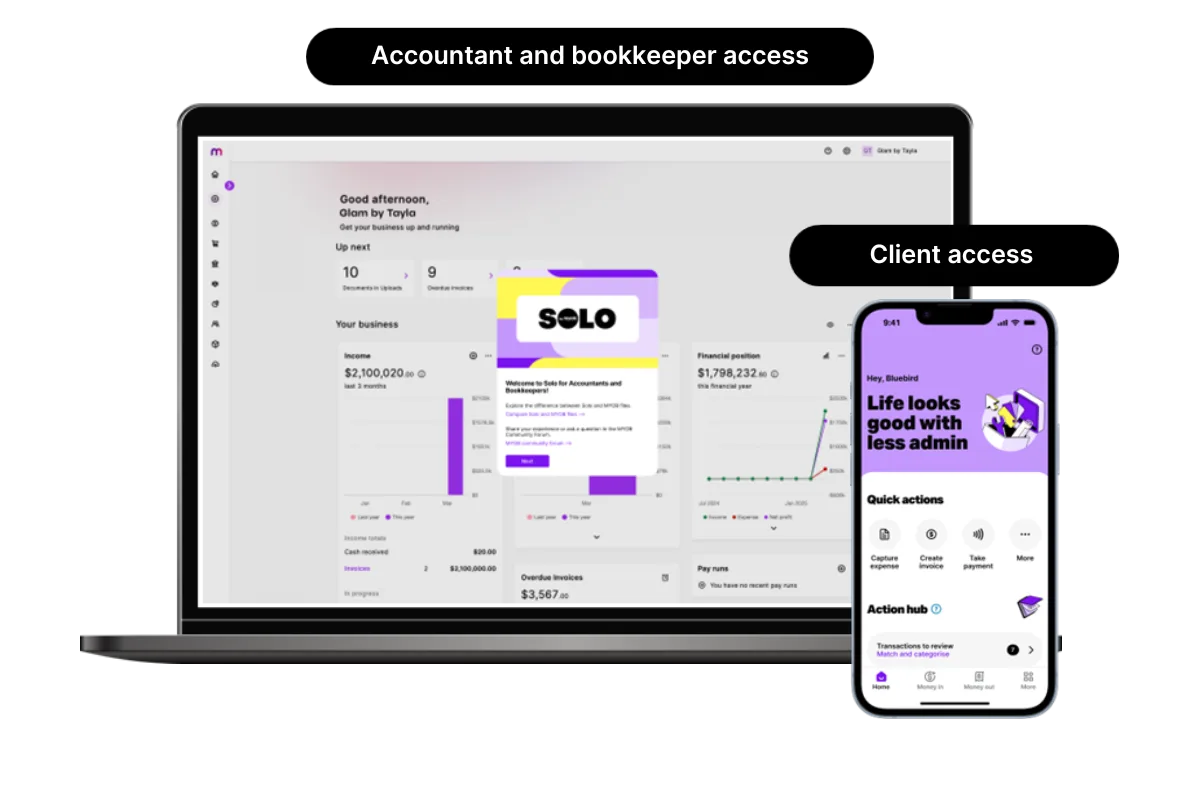

Solo by MYOB for accountants and bookkeepers

Your client can invite you to their file so you can help them stay compliant and keep accurate records.

Access your client's Solo file from MYOB Business

Your client has invited you to their file through their Solo app, but your access is through MYOB Business.

When you sign in to their file in MYOB Business, it will look a bit different as it's been designed for the needs of a sole operator, freelancer and self-employed person. Some things you'd normally be able to do in a client's file cannot be used or have been removed.

What you can do in a Solo file

Access your client's file from your browser

You'll need to accept the email invite from your client to access their file. If you cannot see the email, ask your client to resend the invite. If they entered your name or email incorrectly, your client will need to remove the invite and send you a new one.

If you use MYOB Practice Compliance

You can also open their file from MYOB Practice Compliance, like you would with any other client file.

If you do not use MYOB Practice Compliance

You'll need to sign in to app.myob.com to open your client's file.

