When it comes to calculating your employees' leave, MYOB does all the hard work.

At a glance

-

Leave calculations are governed by the requirements of the Holidays Act 2003.

-

Leave is calculated in MYOB using the days and hours an employee works.

-

Annual holidays are paid at the greater rate of ordinary weekly pay (OWP) and average weekly earnings (AWE).

-

Other leave, like sick leave, is calculated using relevant daily pay (RDP) or average daily pay (ADP).

-

There are options in earnings pay items which control if the earning is included in leave calculations.

Days and hours worked

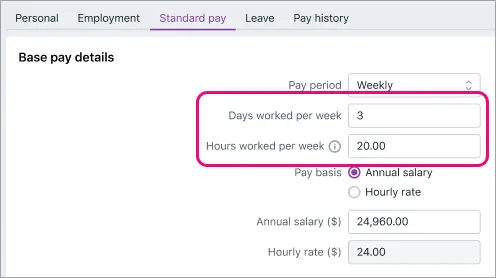

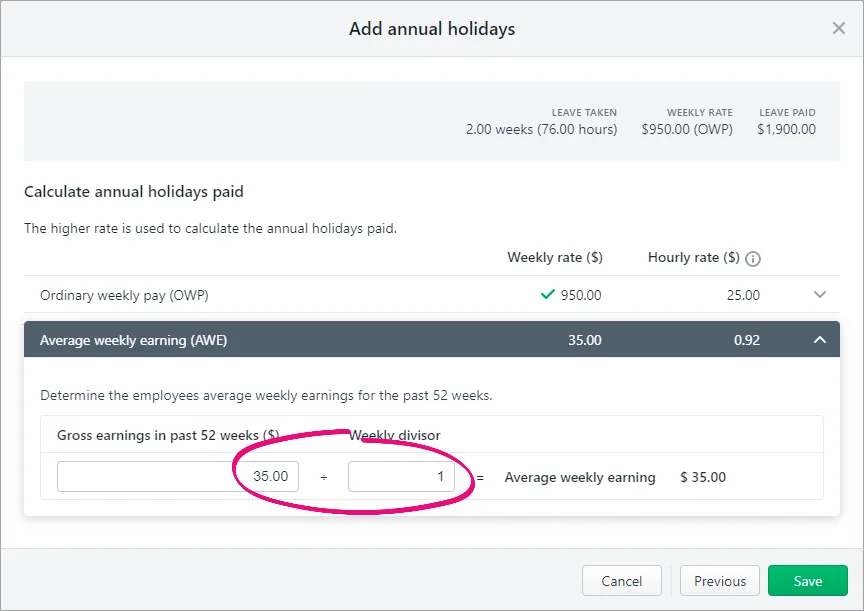

When you pay leave, the amount paid is calculated using the hours or days the employee typically works per week. If an employee works the same hours and days each week, you can enter these values in their standard pay (Payroll menu > Employees > click the employee > Standard pay tab). If an employee's days or hours vary, you can enter or update these values when you do a pay run.

Days worked per week | This includes all days being paid, including normal days worked and any paid leave taken. This value is used to calculate the pay rate for sick leave, public holidays, public holidays worked, alternative holidays and bereavement leave. |

Hours worked per week | This is used as the definition of a week for calculating the pay rate for annual holidays. |

When you do a pay run, these values are used to calculate leave payments. If an employee's days or hours vary, you can update it here.

Helping you calculate leave rates

There are different rates used for different leave payments. Here's a description of each and some guidance on which rate to use.

