When importing goods from overseas, GST is levied at 15% of the landed cost of the goods and is payable to the customs agent, not your overseas supplier. The GST paid to customs needs to appear in Box 13 of the GST return, so you need to create one bill to record the overseas purchase and another bill to record the costs associated with the import.

The customs agent usually handles the costs associated with the import. Generally, the customs agent will arrange payment for, and collection of, the goods on arrival in New Zealand, and may pay your customs duty, freight, insurance and GST liability. You will need to reimburse the customs agent for these costs.

Here's our recommended method for recording overseas purchases. If this approach doesn't suit your business needs, check with an accounting advisor about your best course of action.

1. Setting up

To track your overseas purchases and ensure the GST is reported correctly, you'll need to set up the following:

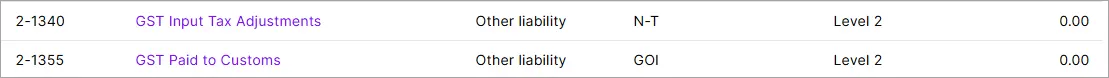

Create two liability categories (Accounting menu > Categories (Chart of accounts) > Liabilities tab > Create category). Need a refresher on creating categories?

GST Input Tax Adjustments - this category might already exist in your file

GST Paid to Customs - this category will hold the value of GST paid to customs and needs the GOI GST code

Here are our example categories as they appear in the category list:

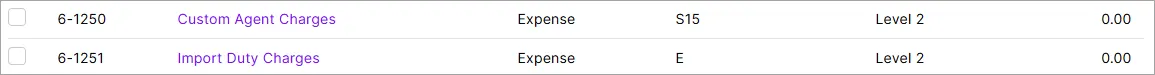

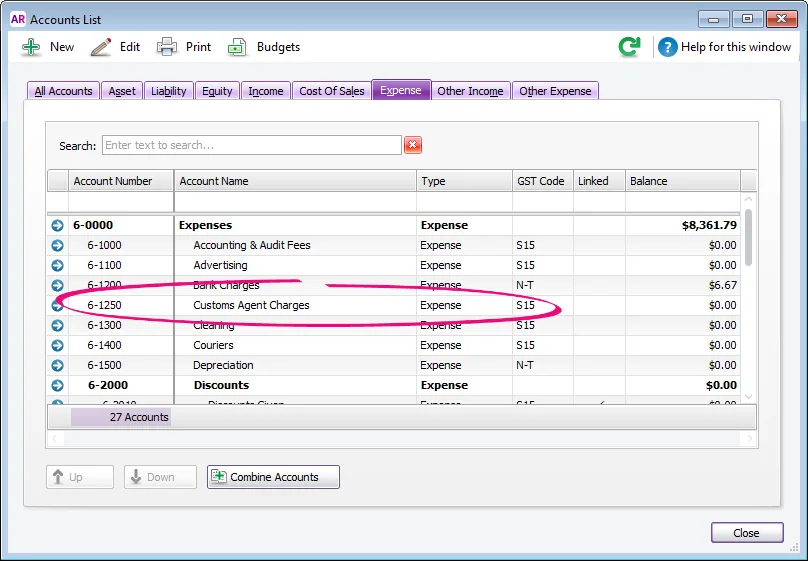

Create two expense categories; one for Import Duty that attracts no GST, and one for other Customs Agent Charges that do have GST. This ensures that Import Duty is not being recorded in your GST.

Here are our example categories as they appear in the category list:

2. Recording the overseas purchase

We'll record the overseas purchase by treating the import costs as expense items.

