A common business practice, especially in the building industry, is for amounts to be withheld from contractors until the job is satisfactorily completed. These are known as retentions.

If you've contracted with another business and withheld a retention, you only need to complete a few short steps to record the retention in AccountRight before and after it's paid to the contractor.

Not quite what you're looking for? This page covers retentions from the perspective of the person who is withholding the payment from the contractor. For information on how to handle retentions from the contractor's perspective, see our page Receiving retention payments.Alternatively, if you'll be paying the contractor as an employee, such as a labour hire arrangement, see Add an employee.

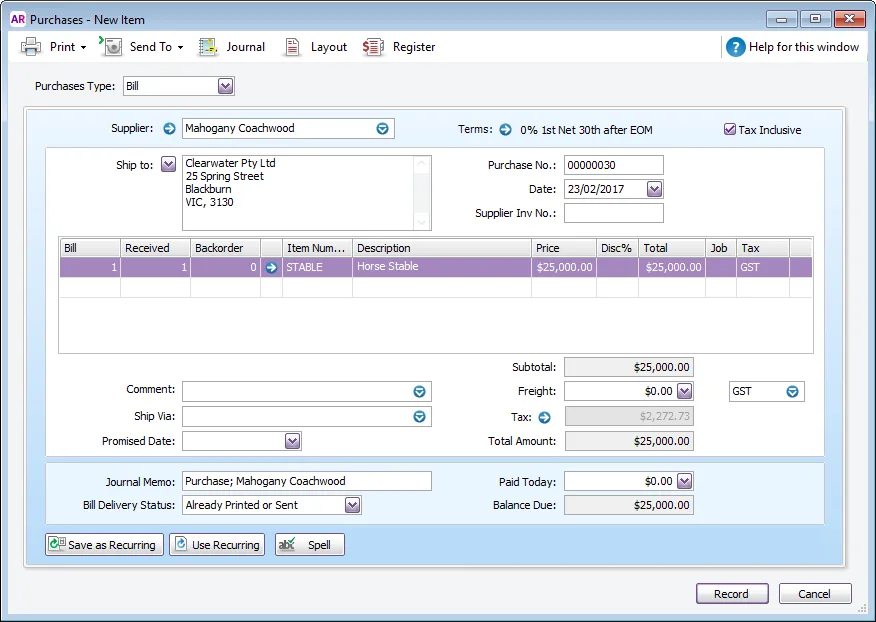

We'll use the following example for these steps:

You're having new stables built, and the total cost of the job is $125,000 including tax. You'll pay this amount progressively over a five month period. The first payment will include $25,000 less 10% of the total cost ($12,500), which is the amount you're withholding until the job is completed satisfactorily.

But no matter your business' specifics, these steps and principles in recording a retention will work for you.

Before you begin

You'll first need to set up your company file with a liability account to hold the retention and a Retainer Withheld item to record it.

