Pay history is a record of an employee's earnings and deductions for the current payroll year, and it updates automatically every time you do a pay run. The only time you would manually enter pay history is after moving from a different payroll system part-way through a payroll year (we cover this below).

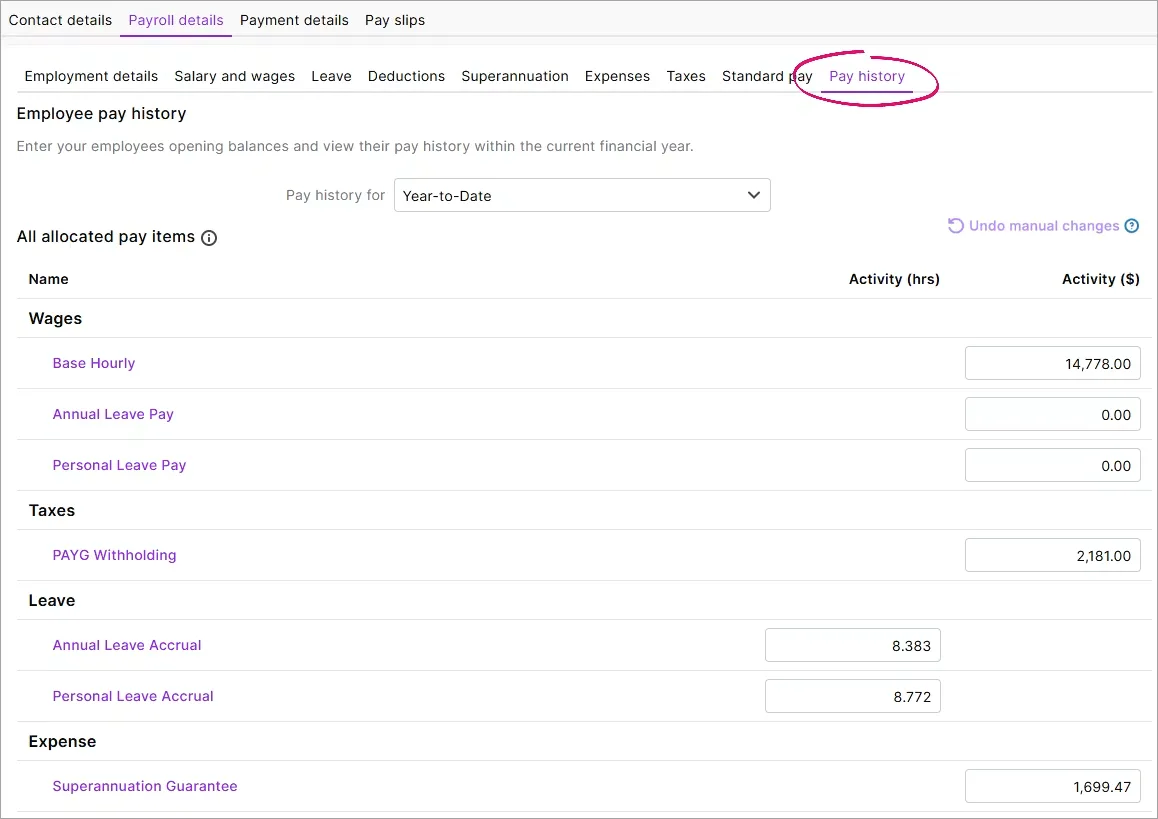

You can view an employee's pay history for a specific month, quarter or the entire year-to-date (Payroll menu > Employees > click an employee > Payroll details tab > Pay history).

Amounts are listed against each applicable pay item, like Base Hourly or PAYG Withholding, etc. You can click a pay item to check how it's set up and who it's assigned to.

Need more payroll details? Take a look at your payroll reports or previous pay slips.

Do not manually adjust pay history

An employee's pay history reflects amounts recorded in pay runs, so it should never be manually adjusted. If you've made a mistake in a pay, don't try to fix it by changing an employee's pay history. Instead, fix it by adjusting the employee's next pay. More about fixing pays.

Manually changing the pay history will cause a few headaches, including:

payroll calculations, like tax and superannuation, will be affected

the amounts won't be reflected against the correct payroll categories

it won't fix an incorrect pay

the change will only be reflected on the Payroll register report, not the Payroll activity report (this report is based on what's been entered into the pays you're processed in MYOB). So if these two reports don't match, it usually means an employee's Pay History has been incorrectly changed.

