Before you send a tax return to a client, you or someone in your practice needs to review and approve it. This process updates the status of the tax return from In progress to Ready for client review. It also displays the Send to client button that lets you send the tax return to your client.

If you're a sole practitioner or if you're the only one preparing, reviewing and approving the tax return, you'll still need to review and approve the tax return so you can access the Send to client button.

When you get started with MYOB Practice tax, we recommend that you review and understand the automatic checks, or validations, that happen on a tax return. Familiarising yourself with the validation messages will ensure that you cover everything you need to in your review process. There may even be some things you no longer need to manually check, because it's covered by validations. Or there may be some things that aren't covered by the validations, that you need to add to your checklist. Review all the displayed tax validation messages.

In the tax return, the Validate button is located on the top of the tax return. Once the tax return has been validated, a section with the validation messages is created and displayed.

Add, view or delete comments on tax returns

You can add comments about tax returns for other users to view. For example, if you want to flag something for review.

You can add and view comments from a couple of places on the Compliance list page, and the comments are synced between these places:

on the Compliance list page, from the overview list of all tax returns

by opening an individual tax return from the Compliance list page. You can add and view the comment from the Data reconciliation, Tax return or Documents sub tabs.

Comments aren't synced between different tax periods.

An icon indicates whether a tax return has any comments:

No comments: a speech bubble outlined in purple.

Comments: a solid purple speech bubble.

If you're on the Compliance page, the icon will be in the Comment column. If you've opened the tax return, the icon will be on the top right of the page.

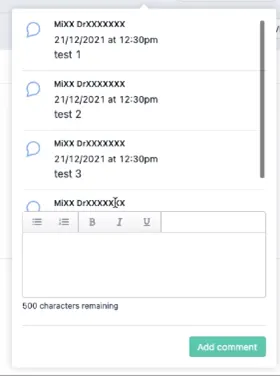

Information about the time, date and author of the comment is included with each comment, and you can also add text formatting. There’s no limit to the number of comments you can add.

Adding a comment:

Open the Compliance list page and, optionally, open a tax return from the list.

Click the comment icon (a solid purple speech bubble or a speech bubble outlined in purple).

On the Compliance list page, the icon will be in the Comment column. If you've opened the tax return, the icon will be on the top right of the page.

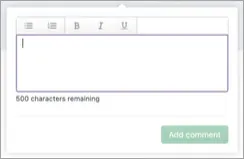

The comment window appears.

Enter your comment in the text field.

Don’t click out of the comment window before you’re finished making your changes. If you click out of the comment window, the window closes without saving the content.

You can use the toolbar above the text field to add formatting. The amount of characters remaining for your comment is displayed below the text field.Click Add comment.

Viewing and deleting a comment:

To view a comment:

Open the Compliance list page and, optionally, open a tax return from the list.

Click the icon indicating a tax return with comments (a solid purple speech bubble).

If you're on the Compliance list page, the icon will be in the Comment column. If you've opened the tax return, the icon will be on the top right of the page.

All the comments that have been added are listed.

To delete a comment:

Hover over the comment. An ellipsis appears to the right of the comment.

Click the ellipsis. A Delete option appears.

Click Delete.

Publish the tax return to PDF

You can publish the tax return details to a PDF to help share the return details for review within your practice.

Click Preview (PDF) on the top right of the tax return.

Select your preferences and click Download to save the PDF or Preview to open the PDF in your browser.

To preview in your browser, you may need to allow pop-ups in your browser.

