What's new in tax 2023

Find out all you need to know about changes to tax compliance in 2023. Learn about what's changed, how to complete certain tasks, and where to find more information.

Rollover data

Compliance settings

Check all compliance settings before you start a tax year and edit the settings if required.

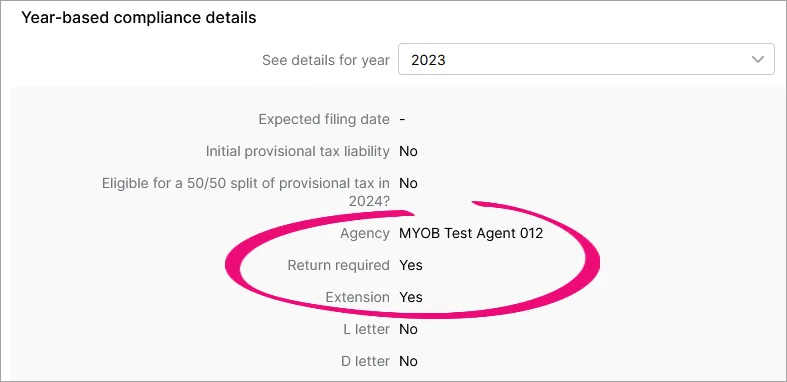

The Agency, Return required and Extension in the Year-based compliance details section roll over from the previous tax year. The other year-based options will reset to the default.

In the Year-based compliance details section, in the See details for year options, you can select up to one year ahead of the current year to view and edit compliance settings for that year.

Tax return data

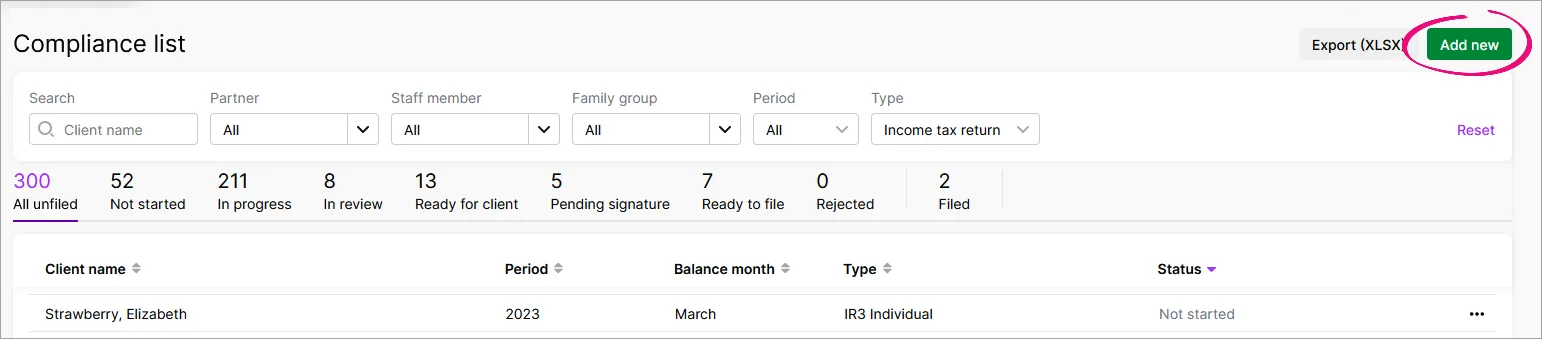

If you had a 2022 return for your client on 31 March, a tax return entry with a Not started status for this year is automatically created.

To roll over details from the 2022 return to the 2023 return, click anywhere in the row showing Not started.

You can also add 2023 returns by clicking the Add new button. This will roll over data if a return existed in the previous year.

Tax changes

Rate changes

ACC earners' levy changes:

Levy rate increased to 1.46%.

Maximum levy payable is $1,993.54.

Maximum earnings for the levy is $136,544.

Student loan annual repayment threshold increased to $21,268.

Working for families tax credits rate changes:

Family tax credit (FTC) increased to:

$6,642 for first child

$5,412 for subsequent children.

Abatement increased to 27%.

Best Start tax credit (BSTC) increased to $3,388 per child.

Residential property income

Changes affect all return types.

References to rental have been changed to property.

There are now four income fields:

Gross residential rental income

Net bright-line profit

Other residential income

Total combined residential income.

Residential property income schedule

There's a new section showing individual method income and deductions, and another section showing bright-line profits, portfolio method income and deductions. Select the residential income method to display the relevant sections.

There's a new residential rental income summary showing amounts from other sections and from the main form.

The IR833 Property sale information will populate into the bright-line table in the Residential property income schedule. Amounts are only included if there was a net profit and you’ve indicated the property is subject to the bright-line test.

There's a new Attributed bright-line profit field to show any bright-line profit from a partnership or LTC. For an IR3, this field will automatically populate with any bright-line profit attributed from an IR7. This amount can then be applied to the relevant method and you can offset any eligible prior-year losses.The Residential property income schedule will be created if one existed in the previous year. The Residential income method option will roll over but, due to the substantial changes made to the residential property income schedule, the property description won't roll over.

