Last updated 4 February 2026

Each month we release improvements, new features and bug fixes to MYOB Business. You'll also notice these changes if you use AccountRight in a web browser. If you use AccountRight desktop software, see what's new.

See what's new without leaving MYOB Business

Click the help icon and look for the What's new link at the bottom of the help panel.

What we released in January

Banking

We've made some improvements on the Bank transactions page to make life a little easier:

Multiple records containing the same category no longer disappear when the page is refreshed.

Now when you unmatch or rematch a bank transaction, only transactions that were created by the match will be removed.

If you use the Tab key to focus on a transaction which isn't linked to a category, you'll no longer see an error.

Also, if a bank transaction is dated within a bank reconciliation period but it's matched to a future dated MYOB record, you can now select that transaction to be reconciled.

MYOB Assist mobile app

Australia only

MYOB Assist, the companion app for MYOB Business and AccountRight, keeps getting better.

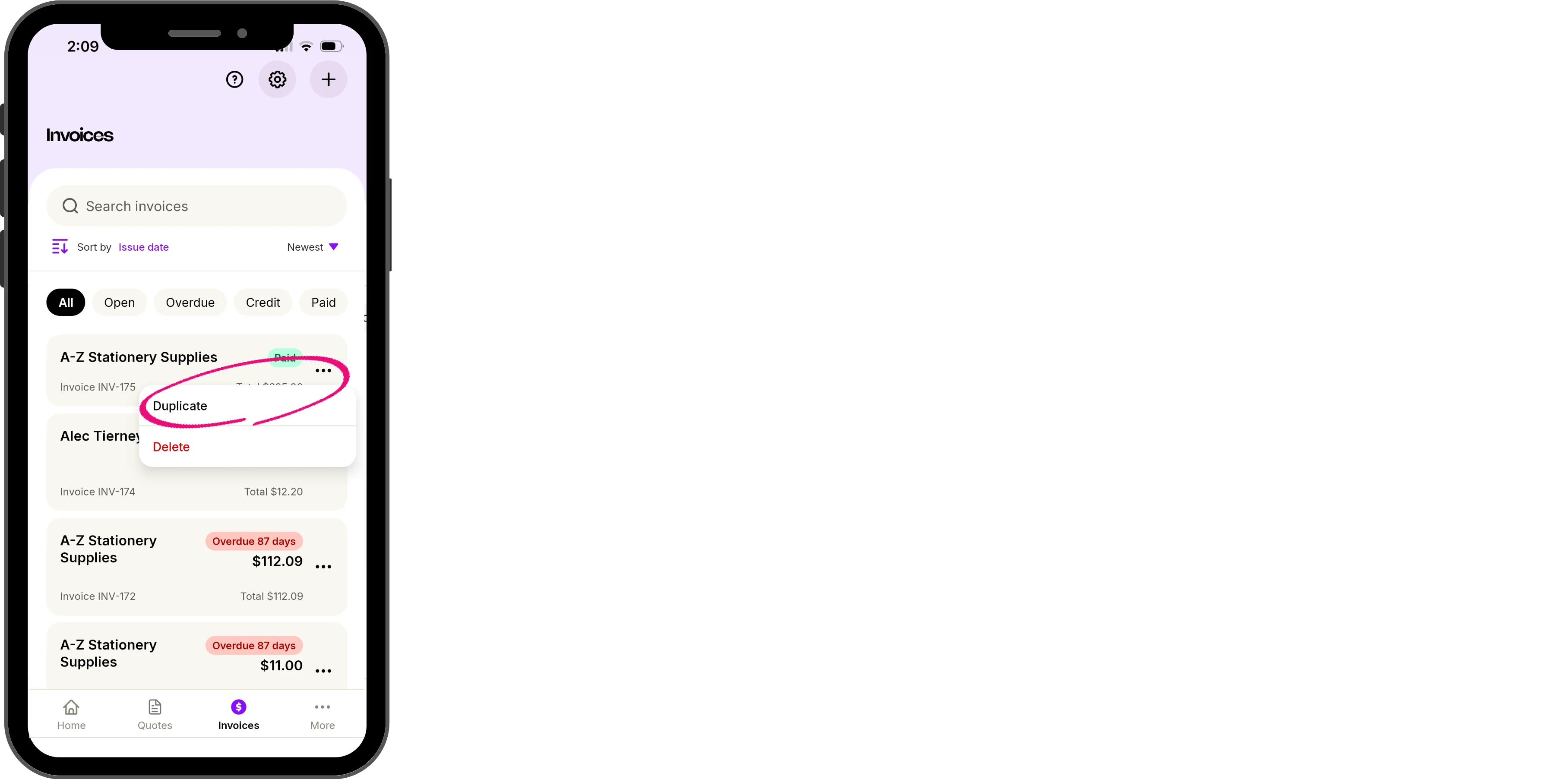

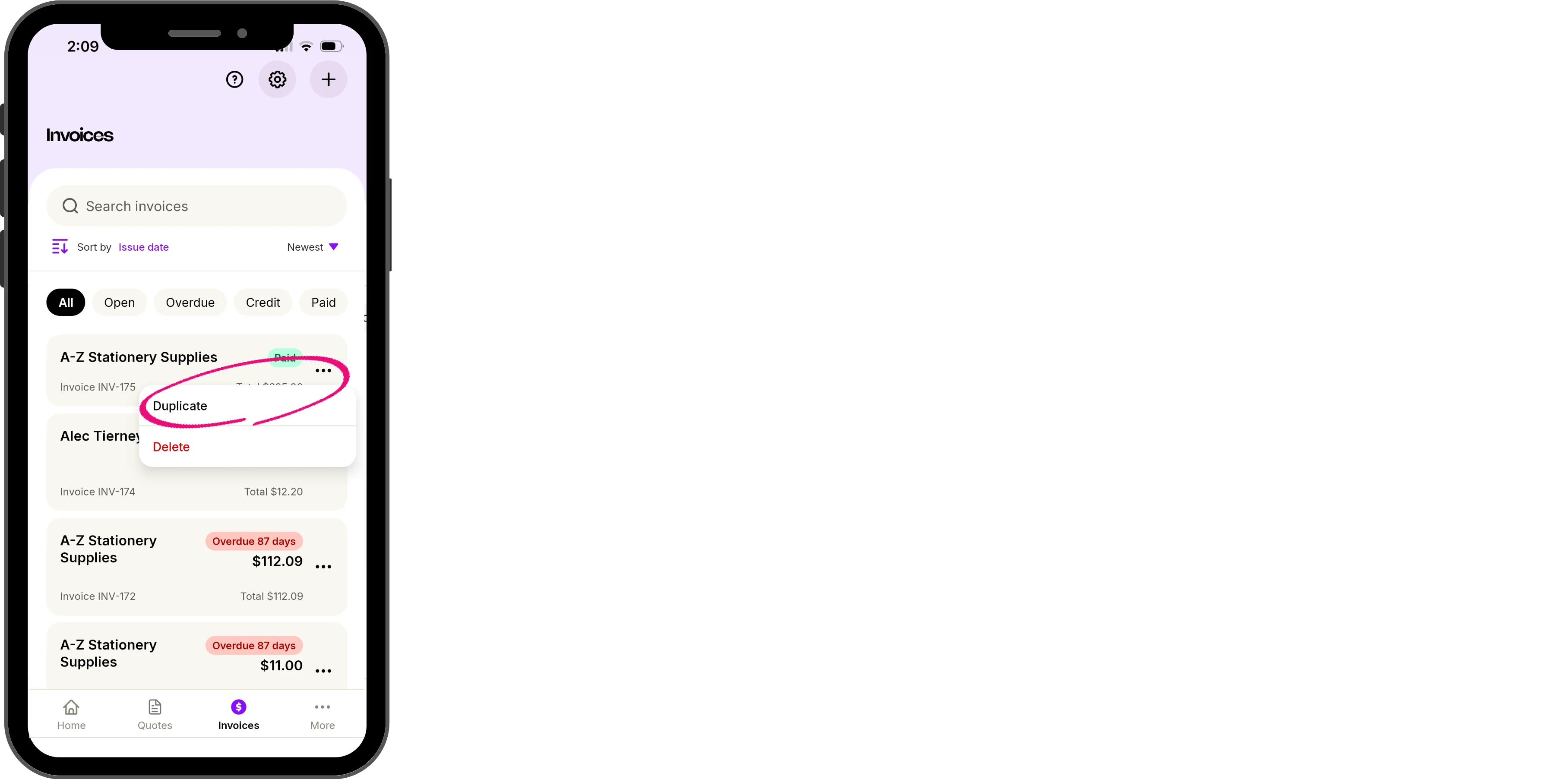

Duplicate invoices and quotes to quickly create new ones

Instead of creating new invoices and quotes from scratch every time, you can now duplicate existing ones. This copies all the details into a new invoice or quote so all you need to do is make any required changes then save and send. Update to the latest version of the app to see this feature (if auto-update is turned off).

