Terminal tax basis

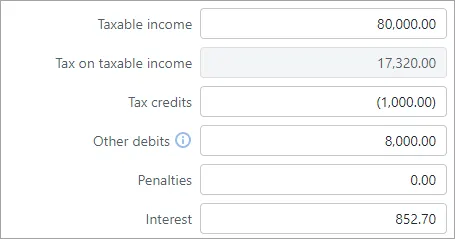

If you haven't filed the tax return, you can enter the taxable income, tax credits and any penalties or interest owing. Then, we'll automatically calculate the Tax on taxable income and Total 20xx income tax owing for you. Other debits (individual entity types only) is where you enter data about portfolio investment entity (PIE) debit and non-resident withholding tax debit.

If you've filed the tax return, you won't be able to edit the terminal tax basis. You'll see the fields in an uneditable state. But we'll prepare your client's terminal tax notice using the data from the filed tax return. We'll also calculate any interest and penalties owing.

Any payments and transfers made during the period prepopulate from the Data reconciliation page, to calculate the final Terminal tax amount.

Income after expenses claimed

IR6 Trusts from 2025 onwards also have an additional field for income after expenses claimed. This amount determines which tax rate applies to a trust or estate being taxed as an ordinary trust.

Read more about trustee income tax rates on the IR website.

Terminal tax basis data sources

The fields in the Terminal tax basis section automatically populate their values from Data reconciliation or tax returns.

Data prioritisation and flow

How are the data sources prioritised?

These fields source their data from the reconciled IR assessment transactions as their first priority.

If there’s no reconciled IR assessment value, the fields use the tax return and the associated schedules as their data source. Tax notices are first populated with return data when you click Send to client on the return to change the return status to Pending client signature. Tax notices are populated with return data again when you click File with IR on the return to change the return status to Filed.

If there’s no approved or filed tax return, you can manually enter the values.

This data sourcing applies to unlocked terminal tax notices (notices with a status of In progress, Not started or In review.) If you want to apply these changes to locked terminal tax notices, you need to unlock them first. You may need to check the amounts of your unlocked notices if you previously entered amounts.

Where does the data come from within the data source?

If sourcing from Data reconciliation:

The data is sourced from the Assessment transaction in the Reconciled transactions section of the Data reconciliation page.

The Terminal tax basis fields source assessment transactions of Data reconciliation entries with a Tax type of Income tax.

If sourcing from tax returns:

In the Terminal tax basis section, the Taxable income and Tax on taxable income values come from section 32 - Taxable income/(loss), in the field Taxable income or loss to carry forward.

-

If you reconcile after the return is filed, the terminal tax notice will use the IR assessment transaction for the source of its values.

-

The fields will become non-editable when the tax return is filed.

-

The fields in the Terminal tax basis section and the Student loan repayment obligation field and Working for Families tax credit field in the Payable amount section work independently. That means it’s possible that a combination of data sources are used within the same tax notice.

For example, if there’s an unfiled tax return in Tax in Practice Compliance and the return is filed via another method outside of Tax, Tax may receive reconciled IR transactions to be used as the data source of some fields. So you could end up with, editable Terminal tax basis fields (because the return hasn’t been marked as filed in Tax) but a non-editable Student loan repayment obligation field (because it’s using reconciled IR data).

-

The basis value on the Tax notices list view (when you don't have an individual tax notice open) displays the status of the tax return that's used as the basis for the tax notice. That status will be Not Started, Draft, Approved, Filed or Assessed.

Draft could be In progress, In review or Ready for client.

Approved could be Pending client signature, Ready to file or Rejected.

Use of money interest (UOMI)

You have a number of UOMI calculation methods available:

Base the calculation on IR's assessment.

Use the UOMI amount from the tax return.

Calculate the amount using a start and end date.

Override the calculated amount with your own manual amount.

Choose not to include UOMI.

The default method that the tax notice uses depends on the status of the tax return, but you can choose a different method.

