If you use MYOB AE/AO, once you've upgraded, you'll start receiving all your Inland Revenue transactions in Tax in MYOB Practice Compliance. So it's important that you continue to reconcile these transactions in Tax instead of AE/AO, so you don't need to reconcile them again later.

Reconciling transactions

There are two types of transactions in Data reconciliation:

IR transactions are downloaded directly from Inland Revenue and reflect the transactions in your client's myIR account.

MYOB transactions are transactions that you've added manually, or that have been generated as a result of a tax notice or tax return created in Tax.

You can reconcile multiple transactions at once, and of different transaction types. For example, you can reconcile two IR transactions (payment and a transfer) and one MYOB transaction.

Transactions will be automatically reconciled where:

the MYOB transaction and IR transaction amounts are similar (within $0.05 of each other)

the transactions are dated within 7 days of each other.

they have the same transaction type.

When you file a tax return a transaction for the tax return assessment, refund or transfer will be added.

Reconciled and unreconciled transactions panels

The Reconciled transactions panel will only be displayed if there are transactions in those categories. The Unreconciled transactions panel is displayed even if there are no currently unreconciled transactions, so that you can always access the Add MYOB transaction function.

Adding an unreconciled MYOB transaction is useful if you want to make an expected transfer or payment outside of what the tax return or tax notice would normally create. For example, if you use tax pooling.

Unreconciled MYOB transactions for payments or transfers will be shown as part of the tax return information. However, these transactions won’t be used in calculations by tax notices. Tax notices will only use reconciled and unreconciled IR transactions in calculating payments required.

Checking and refreshing data

We check for new IR transactions every night, automatically. Any new IR transactions will appear in your client's Data reconciliation page, ready for you to reconcile the very next day. Learn more about when we receive IR data.

You can also check for new Income tax, Tax credits, Student loan and Working for families transactions at any time using the Refresh IR data button on the top right of the Data reconciliation page.

Different ways to reconcile

Reconcile a transaction

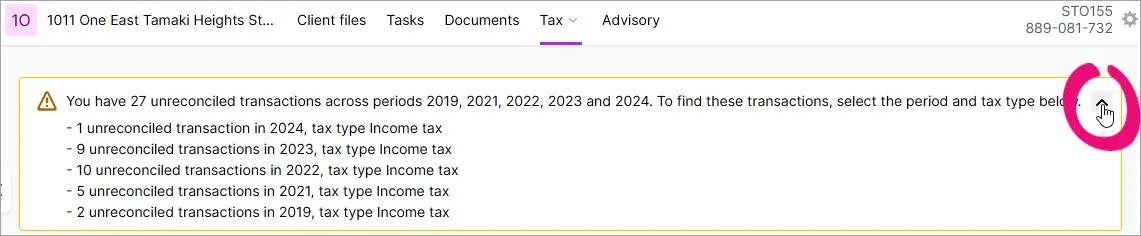

When you open a Data reconciliation entry with unreconciled transactions, an alert at the top of the page displays the number of unreconciled transactions in each period, for each tax type.

Click the expand alert (a downward arrow) icon to display the full alert.

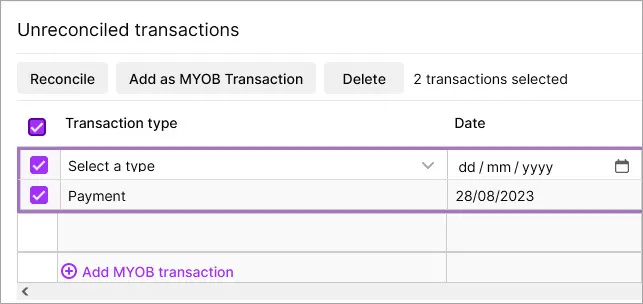

Select the transactions you want to reconcile from the Unreconciled transactions table. The Reconcile, Add as MYOB Transaction and Delete buttons appear above the list of transactions.

Click Reconcile. The message "Success! X transactions have been reconciled" appears and the transactions move to the Reconciled transactions section.

Reconcile an assessment transaction

First, here's bit about how reconciling an assessment transaction works...

If you file a tax return through Tax

An MYOB transaction for the tax return assessment is automatically created in your client's Data reconciliation page.

