AccountRight Plus and Premier, Australia only

If you're registered for Single Touch Payroll (STP), there's no need to prepare payment summaries so we've removed that option from the Payroll command centre.

If you need to report fringe benefits amounts (RFBA), see Reportable fringe benefits amounts (RFBA) with Single Touch Payroll reporting.

Stay compliant by using the latest AccountRight version, and see how we've simplifed your end of payroll year.

Do you pay or give your employees benefits that the ATO considers 'fringe benefits'? The fringe benefits are reportable if the total taxable value exceeds the threshold set by the ATO.

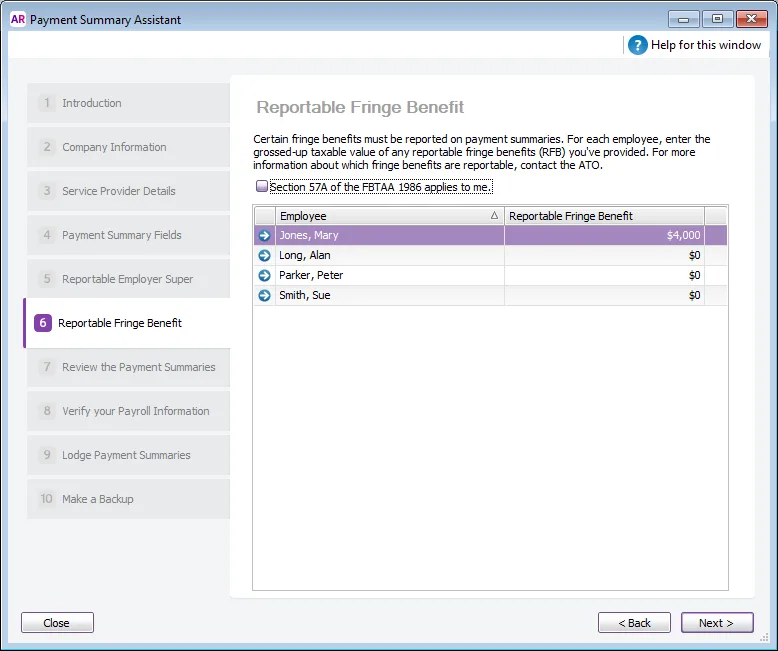

Enter the grossed-up taxable value of those benefits in the Reportable Fringe Benefit step of the Payment Summary Assistant.

Need help deciding what is a fringe benefit, or how to calculate the grossed up amount? See the ATO guidelines.

If you're having specific issues with fringe benefits and payment summaries in AccountRight you should also check out the Frequently Asked Questions below.

Getting an error? If you're getting an error at this step of the assistant, you'll need to contact product support and we'll get you back up and running in no time (on the Contact Us page, click the chat button at the bottom or scroll down for other options).

When you've finished entering the fringe benefit amounts, click Next in the Payment Summary Assistant to review your payment summaries.

Reportable fringe benefits FAQs

How do I enter reportable benefits covered by Section 57A of the FBTAA 1986?

AccountRight 2017.1 or later is required.

If Section 57A of the Fringe Benefits Tax Assessment Act 1986 applies to you, there are changes to how fringe benefits are reported on payment summaries.

Affected businesses are mainly not-for-profit organisations, such as public benevolent institutions, health promotion charities, some hospitals and public ambulance services.

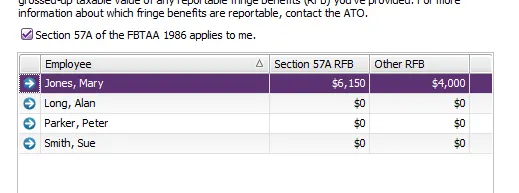

If Section 57A applies, you need to report the benefits that fall under that section on the payment summary, and show other reportable fringe benefits provided to the employees separately.

Select the Section 57A of the FBTAA 1986 applies to me option in the Reportable Fringe Benefit step of the Payment Summary Assistant. You can then enter the fringe benefits you’ve provided that are covered by Section 57A, and separately enter the other reportable fringe benefits you provided to your employees that are not covered by Section 57A.

