Watch this video for an overview of the improvements we've made to the Bank transactions page, including category suggestions:

The Bank transactions page (Banking menu > Bank transactions) is where you'll see your bank transactions, brought into MYOB Business via bank feeds or importing a bank statement. See the actual money transactions going into and out of your bank account, and where MYOB has automatically matched them to applicable transaction records or categories, or suggested possible matches.

Before you begin

If you've just set up bank feeds, check that your bank feed is ready to use, or active. We'll notify you by email when it is, but you can also check the status of your bank feed applications in the Banking hub.

Check that automatic matching has been turned on. MYOB Business automatically matches bank transactions or suggests matches when specific options are turned on.

To check that automatic matching is turned on

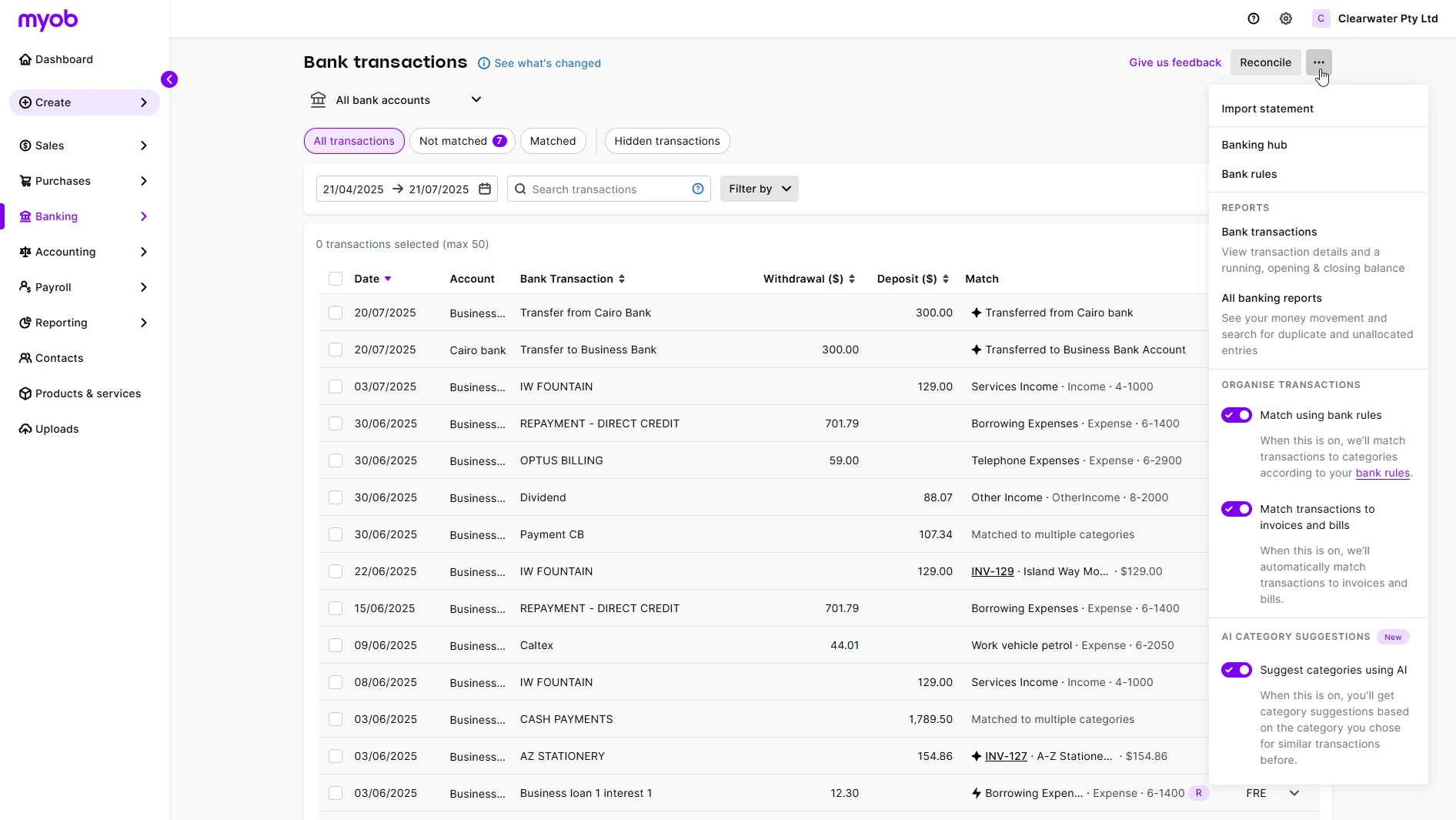

Click the three dots on the right of the Bank transactions page to see automatic matching options:

Match using bank rules – rules are automatically applied to match bank transactions to categories and create matching records in MYOB AccountRight browser.

This option is only for AccountRight browser users – rules are automatically applied by default in MYOB Business.

Selecting or deselecting this option changes the preference setting in your AccountRight desktop software, too.

When this option is turned on, a rule is automatically applied to a bank transaction matching the rule's criteria. This creates a matching transaction record. Find out more about creating rules

Match transactions to invoices and bills – automatically match payments from customers and payments to suppliers to recorded invoices and bills. When an open invoice or bill is automatically matched, the payment is recorded against it, and the invoice or bill is closed.

Suggest categories using AI – get category suggestions for an unmatched transaction based on the previous category chosen for a similar transaction. If you select a different category, this becomes the suggested category the next time. See 'MYOB suggests categories based on previous matches', above.

Working with automatic matches and suggestions

Automatic matching: First, MYOB matches bank transactions to system records. Confirm or change them as needed.

Rules application: Then, if you're using rules, MYOB applies them to create transaction records to match bank transactions. Check that your rules are working as intended.

Category suggestions: MYOB recommends categories based on previous matches. Accept or choose alternative categories.

Record suggestions: Similar transaction records are suggested as matches. Confirm them or find other matches.

Create records from categories: Finally, if there isn't a match for a bank transaction, match it to a category, and MYOB will create the matching transaction record.

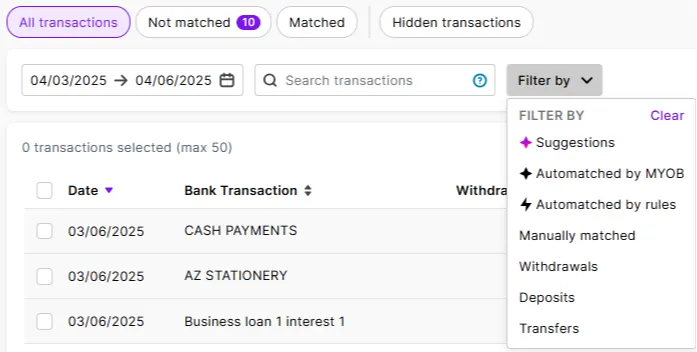

Use the filters to find matches, suggestions and unmatched transactions

Confirm automatic matches

A bank transaction and MYOB record are automatically matched if:

they have the same amount and date (or very close to the same date)

and the MYOB record is the correct transaction type (like spend money for a withdrawal) .

MYOB may also compare other details, like invoice or bill numbers and contact names. If there’s any ambiguity (for example, multiple possible matches or dates that don’t line up), you'll only see a suggested match for you to accept or reject.

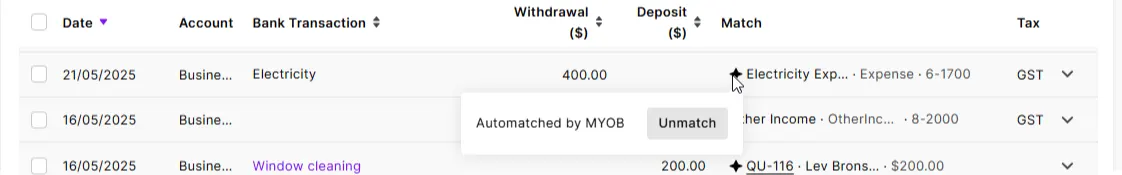

Example: A payment for Metropolitan Electricity of $400 comes out of your bank account on May 21. When this payment appears in your bank feed, it is automatically matched to a spend money for $400 recorded on May 21.

