When you receive a bill from a supplier for a purchase you’ve made, first you need to enter the purchase as a bill in MYOB. Then, you can pay the bill.

If you need to enter payments that aren’t associated with a supplier (for example, a telephone bill or bank charges), enter these as spend money transactions. For more information see Spend money.

To speed things up, why not upload supplier invoices to MYOB Business and let MYOB help create the bill for you?

Watch this video to see how easy it is to enter a bill:

OK, grab the bill you want to enter into MYOB and we'll step you through it.

To enter a bill

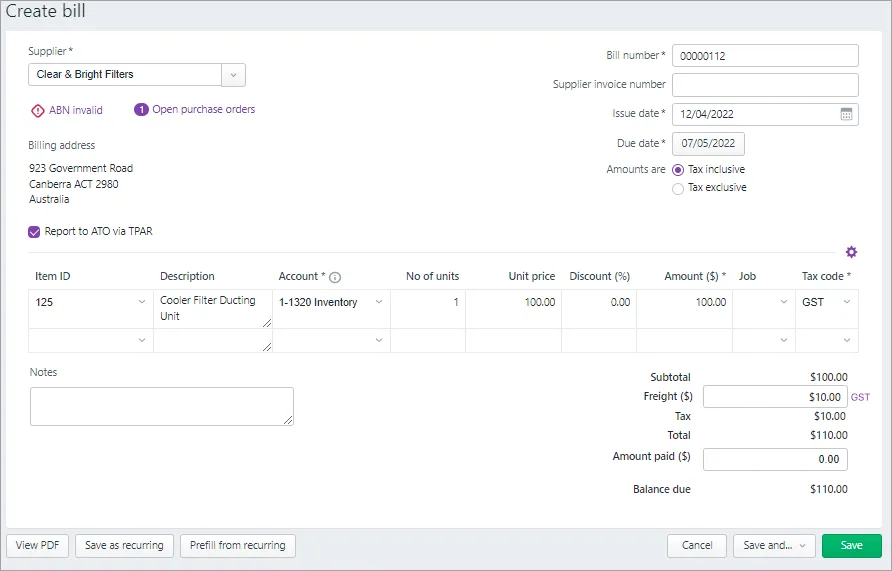

Go to the Create menu and choose Bill. The Create bill page appears.

Speed up data entry by pre-filling the bill details from an uploaded document — just click Prefill from a source document at the top of the bill. Tell me more...

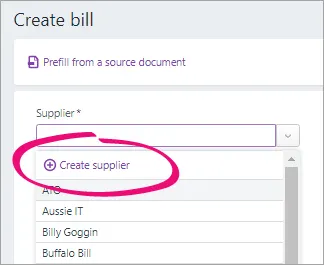

In the Supplier field, enter the supplier’s name, or click the dropdown arrow and choose the supplier from the list.

If you want to:

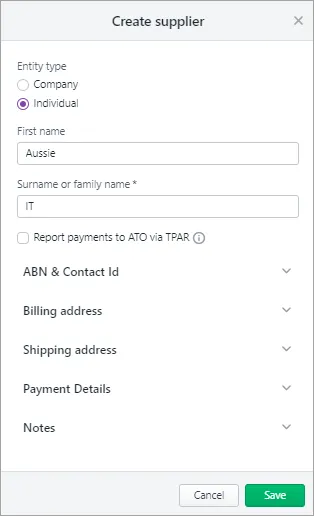

Add a new supplier:

Click the Supplier dropdown arrow and choose Create supplier. Enter as much (or as little) info as you like and click Save. You can always go back later and fill in additional details.

Add missing details to an existing supplier:

Type the supplier's name in the Supplier field and hit Enter. Click the dropdown next for the information you want to add, such as the ABN or billing or shipping address, add the details and click Save.

(Australia only) The status of the ABN you've entered in the supplier's record will checked, and the status shown. Click the status to see more details.

(Australia only) If the bill is a reportable payment, select the option Report to ATO via TPAR. Learn more about Reportable contractor payments.

If necessary, change the Bill number. This number is automatically generated, based on the last number used.

If you change the bill number, you’ll change the automatic numbering. For example, if you change the number to 000081 , the next time you create a bill, the new bill number will be 000082.