Distributing from an IR7

The IR7 Attribution of income/(loss) section includes Residential income method, Gross residential rental income, Net bright-line profit, and Other residential income after the Non-allowable deductions carried forward for each partner or owner for distribution purposes.

Attributed income only includes the Total combined residential income. To edit the amount being distributed, you need to edit the individual fields that make up the total, not the total itself.If an IR3 has residential income attributed from an IR7 partnership or look-through company (LTC), the details will be populated into the portfolio method. If the Residential income method is different, you need to manually update the tables.

Residential property interest

There's a new interest claimed reason: Approved build-to-rent exclusion.

The second interest claimed reason for Loans drawn down prior to 27 March 2021 is no longer applicable and has been removed. In the Rental income statement, the rate for this option is adjusted to 75% and the period column is removed, as all rates are now for a full year.

For more information, see the IR webinar and the relevant IR return guide for the return type you’re completing.

IR3 - Overseas income

IR introduced a new form: IR1261 Overseas income summary. It includes fields for income type, tax jurisdiction and amounts received.

Add the IR1261 attachment from the IR attachments drop-down in the Tax return page or from the link at the overseas income field.

You must attach an IR1261 when filing a 2023 IR3 individual tax return containing overseas income. This means you can no longer use the previous overseas income schedule, nor enter amounts for overseas income directly in the main IR3 form's field.

The IR1261 has a worksheet and a summary. Only the summary is filed with IR. Enter each income type for each tax jurisdiction separately. Enter the information in the worksheet, and the summary will group any duplicate entries. If you don't know the tax jurisdiction that the income was earned from, you can select Unknown. The summary will automatically calculate the allowable tax credits.

When you print the tax statement, the overseas income summary will be included, but the worksheet is optional. The attachment also lets you choose whether you want to print the worksheet as well.

For 2023, only the IR3 needs to file the IR1261. No changes have been made to the overseas income schedule available in other return types.

IR3NR - Jurisdiction of tax residency

The Return information section has been updated in an IR3NR Non-resident individual to include the jurisdiction of tax residency, the tax identification number (TIN) and settings for indicating whether TINs are issued and required. These new fields are filed.

IR8 - Māori authorities, and IR9 - Clubs or societies

You can create and file IR8 Māori authorities or IR9 Clubs or societies income tax return for 2023.

When data is available, these return types will be pre-populated, and will integrate with Data reconciliation and Tax notices.

IR9 Clubs or societies

When you create an IR9, the club or society type and incorporated setting will be populated per the Entity details section in the Compliance settings.

The IR9 has three entity types, and all schedules related to the IR9 are available in the return. A client's club or society type determines which keypoints appear on the main form. If you add a schedule that doesn't match to a visible keypoint, the amounts from the schedule won't update in the main form. In these instances, you can enter any tax credits directly in the Tax calculation section.

Other compliance changes

The following changes have been made for 2023 income tax returns per IR requirements:

The IR3 Portfolio investment entity (PIE) income schedule has a new Update PIR with IR field. This lets you advise IR of what you believe the end-of-year prescribed investor rate (PIR) should be if it's different to what IR currently has on record.

Negative PIE tax credits can only be entered and filed for an IR3. Negative PIE credits can't be filed for other return types.

The Overpayment of provisional tax field has been removed from the IR3 and IR3NR.

Other changes

We’ve added more information to some fields and schedules to make them easier to understand when preparing the return and reading the PDF reports:

The IR3 Income with tax deducted from summary of income schedule includes the ACC earners' levy and total tax deducted.

For the IR3NR:

In the Income with tax deducted from summary of income section, we've separated out schedular payments into separate fields and provided a related schedule to help you easily identify this income.

As with the IR3, the Income with tax deducted from summary of income schedule now includes the ACC earners' levy and total tax deducted.

We've updated the IR3NR interest, dividend and royalties schedules. These schedules display the tax jurisdiction, non-resident withholding tax (NRWT) rate and the calculated NRWT amount. If the tax jurisdiction has more than one NRWT rate, you can select the applicable rate in the schedule.

When transferring a refund, you can add a name for each transfer.

A new Transfers out schedule is available, listing the details of all transfers.

You'll see a warning if a return has a refund and you haven't retrieved a bank account number from IR.

Various other updates have been made to tool tips and validations.

Resolved issues

We’ve fixed the following for 2023:

If a donation deduction is being claimed in an IR4 company return, the claimed amount was not limited to the amount of income. You'll now see a new field displaying the amount that can be claimed.

Best start tax credit (BSTC) entitlement in the Working for families schedule was calculating incorrectly when:

the abatement is being applied

there's more than one child, and

one child less than one year old.

We’ve also modified the schedule to show the BSTC entitlement before abatement as well as after.

Free MYOB webinar

Watch the tax webinar on demand. Discover how to navigate the new IR tax changes and all the ways MYOB Practice tax updates make EOFY easier. Register here.

Tips for completing fields

For tips on completing fields in return types, see Tips for completing fields.

Tax guides from IR

View and search for forms and guides on the IR website for more help with completing tax returns.