Overtime is time worked in addition to normal working hours. Depending on your agreement with an employee, you might pay overtime at the employee's normal rate or a higher rate.

Check the rules!

For all the rules on an employee's hours of work, including overtime, check the Employment New Zealand website.

To include overtime in an employee's pay, and to clearly show it separately from their normal pay, you can set up a new earning.

The same approach can be used for penal rates, weekend rates, or any other additional pay rates.

Setting up overtime

If you pay different overtime rates for an employee, such as one rate for Saturdays and a different rate for Sundays, you'll need to set up an earning for each rate.

Go to the Payroll menu > Employees.

Click an employee who will be paid overtime.

Click the Standard pay tab.

Under Earnings, click Add earnings > Create earnings pay item.

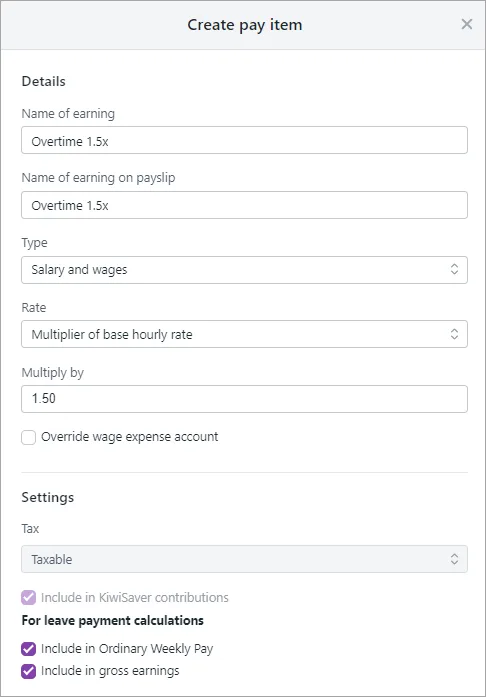

Enter a Name of earning, for example "Overtime x1.5".

If you'd like a different name to show on your employees' pay slips for this earning, enter a Name of earning on pay slip, such as "Saturday rate". Otherwise enter the same text as the Name of earning.

For the earning Type, choose Salary and wages.

Choose the applicable Rate:

Choose Multiplier of base hourly rate for employees paid an hourly rate, then enter the overtime rate in the Multiply by field. For example, for time and half enter 1.5 or for double time enter 2.

Choose Per hour for employees paid a salary, then enter the Default rate ($). This is the amount that will be paid for each hour of this overtime.

(Optional) If you have a separate account that you'll use to keep track of overtime payments:

Select the option Override employee's earning expense category.

Choose the applicable Wage expense category. How do I create categories?

Select the applicable leave payment calculation options.

Include in Ordinary Weekly Pay - Ordinary weekly pay is the amount an employee receives under their employment agreement for an ordinary working week, including:

regular allowances, such as a shift allowance

regular productivity or incentive-based payments (including commission or piece rates)

the cash value of board or lodgings

regular overtime.

If you're not sure if an earning pay item should be included in ordinary weekly pay, check the Employment New Zealand website.

Include in gross earnings - Gross earnings typically means all payments you're required to pay under an employee's employment agreement for the period during which the earnings are being assessed. If all of the components of gross earnings are not included in the relevant calculations for holidays and leave, the employee will likely be underpaid.

If you're not sure if an earning pay item should be included in gross earnings, check the Employment New Zealand website.

If the same overtime rate applies to other employees, choose them under Employees using this pay item. Otherwise you can create a separate earning for different rates/employees.

Here's our example overtime earning for an employee paid an hourly rate:

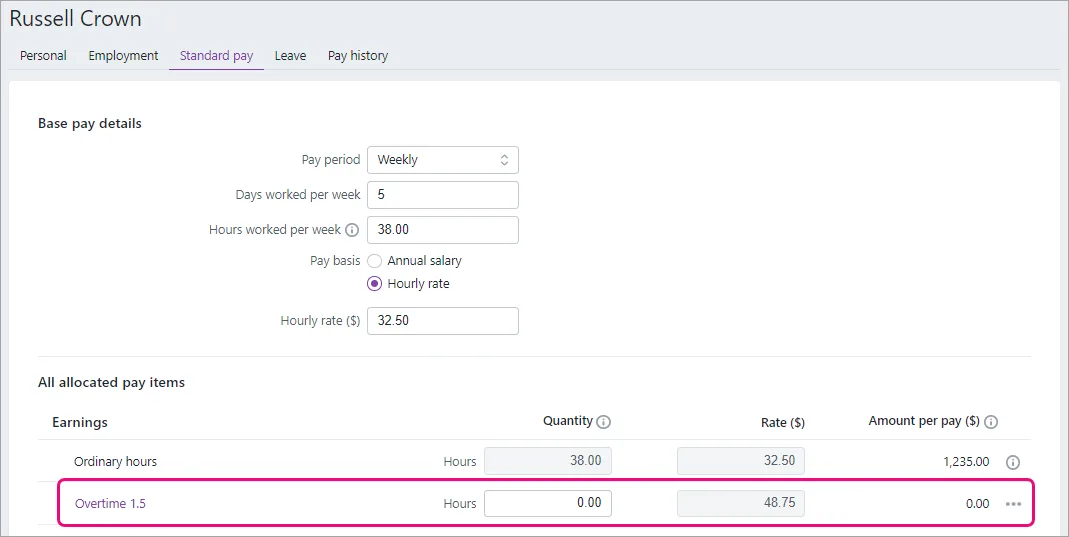

Click Save. The overtime earning is now listed on the Standard pay tab of all chosen employees.

Paying overtime

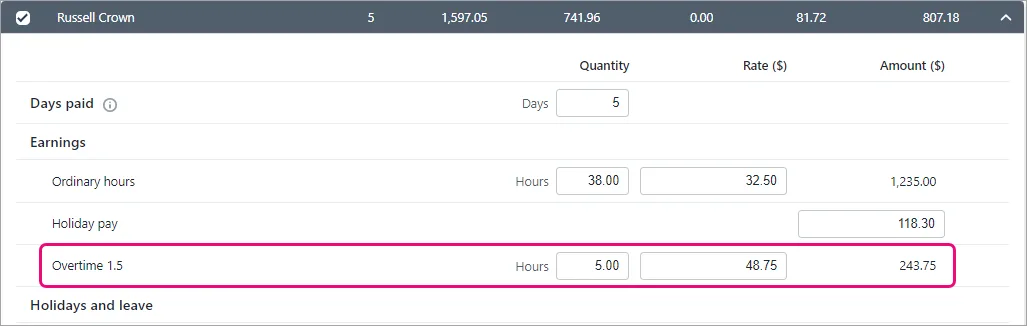

When you pay an employee who's worked overtime, you can enter any overtime hours a employee has worked.

Go to the Create menu > Pay run.

Choose the Pay cycle and confirm the pay dates.

Click Next.

Click the employee to open their pay.

Enter the number of overtime hours against the overtime earning.

Continue processing the pay as normal. Need a refresher?