Only available to early adopters

When your customers pay you securely using online payments, they can now save their credit or debit card details so they don't need to re-enter them each time they pay you. This is more convenient for them and helps making paying you easier.

Their card details are retained using Mastercard's Click to Pay service. This is a simple, secure, and consistent way to checkout. It is built on industry standard EMV specifications and smart security powered by Mastercard. It's supported by major card schemes, such as Mastercard, Visa, and Amex.

How Click to Pay works

When the payer selects the Credit or debit card payment option, Click to Pay will then check if they have an account (based on their email address and browser cookies).

If the payer:

doesn't have an account, they will then have the option to save their card

has an account and are remembered on the device, they will be able to pay using the stored card

has an account but are not remembered on the device, they will need to enter a verification code sent to their mobile number before they can use the card stored on their account.

If they don't have a valid email address or mobile phone in their record, they'll be prompted to provide it.

To help make Click to Pay smoother for customers to use, we recommend that you enter a valid email address and mobile phone number in the billing address of their customer record in MYOB. Find out how to edit customer details.

As Click to Pay is already widely used, the payer may already be registered for Click to Pay. If they're not registered, they just need to complete a couple of steps to register.

Let's see how it works:

Saving payer card details

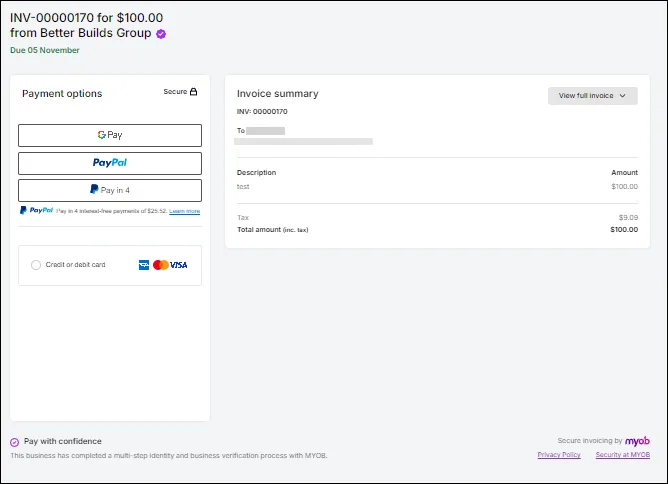

When the customer clicks Pay securely from the invoice email, it opens the online invoice showing a summary of the invoice.

They then select the Credit or debit card payment option.

If there isn't a valid email address or mobile phone number in their customer record, they're prompted to enter it and click Submit.

The next options the customer sees depends on whether they're registered for Click to Pay.