If you have one, enter the Supplier invoice number.

Check the date in the Issue date field.

Choose the Due date for the bill (when the bill needs to be paid).

Select whether the amounts in your bill are Tax inclusive or Tax exclusive.

Click Field layout and select the applicable option based on what you're being billed for.

If you're being billed for items:

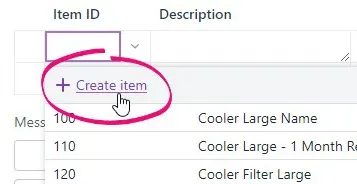

in the Item ID field, click the dropdown to choose an item or search for an item by entering all or part of the Item ID or Supplier item ID. As you type, matching items are shown.

Entering a new item?

Click the dropdown arrow in the Item ID column and choose + Create Item. Enter the item details and click Save. Learn more about Creating items.

When you choose an item, its Description, Asset category for tracking inventory, Unit price and Tax code appear automatically, based on what you entered when you created the item (you can edit these details if you want).

In the No of units field, enter the quantity to be delivered. The calculated Amount is displayed.

There's a built-in calculator in the No of units, Unit price, Discount and Amount fields. Just enter a calculation in the field and tab out of it:

Repeat step a for each item on the bill.

If you're being billed for services:

In the Description column, enter a description of the service you're providing.

Choose the Category the expense from this service will be allocated from. If you're not sure, check with your accounting advisor.

Enter the Amount of this service.

If required, change the Tax code. If you're not sure, check with your accounting advisor.

Repeat step 10 for additional services. If you need to delete a line from your bill, click the delete (x) icon to the right of the item line.

If you want, enter a note to appear on the bill.

If you're making a payment against the bill, enter it in the Amount paid field.

Enter any charges for Freight, and if required, change the default Tax/GST code. If you can't enter Freight, you'll be prompted to specify a linked category for freight. (What is a linked category?)

The totals are calculated at the bottom of the bill:

Subtotal—the total for the items added to the bill

Tax—the amount of tax applied to the bill

Total—the subtotal amount plus the tax amount

Amount paid—the dollar amount that's already been paid to the bill.

Balance due— the amount owing.

(Optional) Choose a Job if the line item relates to a specific job. Tell me more about jobs.

Check that all the information in the bill is correct.

When you're done, use the buttons across the bottom of the page to choose an action.

If you want to... | do this... |

|---|---|

Print or save a PDF copy | Click View PDF. The bill appears as a PDF in a new tab where you can print or save it. See Previewing and printing bills. |

Cancel without saving | Click Cancel. |

Save it as a recurring bill | Click Save as recurring. Enter the recurring transaction Schedule name and choose the Frequency, such as Daily, Weekly or Monthly. Learn more about recurring transactions. |

Prefill the bill from a recurring transaction | Click Prefill from recurring. Select a recurring transaction and click Prefill. The bill is updated with information from the recurring transaction. Learn more about recurring transactions. |

Save the bill and create a new one | Click Save and new then choose Save and create new. The bill is saved and a new, blank bill appears. |

Save the bill and create a duplicate | Click Save and new then choose Save and duplicate. The bill is saved and a new bill with the same details and new bill number is created. |

Save the bill | Click Save. |

Here's our example bill:

Ready to pay the bill? See Entering payments made to suppliers.

FAQs

How can I record cash purchases?

If you want to keep track of cash purchases, set up a contact called "Cash Purchases" and choose this contact when making a cash purchase.

My business isn't registered for GST - why is GST appearing in my bill?

In MYOB Business, the bill's tax code is based on the tax code assigned to the item or category:

In item bills, the default tax code is based on the tax code assigned to the item. If your business is not registered for GST, you should edit the item to set its default tax code to N-T.

In service bills, the default tax code is based on the tax code assigned to the category. If your business is not registered for GST, you should edit the category to set its default tax code to N-T.

Why am I seeing the error "You must specify a cost centre"?

If you use cost centres in AccountRight, there's a preference you can turn on which requires a cost centre to be selected for every transaction.

Until we implement cost centre functionality in the web browser version of AccountRight, if you're seeing this message in the browser you'll need to record the transaction in your desktop AccountRight software.

