You can authorise a super payment at the time you make the payment, or you can authorise it later from the Super payments page. This is also where you can check the status of your super payments.

To open the Super payments page, go to the Payroll menu and choose Super payments. Log in with your MYOB account details if you’re prompted to do so.

Need to change who can authorise a super payment? See Changing your Pay Super payment details.

To authorise a payment

Go to the Payroll menu and choose Super payments.

If prompted, log in with your MYOB account details.

Click the payment to be authorised.

Review the payment details.

Click Authorise to go ahead with the payment.

Enter your MYOB account details and click Get code.

Enter the authorisation code that is sent via SMS to your registered mobile phone number.

Click Authorise and you're done.

If more than one authoriser or Pay Super Administrator needs to authorise each super payment, the Almost there! window will appear instead. Click OK to go through the authorisation process again, but this time the other authoriser will need to enter their details and the SMS code that'll be sent to their mobile phone.

To ensure the funds receive your payments in time, you should authorise the super payments in MYOB by the 20th of the month in which they are due.

To check the status of a payment

In the Super payments page, the Status column will display an updated status for each super payment you've made. These statuses include:

Status | Description |

|---|---|

Pending Authorisation | The payment has been recorded, but needs to be authorised before it can be processed. |

Partially Authorised | The payment has been authorised by at least one authoriser or Pay Super Administrator, but needs to be authorised by at least one more before it can be processed. See the FAQs below for additional information. |

Authorised | The payment has been authorised and has started being processed, but the funds haven't yet been withdrawn from your bank account. |

Processing Payment | The payment has been sent for processing and the direct debit has been initiated. This status may remain for up to 3 business days. If this status is showing for more than 5 days, contact us to look into it. |

Completed | The payment has been processed, and contributions are being paid into your employees' superannuation funds. |

Payment Failed | There was an error making this payment and you'll need to contact us. |

Reversal Required | There was an error which prevented the contributions being paid into your employees' superannuation funds. MYOB will transfer the funds back into your bank account. You'll need to reverse the payment in MYOB, and record it again. |

Reversal Completed | When you reverse a super payment that has a status of Reversal Required or Payment Failed, the status will change to Reversal Completed once the reversal has been processed. |

Status updates

Payment statuses update only when the Super payments page is viewed by a Pay Super Administrator or Authoriser.

If the status column header says Status (Update not available), the statuses could not be updated. Try checking your internet connection and trying again.

FAQs

What if a super payment has been authorised in error?

MYOB can't stop authorised payments.

But if it's before 4pm (Melbourne time) and the payment hasn't been debited from your account, contact your bank and request them to stop the direct debit.

If the payment has already been debited from your account and your bank can't recall the funds, you'll need to contact the super funds and request a refund.

If you need payment reference numbers for any super payments, contact our team who will be happy to help.

How long does it take for superannuation funds to receive payments?

It usually takes around four business days for superannuation payments to be authorised, processed and received by super funds. However, delays can occur (such as payments being rejected due to data errors), so we recommend allowing up to 10 business days for your payment to process. If your payment hasn't been completed after 10 business days, please contact us.

When will the superannuation payment be processed?

The superannuation payment will be debited from your bank account once it has been authorised. If you enter a future date in the Date of payment field of the Create super payment page, but authorise the payment today, it will be processed today.

What can I do about a partially authorised payment?

If a payment has been partially authorised (where not all authorisers have given their approval), you have two options:

Reverse it: In the Super payments page, click the Reference number to open the payment, then click Reverse transaction. The contributions that were part of this payment will reappear in the Super payments page so you can process them again.

Leave it as partially authorised: If you don't want to go ahead with the payment at all, you don't need to do anything, however it will continue to appear in the Super payments page as partially authorised.

What if a super fund advise they didn't receive a payment?

It usually takes around four business days for superannuation payments to be authorised, processed and received by super funds. However, delays can occur (such as payments being rejected due to data errors), so we recommend allowing up to 10 business days for your payment to process. If your payment hasn't been received after 10 business days, please contact us.

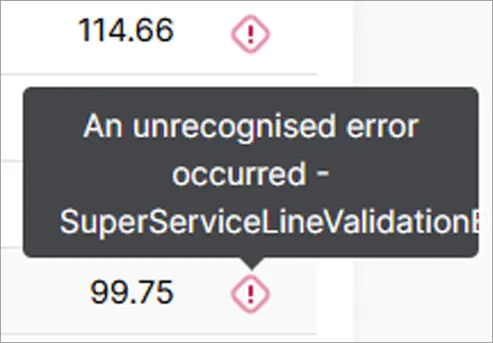

Why am I getting the error "SuperServiceLineValidationError"?

This error can occur if there's incorrect details stored for the employee who's super payment is showing this error.

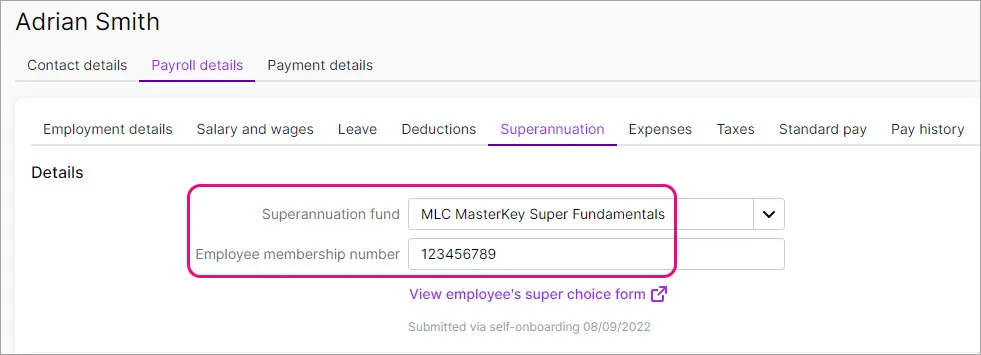

Ask the employee to confirm they've provided you with the correct super fund and membership details. Then check those details have been entered correctly in their employee record (Payroll menu > Employees > click the employee > Payroll details tab > Superannuation tab).