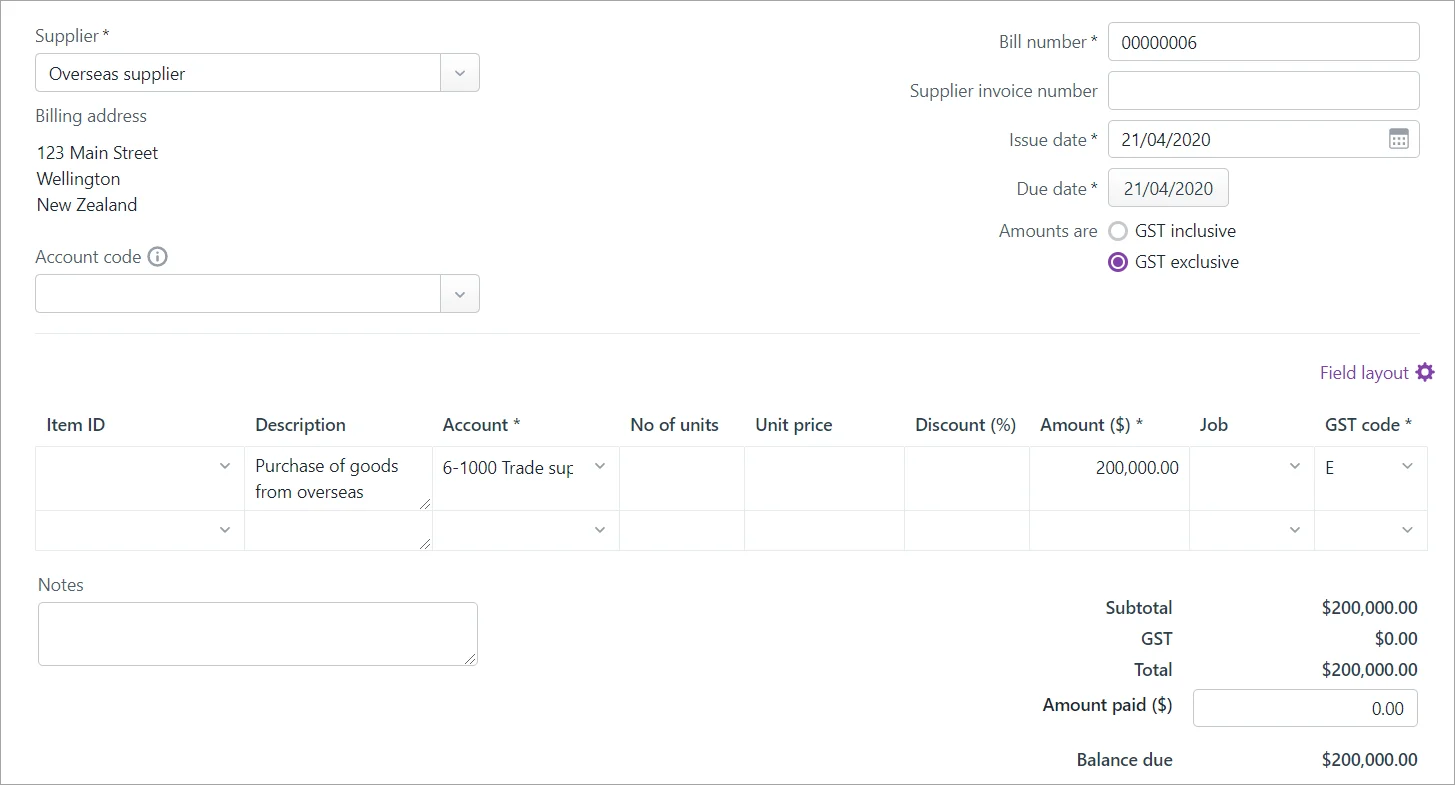

Create a bill for the purchased goods (Create menu > Bill). Need a refresher on creating bills?

Exclude the GST by selecting the GST exclusive option.

Code the purchase using the E GST code.

If the supplier has charged you freight costs, include this on this bill.

Here's our example:

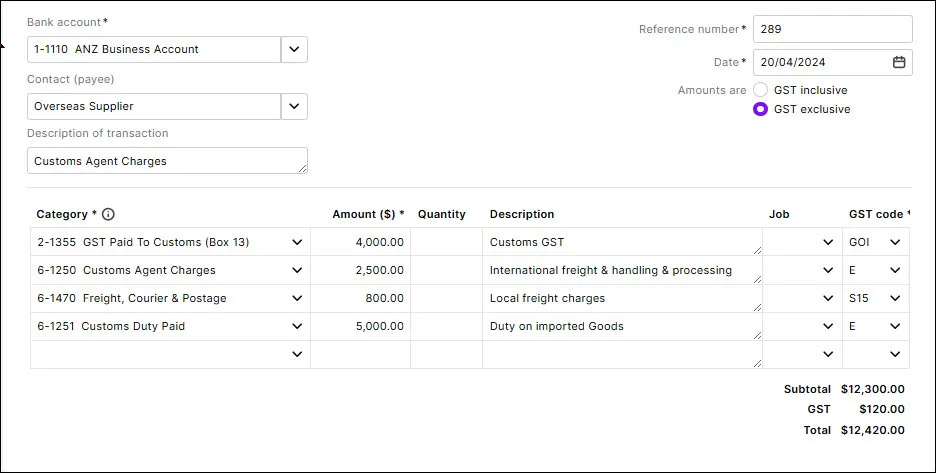

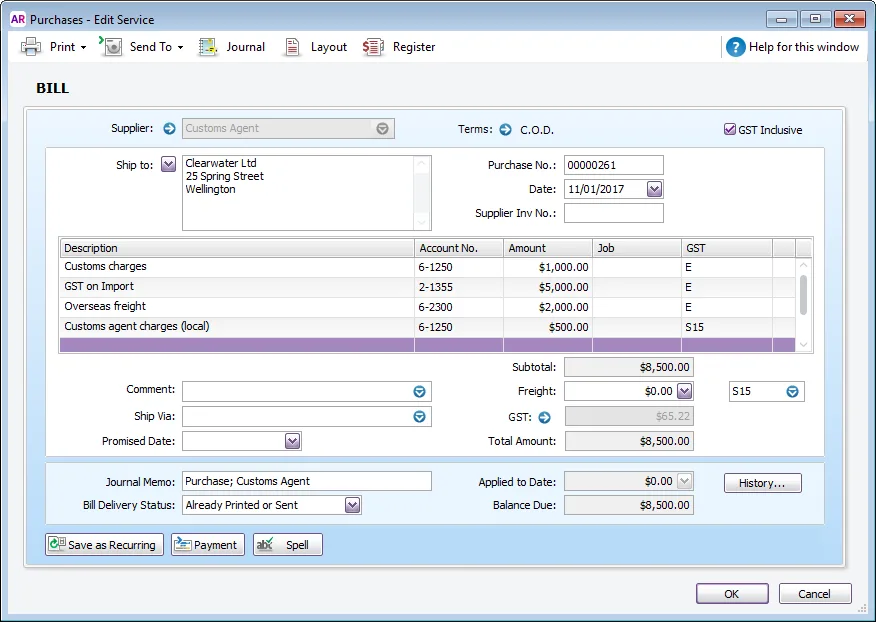

Create a separate bill for the import costs paid to the customs agent. This transaction will increase expenses and record the GST to be included in the GST adjustment.

For the customs agent charges, allocate it to the Customs Agent Charges expense category created earlier, and use the E or S15 GST code (based on the agent's invoice details).

For the customs GST on the agent's invoice, allocate it to the GST Paid to Customs liability category and use the GOI GST code.

For the import duty charged by the customs agent, allocate it to the Import Duty expense category and use the E GST code.

If any local freight has been charged, allocate this to the applicable freight category and use the S15 GST code.

Using the payments basis?

If you're not creating bills but you're accounting for the GST on imports at the time of payment (e.g. via a bank feed), you can simply allocate the GST at the time of payment directly to the GST Input Tax Adjustment account. The initial entry to GST Paid to Customs (as shown in step 2 above) and the subsequent journal entry described below in Task 3 'Transferring the GST' does not need to occur.

Pay these bills as usual (Purchases menu > Bills > click the ellipsis (...) > Record supplier payment). Need a refresher for paying bills?

3. Filing your GST return

Before filing your GST return, run the GST report to ensure that all the GST you need to report is recorded correctly.

Go to the Reporting menu > Reports > GST Report to determine the total amount applied to the GOI GST code for a given period.

