AccountRight Plus and Premier, Australia only

STP replaces the need for payment summaries

All employers must now be reporting to the ATO via Single Touch Payroll (STP) so there's no need to prepare payment summaries. If an employee needs a copy of their income statement (payment summary), they can access these details through myGov. Visit the ATO for more information.

Stay compliant by using the latest AccountRight version, and see how we've simplified your end of payroll year.

The 2018-2019 payroll year was the last year you needed to prepare payment summaries. Now, you need to make sure you finalise your Single Touch Payroll information so it's important that you've set up STP reporting.

AccountRight makes it easy to prepare and amend these payment summaries (previously known as group certificates):

Individual Non-Business

Labour Hire

Employment Termination Payment (ETP).

The easiest way to send your Payment Summary Annual Report to the ATO is to lodge electronically using the ATO's Business Portal . Note that you can't send it using a disk or USB drive.

Already using Single Touch Payroll?

If you've reported payroll information to the ATO using Single Touch Payroll reporting, you don't need to prepare payment summaries. Instead, you finalise your Single Touch Payroll information directly from AccountRight.

Here's a step-by-step guide for preparing your payment summaries:

FAQs

What about pays which span payroll years?

It’s the payment date that determines the year a pay is reported in a payment summary. For example, if a wage is paid to an employee in June, it’s considered a June pay (regardless of the pay period it covers) and will be included in the payment summary. Likewise, if the payment date is July, even if the pay period includes dates in June, the pay is considered a July pay and will be included in next year's payment summaries.

How do I amend payment summaries?

What you need to do depends on whether you've already submitted the EMPDUPE file to the ATO.

If the EMPDUPE file has... | do this... |

|---|---|

NOT been submitted | Run the Payment Summary Assistant again to generate updated payment summaries for your employees. |

been submitted | If you're using AccountRight 2016.2 or later Run the Payment Summary Assistant again to generate updated payment summaries for your employees. At step 7 you can specify that the payment summaries you’re preparing are amendments. Note that if you've closed the payroll year, you'll need to restore the backup made before closing the year and prepare the amended payment summaries using that file. When you print or email an amended payment summary, or submit the Payments Summary Annual Report file again, those payment summaries will be marked as amendments. If you're using AccountRight 2016.1 or earlier You'll need to submit the updated information to the ATO using the payment summary paper form available from the ATO. On the ATO's paper form, you'll need to place an X in the box for the option specifying you are "amending a payment summary statement". To help you complete the ATO's paper form, use the verification report generated by your MYOB software when preparing your payment summaries. |

For more information on correcting a mistake on a payment summary, visit the ATO website.

I need to enter pays for the new payroll year but can't print my payment summaries yet

To enter pays for the new payroll year you'll need to close the old payroll year. But if you don't have time to print the payment summaries before entering your first pays for the new year, make a backup of your company file once you know that all payroll information has been entered for all employees. Store it in a safe place on CD/DVD or other external media.

You can then close the payroll year and enter the pays for July. When you're ready to print your payment summaries, restore the backup that you made and use that file to prepare them. If you restore a backup, only use it to prepare and send your payment summaries. Don't use this company file for recording pays or other transactions.

What employment dates are shown on the payment summaries?

The payment summaries show the Employment Dates From: and To:. The dates that will be used depend on the Start Date and any Termination Date entered in the employee's card. The following table summarises these combinations:

Dates entered in the employee's card |

| Dates that will print on the payment summary | ||

|---|---|---|---|---|

Employee start date | Termination date |

| From | To |

Current payroll year | - |

| Start date | 30/6 |

Pre payroll year | - |

| - | - |

Pre payroll year | Current payroll year |

| 1/7 | Termination date |

Current payroll year | Current payroll year |

| Start date | Termination date |

- | - |

| "Various" | "Various" |

- | Current payroll year |

| 1/7 | Termination date |

How do I view payment summaries from a previous year?

When preparing payment summaries at the end of a financial year, we recommend saving a PDF copy of the payment summaries and storing them should you need to view payment summaries from last year or a previous year.

If you didn't save a copy or can't find them, restore the backup you made before closing your payroll year and reprint the payment summaries using the Prepare Payment Summary Assistant.

Also see Reprinting a payment summary.

Do I have to enter a Tax File Number for all my employees?

Yes. You need to enter Tax File Numbers for all employees whether you print payment summaries for them or not. If you have employees who do not have a Tax File Number, use one of these numbers provided by the Australian Tax Office:

Payee type | Tax File Number to use |

|---|---|

New payee has not made a TFN Declaration, but 28 days have not passed | 111 111 111 |

Payee is under 18 years of age and earnings do not exceed $350 per week, $700 per fortnight or $1,517 per month | 333 333 333 |

Payee is an Australian Government pensioner payee | 444 444 444 |

Payee chooses not to quote a TFN and has not claimed an exemption from quoting a TFN or does not fit into any of the above categories | 000 000 000 |

Why is an employee missing from the payment summary process?

Only employees who have been paid in the current payroll year appear in the payment summary assistant. If an employee is not appearing, check that:

pay history has been recorded for the year (run the Payroll Register report for the year). If you started using AccountRight during the year, you may need to enter opening balances for your employees.

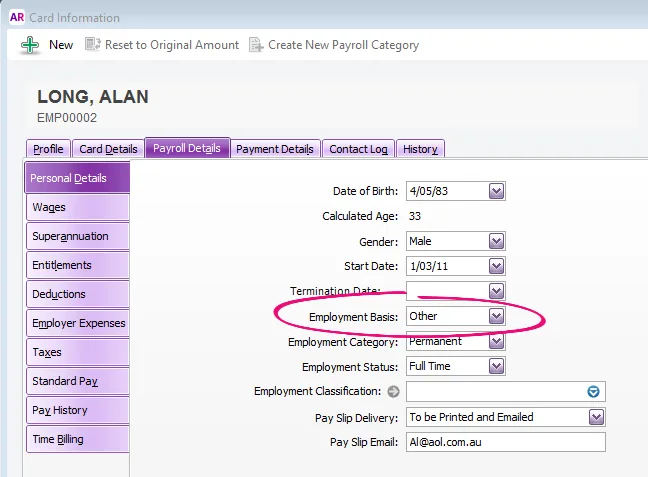

the employee's Employment Basis is set to Individual or Labour Hire. You'll find this setting in the Payroll Details tab> Personal Details of the employee's card. Employees set as Other won't appear in the assistant.

Note that if you want to include an employee who hasn't been paid during the year (for example, they have a fringe benefit amount you need to report), see the FAQ section of this help topic.

How do I exclude an employee from the payment summary process?

To exclude an employee from the payment summary process, set the Employment Basis in their card to Other. This will prevent the employee from appearing in the Payment Summary Assistant.

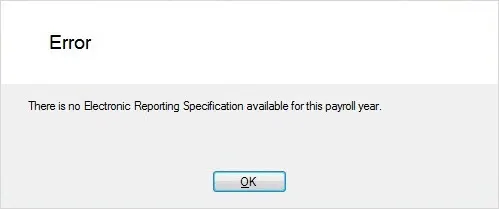

What can I do if I'm getting an error when preparing payment summaries?

If you keep getting errors when preparing payment summaries, such as "There is no Electronic Reporting Specification available for this payroll year", please give us a call on contact us.