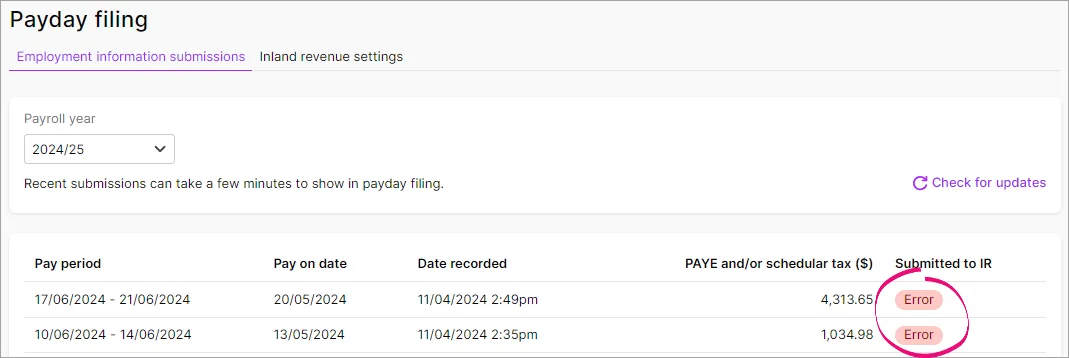

If you receive an error or a submission is rejected, this means the information you've submitted has not been accepted by Inland Revenue (IR). You'll need to troubleshoot the issue and possibly submit the information again.

Missing business IRD number

If a payday filing submission has an error about a missing business IRD number, the error status will remain for that submission even if you've fixed the issue. If you're not sure if the error has been fixed, check in myIR to see if that pay run has been received. See below for details on fixing this error.

Here's some of the common errors and how to fix them.

To view details of a submission

Go to Payroll > Payday filing.

Click the Employment information submissions or Employee details submissions tab.

For submissions with an Error or Rejected status, click the submission to view more details.

After fixing whatever caused the issue, an Error status will remain for that pay run.

Errors explained

Status | Error code | Description | Resolution |

|---|---|---|---|

Rejected | IR error code: 1 Authentication Failure | The link between IR and MYOB has been broken for the person who submitted the employment information. | 1. Go to Payroll > Payday filing. 2. Click Get started > Confirm and authorise. 3. Go to Payroll > Payday filing. 4. Click the rejected submission to view its details. 5. Click Submit to Inland Revenue. |

Error | IR Error Code: This version of the service is no longer supported. | You're trying to file a pay run to IR for a period before Payday filing was introduced on 1 April 2019. This can't be done. | For pay runs before 1 April 2019, you'll need to contact IR and follow the older reporting process (submitting the IR348 form). |

Error | IR error code: Your business is missing an IRD number | The IRD number is missing from your MYOB business settings so employment information hasn't been submitted to IR for this pay run. | 1. Click your business name > Business settings > enter the IRD number > Save. 2. Generate a PDF showing details of the pay run (Payroll menu > Payday filing > click the pay run with this specific Error status > click View return (PDF)). 3. Use the details in the PDF to manually file employment information for this pay run using on-screen entry. For details, see these IR instructions. |

Error | IR error code: 1 Authentication Failure | The link between IR and MYOB has been broken for the person who submitted the information. | If the error is on the Employment information submissions tab, delete the pay then process it again to submit to IR. If the error is on the Employee details submissions tab, you'll need to manually add the employee in myIR. |

Rejected | IR error code: 2 Missing authentication token(s)

| The link between IR and MYOB has been broken for the person who submitted the information. | 1. Go to Payroll > Payday filing. 2. Click Get started > Confirm and authorise. 3. Go to Payroll > Payday filing. 4. Click the rejected submission to view its details. 5. Click Submit to Inland Revenue. |

Error | IR error code: 2 Missing authentication token(s) | The link between IR and MYOB has been broken for the person who submitted the information. | If the error is on the Employment information submissions tab, delete the pay then process it again to submit to IR. If the error is on the Employee details submissions tab, you'll need to manually add the employee in myIR. |

Rejected | IR error code: 4 Unauthorized Delegation | The person who submitted the employment information hasn't been delegated to submit for the business. The most common cause of this error is that IR haven't migrated delegated users from the previous method of filing monthly returns. Another cause of this error is logging in and authorising MYOB using your personal myIR details instead of with the account created by the business. | To check that you have access to the Payroll Account in myIR: 1. Log into myIR as you normally would. 2. Click My Business. 3. Click Settings. 4. Select the Access tab. 5. Check to see which accounts you have access too. You need access to the Payroll account to be able to be able to use payday filing. If you don't have access to the 'Payroll' account, you'll need to speak to the person in the business who is the owner and they'll be able to delegate you access. 6. Once you have access to the 'payroll' account, go back into MYOB and re-submit the rejected returns. If you have completed the steps above and are still getting rejected reports, see the steps below to check that you linked the correct myIR account.To check that the correct myIR account is linked, the person who submitted the employment information needs to: 1. Remove MYOB authorisation: a. Go to Payroll > Payday filing > Inland Revenue settings. b. Click Remove authorisation. 2. Make sure you're logged out of myIR. This ensures you log in to the correct account. 3. Reconnect to Payday filing: a. Go to Payroll > Payday filing. b. Click Get started > Confirm and authorise. 4. Resubmit the employment information: a. Go to Payroll > Payday filing. b. Click the rejected submission to view its details. c. Click Submit to Inland Revenue. |