Choose your Accounting method (Payments or Invoice)

Filter the report for the GOI GST code for the relevant period.

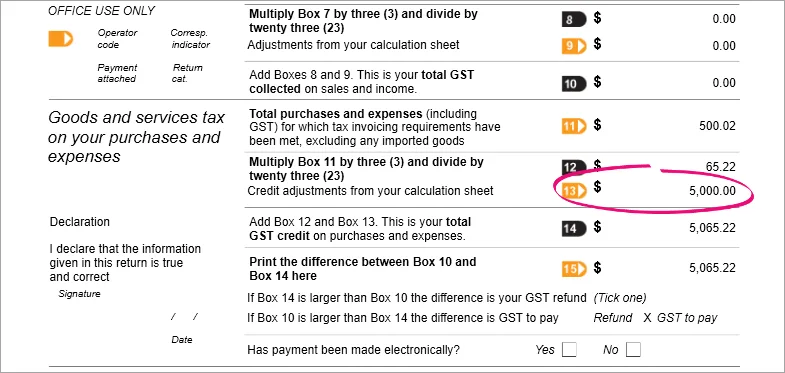

Note that if you run the GST return report, it won't include box 9 (GST debit adjustments) and box 13 (GST credit adjustments), but the return you file to IR will include those values.

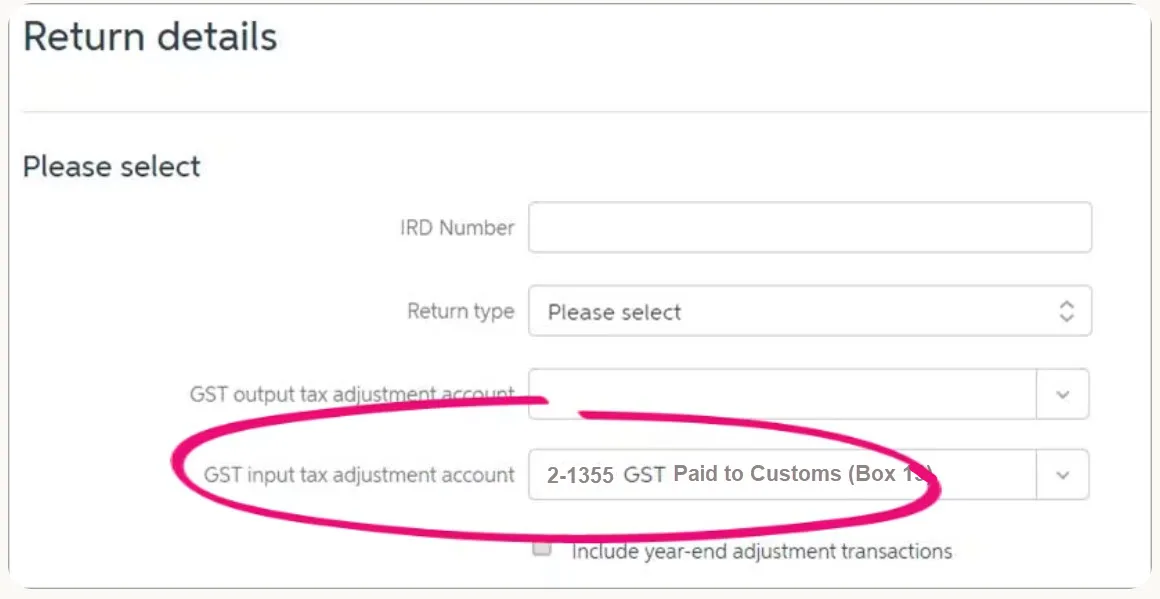

When preparing your GST return

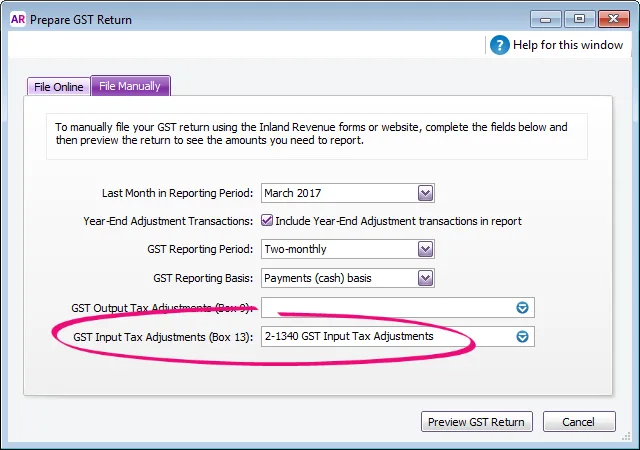

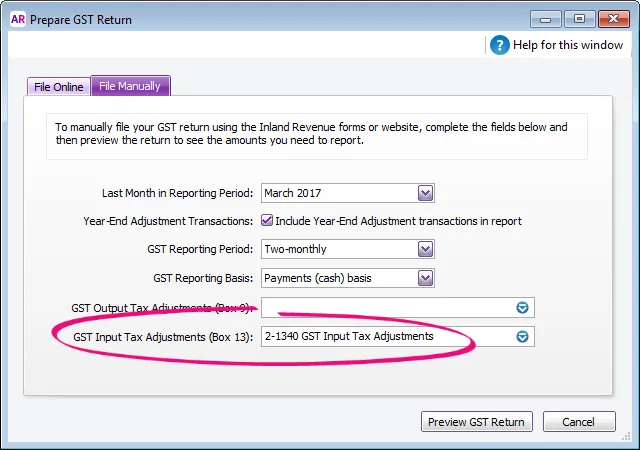

On the Return details screen, choose the GST Input Tax Adjustments category you set up in step 1 as the GST input tax adjustment category.

This ensures the correct value appears at box 13 on the return. Need a refresher for preparing your GST return?

When importing goods from overseas, GST is levied at 15% of the landed cost of the goods and is payable to the customs agent, not your overseas supplier. The GST paid to customs needs to appear in Box 13 of the GST return, so you need to create one bill to record the overseas purchase and another bill to record the costs associated with the import.