An automatic match will have a black sparkle next to it. Hover over it to see what it's matched to. If you need to change the match, hit Unmatch and find another match.

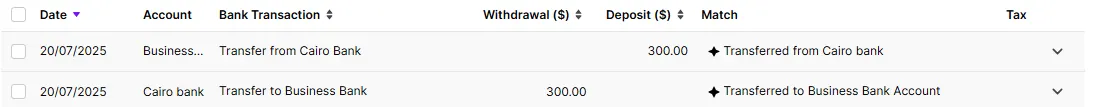

Bank transfers are automatically matched

A bank transfer in a bank feed will be automatically matched to a bank transfer record in MYOB if there is a deposit and withdrawal for the same amount within seven days of each other, and the descriptions contain matching keywords. If you've set up bank feeds on both the bank account you're transferring from and the bank account you're transferring to, the transfer will be automatched for both accounts (you might need to wait until the bank feeds for both accounts have been updated, as some bank feeds update more frequently than others).

Find out more about matching bank transactions

Check that your rules are being applied

You can set up rules to manage regularly occurring bank transactions that always have a particular description (such as BANK INTEREST). Rules automatically create matching transaction records in MYOB Business – find out more about rules.

If you've set up rules, verify that they are being applied and automatically matched to the specified categories.

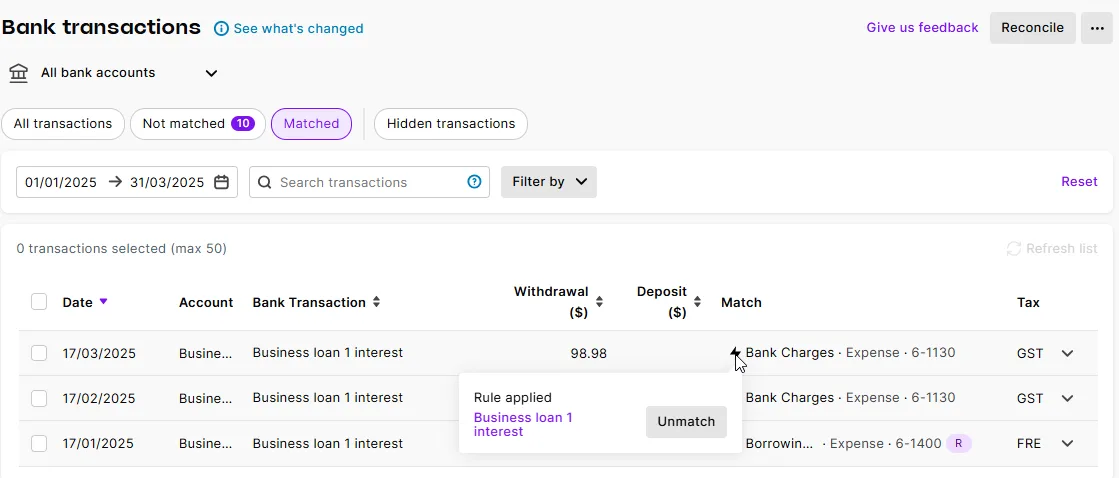

A bank transaction that has a rule applied to it will have a lightning symbol. Hover over it to see the rule applied, click into the rule to see its details or click Unmatch if you don't want the rule to apply to this transaction.

If you think a rule might have missed a transaction, use the Not matched filter and other filters to find it. Edit the rule if necessary.