(AccountRight browser users) Why has the default Freight tax code changed?

If you access an AccountRight company file in a browser, you might notice that the default Tax/GST code for the Freight field is different when you enter a purchase in the browser.

This is because the default Tax/GST code in the browser is set in the linked category for freight (Accounting menu > Manage linked categories > Purchases > Expense or cost of sales category for freight), whereas in the desktop app it's set in the supplier's card (Card Information window > Buying details > Freight Tax Code).

You can easily change the Tax/GST code in the transaction or set a new default Tax/GST code in the browser by editing the freight linked category.

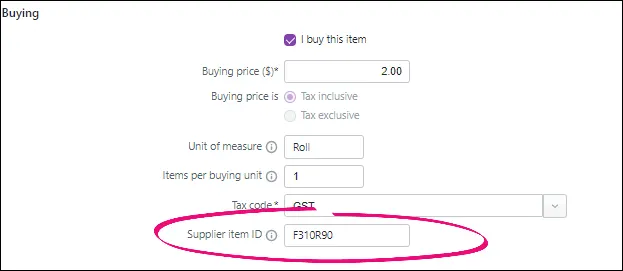

Why is the ITEM NO column blank on my bill PDF?

This is because you need to enter a Supplier item ID in an item listed on the bill.

You can add a Supplier item ID in the Buying section of your inventory items.

You can use the Supplier item ID to check against supplier bills or to help you to find the item when buying or selling it.

The Supplier item ID also appears in the ITEM NO column of your bill PDF (this column previously displayed the Item ID). This makes it easier for the supplier to look up the item in their inventory and close your order.

How do I change the category in item bills?

To ensure the right category is used for your item bills, the asset category for tracking inventory that you've set for the item will be used. If you want to change this category you'll need to do it in the item.

Just bought something? Maybe you've received a bill for electricity or another expense? Or do you need to order something from a supplier?

To help you keep track of what you're purchasing, who you need to pay, and when the payment is due—record it in AccountRight as a bill, quote or order.

And don't worry, if you make a mistake (like entering the wrong amount or double-entering it), you can edit or delete it.

For a quicker way to create a bill, add your supplier invoices to the AccountRight In Tray. Using AccountRight Basics? Enter your expenses using Spend Money transactions.