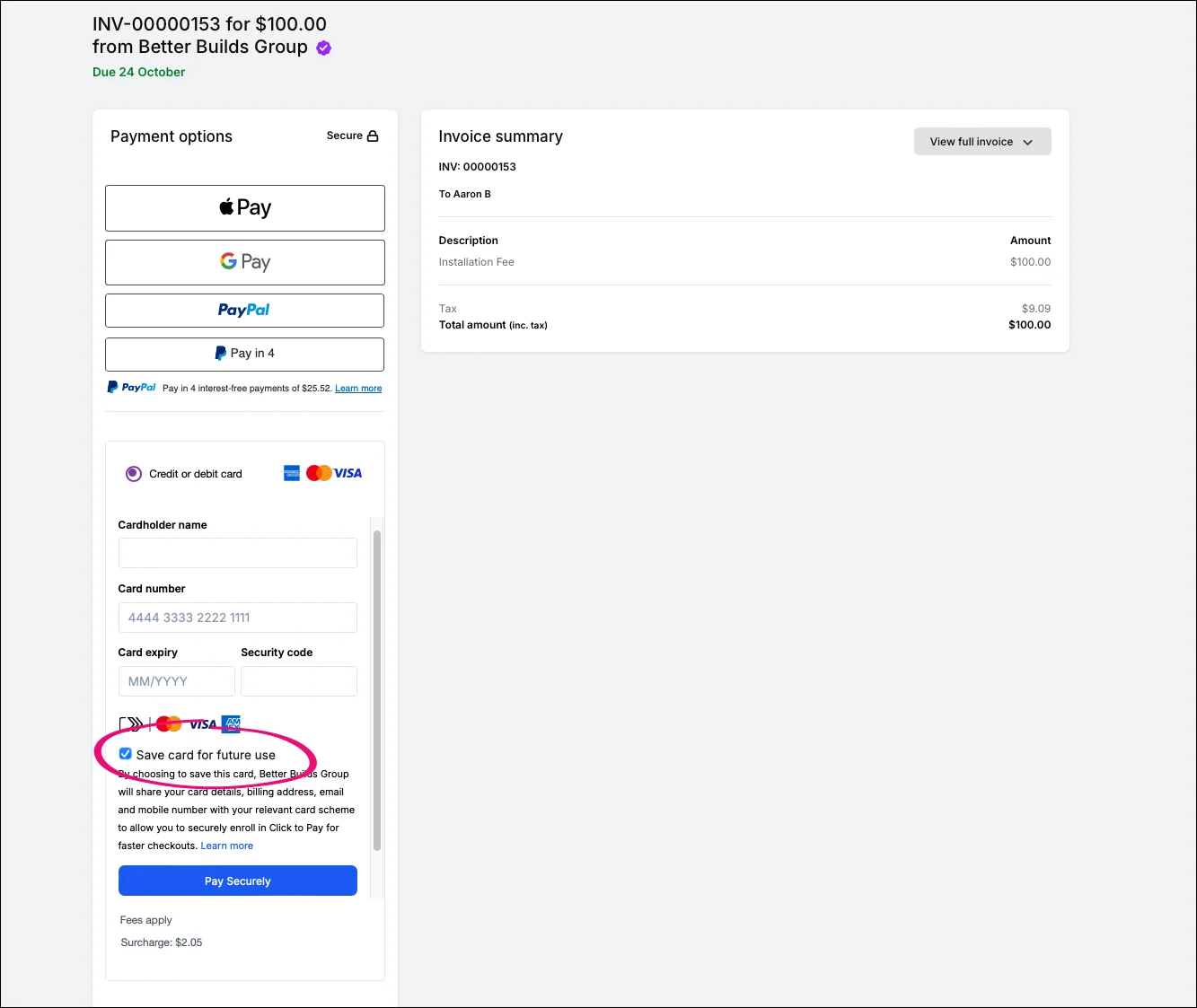

If they are not registered for Click to Pay:

If the customer clicks Save card for future use, they are prompted to enter their email address and mobile number. Click to Pay uses this information to verify the payer and may send a verification code to the mobile number.

(Optional) Select Remember me in this browser for faster checkouts. If they select this, they won't need to enter a verification code the next time they receive an online payments-enabled invoice.

Click Continue to process the payment.

