With online payments, there are no setup or cancellation fees. There's just a transaction fee that will apply to all payments made online.

Transaction fee: $0.25 per transaction + 2.7% of the invoice value (including GST). You can pass on the 2.7% to your customers through surcharging.

When the sale happens, the transaction fees are debited. If you surcharge and there's GST on the invoice, GST will also be applied to the surcharge.

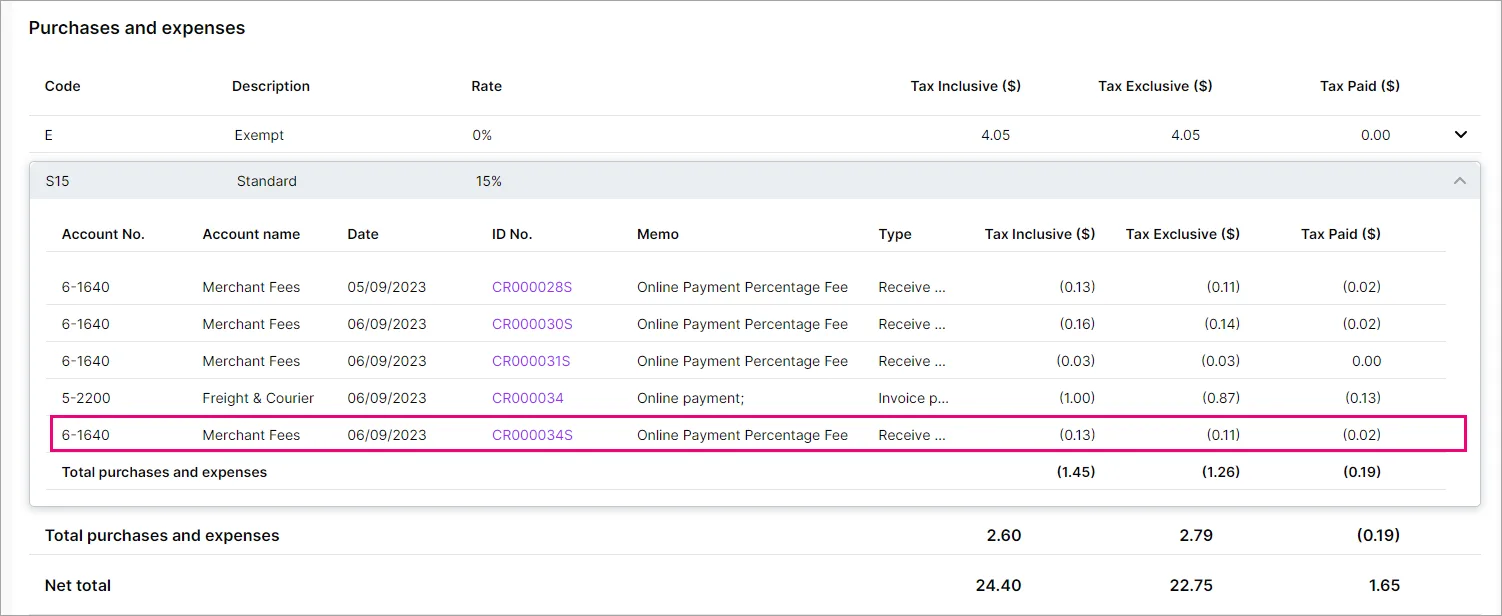

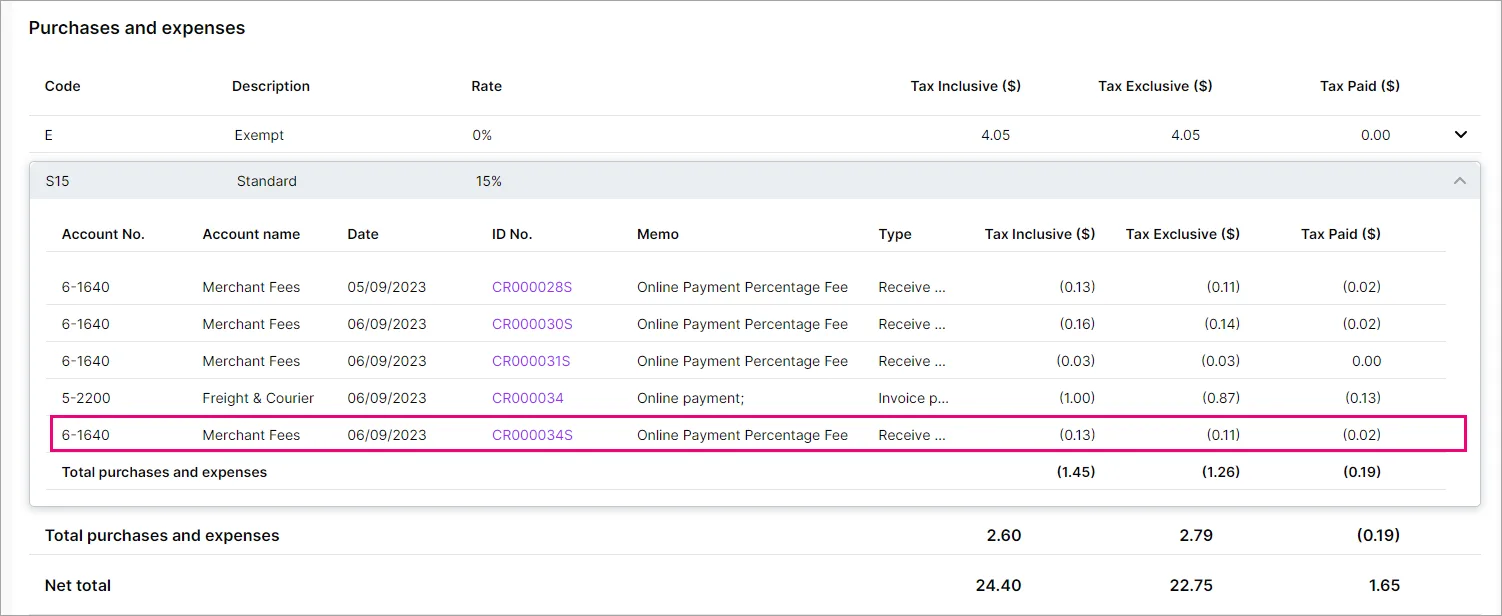

The GST on the surcharge will be paid to your bank account and be shown in Reports > GST report > Purchases and expenses. The transaction will be shown under the MYOB account you've nominated for recording merchant fees.

Example

Here's an example where the invoice includes GST and you're passing the 2.7% surcharge onto the customer.

Invoice total = $115 ($100 + $15 GST)

Customer pays $115 + $3.10 surcharge (2.7% of invoice total) + 46c (GST on surcharge) = $118.56

MYOB transaction fee = 25c

MYOB deducts $3.35 in fees from the customer's payment ($3.10 surcharge +25c transaction fee)

You receive $115.21 into your nominated bank account ($118.56 - $3.35)

Other charges

You might also incur other charges if you’ve received a chargeback or dishonour notice. These charges include:

Chargeback fee: $25 per chargeback. This fee will be incurred regardless of chargeback outcome.

Direct debit dishonour: $2.50. A dishonour fee is issued if we're unable to debit applicable fees or charges from your bank account. Check your balance regularly to ensure there are enough cleared funds in your account.

GST on surcharges

If you pass on the surcharge and there’s GST on your invoice, GST will also apply to the surcharge. GST is applied to the surcharge because providing a payment service is considered part of the sale. For more information, see IR’s GST on surcharges page.

For example, if you sell taxable goods and services, such as shoes, and provide an online payment service that has a surcharge, then you are selling the:

shoes, and

payment service.

As a result, the surcharge incurs GST at the same rate as the shoes.

Checking your fees

We'll send you a monthly email letting you know your online payment transaction fees for the previous month.

For more details on the fees for specific online payments, check the online payment reports.