How payment summaries will display reportable fringe benefits

If amounts are entered in both the Section 57A RFB and Other RFB columns for an employee, two payments summaries will be prepared for them, as required by the ATO:

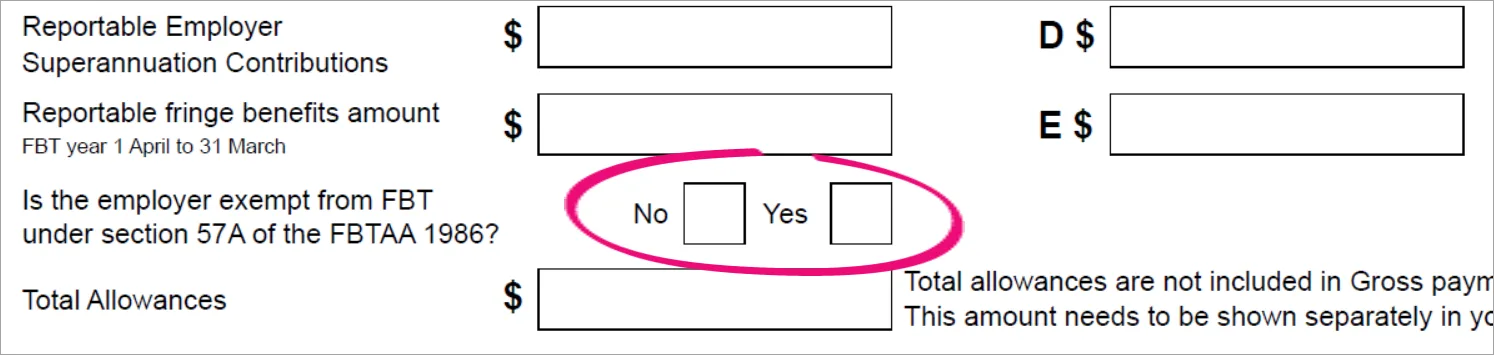

One payment summary will show the amount of fringe benefits covered by Section 57A and the Is the employer exempt from FBT under section 57A of the FBTAA 1986? question on the payment summary will be marked as Yes.

The second payment summary will show the amount of “other” reportable fringe benefits, and the Is the employer exempt from FBT under section 57A of the FBTAA 1986? question will be marked as No. On this payment summary, no other payment details will be printed.

My employee has a fringe benefit amount, but zero income. Why aren't they listed in the Payment Summary Assistant?

If an employee has no income for the financial year, they won't appear in the Payment Summary Assistant. But if the employee requires a payment summary showing just their fringe benefit amount, complete the following:

Open the employee's card (Card File > Cards List > Employee tab).

On the Payroll Details tab, click the Pay History heading.

Select Year-to-Date in the Show Pay History for field.

Enter $100 in the Activity column for the Base Salary or Base Hourly wage category.

Enter -$100 in the Activity column for one of the other listed wage categories, such as Holiday Pay or Sick Pay. These values balance each other out and are entered here to ensure the employee appears in the Payment Summary Assistant. These values have no other effect and no accounts are modified. If there are no other wage categories available for the employee you'll need to create one.

Click OK, then click Close.

When running the Payment Summary Assistant:

Ensure the wage categories used above are selected against Gross Payments at the Payment Summary Fields step.

Enter the employee's fringe benefit amount at the Reportable Fringe Benefit step of the Payment Summary assistant.

The FBT exemption "Yes" and "No" boxes on my payment summaries are both blank - is this OK?

If the FBT exemption doesn't apply to you and therefore you haven't select the Section 57A of the FBTAA 1986 applies to me option when completing your payment summaries, the Yes and No boxes will be blank on your payment summaries.

This is fine and conforms to the ATO's requirements.

How to I report RFBT with Single Touch Payroll?

With Single Touch Payroll reporting, you'll report your RFBT to the ATO at the end of the payroll year. For all the details see End of year finalisation with Single Touch Payroll reporting.

Why is an employee missing from the Payment Summary Assistant?

Only employees who have been paid in the current payroll year appear in the payment summary assistant. If an employee is not appearing, check that:

pay history has been recorded for the year (run the Payroll Register report for the year). If you started using AccountRight during the year, you may need to enter opening balances for your employees.

the employee's Employment Basis is set to Individual or Labour Hire. You'll find this setting in the Payroll Details tab> Personal Details of the employee's card. Employees set as Other won't appear in the assistant.