When an employee's employment ends, you must pay them the value of all of their available annual leave and alternative holiday entitlements, as well as the calculated value of their accrued (but not yet available) annual leave. There's a handy final pay calculator in MYOB that steps you through the process to ensure the correct leave is paid.

For more details on your final pay obligations, visit the Employment New Zealand website.

Public holidays

Employees may be entitled to be paid public holidays that fall after their employment ends, if they have unused annual holidays owed.

To work out if additional public holidays should be paid

To work out whether an employee is entitled to paid public holidays that happen after their employment has ended, follow these steps:

Treat any remaining annual holidays that the employee is entitled to as if the employee had taken them immediately after the date their employment ended.

The employee must be paid for a public holiday if it:

happens within the time period created by adding on these remaining annual holidays to the end of employment, and

happens on a day that the employee would have worked if they were still employed, and if it wasn't a public holiday.

If the employee is entitled to be paid for a public holiday then:

the period that the annual holidays covers is extended by one day for each public holiday the employee is entitled to be paid for, and

this new extended period may contain more public holidays which also need to be considered for payment.

The payment for any public holidays is calculated in the usual way. They are paid at the rate of relevant daily pay or average daily pay (if applicable) for the day.

This situation has no effect on the actual end date of employment.

Visit the Employment New Zealand website to learn more about payment for leave and holidays in final pay.

Leave in advance

If the employee who's leaving has taken leave in advance, they'll have a negative leave balance. This means:

The total amount paid to an employee for taking leave in advance will be deducted from the Total Holiday pay 8% (final pay).

If the total amount paid to the employee for taking leave in advance is more than the final holiday pay amount, then the Holiday pay 8% (final pay) will be $0.00.

If you want the employee to repay this overpayment:

you'll need a written agreement with the employee to have this overpayment repaid

you'll need to create a before tax deduction and manually add the repayment amount against this deduction in the employee's pay.

If the employee's anniversary date falls within their final pay period, see the FAQs below about how to handle this.

To process a final pay

Start a pay run for the employee (Create > Pay run).

Choose the Pay cycle, confirm the pay dates and click Next.

Select the employee who's leaving.

Click the employee to open their pay.

Add or edit the Days paid this period. This includes whole or part days where the employee earned gross earnings, including days paid for leave.

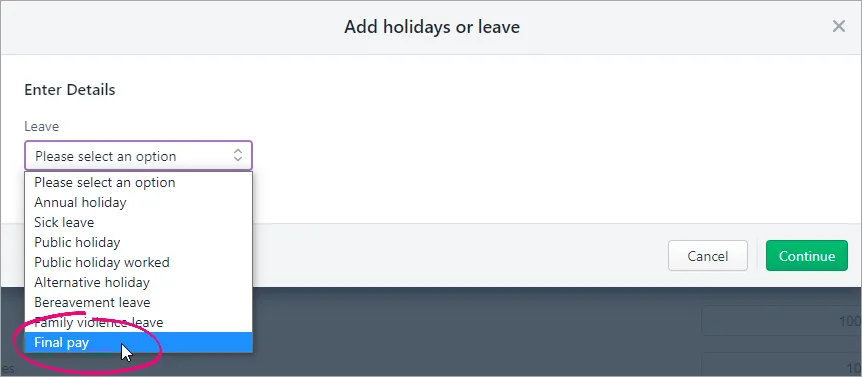

Click Add holidays or leave then choose Final pay.

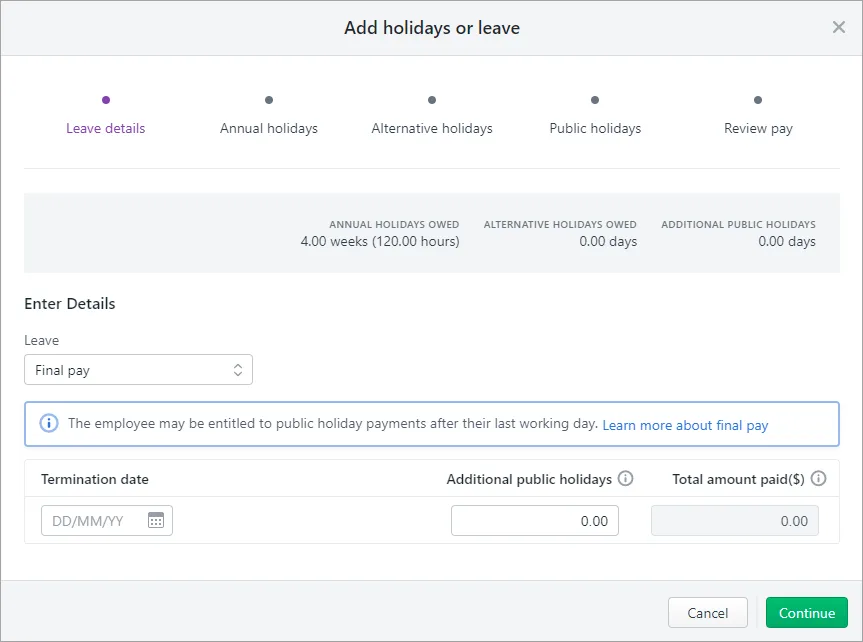

The following screen appears to help you calculate the employee's final pay.