Annual holidays - ordinary weekly pay vs average weekly earnings

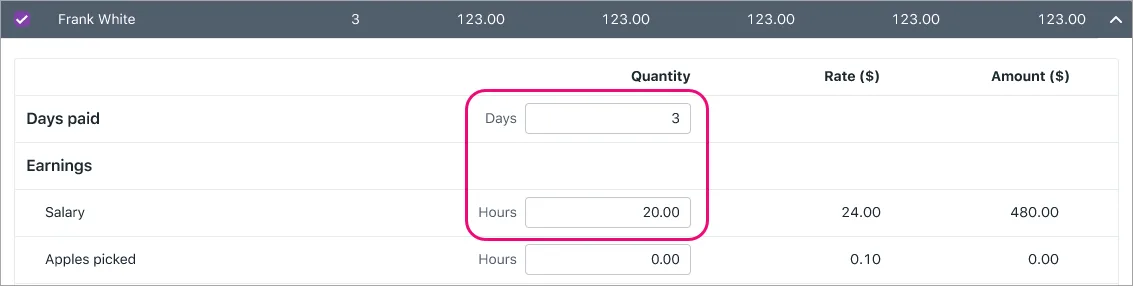

When you pay annual holidays, the weekly rate must be the greater of the employee's ordinary weekly pay (OWP) and average weekly earnings (AWE).When adding annual holidays to an employee's pay, MYOB helps by choosing the higher rate for you (with a green tick). You can also click the drop down arrow to see the details of how MYOB has calculated these rates.

Also, annual leave calculations are pay period driven. This means if the leave start date is before the current pay, a manual adjustment to the leave rates may be required. For details, see Paying leave.

To learn more about determining OWP and AWE, use this quick guide from Employment NZ.

Ordinary weekly pay (OWP)

OWP is the amount an employee receives under their employment agreement for an ordinary working week, including:

regular allowances, such as a shift allowance

regular productivity or incentive-based payments (including commission or piece rates)

the cash value of board or lodgings

regular overtime.

If the employee's work patterns vary from week to week, OWP may need to be adjusted when paying leave. If you can't determine the employee’s OWP, then use the 4 weeks Ordinary Weekly Pay formula as described below. For help working out what's included in an employee's OWP, check the Employment New Zealand website.

Using the 4 weeks Ordinary Weekly Pay formula

When it’s not possible to determine what an employee normally receives for an ordinary working week, you can use the 4 weeks Ordinary Weekly Pay formula to determine their OWP.

When paying annual holidays, click the dropdown arrow for Ordinary weekly pay (OWP).

Select the option use 4 weeks Ordinary Weekly Pay formula.

Work out the employee's gross earnings in the past 4 weeks:

Go to the end of the last pay period before the holiday is taken.

Go back 4 weeks (or length of pay period if longer than 4 weeks).

Add all gross earnings that are liable for OWP.

Enter this value at Gross earnings in past 4 weeks. Need help working this out?

Click Save to add the leave to the employee's pay.

Paying a special OWP rate

An employment agreement may specify a special rate of OWP for the purpose of calculating annual holiday pay if the rate is equal to, or greater than, what would otherwise be calculated.

To pay a special OWP rate:

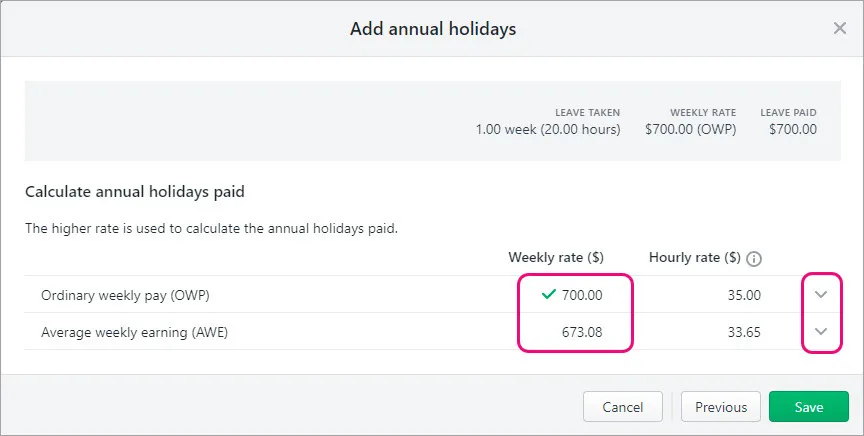

When paying annual holidays, click the dropdown arrow for Average weekly earnings (AWE).

For the Gross earnings in past 52 weeks ($), enter the special weekly OWP rate.

For the Weekly divisor, enter 1.

Here's our example:

Click Save and continue the pay run as normal.