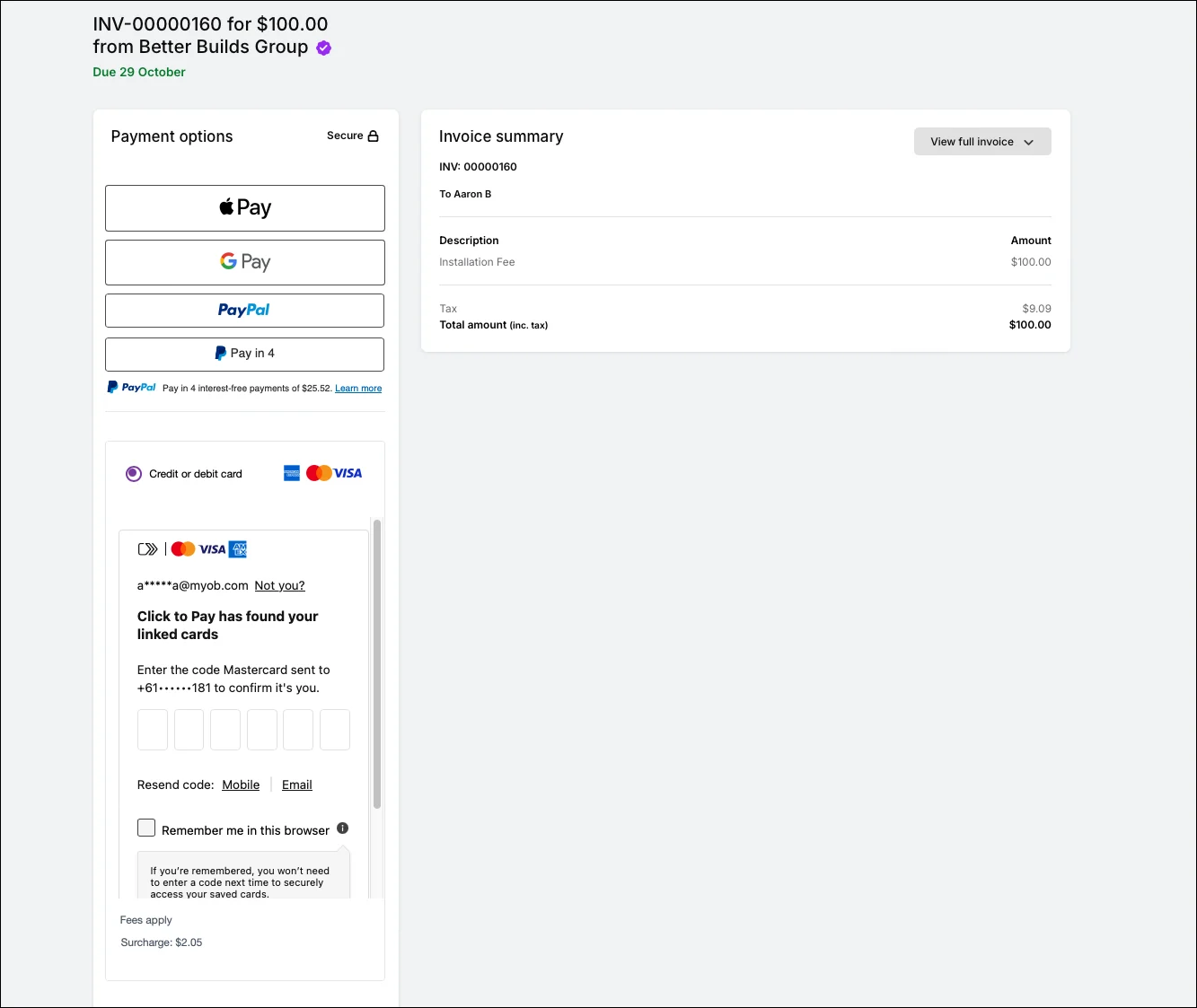

If they are registered for Click to Pay (but not remembered in this browser):

The customer enters a verification code sent to their mobile number.

(Optional) Select Remember me in this browser for faster checkouts. If they select this, they won't need to enter a verification code the next time they receive an online payments-enabled invoice.

Click Continue to Pay Securely to process the payment.