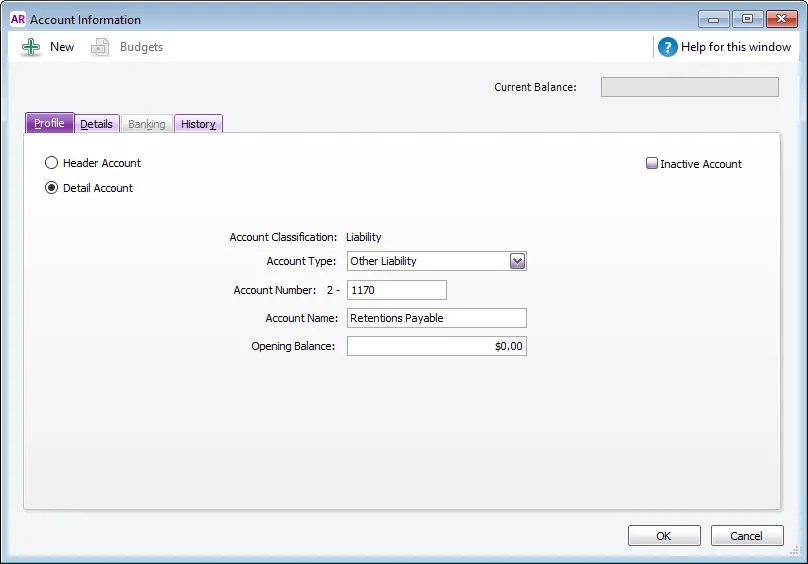

To set up a liability account

Create a liability account, with the Account Type as Other Liability and the Account Name as Retentions Payable.

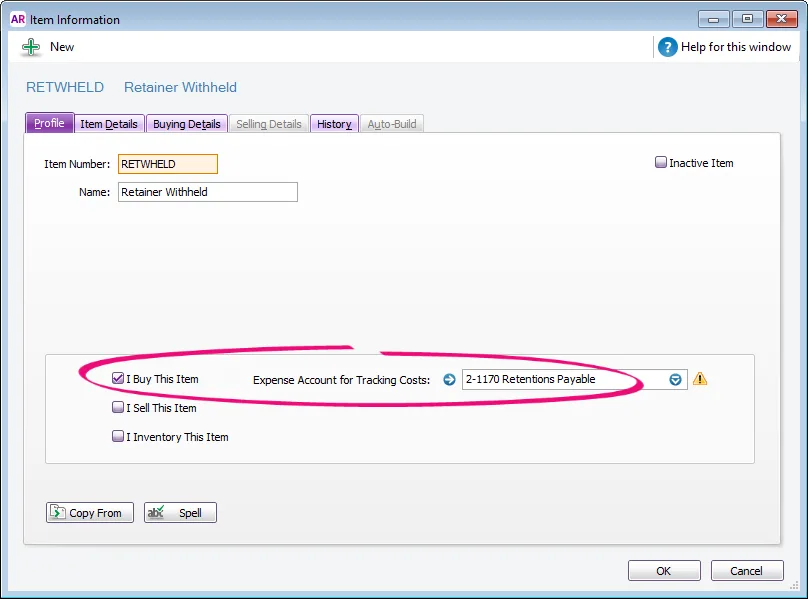

To create a Retainer Withheld item

Create an item with the Item Number as RETWHELD and Name as Retainer Withheld.

This item should also be set up as I Buy This Item only, and it should be linked to the Retentions Payable account created above. Ignore the warning about the account usually being an expense account, as this item is not a normal stock item.

Click the Buying Details tab and make sure that GST/S15 is selected in the Tax/GST Code When Bought field. Finally, click OK to record the transaction.

Need to record the purchase with the retention?

OK, so you've setup your company file and need to record the purchase with the retention. It's as easy as recording the purchase less the retention amount.