Enter the employee's Termination date (their last day of employment).

Enter any Additional public holidays the employee is entitled to. See above for more details.

If the employee has a negative leave balance (because they've taken leave in advance), this will be automatically entered into the Total amount paid field to be deducted from their final pay. See above for more details.

Click Continue.

If the employee has unused annual holidays, the greater rate of Ordinary weekly pay (OWP) or Average weekly earnings (AWE) will be used. Click the dropdown arrow to view or change a calculation. If the employee has no unused leave balance, this step will be skipped.

Click Continue.

If the employee has alternative holidays owing, choose the Leave rate calculation. Tell me more about leave calculations. If the employee has no alternative holidays owing on termination, this step will be skipped.

If you use Relevant daily pay, enter the Quantity (Hours) the employee would have earned (based on their last day working day).

Alternative holidays in a final pay are paid at what the employee was paid on their last day of employment. For example, if they worked 8 hours on their last day of employment, then the quantity (hours) would be 8. If they have 3 alternative holidays owed, then the quantity (hours) would be 8 X 3 = 24 hours.

If you use Average daily pay, enter the Days paid in the past 52 weeks.

Click Continue.

If the employee is entitled to public holidays, choose the Leave rate calculation. Tell me more about leave calculations.

If you use Relevant daily pay, enter the Quantity (Hours) the employee would have earned had they worked on the additional public holidays.

If you use Average daily pay, enter the Days paid in the past 52 weeks.

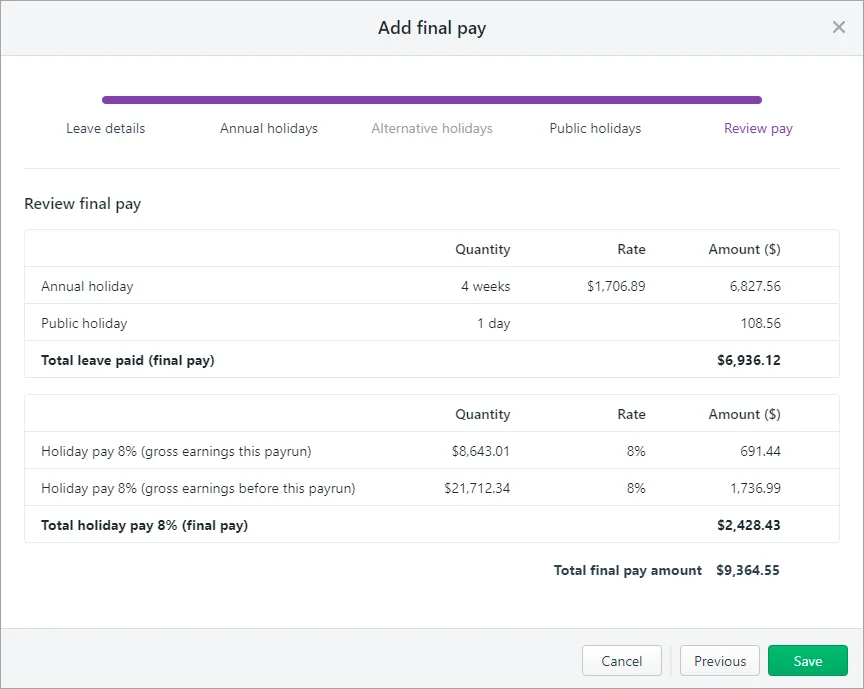

Click Continue and review the details of the final pay.

If you need to make any changes, click Previous to step back through the assistant. Otherwise click Save to include the final pay

Continue processing the pay as normal.

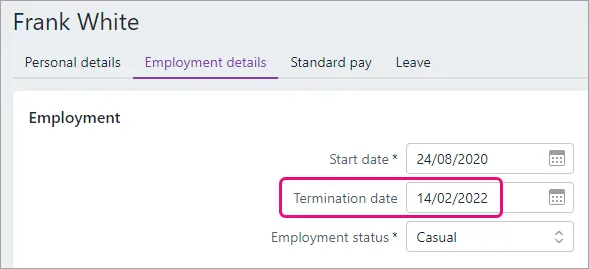

Once you're processed an employee's final pay, the Termination date is added to their record and you won't be able to pay them again.

If you need to pay the employee again, you'll need to delete their termination pay. This will also remove the Termination date from their record.

FAQs

What if an employee's anniversary date falls within their final pay period?

If an employee's anniversary date falls within their final pay period, the holiday pay calculations in the final pay may result in an overpayment. This is because the ‘gross earnings this payrun’ will include the entire pay run, instead of only gross earnings earnt from the anniversary date.

An overpayment will still be compliant, but if you want to avoid this you'll need to split the employee's final pay into two pay runs:

The first pay run will be for the start of their final pay period up until the day before their anniversary date. Process this like a regular pay without clicking Add holidays or leave to use the final pay calculator.

The second pay run will be for the period from their anniversary date up until their final day. You'll process this as per the final pay instructions above.