The customs agent usually handles the costs associated with the import. Generally, the customs agent will arrange payment for, and collection of, the goods on arrival in New Zealand, and may pay your customs duty, freight, insurance and GST liability. You will need to reimburse the customs agent for these costs.

The way you record overseas purchases varies depending on your GST reporting basis (Payments or Invoice). Your accounting advisor will be able to provide additional information regarding anything that might be different for your business.

In Australia? See Recording overseas purchases and import costs (Australia).

If you're using the Payments basis

Setting up

To track your overseas purchases and ensure the GST is reported correctly, you'll need to set up the following:

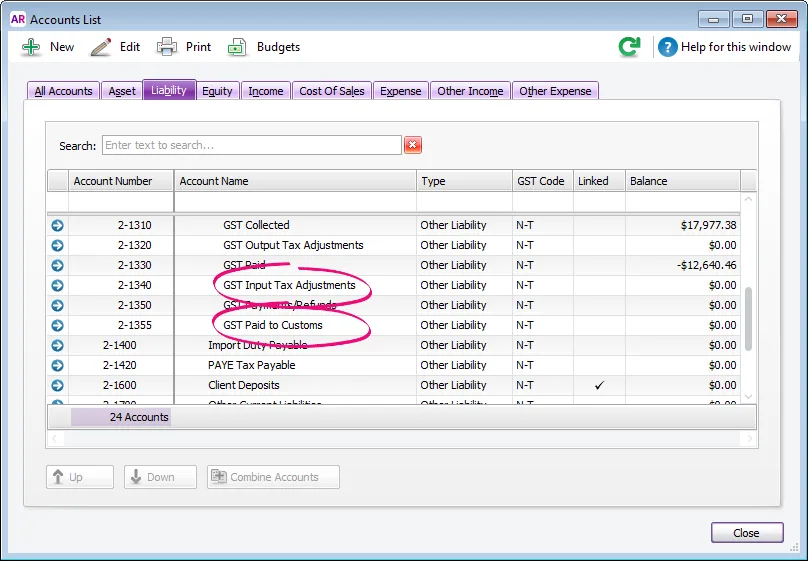

Create two liability accounts (Accounts > Accounts List > Liability tab > New).

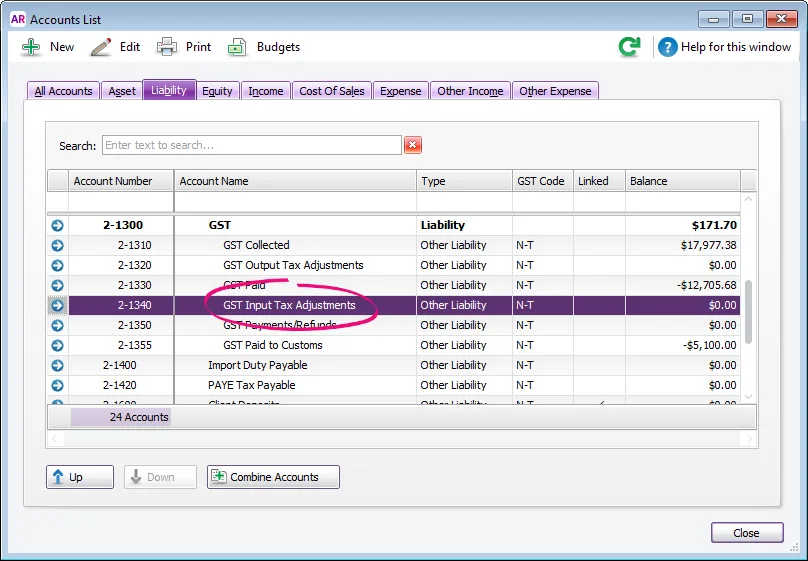

GST Input Tax Adjustments - this account might already exist in your company file

GST Paid to Customs - this account will hold the value of GST paid to customs

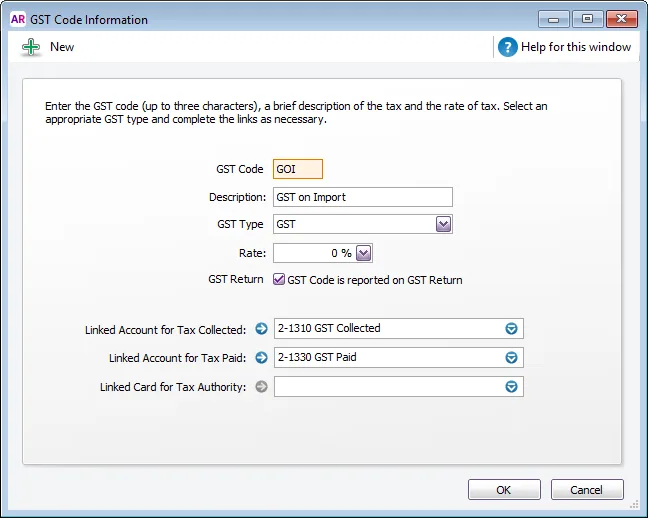

Create a GST Code called GST on Import (Lists > GST Codes).

Link the GST Input Tax Adjustments account to box 13 on your GST return.

Go to the Accounts command centre and click GST & Provisional Tax.

Select the GST Input Tax Adjustments account for box 13. Here's our example:

Click Preview GST Return to ensure this is saved.

Close the GST return.