You'll see your choice reflected in the amounts in the Terminal tax basis and Payable amount sections of the Tax notices page.

The UOMI calculation applies to all tax years. If you need to change terminal tax notices before the 2022 tax year, which have passed their due date, check and correct the calculation if necessary.

You can also learn more about UOMI in tax returns.

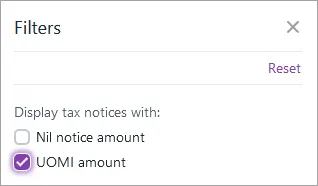

Finding tax notices with a UOMI amount

There are a couple of ways you can find the tax notices that have a UOMI amount when viewing all clients on the Tax notices page:

Filter the Tax notices page. Click More filters above the list of tax notices and select UOMI amount.

Export tax notices data to a spreadsheet. On the top right of the page, click Export (XLSX).

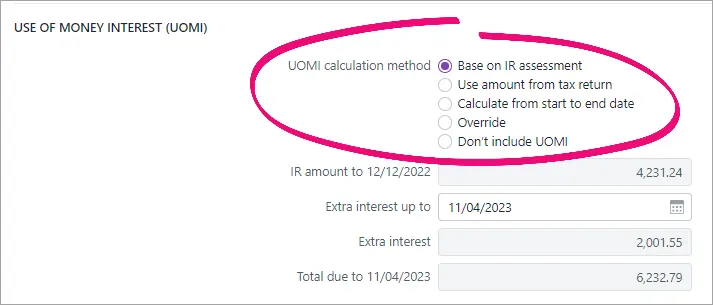

Choosing a UOMI calculation method

Go to Tax > Tax notices and open the terminal tax notice.

At UOMI calculation method, select your preference.

The UOMI calculation method that you select changes the UOMI fields that are available.

UOMI methods and descriptions

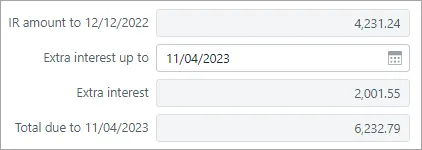

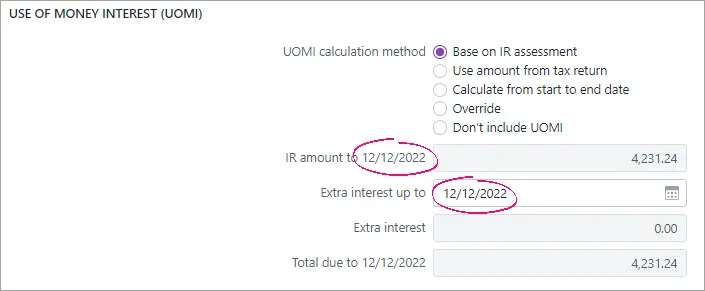

Base on IR assessment – The terminal tax notice will include UOMI from Inland Revenue (IR). The notice also includes interest covering the date IR calculated interest up to the terminal tax payment due date.

The default Extra interest up to date is the terminal tax date.

The IR amount to value comes from the IR statements section of the Data reconciliation page. MYOB transactions aren't included.

Base on IR assessment is the default option after a tax return is filed and Inland Revenue (IR) assesses it. You can't select this option if the return hasn't been assessed.

Changing values

If you want to change the Extra interest and Total due amounts, change the Extra interest up to date.

If you want to exclude the extra interest from the total, and only want to reflect the IR calculated amount, change the Extra interest up to date to be blank or the same as the IR amount to date.

Use amount from tax return – The terminal tax notice will display a UOMI in tax return field with the UOMI amount from the tax return.

