Get 80% off MYOB for a year

Save time and money with MYOB Lite and Pro. Base subscriptions only.

Exclusive savings on MYOB plans

MYOB is for businesses just like yours

Automate everything with MYOB: the essential toolkit for thriving sole traders and growing businesses.

MYOB Lite

For sole traders and small businesses with up to 2 employees. Perfect for you if your business needs the basics (and a bit extra).

Snap and manage expenses

Create and send unlimited invoices and quotes

Accept payments online

Connect up to 2 bank accounts

MYOB Pro

Ideal for small businesses that need flexibility as they grow. Whether you're adding new products or growing your team, you can easily include features like inventory and payroll—scaling up or down whenever it suits you.

Track GST and lodge BAS

Create and send unlimited invoices and quotes

Create customised reports

Optional payroll and inventory management

Why Australian and New Zealand Businesses love MYOB

Swipe left and right to see more

Current slide:00|Total slides:00

I'm ready to move beyond spreadsheets and streamline my workflow

Switching between tabs and documents to manually enter (and re-enter) the same details over and over — sound familiar? It's not only tricky to manage but chews up a lot of time. With MYOB, you can automate all your expense and income-tracking tasks. Faster, easier and error-free.

I want accurate taxes—down to the last cent

Record expenses easily, stay compliant, and maximise your returns. Avoid blunders with automatic tax calculations. No more shocks with MYOB tracking GST on sales. Plus, collaborate effortlessly with experts at no extra cost.

I want insights on my performance, without the guesswork

Easy-to-understand reporting shows your financial performance, bringing everything together in one place for clear spending insights. Make confident decisions with customisable budgets, and track your income and expenses on the go to instantly see what your business needs.

I want compliant (and straightforward) payroll

Make payday a breeze, whether you’re paying one person or a whole team. With MYOB Business, you can manage everything from onboarding to leave entitlements all in one place. Be confident in your payroll calculations and key your records safe and accessible on any device.

Frequently asked questions

Do I have to sign a lock in contract?

This offer is an annual plan meaning your MYOB Business subscription auto-renews for 12 months at the end of your initial 12 months unless you request to cancel at least 10 days before your renewal date, in accordance with the MYOB Business product terms of use. At the end of your initial 12 month period, the cost of your base subscription will automatically revert to the standard price advertised on our website.

How long does it take to set up?

Just a few minutes - honestly.

1. Simply choose the subscription plan that’s right for your business and purchase from this page to take advantage of the offer.

2. Sign up.

3. Log in (you’ll have access immediately). Once you’re logged in, we'll give you step-by-step guidance to help you set up and use the features your business needs.

How will I be billed?

Depending on whether you paid via credit card or direct debit at sign-up, your card or account will automatically be debited upon renewal of your yearly subscription. You will receive a billing reminder notification ~30-days in advance that the payment is going to be taken.

Can I migrate my data into my MYOB Business software?

There are two ways to move your data to MYOB.

Option 1: Manage your own move

See our step-by-step guides:

Migrate from other software (Reckon, Xero or QuickBooks)

Option 2: Get help moving from Reckon, QuickBooks or Xero to MYOB

With the help of MMC Convert, our migration partner, you can have your data securely migrated from your current accounting software to MYOB. Plus, we'll cover the cost to migrate data from the current and previous financial year. Make the move.

What happens if I upgrade or downgrade my subscription?

If you upgrade your subscription in the 12 month bonus period, you will be required to pay the price difference you will only get the benefit of the offer for the remaining period you were originally entitled to (the 12months does not reset).

If you downgrade your subscription in the 12 month bonus period, you will not recieve a refund on the difference between the lower and higher subscription, but you will get the offer benefit for the remaining period of the 12 month period (the 12months does not reset).