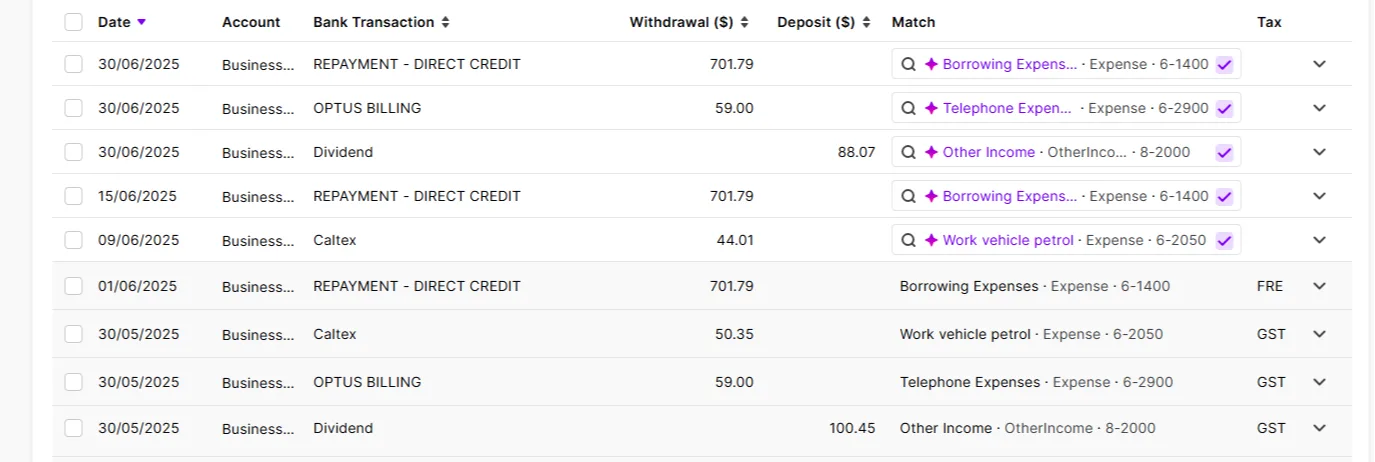

MYOB suggests categories based on previous matches

MYOB Business learns from how you previously matched a transaction to a category to suggest a matching category the next time a similar transaction comes in. This saves you from searching for a category to match it to.

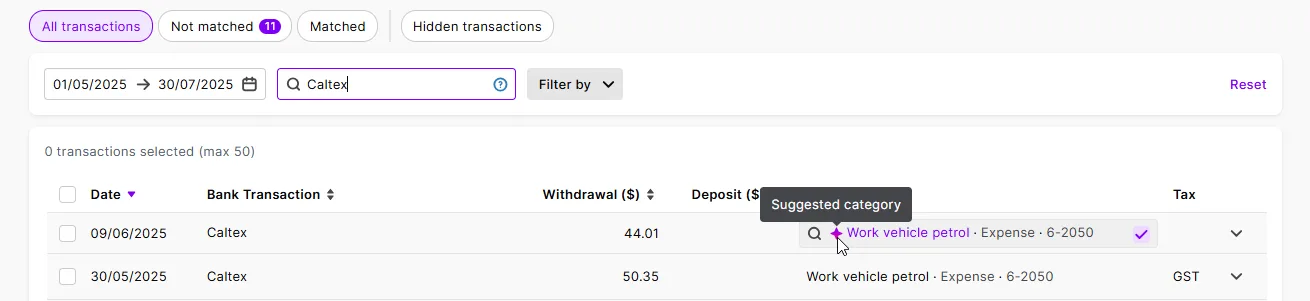

Example: You match a payment for petrol on 16 May to an expense category, Work vehicle petrol. When another payment for petrol on 21 May appears in your bank feed, there is a suggested match to that category:

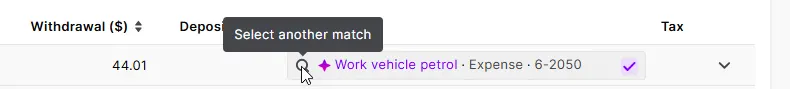

A purple sparkle indicates a suggested category. Hit the tick to accept the match, or click the search icon if you want to match it to a different category or transaction record.

The more suggested category matches you accept or edit, the more accurate category suggestions become, and the more time it saves you:

If you've got rules set up, they'll take precedence over category suggestions.

If the rule type is:

-

Spend money transaction or Receive money transaction: Suggested categories will not appear when these rules are applied.

-

Invoice or Bill: Suggested categories may still appear alongside invoice or bill rule suggestions.