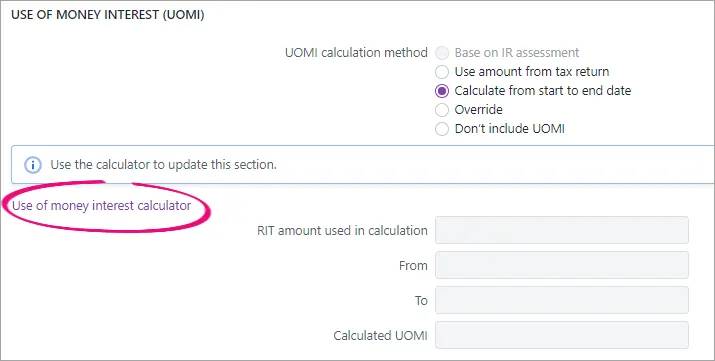

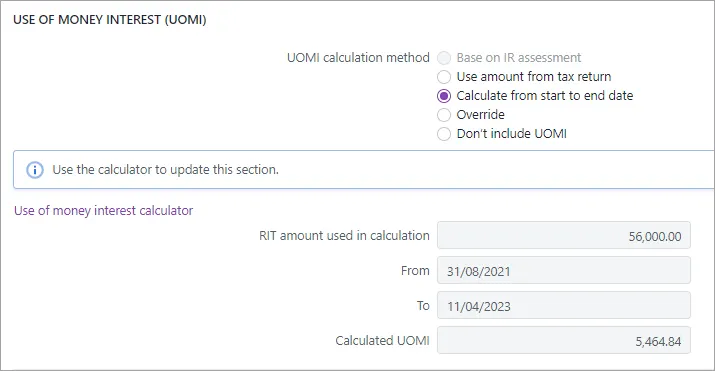

This is the default option after a tax return is approved (the return has a status of Pending client signature or Ready to file), or after a return is filed but IR hasn't assessed it.Calculate from start to end date – The terminal tax notice calculates UOMI based on a date range. The Calculated UOMI is displayed along with the RIT and dates used in the calculation.

If you want to change the calculation:

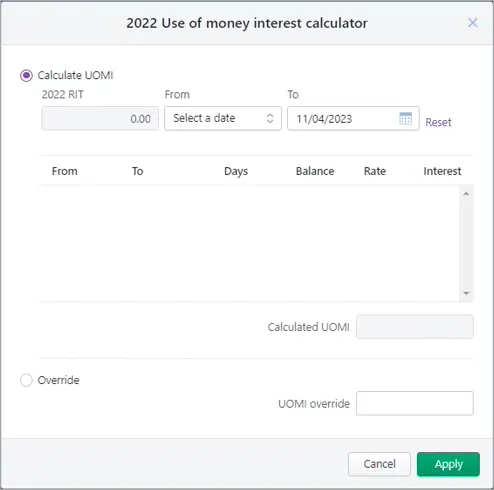

Select Calculate from start to end date and click Use of money interest calculator.

The Use of money interest calculator dialog appears.

Select a From and To date.

The available From dates are the day after the provisional and terminal tax dates.

The default To date is the terminal tax due date.Click Apply. The tax notices displays the updated values.

Override – Select Override and enter your own UOMI amount in UOMI override.

Don’t include UOMI – No UOMI amount will display on the terminal tax notice. This is the default option if a tax return isn't approved.