Error | Error Code 5: Unauthorised Vendor | Our experts are investigating this error. | There's nothing you need to do. Once the issue is fixed, your payday files will be submitted to IR. |

Error | IR error code: 21 Invalid XML | This error means there's missing or invalid employee or employer information in the file you're submitting to IR. It might be an email address, name, phone number or IRD number for your business or an employee that needs fixing. | Check your business settings (click your business name > Business settings) and confirm these details: • IRD Number/GST Number (must be 9-digits long) • Email (acceptable characters include A-Z, a-z, 0-9 and @ . - _) • Phone (must be in 0XX format not +64) Check your employees details (Payroll > Employers > click an employee's name) and confirm these details: • First Name and Surname or family name (make sure the right name is entered into the right field) • Email (acceptable characters include A-Z, a-z, 0-9 and @ . - _) • Phone (must be in 0XX format not +64) • IRD number on the Employment details tab (must be 9-digits long. Older IRD numbers are 8-digits long so must be preceded by a zero) If you update any incorrect details, you'll need to delete the pay then process it again to submit to IR. Still having trouble? Contact us for help. |

Rejected | Error Code 102: ID/Account Type Invalid | This error can occur because the myIR account associated with the IRD number doesn't have access to an 'EMP' account. | Call IR on: You can then resubmit the employment information: 1. Go to Payroll > Payday filing. 2. Click the rejected submission to view its details. 3. Click Submit to Inland Revenue. |

Error | IR error code: 103 No Return Found | The return has been deleted in myIR. | If you didn't delete the employment information from myIR, you may need to contact IR to find out what happened. |

Error | IR error code 104: Invalid Filing Period | This can occur for a number of reasons: You're trying to file for a period which you've already filed a non-payday return for. You're trying to file too far in advance. | Check the period/dates you're filing for. |

Error | IR error code 106 | A relationship between this account and employee IRD already exists | No action is required, but if you go into myIR and view the employees for the business, you see that the employee already exists. |

Error | IR error code 108 | The provided Tax Code was invalid | If you're seeing this error for an employee submission, you'll need to create the employee in your myIR portal with the right tax code. If you're seeing this error for a payday filing submission, you'll have to delete the pay in MYOB Business, update the tax code in the employee's contact record, then re-do their pay. |

Error | IR error code 121 | The provided Employee IRD number is not valid | If you're seeing this error for an employee submission, you'll need to create the employee in your myIR portal with the right IRD number. If you're seeing this error for a payday filing submission, you'll have to delete the pay in MYOB Business, update the IRD number in the employee's contact record, then re-do their pay. |

Error | IR error code 134 | The employee's IRD number is invalid. | 1. Update the employee's IRD number (Payroll menu > Employees > click the employee's name > Employment details tab > IRD number). 2. Delete the employee's pay. 3. Redo the employee's pay. |

Error | IR error code 138 | The employee must not have an 'SL' type tax code, as they have no student loan or they have a student loan repayment exemption. | Correct the employee's tax code in MYOB, and manually add the employee to your myIR account, making sure to use the correct tax code. |

Error | IR error code 139 | The employee must have an 'SL' type tax code, as they have a student loan or they do not have have a student loan repayment exemption. | Correct the employee's tax code in MYOB, and manually add the employee to your myIR account, making sure to use the correct tax code. |

Error | IR error code 160 | You'll need to check in myIR to see if the pay has filed successfully. | Log in to myIR and check if the pay has been filed: • If the pay has been filed and is only listed once, you can ignore the error. • If the pay has been filed and is listed twice, delete one of the pays in myIR (if you need help doing this, contact IR). • If the pay does not show in myIR, delete the pay in MYOB and reprocess the pay to refile it to IR. |

Error | IR error code 162: The filing period pre | You can’t file this return through payday filing because the filing period predates the payday filing system. | File a paper return with IR, if you haven’t already done one. |

Error | IR error code 164: The filing period is too far in the future | The period you are trying to file for is too far in the future. | Wait, and file this return closer to the date. |

Error | IR error code 173 | Your myIR account is either inactive or not registered for the period you're filing against. | Get in touch with Inland Revenue to either sign up for myIR or to confirm your myIR is active. |

Not submitted | IR error code 400 | This error usually means there's an issue on the IR end affecting the submission. | 1. Go to Payroll > Payday filing. 2. Click the submission to view its details. 3. Click Submit to Inland Revenue. |

Rejected | IR error code 1000 | You'll need to re-authorise MYOB and resubmit the employment information. | 1. Go to Payroll > Payday filing. 2. Click the Inland revenue settings tab and click Authorise MYOB and complete the authorisation in myIR using the user ID and password for your business (not your personal account details). 3. Go to Payroll > Payday filing. |

Rejected | IR error code 1001 | This error means you've been disconnected from IR. | 1. Go to Payroll > Payday filing. 2. Click Get started > Confirm and authorise. 3. Go to Payroll > Payday filing. 4. Click the rejected submission to view its details. 5. Click Submit to Inland Revenue. |

Error | IR error code 1001 | This error means you've been disconnected from IR. | If the error is on the Employment information submissions tab, delete the pay then process it again to submit to IR. If the error is on the Employee details submissions tab, you'll need to manually add the employee in myIR. |