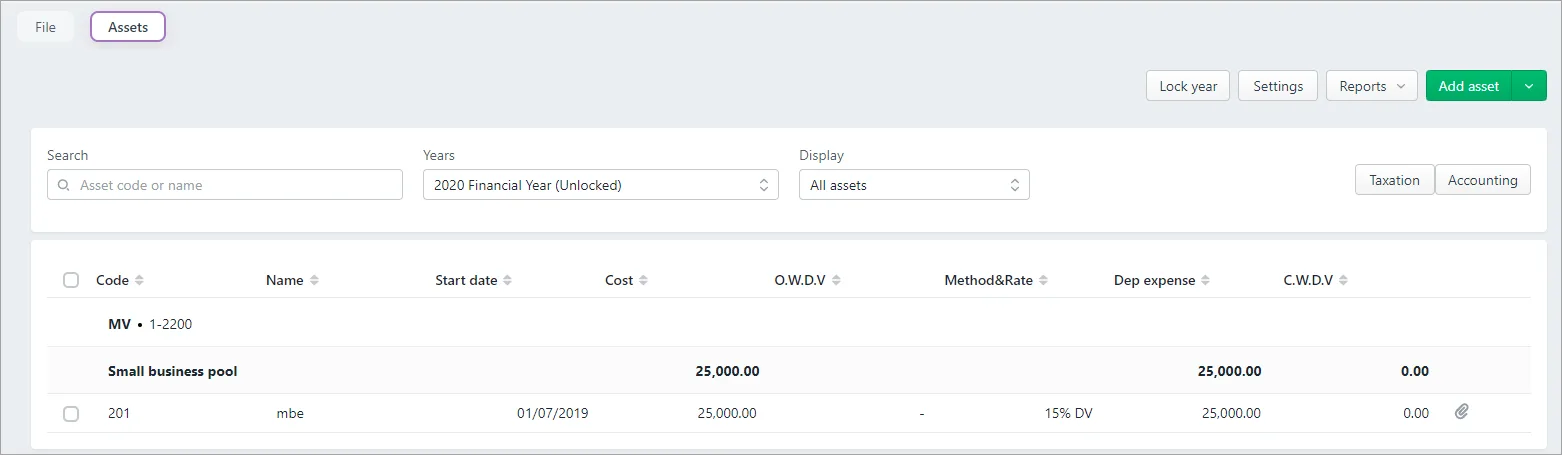

Assets register is where all your assets are listed for a client. You can choose what columns are displayed asset register, calculation methods, etc. Changes you make to the asset register settings impact the depreciation calculation and entries generated for the current year. These changes flow through to later years.

You can go back to the previous years to make add or edit assets in that financial year. Practice Compliance will calculate the correct opening written down value for the subsequent years.

You can post the depreciation calculation entries as either Taxation or Accounting journals.

To choose which columns to display

Right-click the header row and select the columns you want to display.

Choose from:

Start date

Cost

O.W.D.V: opening written down value

Method & Rate

Dep expense: depreciation expense

C.W.D.V: closing written down value

Acquisition date

Disposal date

Location

Accumulated dep: accumulated depreciation

Value for dep: value for depreciation

Private use

Private use amount

Termination value

(AU) Assessable/Deductible

(NZ) Profit/Loss

Capital gain tax

(NZ) Number of months