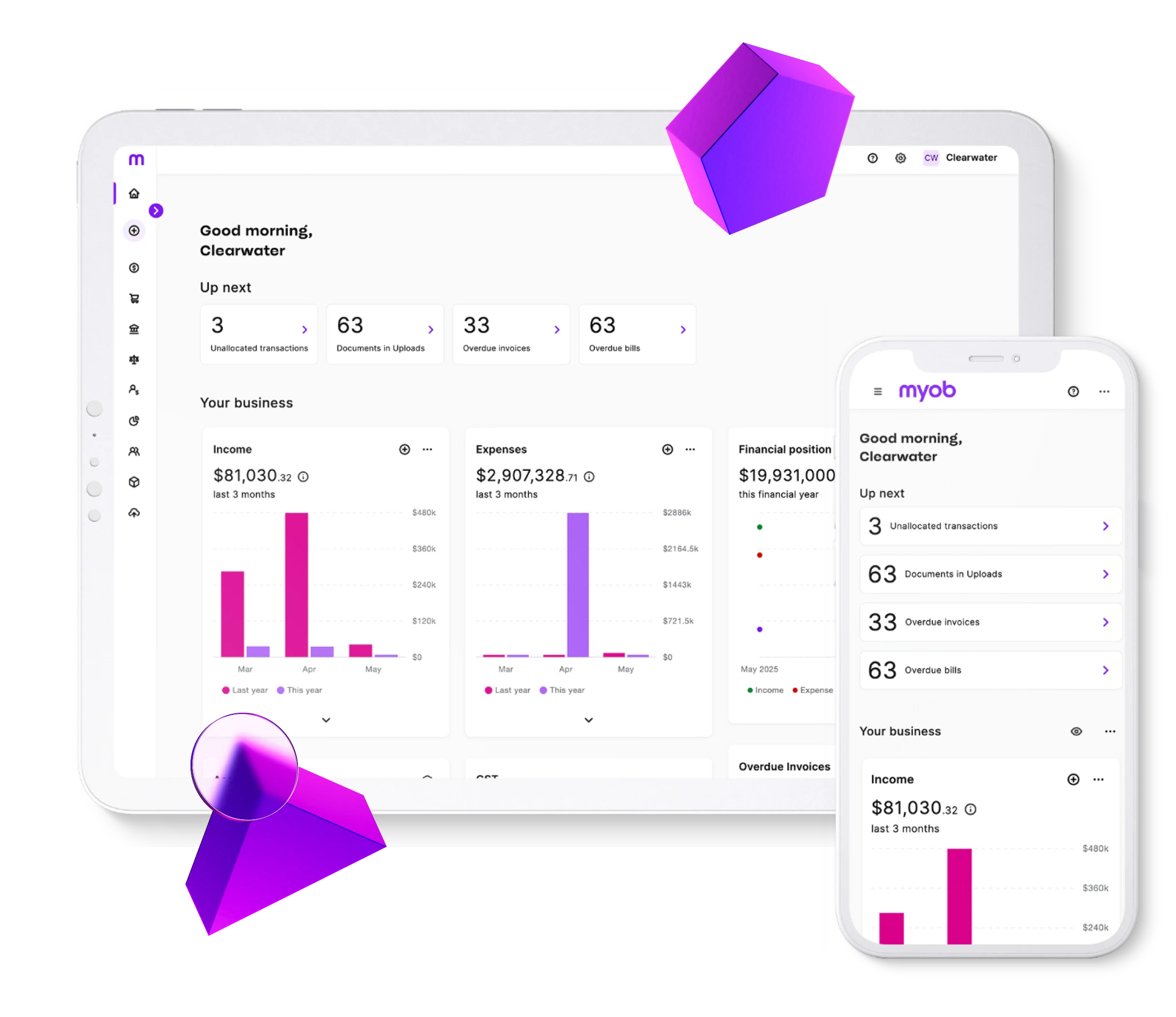

Can I use my account on my phone?

Yep, our software is available on all desktop, mobile and tablet operating systems. We also have handy apps for managing your business on the go.

For small business plans, our accounting software is compatible with all browsers on desktop, mobile, and tablet. Plus, you can enhance your workflow with our companion apps, such as MYOB Invoice and MYOB Capture, which allow you to create invoices and snap receipts directly from your mobile device. Explore the full range of MYOB mobile apps.

Can I give account access to other people?

You can share access to your MYOB account with your advisor, accountant or bookkeeper at any time at no extra cost.

You can also adjust their access level so you can control what they can see and do.

I still have questions – how can I get help?

Please visit our support centre if you need help with:

- your MYOB account

- using a product

- troubleshooting