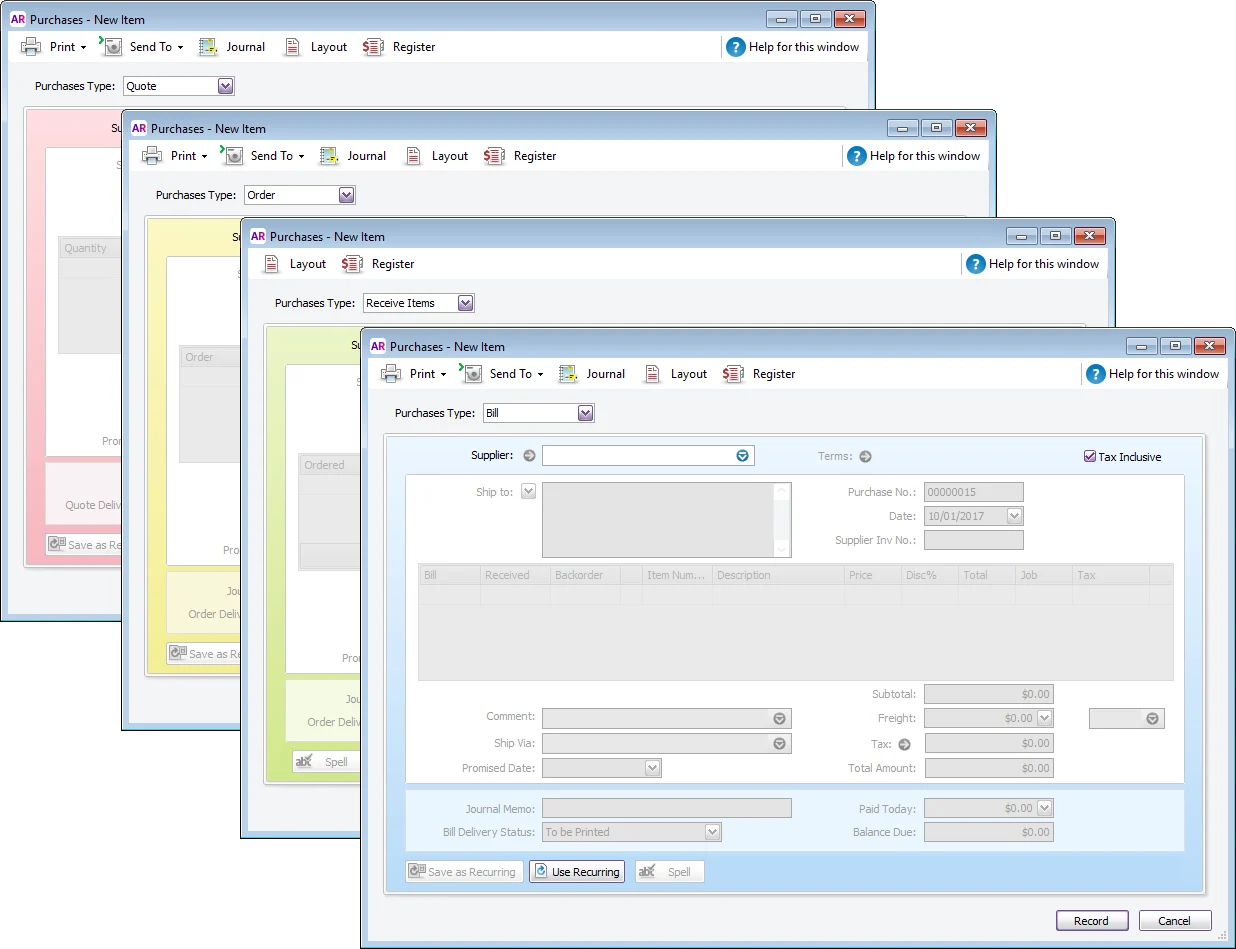

What's the difference between a bill, quote and order?

You'll choose the Purchase Type at the top of the purchase transaction. Each type represents a different stage in the purchase process, from quote or order to a bill.

Quote—Enter a quote to store an estimate or quote you received from one of your suppliers. A quote has no impact on your inventory levels and can be changed to an order or a bill when you are ready to purchase.

Order—An order is a purchase where no goods or services have been received yet. While orders don't affect your financial figures, they do affect your inventory levels. Orders don’t create transactions unless you have paid a deposit to the supplier. An order can be changed to a bill but not a quote.

Receive Items—If you receive items you've ordered but haven't yet been billed for them, you can record a 'receive item' transaction. When you record items received, the item is added to your inventory and the cost of the item is added to an accrual account for inventory items until you record a purchase for it. An accounts payable transaction is not recorded at this time. You can only record a received items transaction in the item layout, and only against an order.

Bill—A bill is used when you receive the goods or services from a supplier, or they've sent you their invoice, i.e. you've been charged for the purchase. Recording a bill will update the appropriate accounts, including the account for tracking payables. Bills can be open (unpaid), closed (paid) or debit (negative purchase). A bill can't be changed to a quote or an order.

When a purchases progresses from one stage to another, for example an order is fulfilled and you receive the supplier's bill, you can change the purchase type.