To record the purchase less the retention

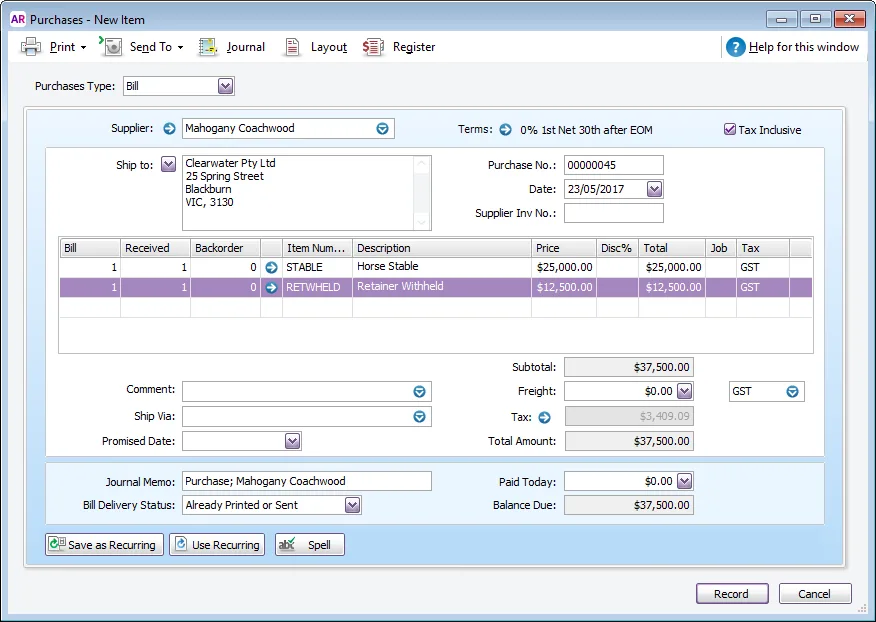

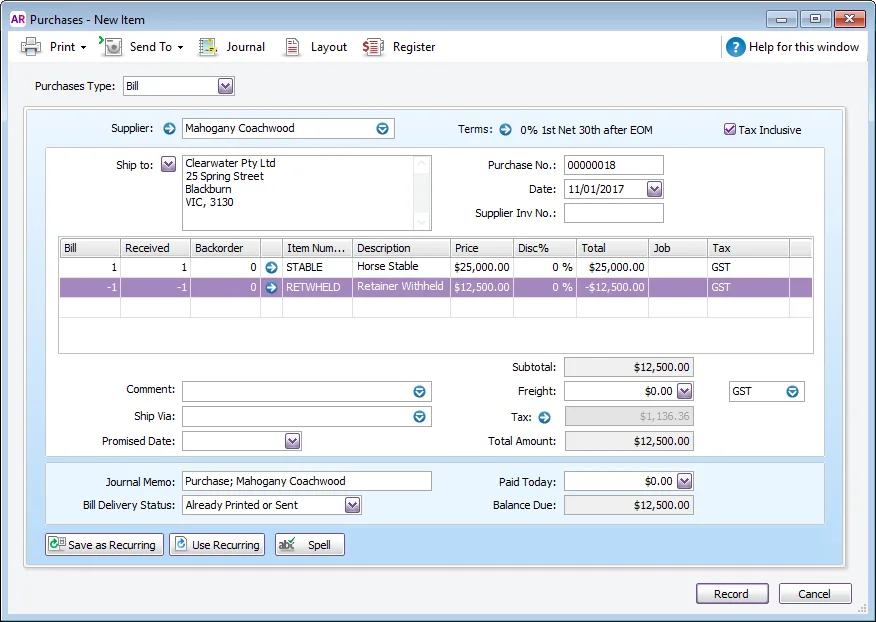

Enter a purchase using the Item layout. You'll record both the amount being paid and the amount retained from this payment.

Keep the following in mind when recording this purchase:

The Retainer Withheld will be entered as a negative amount (in our example, -$12,500).

Ensure the Tax/GST Inclusive option is selected in the top right corner of the window.

Progressive payments

If you're making progressive payments, you'll need to repeat this process for each payment (except the final payment). If you do not retain any further monies after you've made the first payment, you should enter the remainder of the progressive payments without any amount being retained. Using our example, this is what the 2nd, 3rd and 4th payments look like:

Ready to pay the retention?

Once the work is completed to your satisfaction, the contractor is entitled to receive the retainer withheld.

Before you record the final bill, you might want to determine the amount that has been withheld. Run the Purchases (Item Summary) report (Reports > Index to Reports > Purchases > Item > Purchases (Item Summary)) and set the filter to the Retainer Withheld item only. Set the Purchase Status to All Bills and select the relevant date range.

Once you determine the amount withheld you're ready to record the final bill.

To record the final payment and retainer

Enter a purchase using the Item layout to record the final payment and return of the retainer withheld above.

The Retainer Withheld item will be added as a positive value (in our example, $12,500). This will result in the Retainer Withheld account being cleared.