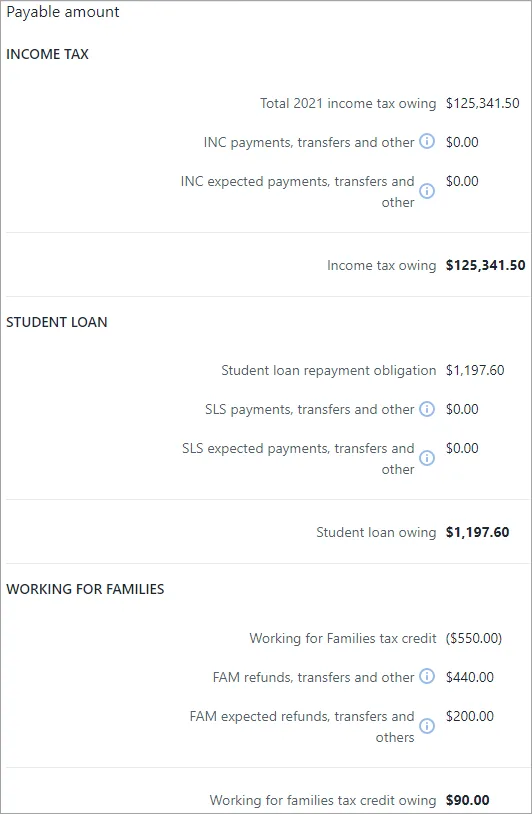

Payable amount

The payable amount shows how the terminal tax amount is calculated.

You'll only see the SLS section and the INC prefix on fields when viewing tax notices for individual entities.

Payable amount fields

The following fields are factored into the Total notice amount value in the Tax notice summary section of the page, and in the Notice amount on the Tax notices page list view that’s displayed when you don’t have a specific tax notice open.

Income tax fields:

Total 20xx income tax owing – This field displays the amount owing to IR before factoring into the calculation the INC payments, transfers and other and INC expected payments, transfers and other fields.

INC payments, transfers and other – This field only displays reconciled IR transactions from the Data reconciliation page. It considers payments, transfers and refunds.

INC expected payments, transfers and other – This field displays unreconciled MYOB transactions from the Data reconciliation page. It considers transfers in and out, payments, refunds and other.

Income tax owing – This value is the Total 20xx income tax owing value, minus the Payments & transfers value, minus the Expected payments & transfers value. The value is reflected in the Tax notice summary section of the page.

Student loan fields:

Student loan repayment obligation – This field automatically populates its value from Data reconciliation or tax returns. For more information, see Payable amount data sources below.

SLS payments, transfers and other – This field displays reconciled IR transactions from the Data reconciliation page.

SLS expected payments, transfers and other – This field displays unreconciled MYOB transactions from the Data reconciliation page.

Student loan owing – The value is the Student loan repayment obligation value, minus the SLS payments, transfers and other value, minus the SLS expected payments, transfers and other value. The value is reflected in the Tax notice summary section of the page.

You no longer need to use voluntary adjustments for recalculated student loan amounts. The student loan fields automatically display the recalculated amounts.

Working for families fields:

These payments may be made weekly, fortnightly or as a lump sum amount paid after the end of the tax year. The payment is received as a refund in the interval chosen by your clients.

Working for Families tax credit—This field automatically populates its value from Data reconciliation or tax returns. For more information, see Payable amount data sources below.

FAM refunds, transfers and other —This field displays reconciled IR transactions from the Data reconciliation page.

FAM expected refunds, transfers and other—This field displays unreconciled MYOB transactions from the Data reconciliation page.

Working for families tax credit owing—This field displays the amount owing to IR if Working for families is overpaid. The value is the sum of the other three fields in this Working for families section of the page. If the sum is negative amount, then the field will display 0. The value is reflected in the Tax notice summary section of the page.

You no longer need to use a FAM voluntary adjustment to display the correct amount on the tax notice PDF when Working for families is overpaid.

It's important that you check that amounts of any in-progress tax notices are correct before sending the notices for approval.

As you progress through the compliance workflow, changes in status can trigger changes in amounts that may require a review of voluntary adjustments.

Expected payments appear in Data reconciliation when the return is filed or when a transaction has been manually added in Data reconciliation. This means that for tax notices that aren't yet approved:

-

you might need to manually add voluntary adjustments if the tax notice is going to be sent before the tax return, or

-

when the tax return is sent to the client, you may need to remove voluntary adjustments from the tax notice.

When a tax return assessment is reconciled in Data reconciliation, you’ll see an alert on the Tax notices page about tax return data being available. If you see this message, you can click to open and review the details and decide if you want to recalculate the tax notice amounts using the new data. You do this by clicking Send for rework on the tax notice to change the tax notice status back to in-progress, which updates the tax notice amounts. If you change the tax notice to in-progress, you can then edit or remove the voluntary adjustments as needed.