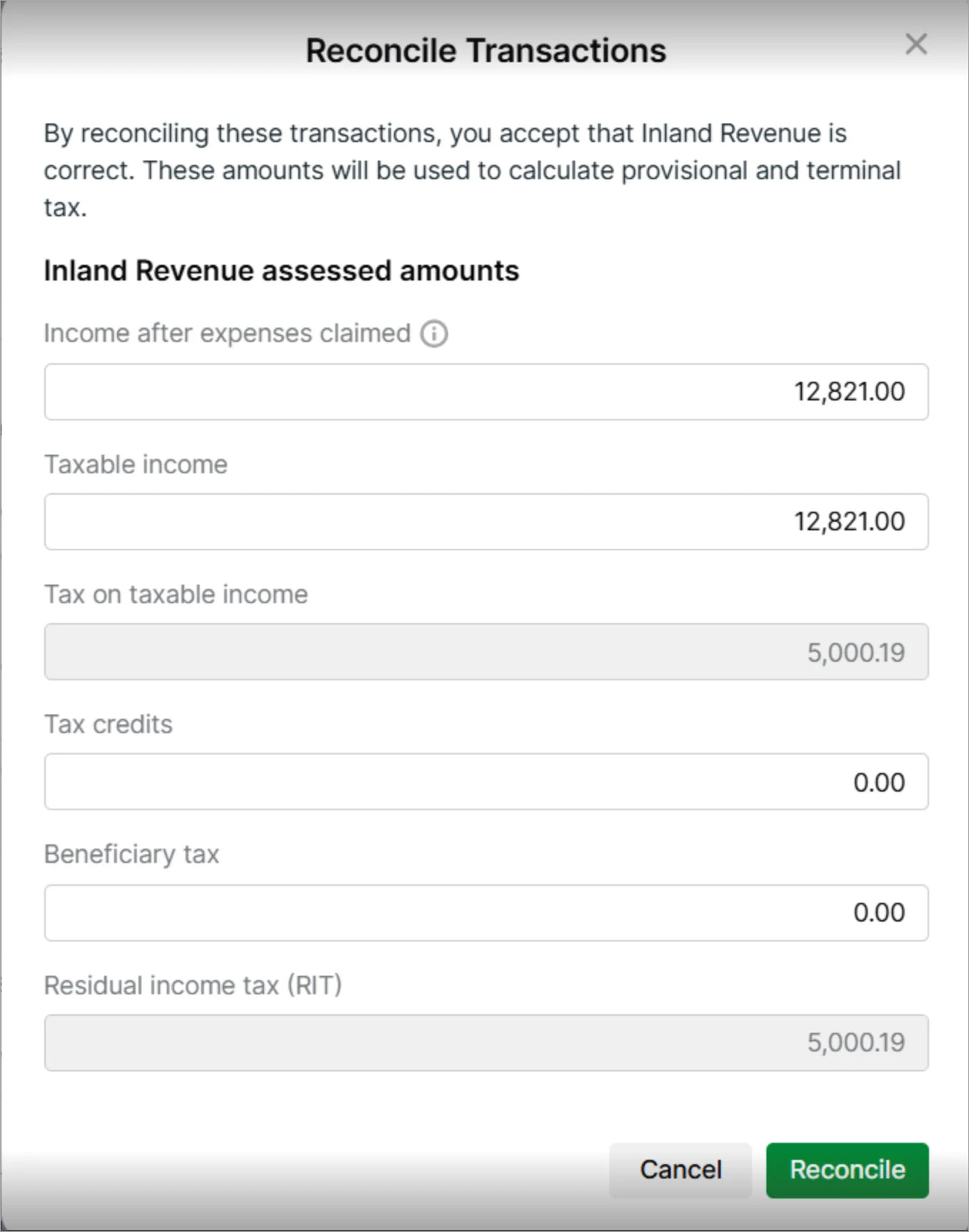

When reconciling this transaction against the IR transaction for Inland Revenue's assessment, if the MYOB and IR Residual Income Tax (RIT) amounts differ by more than $0.05, the Reconcile transactions window appears to let you enter the IR assessment details However, if you've filed a tax return through Tax and the RIT amounts differ by less than $0.05, then we'll use the data from your client's tax return in Tax to prepopulate tax notices.

If you haven't filed through Tax

If you haven't filed the tax return through Tax but you're reconciling the Inland Revenue's assessment transaction, you'll still see the Reconcile transaction window. This lets you enter the IR assessment details when you add an MYOB transaction for the assessment amount, or duplicate the IR transaction using Add as MYOB transaction.