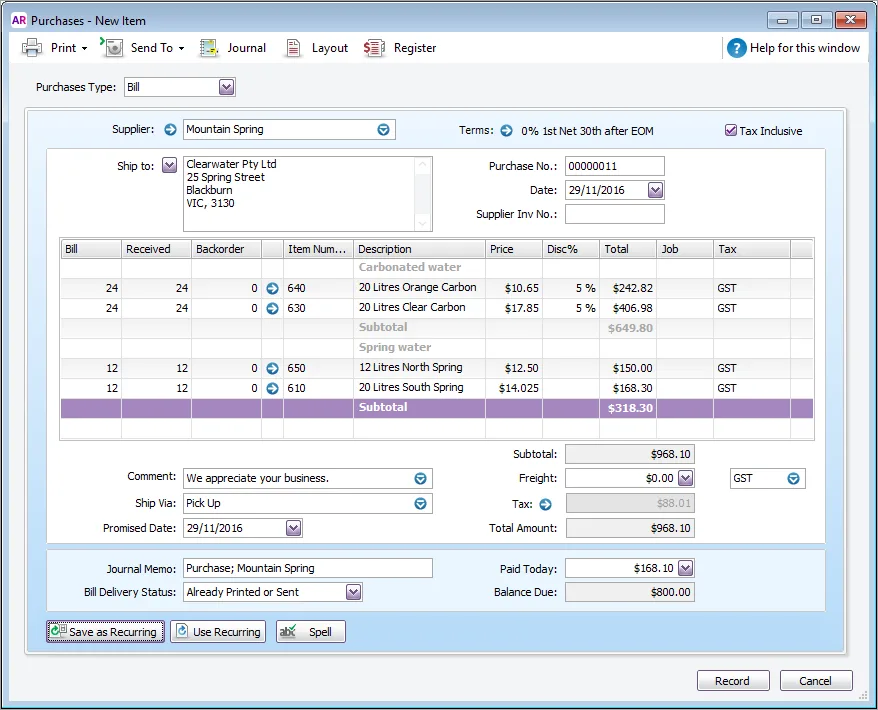

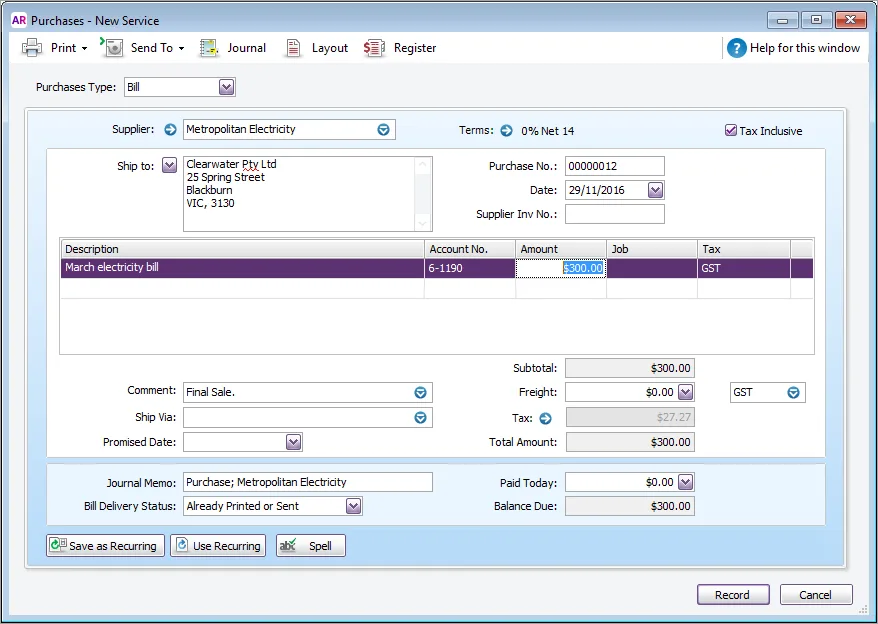

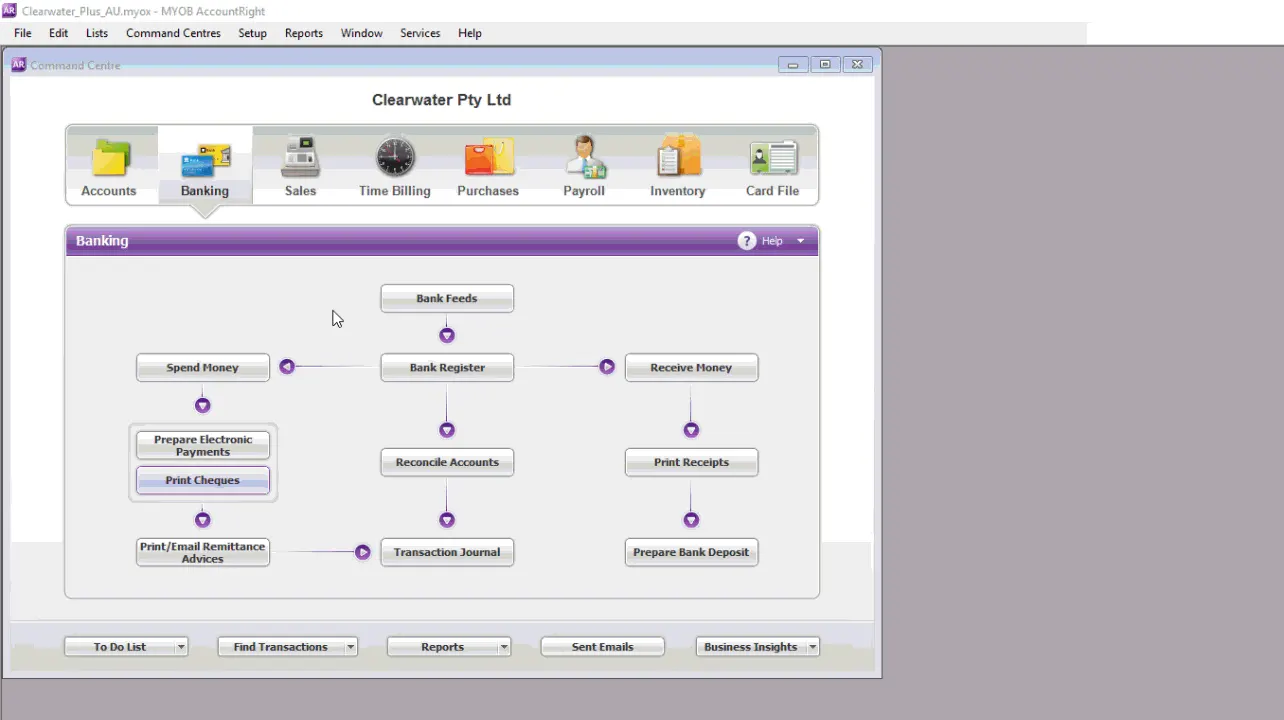

To enter a purchase

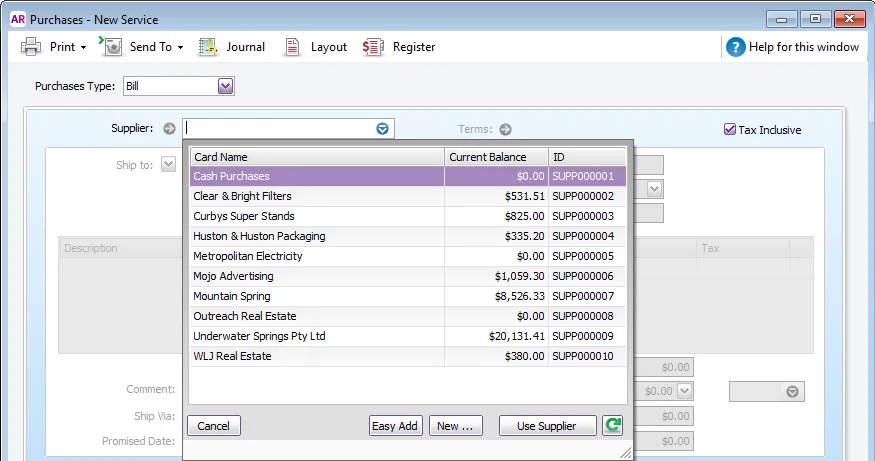

Go to the Purchases command centre and click Enter Purchases.

Select the supplier, or add a card for them. Note that you can't change the supplier once you've recorded the purchase.

Are the credit terms right? Click the Terms arrow to change the supplier's default credit terms for this purchase only.

If you're entering prices that include tax or GST, select the Tax Inclusive (Australia) or GST Inclusive (New Zealand) option. The selection you make will be remembered for your next purchase. Don't change this setting after you start entering amounts.

The Purchase No. field shows the next available number. If you click in the Purchase No. field, Auto # appears to confirm that the number has been automatically selected for you. You can type a different number into the field if you want. Subsequent purchase numbers will then increment from the new number. If your purchase number includes letters, the letters won't automatically appear in subsequent purchase numbers (you'll need to enter these each time).

