, click the client’s name to open their compliance list in a new tab (the return that you're working on remains open.) Ensure that the compliance job is in progress, then enter the distribution amounts in the schedule or main return. |

IRD number not found in any client record. Check if you've entered it correctly. You can only distribute to clients. | The IRD number won't be used for the distribution if the entity isn't a client in Practice Compliance. If your practice won't be preparing the return receiving the distribution, you can ignore this error. If your practice will be preparing the receiving return and the client is set up, ensure the IRD number is correct. If the client hasn't been set up, add the distribution recipient as a client, including their IRD number, then create the return. |

Not a valid IRD number. | You're trying to distribute to an entity with a blank IRD number field, or the IRD number failed the validation check. There must be a valid IRD number before you can distribute. |

Return not found. Create the client's tax return. | The return to distribute to must already be created before you can distribute. |