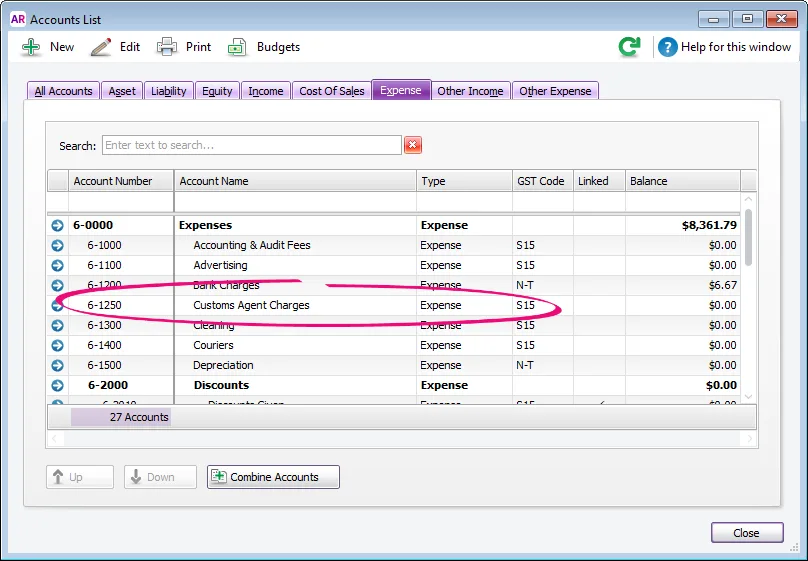

Create an Expense account (or Cost of Sales) account for the Customs Agent's charges. Here's our example:

Recording the overseas purchase

Depending on how you want to treat the imports costs, there's two ways you can record the overseas purchase and account for the GST.

Treat the import costs as expense items

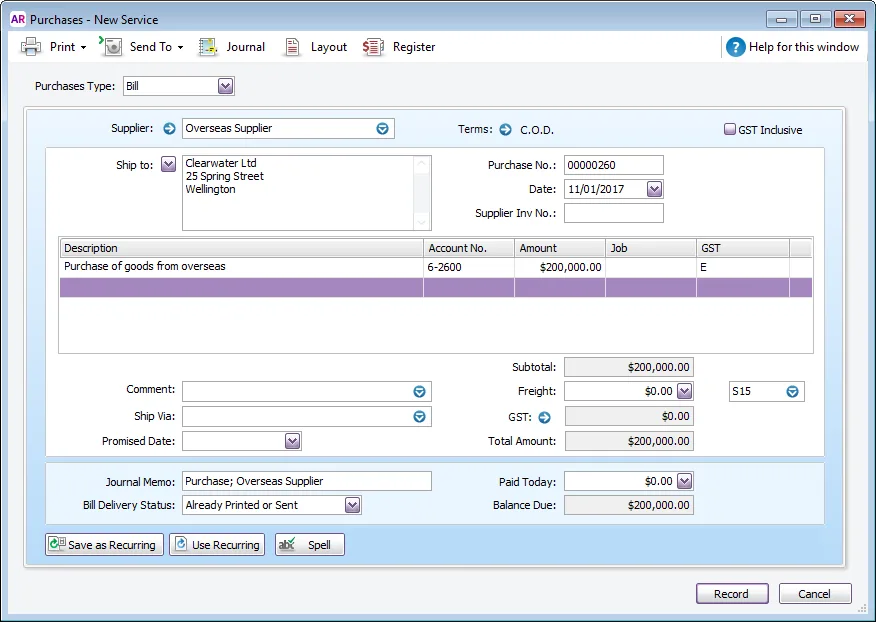

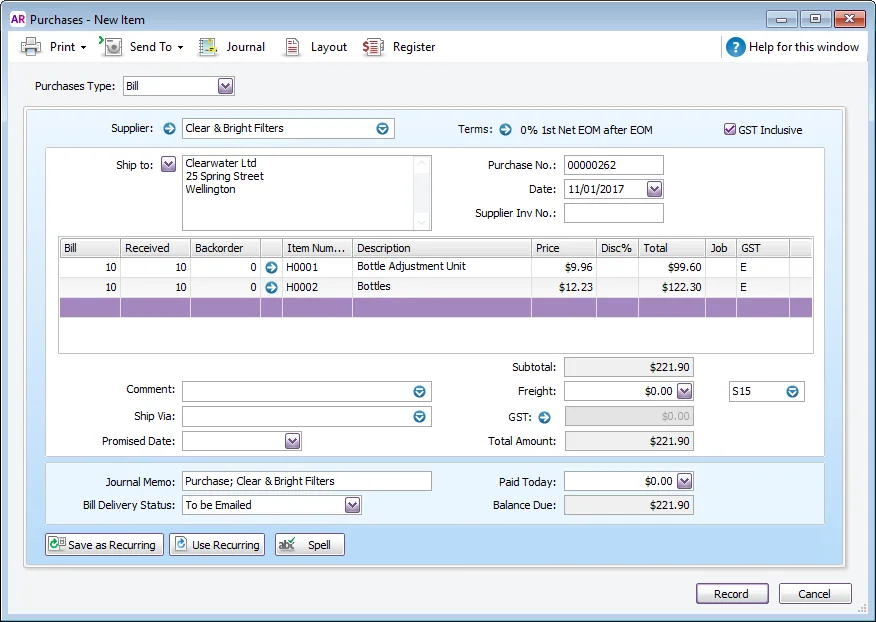

Create a bill for the purchased goods. Exclude the GST by deselecting the GST Inclusive option, and coding the purchase using the E GST code.

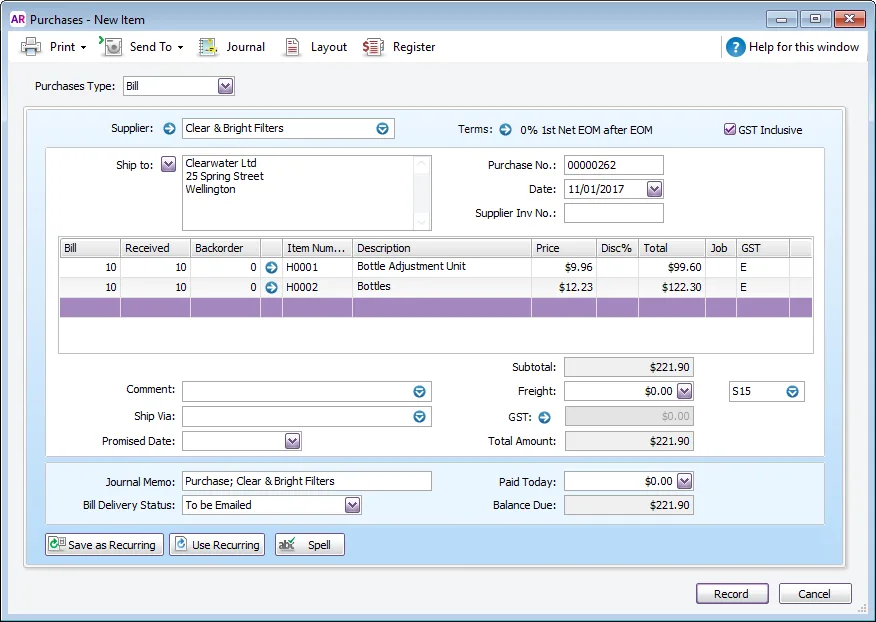

Here's our example:

If the supplier has charged you freight costs, this should be included on this bill.