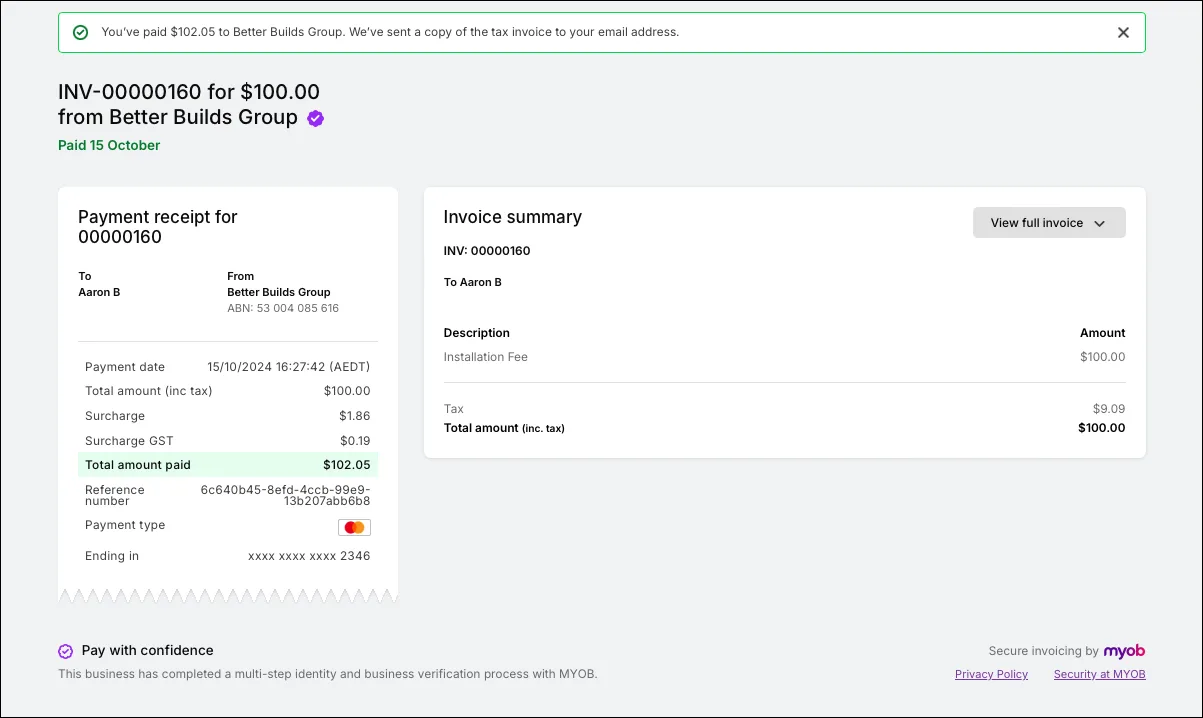

Once the payment goes through, the payment receipt is shown:

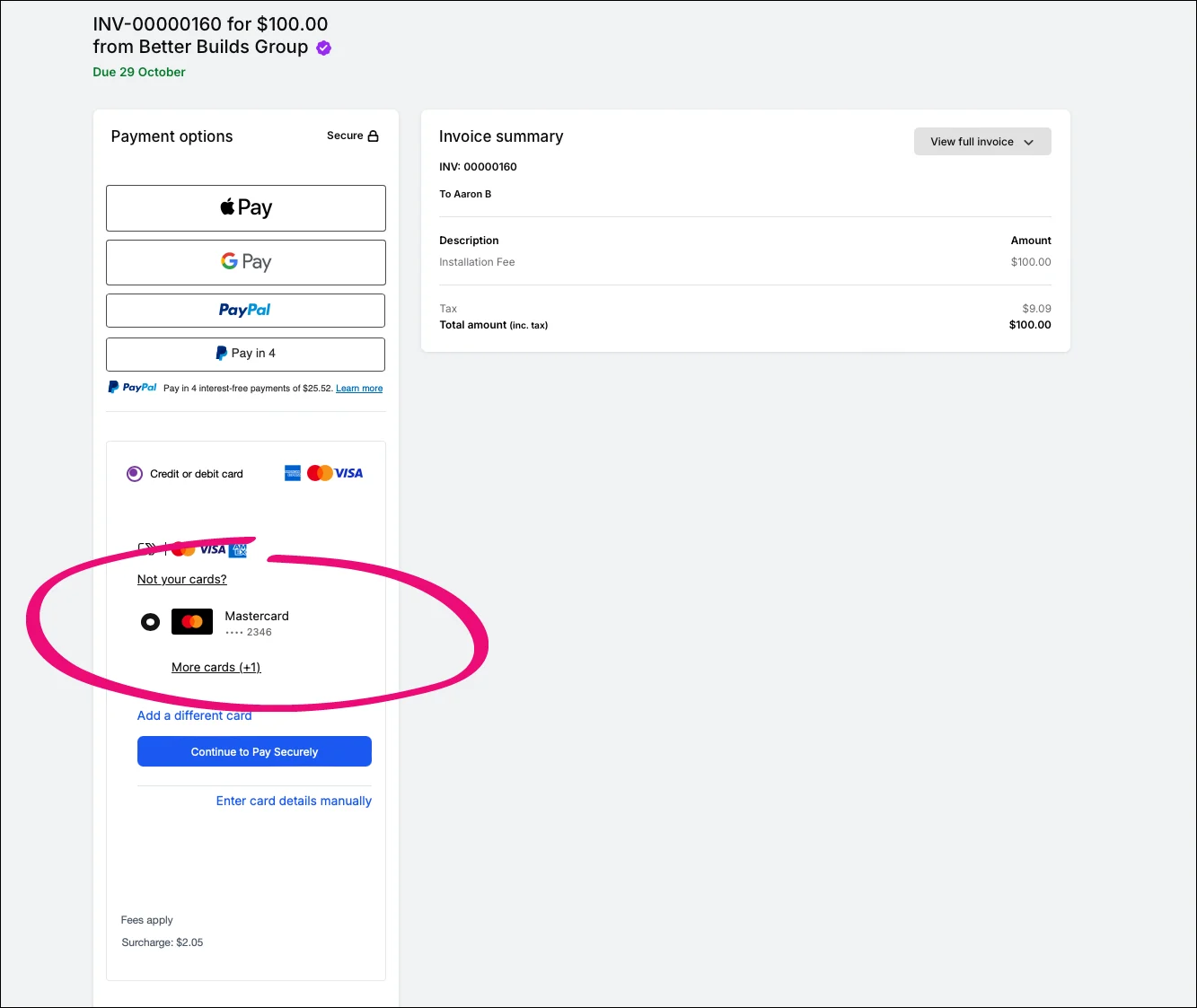

When the customer receives any future online payments-enabled invoices, their card will be listed as a payment option, saving them from having to re-enter the card details manually:

They can add additional credit and debit cards by clicking More cards and following the prompts.

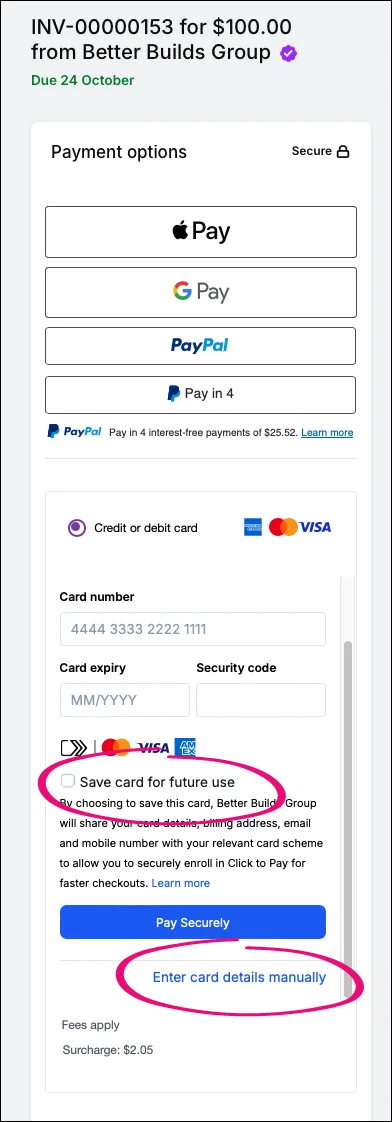

What if the payer doesn’t want to save their card details?

They can either:

deselect Save card for future use. Then click Pay Securely to complete the payment

or, click Enter card details manually, enter the card details and click Pay Securely to complete the payment.