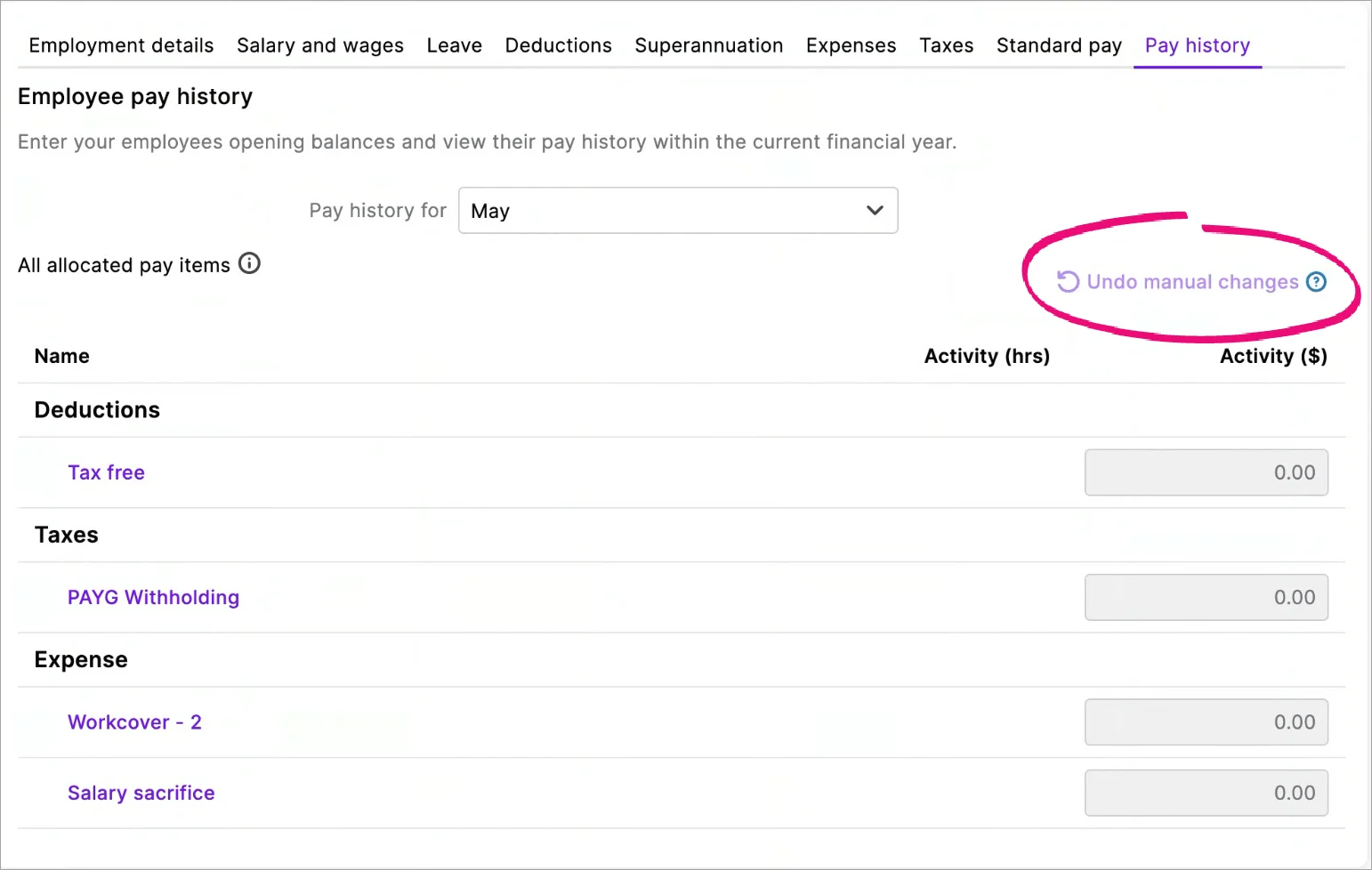

Undoing manual changes

If the pay history has been manually changed in the current payroll year, click Undo manual changes. The pay history values will go back to amounts recorded in pay runs. Make sure you then click Save to save the changes in the employee's record.

Started using MYOB this financial year?

If you moved from another payroll system this financial year, undoing manual changes also removes any historical pay amounts you entered in an employee's pay history.

Moved from another payroll system?