Choose from suggested records

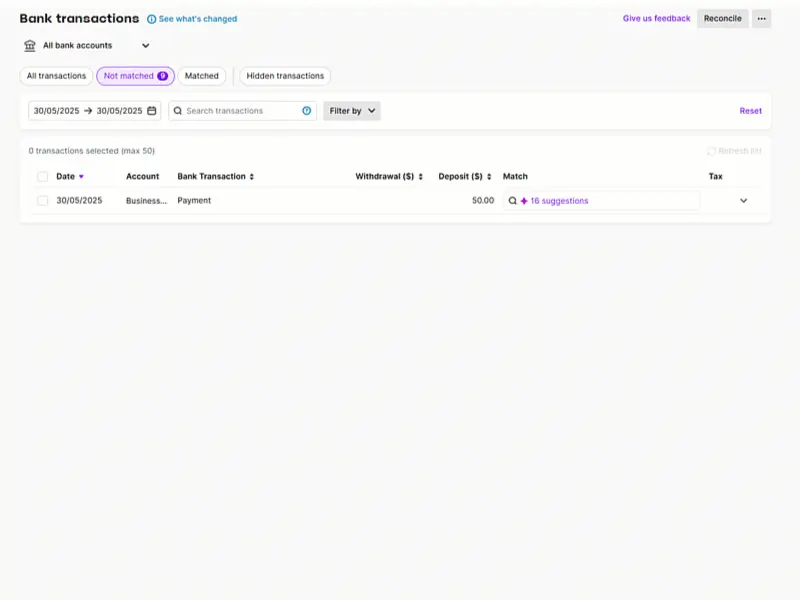

If there are one or more transaction records similar to the bank transaction (for example, they have the same amount as the bank transaction but are recorded on a different date), they'll be suggested as possible matches. A purple sparkle indicates suggestions. See a summary of them or click the dropdown to see more details. Choose from the suggestions and hit Save:

No automatic matches or suggestions?

Make sure there is a transaction record in MYOB

There won't be an automatic match if:

there isn't a matching transaction record in MYOB, or

there is a transaction record, but it doesn't meet automatching criteria:

the bank transaction and transaction record have different dates

there are rounding differences in amounts – if this is the case, select the transaction, click 'Add adjustment,' and record a transaction to bring the out-of-balance amount to $0.00.

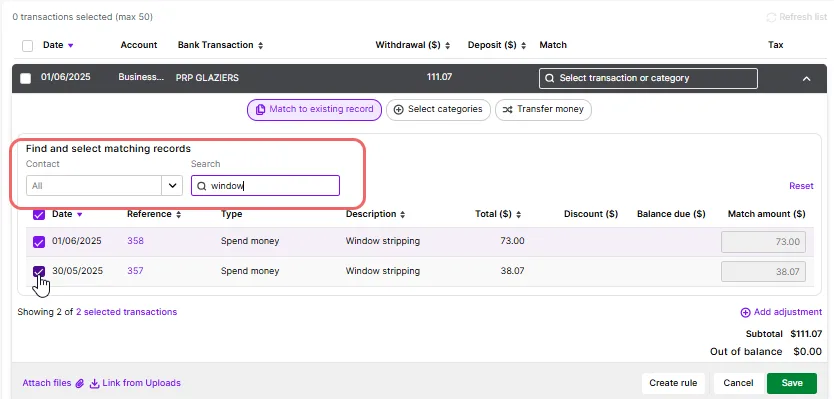

or because a single bank transaction needs to be matched to multiple MYOB records.

If the transaction record may exist in MYOB, but isn't automatching, try searching for it. Expand the bank transaction, and on the Match to existing record tab, use the filters to search for a transaction. In the following example, a bank transaction is manually matched to two transaction records found through searching:

You can also try adjusting the filters at the top of the Bank transactions page, especially the date filters.

If there isn't a matching transaction record in MYOB, see 'No matching record? Match to a category', below.