In focus...

Get a sneak peek of what we're working on – see what's coming up.

Previous releases

To learn about changes to MYOB Business in previous releases, see MYOB Business release history.

Each month, we release improvements, new features, and bug fixes. If your company file is online, you can also use AccountRight in a web browser – take a look at what's new in the browser.

What's new in AccountRight version 2026.1 - released 11 February

Banking

Faster bank transaction review

We’ve improved the performance of bank transaction matching so loading and updating your matched and unmatched transactions is faster and smoother – especially for busy files with lots of banking activity. This doesn't change how you work, it's just a snappier experience.

MYOB Assist mobile app

Australia only

MYOB Assist, the companion app for MYOB Business and AccountRight, keeps getting better.

Duplicate invoices and quotes to quickly create new ones

Instead of creating new invoices and quotes from scratch every time, you can now duplicate existing ones. This copies all the details into a new invoice or quote so all you need to do is make any required changes then save and send. Update to the latest version of the app to see this feature (if auto-update is turned off).

AccountRight bug fixes

We’ve fixed an issue that could cause matched transactions to be removed when you unmatched or rematched a bank transaction. Now, only transactions that were created by the match will be removed when you unmatch or rematch.

Coming soon...

If your company file is online, there are some exciting things just around the corner. When AccountRight 2026.1 is released, the following features will be going to a small group of users as part of our testing, but they'll soon be rolled out to everyone.

Automatic and manual online backups

Online company files are automatically backed up to the cloud each week, and you'll soon be able to create your own point-in-time online backups whenever you need. Online backups will be stored securely for 6 months.Self-serve restores from online backups

If something goes wrong, like an import that doesn't go to plan, you'll soon be able to restore your online company file back to an earlier point in time – without needing to contact support.Spend less time signing in and more time getting stuff done

Soon, you'll no longer need sign into AccountRight browser separately when you are already signed into the AccountRight desktop app (and vice versa). Once you’re signed in, you’ll stay connected across platforms without needing to re-enter your details (unless your software times out after inactivity).Open Banking (progressive rollout - Australia only)

From early March 2026, Open Banking will roll out in stages in the browser version of AccountRight, starting with new customers at major banks and progressively expanding to all participating banks and existing customers. Note, if you set up bank feeds via Open Banking, you'll need to provide a valid ABN and enable a nominated representative via online bank permissions. Keep an eye out for further communications.

After each release, we retire an older version

We usually release an AccountRight update around the middle of the month with improvements and fixes.

As updates are released, older versions are decommissioned and no longer work online. If you're using an older version and your file's online, you must update to the latest AccountRight version to keep working.

If you're using AccountRight version 2025.11, you must update by 24 February*.

Shut down AccountRight when you're not using it. If you leave AccountRight open all the time, you may miss out on automatic updates.

* All dates are indicative only and subject to change.

How to get this update

If you use AccountRight PC Edition (version 2021.1 or later) or AccountRight Server Edition (version 2022.4 or later) you'll automatically be updated to the latest release of AccountRight. The next time you log in after that, you'll be prompted to restart AccountRight to complete the update.

If you use AccountRight Server Edition version 2022.3 or earlier you can download the latest version for your server (AccountRight subscription required). Learn more about updating an AccountRight network.

Not sure what edition you're using? If you can see SE in the desktop shortcut description, you're using Server Edition. Otherwise, you're probably using the PC Edition.

If you're updating from an older AccountRight version, like AccountRight Classic (v19), learn how to upgrade.

If you see a message that AccountRight needs updating when you open AccountRight, you need to restart AccountRight to install any pending updates. See Getting the latest version.

Previous releases

To learn about changes to AccountRight in previous releases, see the release history.