If you've started using MYOB part way through the payroll year, you can enter the amounts you've already paid your employees this payroll year.

This is the only time you should manually enter anything into an employee's pay history.

For example, if you've started using MYOB in December, you can enter the pay amounts for each employee for July to November. You can enter amounts for each month, quarter, or year-to-date.

You'll need to know the pay details (wages and other earnings, deductions, tax and super) for each employee for each period you're entering. You should be able to get this information from your previous payroll system.

If you've completed your other payroll setup tasks, including reviewing your pay items and reviewed your employees' standard pays, this is how you enter your employees' pay history:

Go to the Payroll menu and choose Employees.

Click an employee's name to open their record.

Click the Payroll details tab.

Click the Pay history tab.

Use the Pay history for dropdown list to choose the period you're entering pay history for (a specific month or quarter or year-to-date).

If you choose to enter monthly pay history, you'll need to repeat these steps for each past month in the current payroll year.

Enter amounts in the Activity column for each pay item for the chosen period. For deductions, enter the amounts as negative values.

If the employee has any leave hours owing to them, click the Leave tab and enter those leave balances (in hours) in the Balance adjustment column.

If the employee has accrued superannuation which has yet to be submitted to their fund (using Pay Super), don't enter it in their pay history. Instead, record an unscheduled pay for $0 that only includes the accrued super. For more details, see Checking and adjusting superannuation.

When you're done, click Save.

Repeat these steps for each employee you're entering pay history for.

AccountRight Plus and Premier, Australia only

Pay history is a record of an employee's earnings and deductions for the current payroll year, and it updates automatically every time you do a pay run. The only time you would manually enter pay history is after moving from a different payroll system part-way through a payroll year (we cover this below).

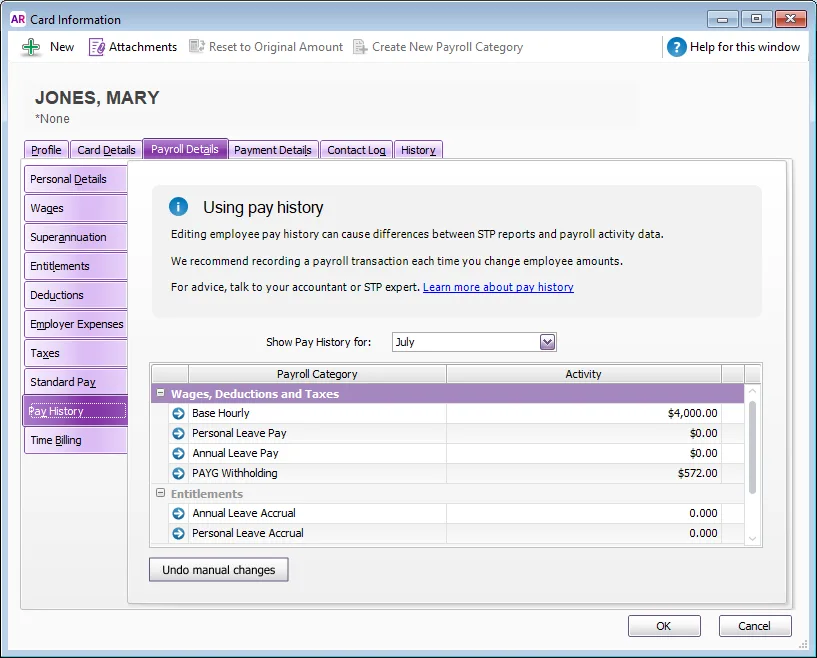

You can view an employee's pay history for a specific month, quarter or the entire year-to-date (Card File command centre > Cards List > Employee tab > open an employee's card > Payroll Details tab > Pay History).

Amounts are listed against each applicable payroll category, like Base Hourly or PAYG Withholding, etc. You can click a payroll category to check how it's set up and who it's assigned to.

Need more payroll details? Take a look at your payroll reports or previous pay slips.

Do not manually adjust pay history

An employee's pay history reflects amounts recorded in pay runs, so it should never be manually adjusted. If you've made a mistake in a pay, don't try to fix it by changing the Pay History in an employee's card. Instead, fix it by adjusting the employee's next pay. More about fixing pays.

Manually changing the pay history will cause a few headaches, including:

payroll calculations, like tax and superannuation, will be affected

the amounts won't be reflected against the correct payroll accounts

it won't fix an incorrect pay

the change will only be shown on the Payroll Register report, not the Payroll Activity report (this report shows what's been entered through Process Payroll). So if these two reports don't match, it usually means an employee's Pay History has been incorrectly changed.