We use these IR assessment details to calculate provisional and terminal tax in tax notices, so that your client can pay the right amount of tax, without incurring interest on underpayment.

Enter Inland Revenue assessment amounts

Click Reconcile.

In the Reconcile transaction window, enter the Income after expenses claimed (IR6 trusts only), Taxable income and Tax credits, or Beneficiary tax for trusts or Other debits for individuals. We'll automatically calculate the Tax on taxable income and Residual income tax (RIT) for you.

The Income after expenses claimed and Beneficiary tax fields are available for trust entity types; the Other debits field is available for individual entity types.

Click Reconcile.

If you need to update the RIT later, you can! See To update the IR assessed amounts.

Update Inland Revenue assessment amounts

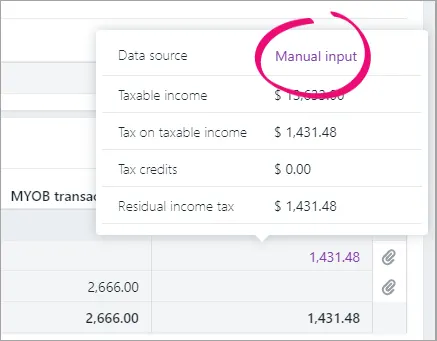

Find the assessment transaction under Reconciled transactions, and click the IR transaction amount.

Click Manual input.

Enter the new assessment amounts.

Add an MYOB transaction

Add a new MYOB transaction

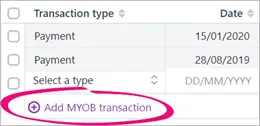

On the Unreconciled transactions panel, click Add MYOB transaction.

A new row appears at the bottom of the Unreconciled transactions list.Enter details about the transaction type, date, description and MYOB transaction amount.

-

You can enter any text into the Description field to record information about the transaction. The description entered doesn't display anywhere else, but may be useful to store brief notes.

-

When adding a transfer transaction, it's only created for the client and the year that you're adding it into. The contra-entry of the transfer doesn't get automatically generated at the same time, even if it's for the same client. You'll need to go to the relevant client and year to record the contra-entry of the transfer, using the Add MYOB transaction function again.

-

Duplicate a transaction

Select the transactions you want to duplicate from the Unreconciled transactions table. The Reconcile, Add as MYOB Transaction and Delete buttons appear above the list of transactions.

Click Add as MYOB transaction. The details of the transaction is duplicated and added as an MYOB Transaction.

You can only duplicate IR transactions.

Delete a transaction

If you don't receive an IR tax return assessment because it has a $0.00 value, you can delete the MYOB assessment transaction with a $0.00 value so you don't end up with unreconciled transactions that are no longer needed.

You can also delete MYOB assessments that have a value (anything that's not $0.00).

Select the transaction you want to delete from the Unreconciled transactions table. The Reconcile, Add as MYOB Transaction and Delete buttons appear above the list of transactions.

If you want to delete a transaction that's already been reconciled, you must unreconcile it first. You can't delete IR transactions.

Click Delete.

Unreconcile a transaction

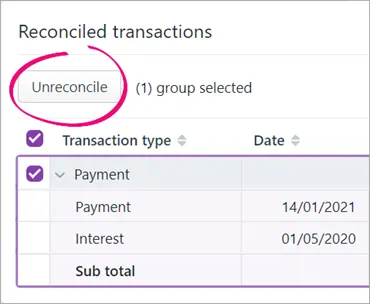

In the Reconciled transactions section, select the group of reconciled transactions you want to unreconcile. The Unreconcile button appears above the list of reconciled transactions.

Click Unreconcile.

The group of transactions moves back to the Unreconciled transactions section.

Reconcile a transaction for a different period

Select a client on the client side menu and go to Tax > Data reconciliation.

Select an option from the Period and Tax Type drop-downs.

If you used to use MYOB AE/AO

You can view Inland Revenue (IR) transactions up to 2 tax years prior to your first tax year in Tax, the earliest viewable year being 2019. So if your first tax year is 2021, you can view IR transactions for the 2019 and 2020 tax years online. You can view transactions for 2018 and prior years in MYOB Tax Manager.

This for viewing static data for historical purposes only.