You might want to use the preferences below to have more control over your purchase numbers.

to prevent duplicate purchase numbers being used (Setup > Preferences > Purchase> Warn for Duplicate...Numbers on Recorded Purchases).

to keep the same purchase number when converting a quote or order to an invoice (Setup > Preferences > Purchases> Retain Original PO Number when Changing a Purchase between Quotes, Orders or Bills).

Want to change the purchase layout to suit the type of goods or services you're purchasing? Click Layout. Note that purchases using the Miscellaneous layout can't be printed or emailed.

Use the the Purchases Easy Setup Assistant to set a default purchase layout (Setup menu > Easy Setup Assistant > Purchases > Layout). Or you can set a supplier-specific default layout in the Buying Details tab of the supplier’s card.

Select whether you're recording a quote, order or Receive Items (Not Basics), or bill from the Purchase Type list in the top-left corner. The Receive Items option only appears for the Item purchase layout. If you record a quote or order, you can change the purchase type later when the status of the purchase changes.

Enter details of what you're buying, as well as headings, subtotals and blank lines. The fields that are available depend on the purchase type and layout you've selected.

Need to remove a line? Right-click it and choose Delete Line.Enter item purchase fields

Field

Description

Order/Quantity/Bill

Enter the quantity to be delivered. The field name depends on whether you’re recording a quote, order or bill.

Received

This field is read-only. It displays the quantity of items received against an order.

If you're using the Receive Items layout, a To Date and Receive columns appear instead.

Item Number

Enter an item from your item list.

Backorder

Enter the quantity of the item to be placed on backorder. An order for this amount will be created automatically when you click Record.

Description

A description of the item appears automatically. You can change this if you want. If you want to check spelling in this field, click Spell.

Location

[AccountRight Premier 2019.2 and later only] If you store this item in more than one location, select the location where the item will be received. For more information, see Multiple inventory locations.

Price

The price of the item appears automatically. You can change this if you want.

Disc%

[Optional] If you've been given a discount, type it as a percentage. If you've been given a dollar discount, enter the updated price in the Total column, and the discount percentage will be calculated for you.

Total

The total price of the items is calculated automatically. If you change the total, the Disc% field is updated to show the discount applicable.

Job

[Optional] Select a job number here to assign a line item to a specific job. This line item can be reimbursed later.

Tax/GST

The default tax (Australia) or GST (New Zealand) code for an item appears here. If you want to change it, enter the required tax/GST code.

Enter Service, Professional, and Miscellaneous purchase fields

Field

Description

Description

Enter a description of the goods or services being purchased. If you want to check spelling in this field, click Spell.

Acct No. or Account Name

Enter the account to which to allocate the purchase. This should be an expense or cost of sales account. You should not select your accounts payable account for supplier purchases.

There's a preference which controls if the account name or number is displayed (Setup > Preferences > Windows tab > Select and Display Account Name, Not Account Number).Amount

Enter the amount you've been billed for.

Job

[Optional] Select a job number here to assign a line item to a specific job. This line item can be reimbursed later.

Tax/GST

Select a tax code (Australia) or GST code (New Zealand) for the purchase.

Enter any charges for Freight, and if required, select the right Tax/GST code. If you can't enter Freight, make sure you've specified a linked account for freight.

Calculated tax/GSTClick the zoom arrow next to the Tax / GST field to view or change the tax (Australia) or GST (New Zealand) amounts assigned to the purchase. Be aware that changes to a transaction's calculated tax/GST won't be reflected in BASlink or GST Return calculations.

Enter an amount in the Paid Today field to record the amount you've paid at the time of the purchase. If you are creating an order, record the amount you gave you as a deposit.

Enter any additional purchases information:

Comment - A comment you want the supplier to see on the purchase form

Ship Via - The method the purchase will be shipped to you

You can set up a default list of comments and shipping methods, that can be selected when recording purchases. See Sales and purchases information.

Promised Date - The date you expect delivery

Journal Memo - A description of the purchase that will appear in the journal entry for it

Bill Delivery - Select whether you want to print or email the form later, or if you don't want to print or email it, select Already Printed or Sent

Click Record (or Save Quote for quotes) to just save the purchase, or click Print to also print a form. If you want to email the purchase or save it as a PDF (not available for Miscellaneous purchases), click Send To.

