There are two ways you can pay a bonus or commission:

include the payment in the employee's regular pay, or

process the payment separately.

Either way, you'll need to set up the bonus or commission payment and assign it to the applicable employees. You can then process the payment in a pay run.

Setting up a bonus or commission

You can create an earning for bonus or commission payments so you can include those payments in an employee's pay. If an employee requires more than one type of bonus or commission, you can create additional earnings.

If the bonus or commission will be the same amount each pay, you can set this amount. You can also set different amounts per employee, or enter the bonus or commission amount when you do a pay run.

To create an earning for bonus or commission payments

Go to the Payroll menu > Employees.

Click the employee who will be paid the bonus or commission. You'll be able to add the earning to additional employees later.

Click the Standard pay tab.

Under Earnings, click Add earnings > Create earnings pay item.

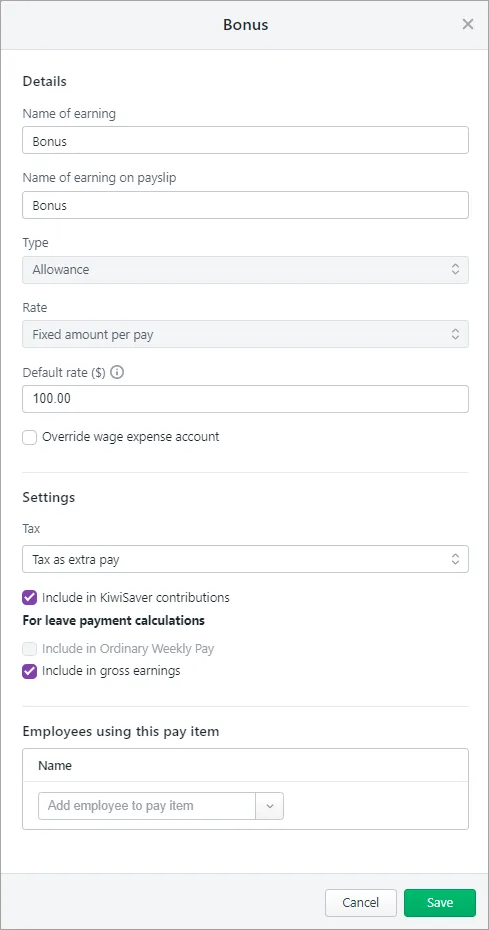

Enter a Name for the earning, for example "Christmas Bonus"

If you'd like a different, more personalised, name to show on pay slips for this earning, enter a Name of earning on pay slip, such as "Performance Bonus - Steven". Otherwise enter the same text as the Name.

For the Type, choose Allowance.

Choose the Rate:

Fixed amount per pay - same amount each pay

Per unit - set amount per number of units, such as kilometres

Enter the Default rate. Or you can leave this set this to 0.00 and enter the amount when you do a pay run (see below).

(Optional) If you want to track these bonus or commission payments through a separate account, select the option Override employees' wage expense account and choose the override account in the field that appears. Need to create a new account?

Select the applicable Tax:

If the bonus is paid as a lump sum, choose Tax as extra pay (Non-termination payment). To check if a bonus is a lump sum payment, visit ird.govt.nz. Deselect the option Include ACC earners' levy.

If the bonus is paid regularly, choose Taxable.

Select the option Include in KiwiSaver contributions.

If the bonus or commission will be included in gross earnings for leave calculations, select the option Include in gross earnings. Most bonuses are included in gross earnings unless the bonus is discretionary. For help working out if the bonus should be included in gross earnings, visit employment.govt.nz

Under Employees using this pay item, choose all other employees who are to be paid this bonus or commission. To remove an employee, click the delete icon for that employee.

When you're done, click Save. Here's our example:

The bonus or commission earning will now be available in each of the chosen employee's pays. When you do a pay run, you can enter or change the bonus or commission amount you're paying them. Or you can set a default payment amount for an employee as described below.

To assign the earning to additional employees

After setting up a bonus or commission earning (as described above), you can assign it to additional employees.

Go to the Payroll menu > Employees.

Click the employee's name.

Click the Standard pay tab.

Under Earnings, click Add earnings and choose the bonus or commission earning you created above.

