A retention is a payment amount withheld from a job, usually in the building and construction industry, that is not paid in full until the job is completed. This is done to ensure that all the work is complete to the payer's satisfaction before handing over the full amount.

If you're a contractor with a retention, you only need to complete a few short steps to record the retention in AccountRight before and after you've received the payment.

Not quite what you're looking for?

This topic covers retentions from the perspective of the contractor from whom the retention payment is being withheld. For information on how to handle retentions from the perspective of the business doing the withholding, see Withholding payments from contractors.

We'll use the following example for these steps:

MK Constructions (the AccountRight user) have made an agreement with Joy Smith that Joy will withhold a $20,000 retention until the building is completed to her satisfaction. Therefore, Joy will only be invoiced during the contract for the full amount minus the retention. The invoice for the remaining amount will invoiced at a later date.

But no matter your business' specifics, these steps and principles in recording a retention will work for you.

Before you begin

If you're the contractor from whom the payments are being withheld, you'll need to setup your company file with a new asset and new liability account. These accounts will help your record the retainer when the job begins and clear it when the job finishes.

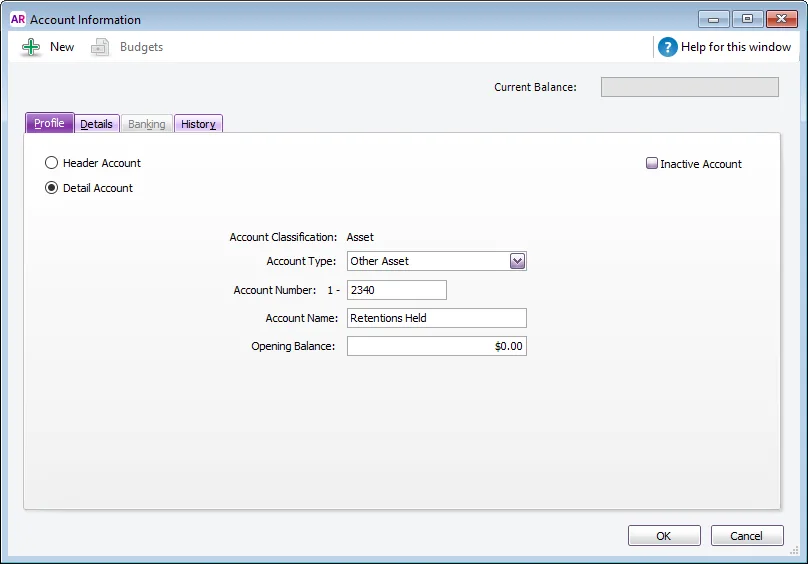

To create an asset account for Retentions Held

Create a new asset account, with the Account Type as Other Asset and the Account Name as Retentions Held.

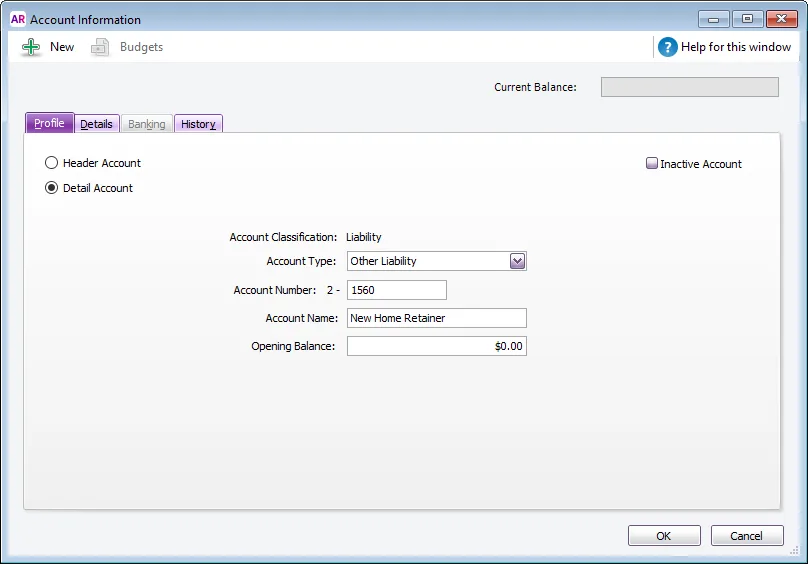

To create a liability account for Liability for Defects

Create a new liability account, with the Account Type as Other Liability and the Account Name as one that suits your business needs. For our example, we'll name it New Home Retainer.

If you have several aspects of your business from which you receive retentions, you may want to set up several liability accounts to separate out and report on each.

Just received a retention?

OK, so you've been contracted for a new job and received your retention. First, we'll show you how to invoice a retention that has yet to be paid.