To remove voluntary adjustments to fix any affected tax notices, filter the Tax notices list by voluntary adjustments, open the tax notice and click remove to the right of the Voluntary adjustment section in the tax notice. See below for detailed steps.

Payable amount data sources

The Student loan repayment obligation field and Working for Families tax credit field automatically populate their values from Data reconciliation or tax returns.

How are the data sources prioritised?

These fields source their data from the reconciled IR assessment transactions as their first priority.

If there’s no reconciled IR assessment value, the fields use the filed tax return and the associated schedules as their data source.

If there’s no filed tax return, you can manually enter the values.

Where does the data come from within each data source?

If sourcing from Data reconciliation:

The data is sourced from the Assessment transaction in the Reconciled transactions section of the Data reconciliation page.

The Student loan repayment obligation field sources assessment transactions of Data reconciliation entries with a Tax type of Student loan.

The Working for Families tax credit field sources assessment transactions of Data reconciliation entries with a Tax type of Working for families.

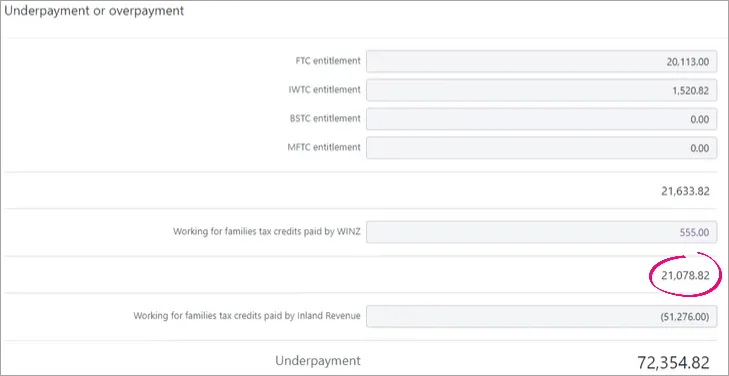

If sourcing from tax returns:

The Student loan repayment obligation value comes from the End of year repayment obligation amount in the Student loan schedule.

The Working for Families tax credit value comes from the total of the entitlements minus the tax credits paid by WINZ of the Working for families schedule, displayed beneath the Working for families tax credits paid by WINZ field.

-

If you reconcile after the return is filed, the terminal tax notice will use the IR assessment transaction for the source of its values.

-

The fields will become non-editable when the tax return is filed.

-

The Student loan repayment obligation field, Working for Families tax credit field and the fields in the Terminal tax basis section work independently. That means it’s possible that a combination of data sources are used within the same tax notice.

For example, if there’s an unfiled tax return in Tax in Practice Compliance and the return is filed via another method outside of Tax, Tax may receive reconciled IR transactions to be used as the data source of some fields. So you could end up with, editable Terminal tax basis fields (because the return hasn’t been marked as filed in Tax) but a non-editable Student loan repayment obligation field (because it’s using reconciled IR data).

-

Tax pooling

Apply tax pooling to a tax notice

To apply tax pooling to a tax notice, open the terminal tax notice and select Yes to the question Will this instalment be tax pooled?

If there's an MYOB transaction for the expected terminal tax payment in Data reconciliation, we'll reverse it, so the terminal tax payable won't carry forward to the next tax notice.

Tax pooling applies to INC terminal amount only.