Online company files only

With online payments, there are no setup or cancellation fees. There's just a transaction fee that will apply to all payments made online.

Transaction fee: $0.25 per transaction + 2.7% of the invoice value (including GST). You can pass on the 2.7% to your customers through surcharging.

When the sale happens, the transaction fees are debited. If you surcharge and there's GST on the invoice, GST will also be applied to the surcharge.

The GST on the surcharge will be paid to your bank account and be shown in Reports > GST report > Purchases and expenses. The transaction will be shown under the MYOB account you've nominated for recording merchant fees.

Example

Here's an example where the invoice includes GST and you're passing the 2.7% surcharge onto the customer.

Invoice total = $115 ($100 + $15 GST)

Customer pays $115 + $3.10 surcharge (2.7% of invoice total) + 46c (GST on surcharge) = $118.56

MYOB transaction fee = 25c

MYOB deducts $3.35 in fees from the customer's payment ($3.10 surcharge +25c transaction fee)

You receive $115.21 into your nominated bank account ($118.56 - $3.35)

GST on surcharges

If you pass on the surcharge and there’s GST on your invoice, GST will also apply to the surcharge. GST is applied to the surcharge because providing a payment service is considered part of the sale. For more information, see IR’s GST on surcharges page.

For example, if you sell taxable goods and services, such as shoes, and provide an online payment service that has a surcharge, then you are selling the:

shoes, and

payment service.

As a result, the surcharge incurs GST at the same rate as the shoes.

Other charges

You might also incur other charges if you’ve received a chargeback or dishonour notice. These charges include:

Chargeback fee: $25 per chargeback. This fee will be incurred regardless of chargeback outcome.

Direct debit dishonour: $2.50. A dishonour fee is issued if we're unable to debit applicable fees or charges from your bank account. Check your balance regularly to ensure there are enough cleared funds in your account.

Checking your fees

We'll send you a monthly email letting you know your online invoice payment transaction fees for the previous month.

For more details on the fees for specific online invoice payments, check the online invoice payments reports.