About Tax:

Workflows:

Key help topics:

Tax is packed full of tools to help your practice take care of your client's tax obligations. It reduces the time you spend preparing tax returns, freeing you up to offer more value-added tax consulting services to your clients.

After upgrading to Tax, you'll start receiving all your Inland Revenue transactions in Tax, so make sure you continue to reconcile these transactions in Tax, instead of in AE/AO.

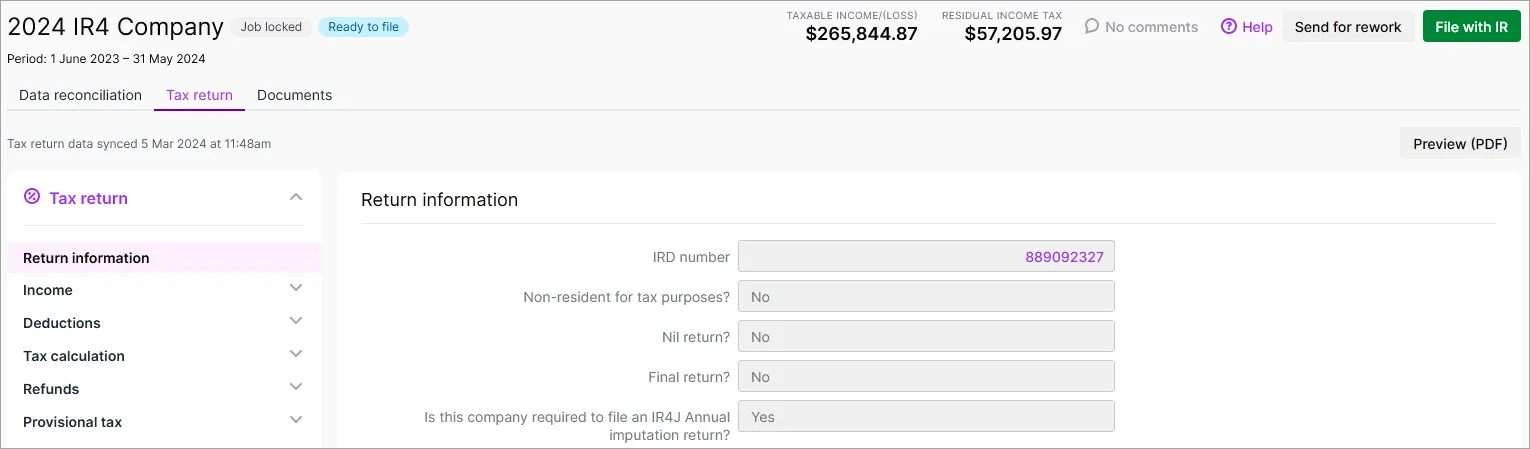

Prepare tax returns

You can prepare and file major tax forms using the new Inland Revenue gateway filing service with Tax. These include IR3, IR3NR, IR4, IR526, IR6, IR7, IR8, IR9 plus attachments IR10, IR1261, IR215, IR4J, IR8J and IR833.

You'll enjoy a streamlined user experience, navigation options on the page and via browser shortcuts.

Because Tax is online, you can work on taxes from anywhere and easily collaborate with your clients. Your clients can electronically sign tax returns when you send them via the portal.

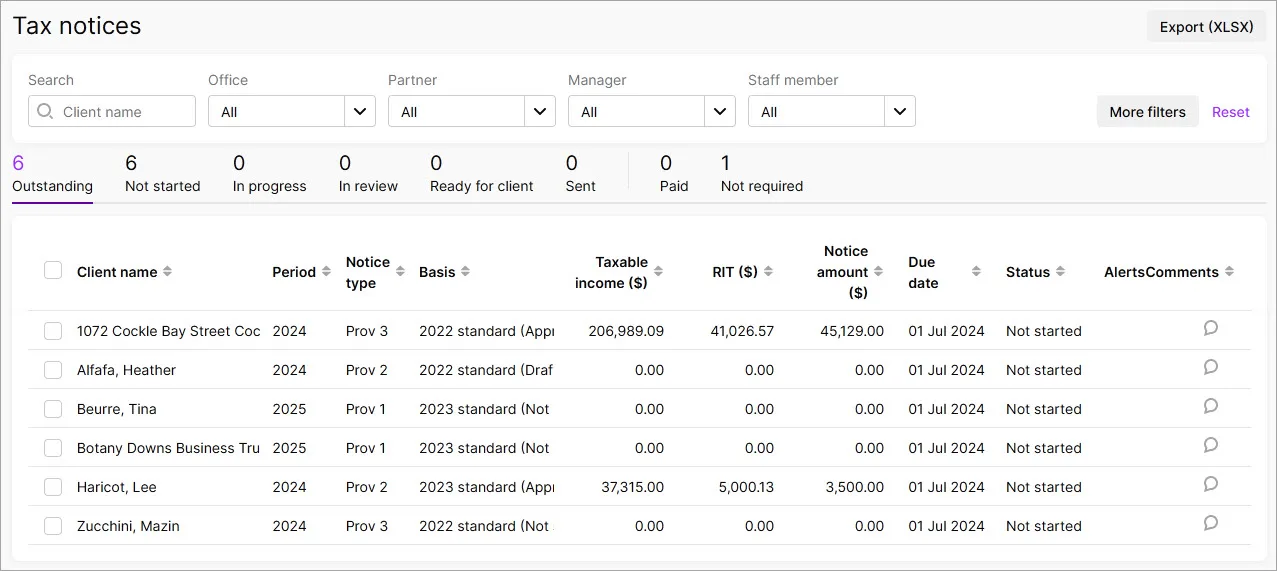

Send tax notices

Calculate your client's provisional and terminal tax payable, and remind them to pay by sending them a tax notice.

When you prepare the tax notice, let us know if your client uses tax pooling. We'll make sure the provisional tax payable doesn't carry forward to the next tax notice as a missed payment.

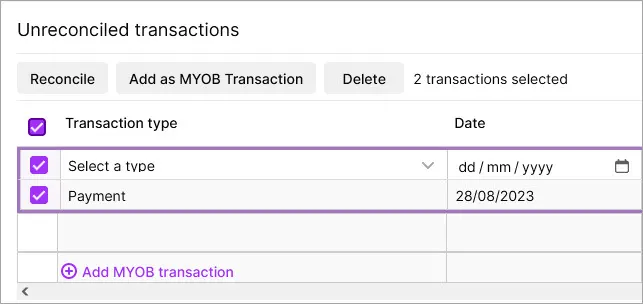

Reconcile Inland Revenue data

Data reconciliation shows your client's reconciled and unreconciled transactions from Inland Revenue and MYOB. We bring you new transactions daily, directly from Inland Revenue, so you have the most up-to-date data.

Reconciling transactions is fast and easy with the freedom to reconcile multiple transactions at once. We'll also automatically reconcile similar transactions on your behalf.

When you file a return, we'll create a transaction for the assessment and expected payment. When your client pays Inland Revenue, we'll also reconcile that transaction for you.

Get started

If Tax is already enabled for your practice, you can get started now.

You can also take the free online course.