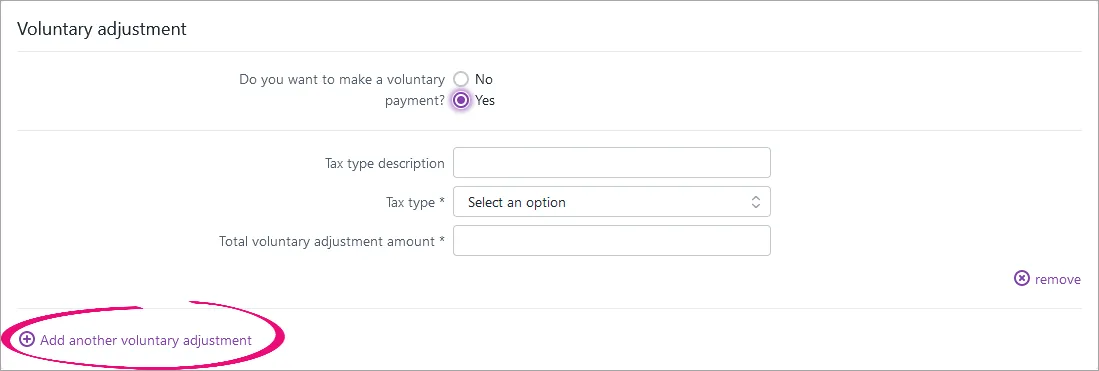

Voluntary adjustment

You have up to 5 voluntary adjustments for individual entities, and up to 3 for all other entity types.

If you want your client to pay less tax than the terminal tax amount, you can make a negative voluntary adjustment by selecting the tax type INC or FAM. This is useful for scenarios where there’s an amount owing to IR.

Make a voluntary adjustment

Answer Yes to the question Do you want to make a voluntary payment?

Select a Tax type:

FAM – Working for families

FBT – Fringe benefits tax

GST – Goods and services tax

INC – Income tax

SLS – Student loan

Enter the voluntary adjustment amount.

If you've selected the tax type FBT, GST or SLS, you must enter a positive amount.

To add an additional voluntary adjustment, click Add another voluntary adjustment.

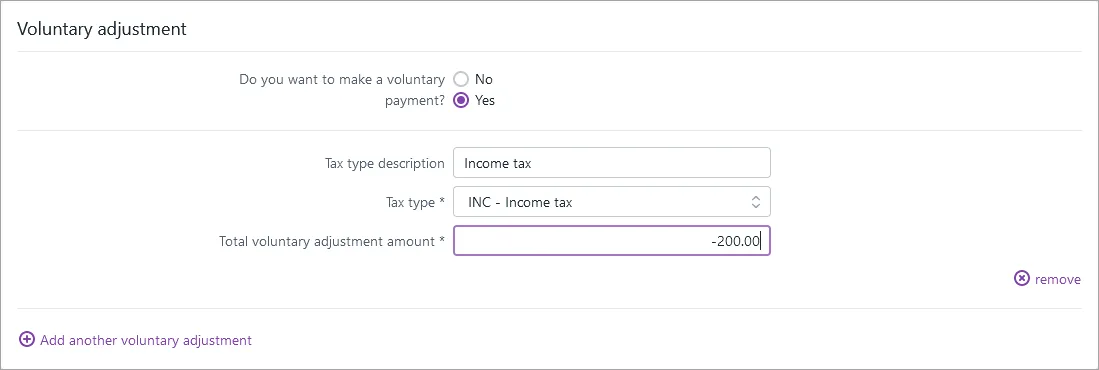

Make a negative voluntary adjustment

Income tax and Working for families tax types only

To add a credit voluntary adjustment to a tax notice, answer Yes to the question Do you want to make a voluntary payment?

In the Tax type drop-down, select either INC - Income or FAM - Working for families.

In the Total voluntary adjustment amount field, enter a negative amount.

The Tax notice summary fields update automatically. The negative voluntary adjustment amount appears in brackets and reduces the amount payable.

Remove voluntary adjustments

Go to the Tax > Tax notices page.

On the filter bar, click More filters and select Any from Voluntary adjustments.

Open the affected tax notices and click remove to the right of the adjustment in the Voluntary adjustment section.

Tax notice summary

The amounts under Tax notice summary are only displayed when the balance is positive, meaning there's a payable amount owing to IR.