Do you regularly record similar purchases? Save time by saving the purchase as a recurring transaction.

FAQs

What is the Supplier Inv No. field used for?

If the supplier gave you an invoice for this transaction, you can enter that quote, order or invoice number in the Supplier Inv No. field. You can search for purchases by the supplier's invoice number. You can also add the field to your purchases reports.

Can I display tax/GST on each line of a purchase?

Yes. You can personalise the purchase form to add the Line Tax field. Then when you email or print the purchase order it will display tax/GST on each line.

Here's how:

Go to the Setup menu and choose Customise Forms.

Select the form to be customised then click Customise.

Right-click on the form where the transaction lines are displayed and choose Show/Hide Columns.

In the Available Columns list, click Line Tax then click Show.

Click OK.

Click Print Preview to see what the form will look like.

Make any necessary changes.

When you're happy with the changes, save the form

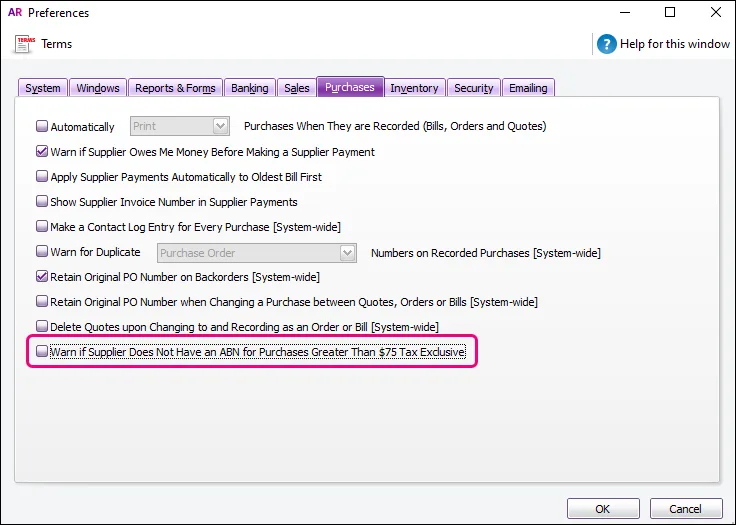

How do I turn off the 'no ABN' warning when recording purchases?

If you want to turn off the 'No ABN/TFN' warning message that appears when recording purchases of more than $75 (for example, if you buy from an overseas supplier with no ABN), go to the Setup menu > Purchases tab and deselect the option:

How do I record a note about the purchase?

You can enter a brief description in the Journal Memo field. You can search for purchases using the text you enter in this field. If you don't want this information to appear on printed/emailed purchases, ensure that the Memo field is not included on the form.

How do I edit the list of comments and shipping methods?

To add, edit or delete the list of comments and shipping methods, go to the Lists menu > Sales and Purchases Information window.

Why is the item number blank when I print purchases?

The default field on the purchase form is Supplier Item Number, this is entered in the item information under buying details. If you don't use this field then the item number will print blank.

You can personalise the purchase form to remove Supplier Item Number and add My Item Number. Then when you email or print the purchase it will display the Item Number entered under the Profile tab of your item.

Here's how:

Go to the Setup menu and choose Customise Forms.

Select the form to be customised then click Customise.

Right-click on the form where the transaction lines are displayed and choose Show/Hide Columns.

In the Available Columns list, click My Item NO. then click Show.

In the Available Columns list, click Item NO then click Hide.

Click OK.

(Optional) If you want to change the column order, click and drag the column headings.

Click Print Preview to see what the form will look like.

Make any necessary changes.

When you're happy with the changes, save the form.

See this in action

Why does the freight amount disappear after I enter it?

If you enter an amount in the Freight field and the amount disappears after you tab out of the field, this indicates that you need to specify a linked account for freight.

How do I turn automatic spell checking off or on?

Go to the Setup menu and choose Preferences. The Preferences window appears.

Click the Windows tab.

If you want to automatically check spelling select the Automatically Check Spelling in Text Fields Before Recording Transactions option.

To turn off automatic checking, deselect this option.

For more information on the spelling checking feature, see Check spelling