Inland Revenue decommissioned the E-file filing system on 16 April 2021, replacing it with the new gateway filing services. This means that you only can file tax returns using the gateway services after 16 April 2021.

Filing tax returns using Inland Revenue gateway services

There are a few differences between E-file and gateway services.

Area | Impact |

|---|---|

Filing tax returns | When using gateway services, staff will need their own, individual myIR login to file a return using gateway services. Staff can only file a return if their myIR login has authority to do so as per the agency setup in myIR. See Filing tax returns using gateway services below. |

Unlinked clients | If a client isn't already linked to an agency, an agency would be automatically linked when their tax return was filed using e-file. With gateway services, an agency must be authorised to file for that client first, before their return an be filed. This can be done in myIR. |

Correspondence | With E-file, you could send correspondence to Inland Revenue by attaching it to a client's tax return or filing it directly. Gateway services doesn't allow correspondence, but if correspondence is required for any reason, you can send it using myIR secure mail. |

Refund transfers | E-file limited transfers to own, or other INC accounts only. Gateway services allows up to 20 transfers to any tax type. |

Front cover | Client and bank account details are no longer sent to Inland Revenue when a return is filed using gateway services. However, any changes to these details can still be made via myIR. |

IRD summary | Inland Revenue don't provide C-series reports for tax returns filed using gateway services, so there's no specific declaration that must be used for IRD summaries. For tax returns prepared in Tax, we print a declaration and signature section on the Tax statement. This declaration uses the same wording as if the tax return was filed through myIR. |

Checksum | E-file used a checksum which was checked by Inland Revenue on receiving the return as a way of validating what was sent. Gateway services doesn't use a checksum. Gateway services validates on specific fields and return criteria and if your return doesn't comply, it will be rejected by IR and you'll see an error message advising what criteria hasn't been met. |

Filing tax returns using gateway services

To file returns using gateway services, you'll need to use your myIR credentials, instead of your E-File logon details. Each staff member using gateway services will need their own myIR logon, so you might need to set up unique myIR logins for staff that don't already have one.

See the Inland Revenue website for more information on how to set up myIR logons for your staff.

Restricting staff from filing tax returns

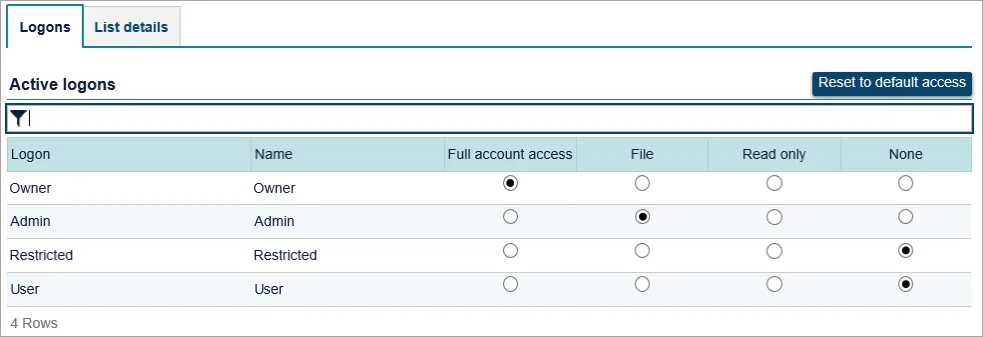

The ability to file tax returns is based on each user’s level of access in myIR.

Staff members must have either Full account access or File access in myIR to file returns on behalf of your practice.

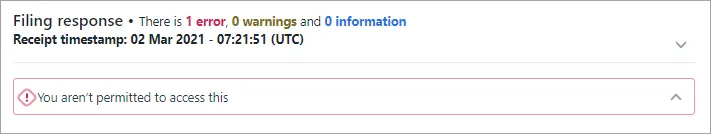

If a staff member has Read only or None access, they’ll receive the message You aren’t permitted to access this when attempting to file a tax return in Tax.

You can restrict filing access to staff members by client list. For example, some staff might be able to file tax returns for a clients on one client list, but not for clients on another client list.

To manage access levels for your staff, log into myIR as an Administrator and go to Manage agency > Manage staff logons.

For more information on different access levels in myIR and how to apply them, download IR's Manage agency guide.