Do all the main accounting work

In their file, you will be able to:

prepare and lodge BAS

fix transactions that are causing issues with reconciliation

create and change their accounts (called 'categories')

create reports.

Some MYOB Business features won't be available

The file can be accessed from MYOB Business, but a client with a Solo file will not have all the same options as other client files because it's designed for the needs of a sole operator, freelancers or self-employed person.

These options are not available:

set up payroll

set bank rules

set up recurring bills and invoices

import data

export data (we're working on this feature, and it will be coming soon)

create sales orders

create purchase orders

send quotes

manage stock, including tracking items.

We're working on functionality for the Solo app all the time, so some of this may be introduced later. Stay up to date with what we're working on.

What is different for you and your client

Some things can only be done by your client

You'll be restricted from tasks that require your client to use their app to give consent or provide personal and banking information, such as:

sharing and removing access for their file

If you use MYOB Practice Compliance, you can invite other staff in your practice to their file.signing up for Tap to Pay and online payments.

You'll also not be able to see a list of your client's items, create or delete them.

If your client has issues with these tasks, they can check the Solo help articles or chat to the digital assistant in their app.

Some features are for accountants and bookkeepers only

Clients have some limitations when they use the Solo app. As their accountant or bookkeeper, you'll have access to additional features and be able to:

Lodge activity statements.

Your client will not be able to lodge activity statements through their app.Set lock periods.

Your client will see a note in transactions that have been locked and will not be able to make any changes to them.Import historical transactions in a .QIF or .OFX file for a bank account that your client has connected.

If you use MYOB Practice Compliance, you can invite other staff in your practice to their file.

We're working on the functionality of the Solo app all the time, so some of these features may be introduced for your clients later. Stay up to date with what we're working on.

Solo uses different language. Here's how to get familiar with terms your clients might use

Your client may refer to some of the different language that's used in their app to describe different concepts and tasks. Solo is designed for anyone who runs a business on their own, so it uses language that avoids financial jargon and accounting terms. Instead, it uses simplified, natural language that is more likely to be familiar with this audience.

Here are the differences in language between MYOB Business and Solo by MYOB:

Concept or task | MYOB Business term | Solo by MYOB term |

|---|---|---|

Chart of accounts | Categories (Chart of accounts) | Categories |

Bring money in | Sales, which includes invoices and receive money | Money in, which includes invoices and income |

Receive customer payment | Receive payment and record invoice payment | Take a payment and record payment |

Spend money | Spend money, which includes supplier payment and pay bills | Money out, which includes paid and upcoming expenses |

Mobile card payments | Online payments ('pay now' button on emailed invoices) and secure invoicing | Tap to Pay and online payments |

Record of financial transactions for a business | General ledger report | Transaction list report |

Upload a bill or expense receipt | Uploads | Upcoming expenses |

Get bank transactions | Banking | Connected accounts |

People you transact with | Contacts | Customers and suppliers |

Getting help with a Solo file

Help for accountants and bookkeepers

You have a dedicated community forum for accountants and bookkeepers. In here, you can ask questions and get help from MYOB and other accountants and bookkeepers.

In MYOB Business, you'll also have help for each page. Just click the question mark at the top right to open the help panel. You'll see information to the page you're on, without having to leave your software. Depending on the page, you might also see some frequently asked questions or links to more detailed help topics. These topics will be for MYOB Business and may be different for a Solo file.

If you use MYOB Practice Compliance

You'll have access to your client's file from MYOB Practice Compliance and can get help in MYOB Practice Compliance, including through live chat and logging a support case.

Help for your clients

If your client has an issue, they have their own dedicated ways of getting help:

In app help - at the top right of most screens, click the question mark (?) to see info relating to that screen.

Solo help articles - learn how to use the app.

In-app digital assistant - it can answer questions 24/7 or give other help options, like chatting with a Solo Community Lead.

My Account - clients can manage their MYOB subscription, view or pay their MYOB invoices or update their payment details.

Solo community forum - view topics and discuss their questions with other Solo users and Community Leads.