There are a couple of common reasons why you might be getting this error. Usually, it's because there is a mismatch of data between ATO and MYOB systems.

In Access Manager...

Log into Access Manager and make sure the tax or BAS agent has permission to lodge payroll reports.

Confirm you've notified the ATO the business is using MYOB for payroll reporting.

In the tax or BAS agent portal...

Make sure the client is in your client list.

Confirm the client's details are correct (ABN, TFN and ABN branch number), and that they match what's in MYOB.

In MYOB...

Once the error is fixed, the latest payroll information will be sent to the ATO when you report your next pay run to the ATO, or you can send an update event as described in the FAQs below.

FAQs

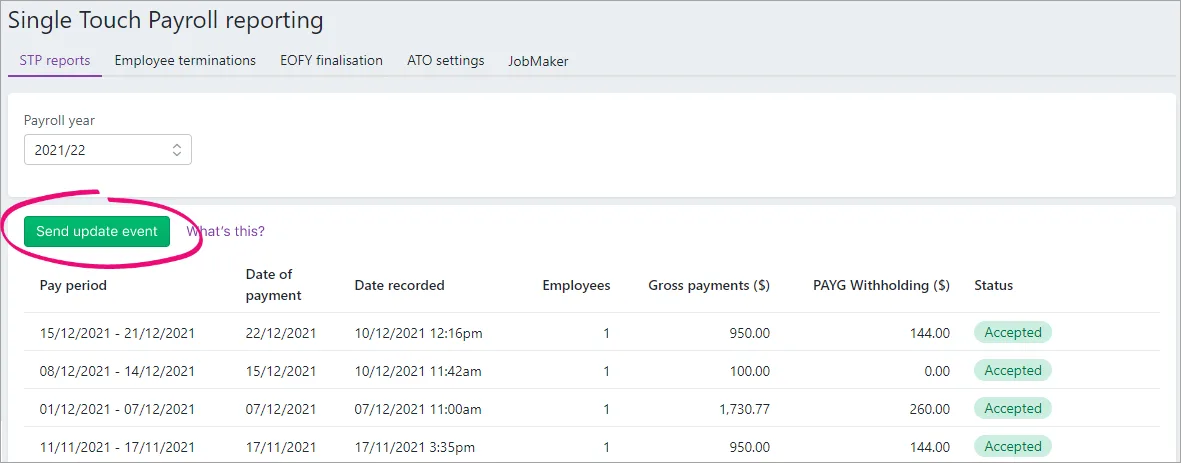

How do I send an update event to the ATO?

An update event is where you send your employees' latest year to date payroll totals to the ATO. This ensures your payroll totals in MYOB sync with the figures held by the ATO.

You can send an update event from the STP reporting centre.

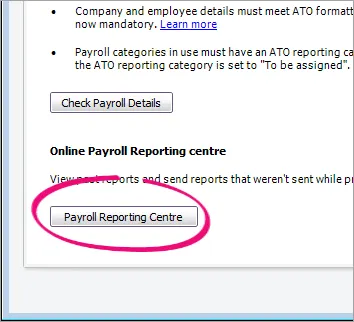

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

Click the STP reports tab.

Choose the applicable Payroll year.

Click Send update event.

When prompted, enter your details and click Send.

Update events are listed in the Single Touch Payroll reporting centre with your other payroll submissions, but with zero (0.00) amounts.