This error can also be caused by incorrect characters on the Contact details tab of the employee's record. Look for anything odd, like:

non-alphanumeric characters in the employee's name. Characters like ` ' ñ or any other irregular characters.

letters in the employee's phone number.

If you make any changes, don't forget to click Save.

AccountRight Plus and Premier only

You can authorise a super payment at the time you make the payment, or you can authorise it later from the Manage Payments window. This is also where you can check the status of your super payments.

To open the Manage Payments window, go to the Payroll command centre and click Manage Payments. Log in with your MYOB account details if you’re prompted to do so.

Need to change who can authorise a super payment? See Changing your Pay Super payment details.

To authorise a payment

Go to the Payroll command centre and click Manage Payments.

If prompted to do so, sign in with your MYOB account details.

Click the zoom arrow of a payment that shows the Pending Authorisation or Partially Authorised status.

Review the payment details.

Click Authorise to go ahead with the payment.

Enter your MYOB account details and click Get code.

Enter the authorisation code that is sent via SMS to your registered mobile phone number.

Click Authorise and you're done.

If more than one authoriser or Pay Super Administrator needs to authorise each super payment, the Almost there! window will appear instead. Click OK to go through the authorisation process again, but this time the other authoriser will need to enter their details and the SMS code that'll be sent to their mobile phone.

To ensure the funds receive your payments in time, you should authorise the super payments in AccountRight at least 5 business days before they are due.

To check the status of a payment

In the Manage Payments window, the Status column will display an updated status for each super payment you've made. These statuses include:

Status | Description |

|---|---|

Pending Authorisation | The payment has been recorded, but needs to be authorised before it can be processed. |

Partially Authorised | The payment has been authorised by at least one authoriser or Pay Super Administrator, but needs to be authorised by at least one more before it can be processed. See the FAQs below for additional information. |

Authorised | The payment has been authorised and has started being processed, but the funds haven't yet been withdrawn from your bank account. |

Processing Payment | The payment has been sent for processing and the direct debit has been initiated. This status may remain for up to 3 business days. If this status is showing for more than 5 days, contact us to look into it. |

Completed | The payment has been processed, and contributions are being paid into your employees' superannuation funds. |

Payment Failed | There was an error making this payment and you'll need to contact us. |

Reversal Required | There was an error which prevented the contributions being paid into your employees' superannuation funds. MYOB will transfer the funds back into your bank account. You'll need to reverse the payment in MYOB, and record it again. |

Reversal Completed | When you reverse a super payment that has a status of Reversal Required or Payment Failed, the status will change to Reversal Completed once the reversal has been processed. |

Status updates

Payment statuses update only when the Manage Payments window is viewed by a Pay Super Administrator or Authoriser.

If the status column header says Status (Update not available), the statuses could not be updated. Try checking your internet connection and trying again.

FAQs

What if a super payment has been authorised in error?

MYOB can't stop authorised payments.

But if it's before 4pm (Melbourne time) and the payment hasn't been debited from your account, contact your bank and request them to stop the direct debit.

If the payment has already been debited from your account and your bank can't recall the funds, you'll need to contact the super funds and request a refund.

If you need payment reference numbers for any super payments, contact our team who will be happy to help.

How do I change a Pay Super authoriser?

If you're a Pay Super Administrator, you can make this change online. Otherwise you'll need to submit a form to change an authoriser.

For more info, see Changing your Pay Super payment details.

How long does it take for superannuation funds to receive payments?

It usually takes around four business days for superannuation payments to be authorised, processed and received by super funds. However, delays can occur (such as payments being rejected due to data errors), so we recommend allowing up to 10 business days for your payment to process. If your payment hasn't been completed after 10 business days, please contact us.

When will the superannuation payment be processed?

The superannuation payment will be debited from your bank account once it has been authorised. If you enter a future date in the Date field of the Pay Superannuation window, but authorise the payment today, it will be processed today.

What can I do about a partially authorised payment?

If a payment has been partially authorised (where not all authorisers have given their approval), you have two options:

Reverse it: In the Manage Payments window, click the zoom arrow to open the payment, then go to the Edit menu and choose Reverse Pay Superannuation. The contributions that were part of this payment will reappear in the Pay Superannuation window so you can process them again.

Leave it as partially authorised: If you don't want to go ahead with the payment at all, you don't need to do anything, however it will continue to appear in the Manage Payments window as partially authorised.

How do I delete or reverse transactions from the Manage Payments window?

You can't delete payments from the Manage Payments window, but you can reverse them.

Click the zoom arrow to open the transaction.

Go to the Edit menu and choose Reverse Pay Superannuation.

Click OK to the confirmation message. The entire Pay Super transaction is reversed. Each of the contributions within the transaction will now be listed again on the Pay Superannuation window. Learn more about reversing and reprocessing superannuation payments.

Reversed payments still showing

After reversing a Pay Super transaction it will remain on the Manage Payments window. If you'd like the ability to delete or hide reversed Pay Super transactions, vote for this feature on the AccountRight Idea Exchange.

What if a super fund advise they didn't receive a payment?

It usually takes around four business days for superannuation payments to be authorised, processed and received by super funds. However, delays can occur (such as payments being rejected due to data errors), so we recommend allowing up to 10 business days for your payment to process. If your payment hasn't been received after 10 business days, please contact us.