No matching record? Match to a category

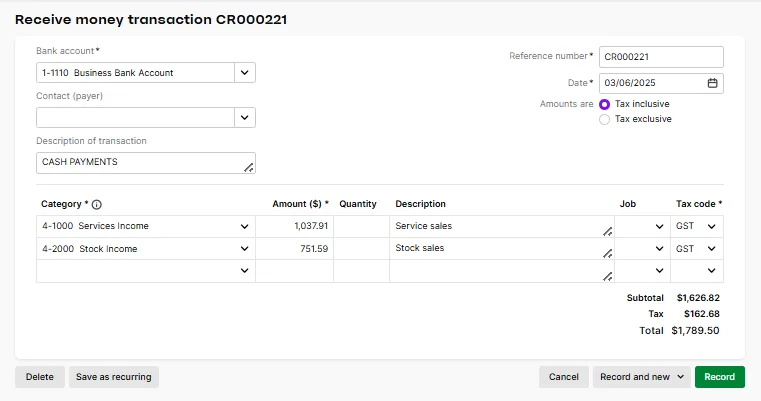

If a bank transaction doesn't have a matching record in MYOB Business, match it to the appropriate category. This creates the matching record – such as a spend money record for a withdrawal, or a receive money record for a deposit.

If you're unsure which categories to match bank transactions to, consult your bookkeeper or accountant.

MYOB Business remembers the category you match to a bank transaction. When a similar transaction appears in your bank feed, it suggests the previously used category, helping you save time. These suggestions will be marked as History in the Method column. See 'Review category suggestions', above.

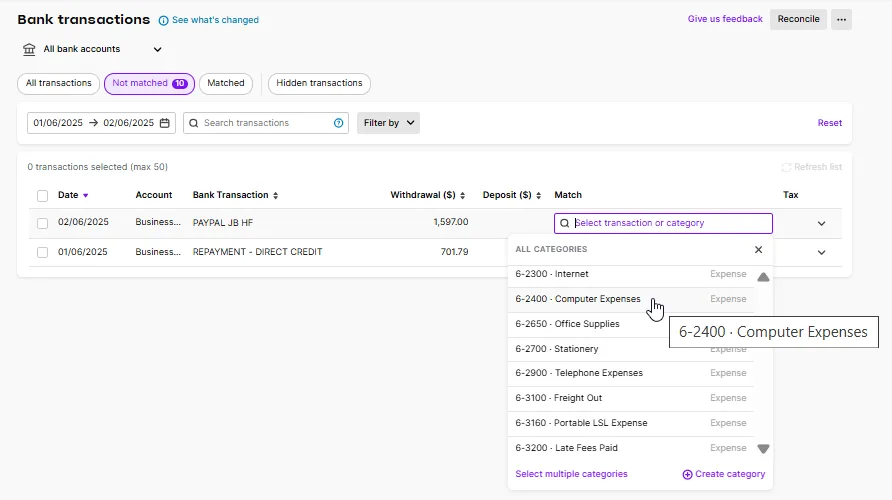

To match a transaction to a single category, click in the Match column and select it:

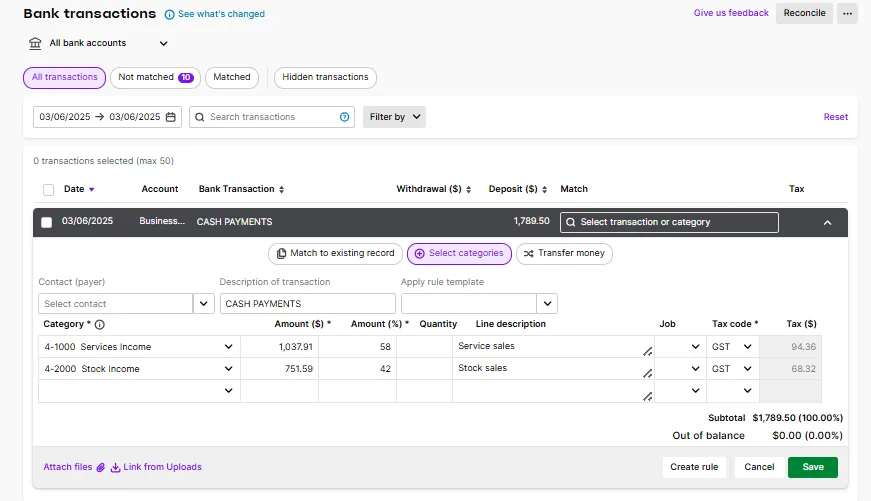

To match multiple categories (which will split the transaction amount over multiple transaction lines), click Select multiple categories. Choose your categories, how the amounts are split, add any other details and click Save:

In the example above, this match will create a receive money transaction split over two categories:

Find out more about matching bank transactions to categories