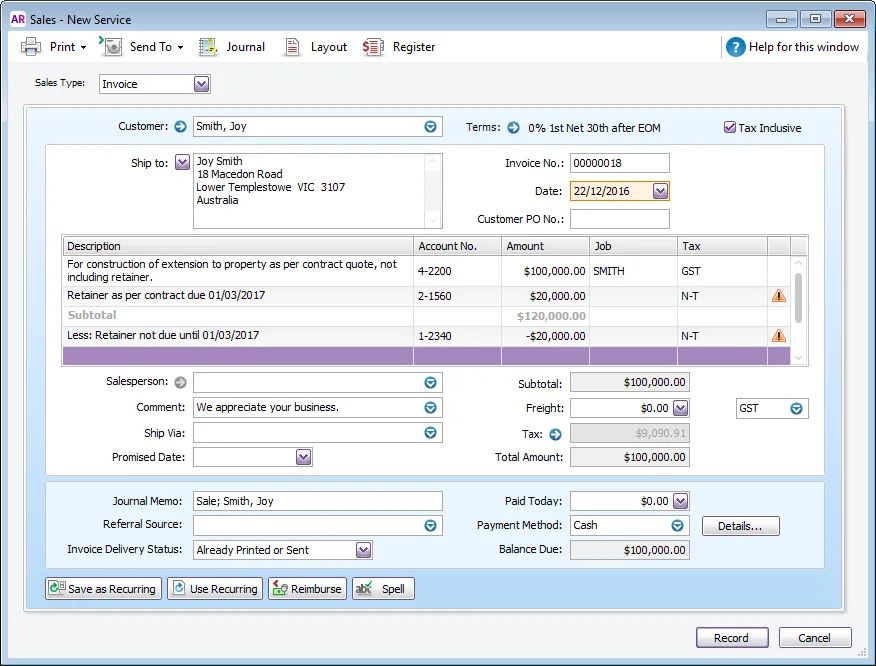

To record an unpaid retention

Create an invoice for the retention, keeping in mind the following points:

The amount of the retainer due is put in the Liability for Defects account and N-T assigned as the tax/GST code.

The next line relates to the retainer and is entered as a negative amount with N-T as the tax/GST code.

By creating the invoice like this, you will not be including the retainer as part of the receivables report as it is not yet due.

Recapping this transaction will display the retainer amount in both the Retentions held and Liability for defects amount.

When the retention is paid

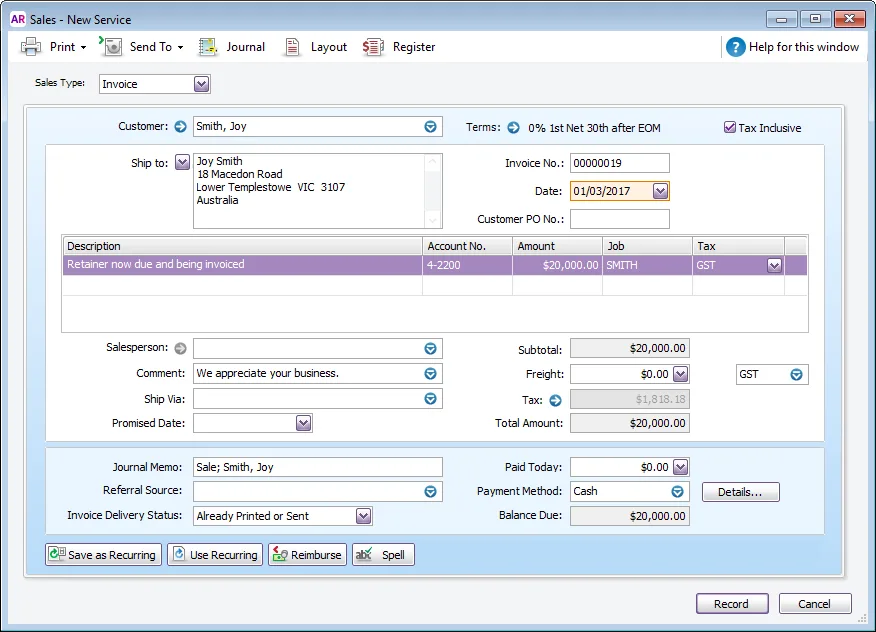

When the job is completed and the retention paid, you'll need to create an invoice for the value of the retention.

To record a paid retention

Enter a sales invoice for the paid retention, keeping in mind the following:

The Account No. will be an income account that best suits your company's needs. For this example, we chose the 4-2500 Construction Income account.

Because the retainer is now paid, you'll enter the GST/S15 tax/GST code.

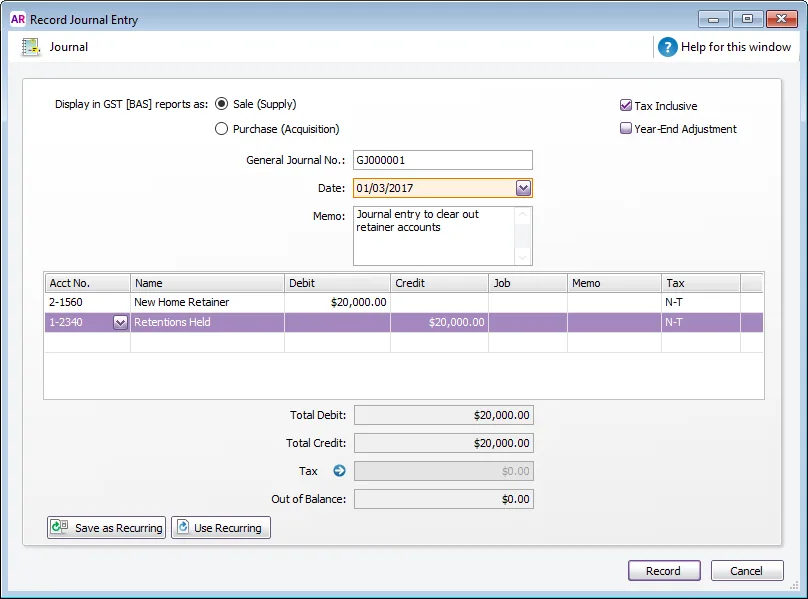

To clear the Retention Held and Liability for Defects accounts

Once the retention transaction is recorded, your relevant income, GST and trade debtors accounts will be up to date. However, the amounts held in the Retention Held and Liability defects accounts still need to be cleared out.

To clear these accounts, Record a journal entry to debit the Extensions Retainer account and credit the Retentions Held account.

After recording this journal entry, the two retainer accounts are cleared, and the retention is recorded.

Want to learn more?

There's plenty of business experts on our community forum who know a lot more about retention payments than we do.

Julie Carter, one of our top forum contributors, has a wealth of experience in this area. Check out her great article on Retention money and how it works.