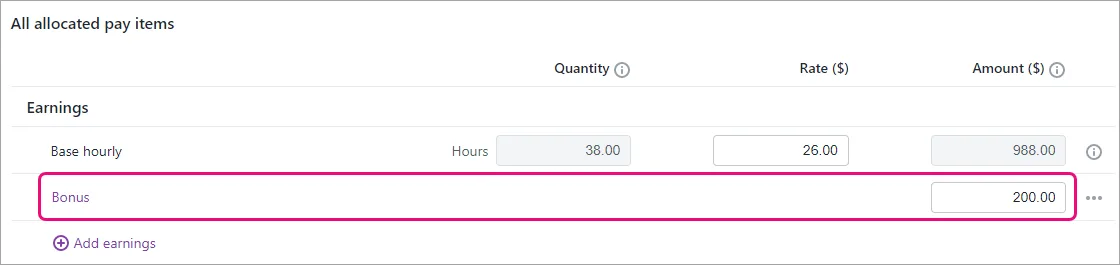

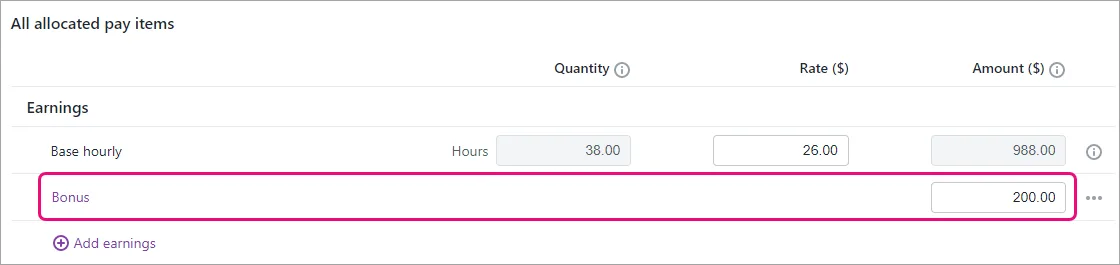

If the employee will receive the same amount for the bonus or commission each pay, enter this value. If this is set to 0.00 you'll need to enter the amount each time you pay the employee.

Click Save.

To set a payment amount for an employee

If an employee will receive the same payment amount each pay, you can set that amount in their standard pay. This means you won't have to enter the amount each time you pay that employee.

Go to the Payroll menu > Employees.

Click the employee's name.

Click the Standard pay tab.

Enter the bonus or commission amount to be paid to this employee each pay.

Click Save.

The set amount will now be included each time you pay the employee. But you can easily change or remove the amount when you pay the bonus or commission as shown below.

Once you're set up, you can pay the bonus or commission.

Paying the bonus or commission

Once you've set up the bonus or commission, you can include it in an employee's regular pay, or you can run a separate pay for it to make it clear what you're paying.

To pay the bonus or commission

Go to the Create menu and choose Pay run.

Choose the Pay cycle and confirm the pay dates.

Click Next.

Deselect the employees you're NOT paying.

Click an employee to open their pay.

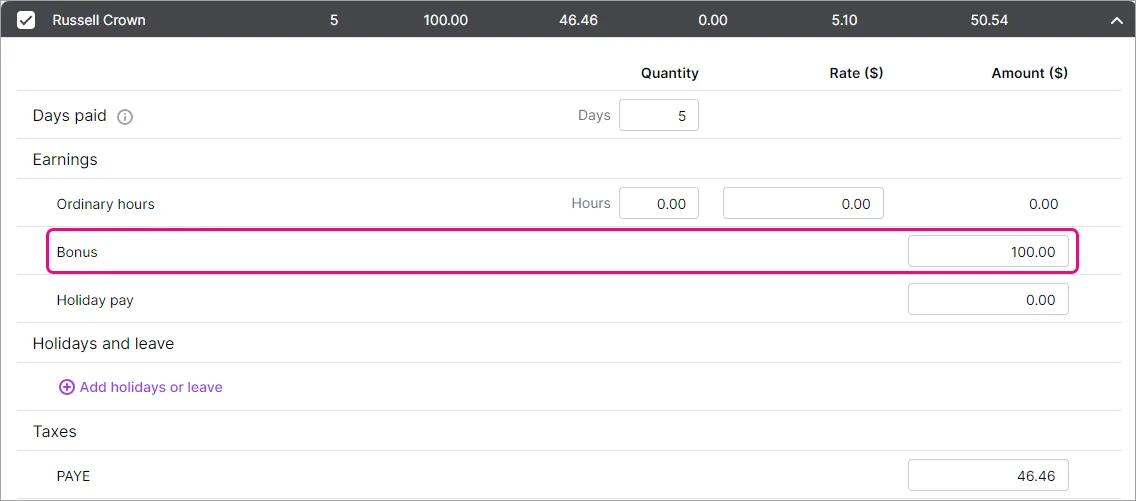

Enter or confirm the amount being paid against the applicable Bonus or Commission.

If this is a separate pay just for the bonus or commission, remove all other Hours and Amounts from the pay. This ensures they're only paid for the bonus or commission.

Here's our example of a bonus-only pay:

Click Next and continue processing the pay as normal. Need a refresher?