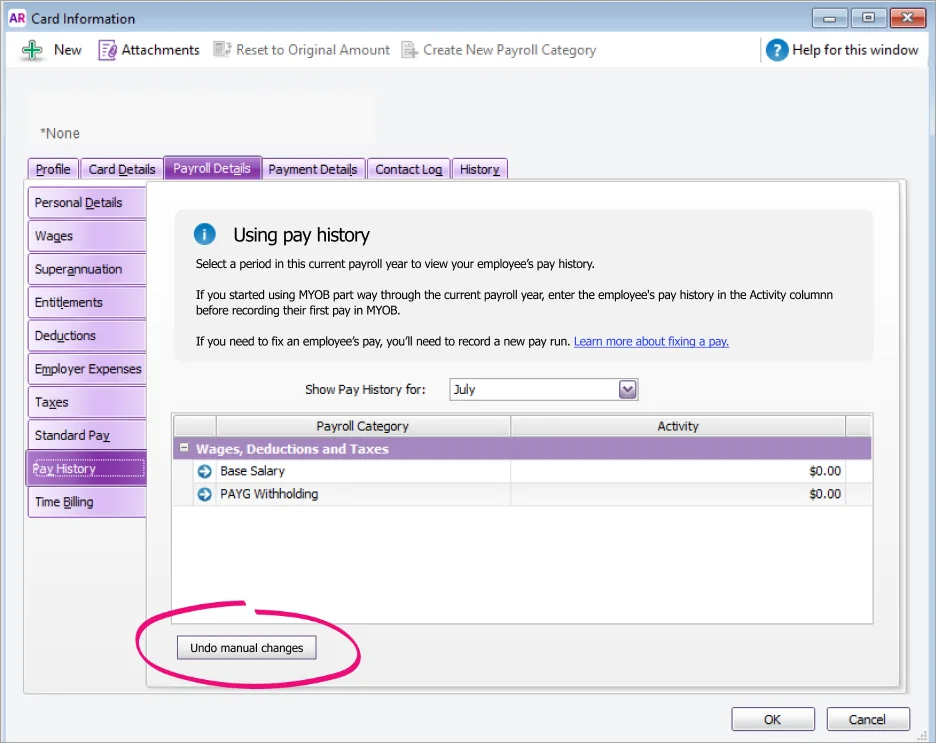

Undoing manual changes

If the pay history has been manually changed in the current payroll year, click Undo Manual Changes. The pay history values will go back to amounts recorded in pay runs. Make sure you then click OK to save the changes in the employee's card.

Started using MYOB this financial year?

If you moved from another payroll system this financial year, undoing manual changes also removes any historical pay amounts you entered in an employee's pay history.

Moved from another payroll system?

If you've started using AccountRight part way through the payroll year, you can enter the amounts you've already paid your employees this payroll year.

This is the only time you should manually enter anything into an employee's Pay History.

For example, if you've started using AccountRight in December, you can enter the pay amounts for each employee for July to November. You can enter amounts for each month, quarter, or year-to-date.

You'll need to know the pay details (wages and other earnings, deductions, tax and super) for each employee for each period you're entering. You should be able to get this information from your previous payroll system.

If you've completed your other payroll setup tasks, including reviewing your payroll categories and reviewing your employees' standard pays, this is how you enter your employees' pay history:

Go to the Card File command centre and click Cards List.

Click the Employee tab.

Click to open the card for the employee whose pay history you want to enter.

Click the Payroll Details tab.

Click Pay History.

Use the Show Pay History for dropdown list to choose the period you're entering pay history for (a specific month or quarter or year-to-date).

If you choose to enter monthly pay history, you'll need to repeat these steps for each past month in the current payroll year.

Enter amounts in the Activity column for each payroll category for the chosen period. For deductions, enter the amounts as negative values.

If the employee has entitlement hours owing to them, click Entitlements and enter the opening balances (in hours) in the Balance Adjustment column.

If the employee has accrued superannuation which has yet to be submitted to their fund (using Pay Super), don't enter it in their pay history. Instead, record an unscheduled pay for $0 that only includes the accrued super. For more details, see Checking and adjusting superannuation.

When you're done, click OK.

Repeat these steps for each employee you're entering pay history for.