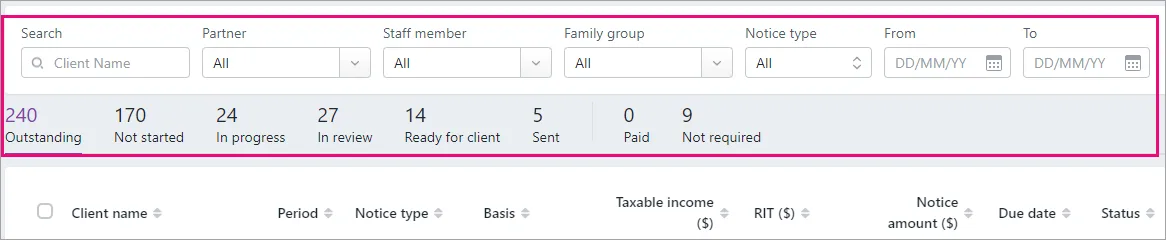

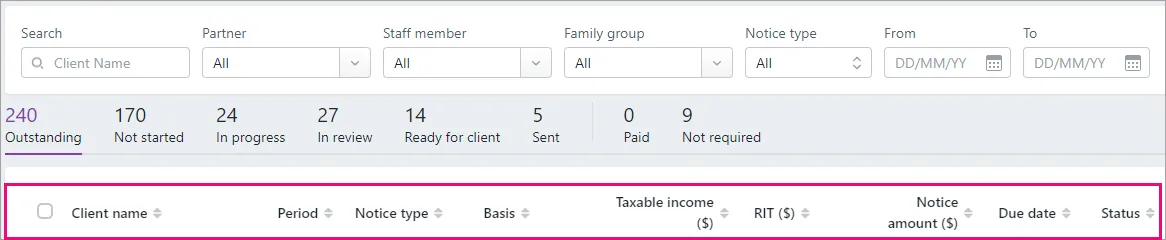

Export Compliance list and Contacts data to a spreadsheet

Want a handy way to make and share notes and comments while reviewing? You can export Compliance list and Client list data together into an XLSX file. This lets you open it in Microsoft Excel.

Exporting is done from the Compliance list page, so you can customise which compliance list data is exported by changing the sort order or by applying a filter. Filters change the data in the columns, but the values from the filters aren't displayed in the export. For example, you can filter the data for partners, but the values inside the Partner filter won't display in the export.

You may notice some differences in how the data is displayed in MYOB Practice compared to the XLSX file. For example, the Period year in MYOB Practice is displayed as two Period start and Period end columns.

The user who is logged in to MYOB Practice and who exports the data will be displayed as the author in the XLSX file's properties.

Disclaimer

Please note that the data you’re exporting may include individuals’ personal information. You should take steps to keep that information secure.

Open the Compliance list page.

Optionally, customise the data that you'll export:

To narrow down the data to export, apply a filter from the top of the list or click a status tab.

To change the sort order, click a column header.

On the top right of the page, click Export (XLSX).

The XLSX file of Compliance list and Client list data is downloaded to your browser's download location, using the file name format YYYY-MM-DD_MYOB_ComplianceList.xlsx.

Request an internal review

In the client's Tax return click Send for Review.

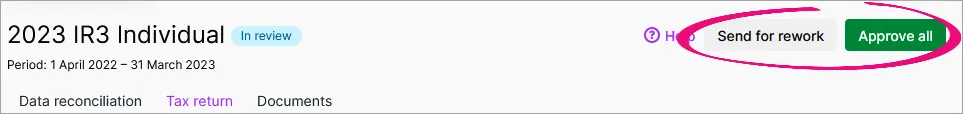

The Approve all and Send for rework buttons appear and the status of the tax return changes to In Review.If someone else will be reviewing the tax return, let them know that it's ready for their review.

Review and approve the tax return

Open the tax return and review the data inside.

If further changes are required, click Send for Rework to update the status of the tax return back to In progress.

If you're happy with the tax return and it's ready to send to your client, click Approve all.

The tax return status changes to Ready for client review and the Send to client button appears.

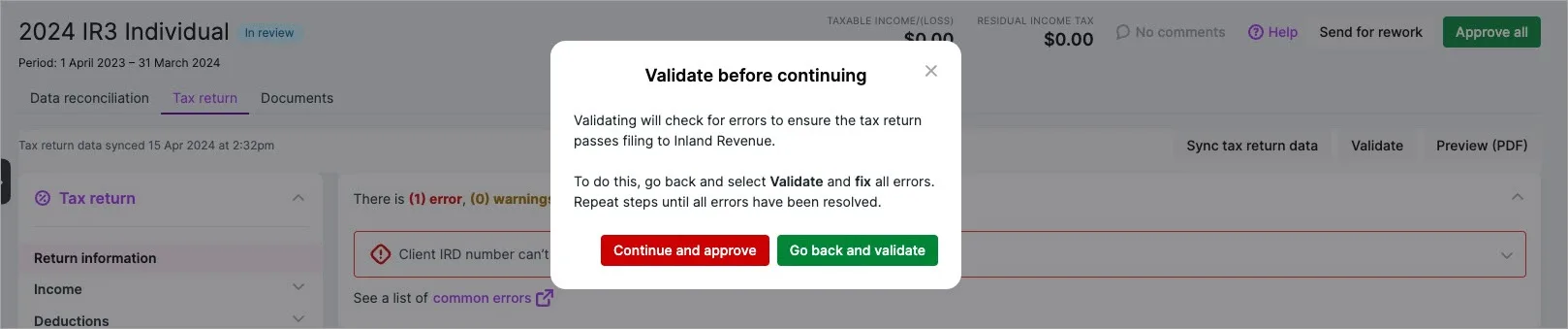

You'll see a message to warn you if you approve a tax return that has validation errors or hasn't been validated, with an option to continue or go back and validate.

Approving a tax return will lock the return so that no further changes can be made, unless you send it for rework. Learn more about the different statuses in the tax return workflow.

Don't see the button in your MYOB Practice page? Check if your practice has any Access Management restrictions.