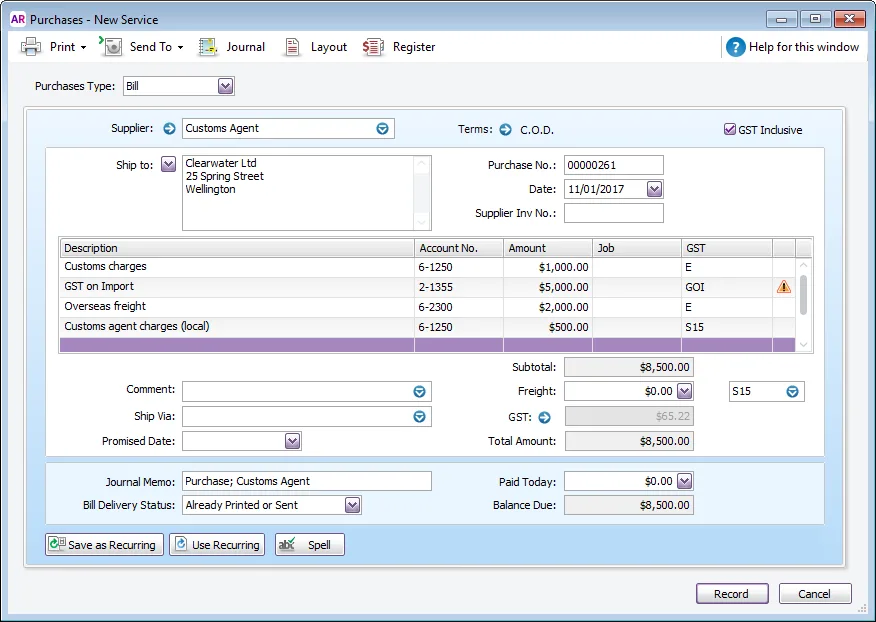

Create a separate bill for the import costs paid to the customs agent.

For the customs charges, allocate it to the Customs Agent Charges expense account created earlier, and use the E GST code to exclude any GST.

For the GST on the import, allocate it to the GST Paid to Customs liability account and use the GOI GST code (ignore the displayed warning).

For the import duty charged by the customs agent, allocate it to the Customs Agent Charges expense account and use the S15 GST code.

For any other expenses the customs agent may be charging you, for example overseas freight and/or insurance, allocate it to the applicable expense account and use the E GST code.

If any local freight has been charged, allocate this to the applicable freight account and use the S15 GST code.

Here's our example:

This transaction will increase expenses and record the GST to be included in the GST adjustment.

Pay these bills as usual.

Transferring the GST

Before running your GST return, you need to determine the GST value from the import, then transfer this amount to the GST Input Tax Adjustments account.

Here's how:

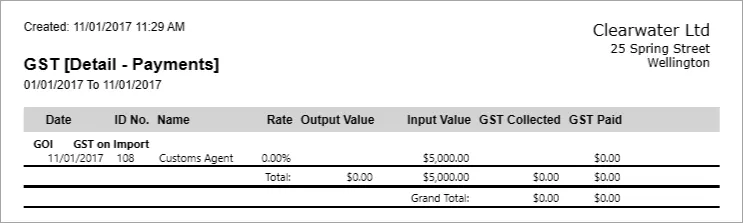

Run the GST [Detail - Payments] report (Reports > Index to Reports > GST > GST [Detail - Payments]). Filter the report for the GOI (GST on Import) GST code for the relevant period.

Here's our example:

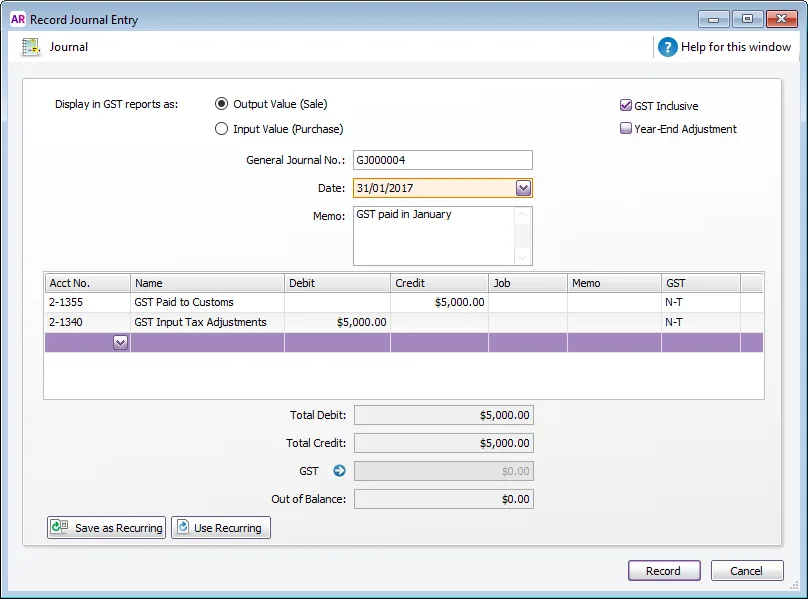

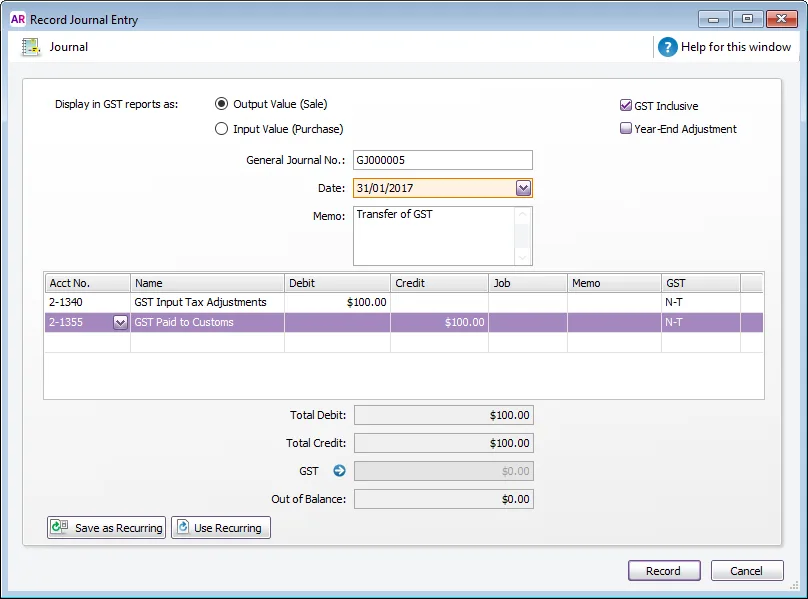

Record a journal entry (Accounts > Record Journal Entry) to transfer the balance from the GST Paid to Customs account to the GST Input Tax Adjustment account.

Here's our example:

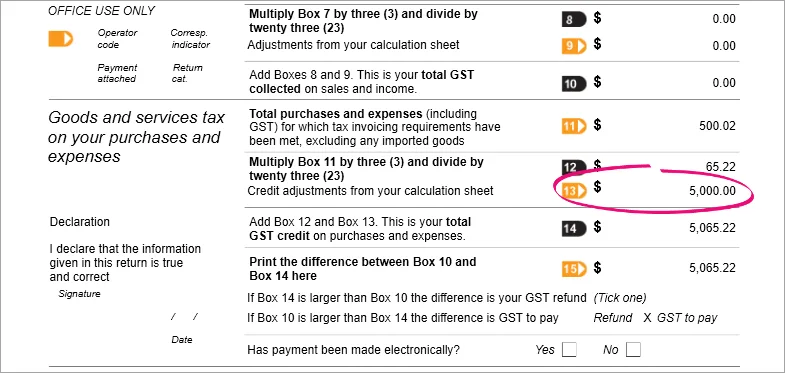

Prepare your GST return as usual.

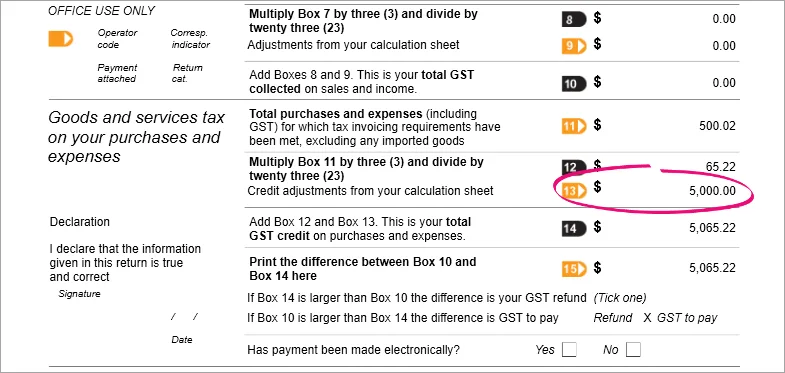

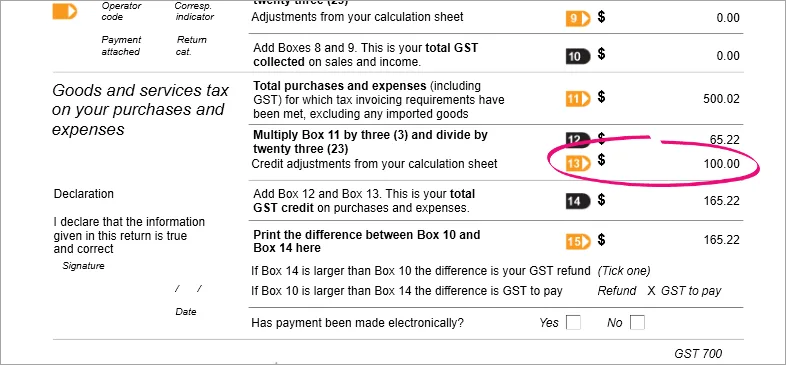

Here's our example showing Box 13 with the applicable GST amount:

Include all costs in the purchased item's value

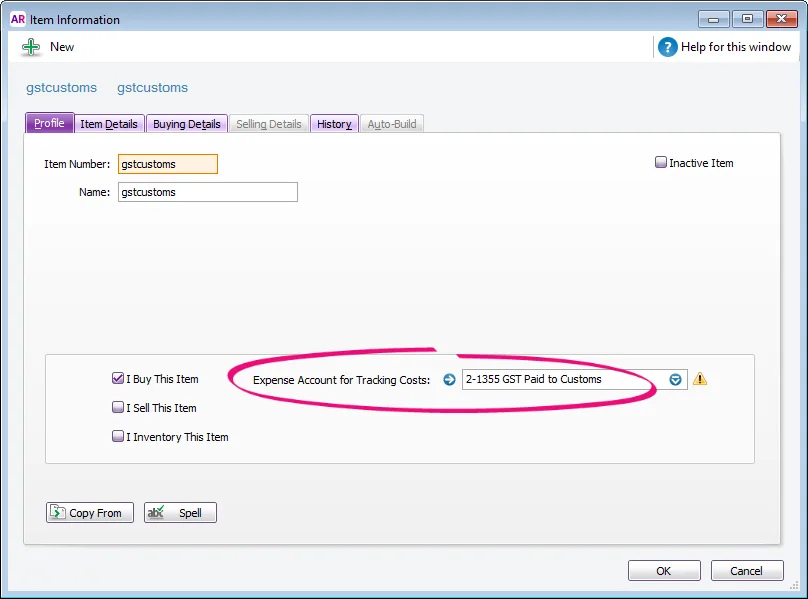

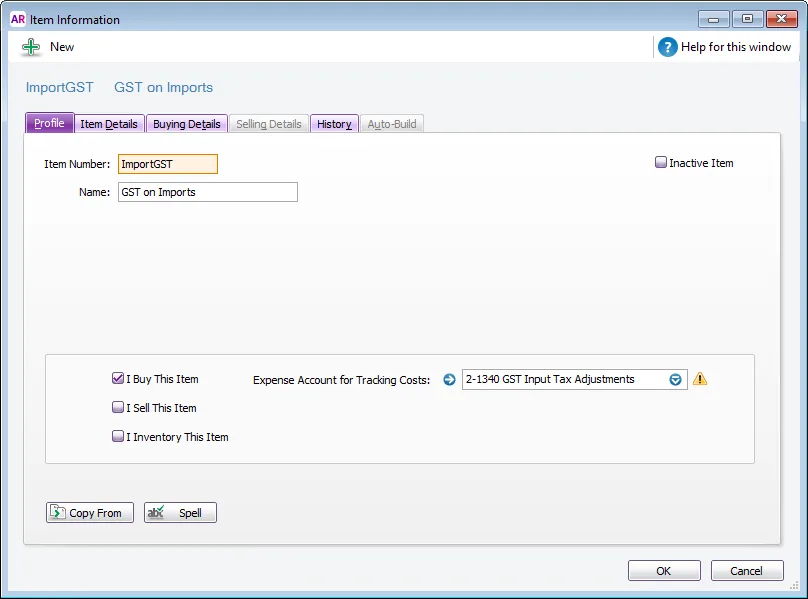

Create an inventory item to track the GST on imports.

Name the item gstcustoms (or similar).

Select the option I Buy This Item.

For the Expense Account for Tracking Costs, select the GST Paid to Customs liability account created earlier (ignore the warning about the type of account you've selected).

Click the Buying Details tab and select E as the GST Code when Bought.

Here's our example:

Create a bill for the purchased goods, excluding any GST. Here's our example:

If the supplier has charged you freight costs, this should be included on this bill.

Create a separate bill for the import costs paid to the customs agent.

Select the Item layout.

Enter a line for the gstcustoms item created earlier, and enter its price as the GST paid to customs and use the N-T GST code.

Enter extra lines for each item the import bill applies to, and add a portion of the import costs to each line. Enter zero for the Received quantity for these lines to ensure you increase their value only and not the quantity on hand. Use the N-T GST code for these lines.

If any local freight has been charged, allocate this to the applicable freight account and use the S15 GST code.

Here's our example:

Pay these bills as usual.

Transferring the GST

Before running your GST return, you need to transfer the GST amount to the GST Input Tax Adjustments account. This will increase the average cost of the item(s) and ensure the GST is reported at Box 13 of your GST return.

Here's how:

Record a journal entry (Accounts > Record Journal Entry) to transfer the balance from the GST Paid to Customs account to the GST Input Tax Adjustment account.

Here's our example:

Prepare your GST return as usual.

Here's our example showing Box 13 with the applicable GST amount:

If you're using the Invoice basis

Setting up

To track your overseas purchases and ensure the GST is reported correctly, you'll need a liability account to hold the GST paid by you to the customs agent. This account will need to be linked to Box 13 on your GST return.

Check your accounts list for a liability account called GST Input Tax Adjustments (go to Accounts > Accounts List > Liability tab). If the account doesn't exist, click New to create it.

Link the GST Input Tax Adjustments account to Box 13 on your GST return.

Go to the Accounts command centre and click GST & Provisional Tax.

Select the GST Input Tax Adjustments account for box 13. Here's our example:

Click Preview GST Return to ensure this is saved.

Close the GST return.

Create an Expense account (or Cost of Sales) account for the Customs Agent's charges. Here's our example:

Recording the overseas purchase

Depending on how you want to treat the imports costs, there's two ways you can record the overseas purchase and account for the GST.

Treat the import costs as expense items

Create a bill to record the purchase from the overseas supplier. Exclude the GST by deselecting the GST Inclusive option, and coding the purchase using the E GST code.

Here's our example:

If the supplier has charged you freight costs, this should be included on this bill.

Create a separate bill for the import costs paid to the customs agent.

For the customs charges, allocate it to the Customs Agent Charges expense account created earlier, and use the E GST code to exclude any GST.

For the GST on the import, allocate it to the GST Input Tax Adjustments liability account and use the E GST code to exclude any GST.

For the import duty charged by the customs agent, allocate it to the Customs Agent Charges expense account created earlier, and use the S15 GST code.

For any other expenses the customs agent may be charging you, for example overseas freight and/or insurance, allocate it to the applicable expense account and use the E GST code.

If any local freight has been charged, allocate this to the applicable freight account and use the S15 GST code.

Here's our example:

Pay these bills as usual.

The above purchase will increase expenses and include the GST in Box 13 of your GST return.

Include all costs in the purchased item's value

Create an inventory item to track the GST on imports.

Name the item GST on Imports (or similar).

Select the option I Buy This Item.

For the Expense Account for Tracking Costs, select the GST Input Tax Adjustments liability account (ignore the warning about the type of account you've selected).

Click the Buying Details tab and select E as the GST Code when Bought.

Here's our example:

Create a bill for the purchased goods, excluding any GST. Here's our example:

Create a separate bill for the costs paid to the customs agent.

Select the Item layout.

Enter a line for the GST on Imports item created above, and enter its price as the GST paid to customs.

Enter extra lines for each item the import bill applies to, and add a portion of the import costs to each line. Enter zero for the Received quantity for these lines to ensure only their value is increased and not the quantity on hand.

Here's our example:

Pay these bills as usual.

The above purchase will increase expenses and include the GST in Box 13 of your GST return.