Average weekly earnings (AWE)

AWE are worked out by calculating the employee’s gross earnings over the 12 months (or since their start date if less than 12 months) prior to the end of the last payroll period before the annual holiday is taken, and dividing that figure by 52.This means for a pay to be included in the AWE calculation, the pay period end date must fall within the last 52 weeks. For details on what's included in an employee's gross earnings for calculating AWE, check the Employment New Zealand website.

All other leave - relevant daily pay vs average daily pay

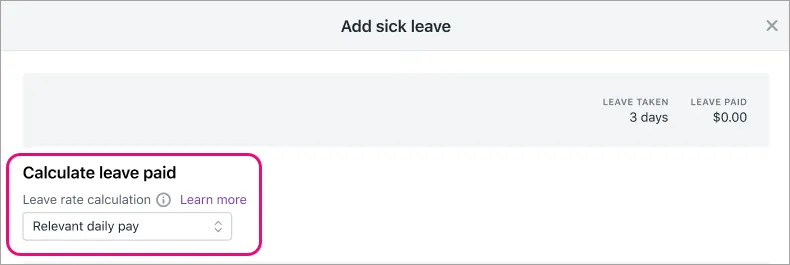

When you pay leave (not annual holidays), you can choose whether the leave rate will be calculated using Relevant daily pay or Average daily pay.

Relevant daily pay | This is the amount an employee would have earned if they were at work on the day. For example, an employee might receive a different pay rate for leave on a day when they are usually paid more, like a Sunday. In MYOB the relevant daily pay consists of the Ordinary hours pay item, and all hourly rate pay items that are part of the employee’s standard pay. By choosing this option, you'll be able to enter the quantity of hours for each pay item that the employee would have earned had they worked this leave period. Fixed amount earnings are treated as enduring allowances and are not included in relevant daily pay.If the relevant daily pay rate differs from day to day for a continuous block of leave, enter the employee's leave as separate entries for each rate (instead of entering it as one leave entry). This provides you more accurate record keeping. See Paying leave for details. |

Average daily pay | This can only be used if it’s not possible or practicable to work out relevant daily pay, or the employee's daily pay varies in the pay period in question. By choosing this option, the employees average daily pay rate will be determined based on: their gross earnings in the past 52 weeks, and dividing this by the number of whole or part days the employee either worked or was on paid leave or holidays during that period. For a pay to be included in average daily pay calculations, the pay period end date must fall within the last 52 weeks. |

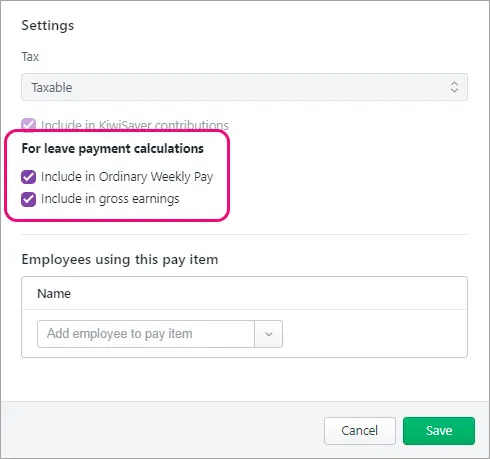

Including earnings in leave calculations

When you create earning pay items, like overtime, allowances, bonuses or other payments, you can choose to include the earning in leave payment calculations.

Include in Ordinary Weekly Pay - Ordinary weekly pay is the amount an employee receives under their employment agreement for an ordinary working week, including:

regular allowances, such as a shift allowance

regular productivity or incentive-based payments (including commission or piece rates)

the cash value of board or lodgings

regular overtime.

If you're not sure if an earning pay item should be included in ordinary weekly pay, check the Employment New Zealand website.

Include in gross earnings - Gross earnings typically means all payments you're required to pay under an employee's employment agreement for the period during which the earnings are being assessed. If all of the components of gross earnings are not included in the relevant calculations for holidays and leave, the employee will likely be underpaid.

If this option is selected for an earning pay item, the pay item will be used for average weekly earning (AWE), average daily pay (ADP) and termination payments to calculate the 8% of gross earnings since last anniversary earnings.

If you're not sure if an earning pay item should be included in gross earnings, check the Employment New Zealand website.