Paid parental leave is a government scheme for eligible working parents. For eligibility criteria, check the Employment New Zealand website.

If eligible, government payments go directly to the employee taking parental leave. This means you won't need to record those payments in MYOB.

Annual holidays still accrue on parental leave

Annual holidays still accrue while an employee is on parental leave, and this will happen automatically in MYOB. This means the employee doesn't need to be included in pay runs, but you can include them if you like.

When the employee returns to work, you'll need to make sure you reinstate their standard pay details. You also might need to pay their leave using the average weekly earnings (AWE) rate.

To exclude an employee from pay runs during parental leave

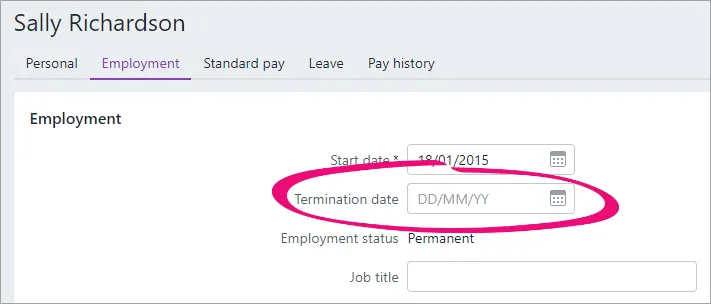

To prevent an employee from being included in pay runs, you'll need to add a termination date to their contact record.

Go to the Payroll menu > Employees.

Click the employee's name.

Click the Employment tab.

Enter or choose the Termination date.

Click Save.

To include an employee in pay runs during parental leave

If you'd like to keep the employee in your pay runs while they're on parental leave, there's a few things you'll need to do in their contact record:

Remove their standard pay amounts so they're not actually paid when you do a pay run.

Create a new earning to record the periods the employee is on parental leave.

Remove their email address to prevent their pay slips being emailed.

Here's how to do it:

Go to the Payroll menu > Employees.

Click the employee's name.

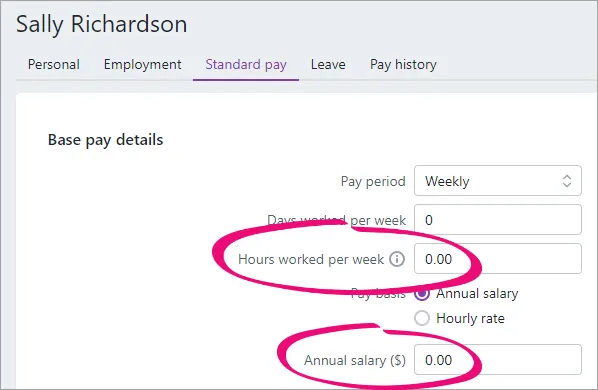

Click the Standard pay tab.

Change the Hours worked per week and Annual salary or Hourly rate to 0.00.

Use the Notes field

Make a record of these values in the Notes field on the Personal tab of the employee's contact record. This will help when you need to add these values back upon the employee's return.

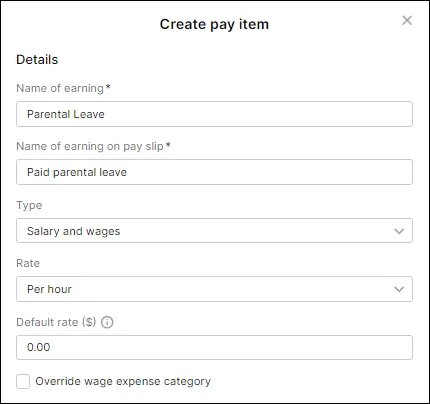

Click Add earnings > Create new earnings pay item.

Name the earning "Parental Leave" and set it to Salary and wages with a Rate of Per hour. Leave the Default rate at 0.00.

Click Save.

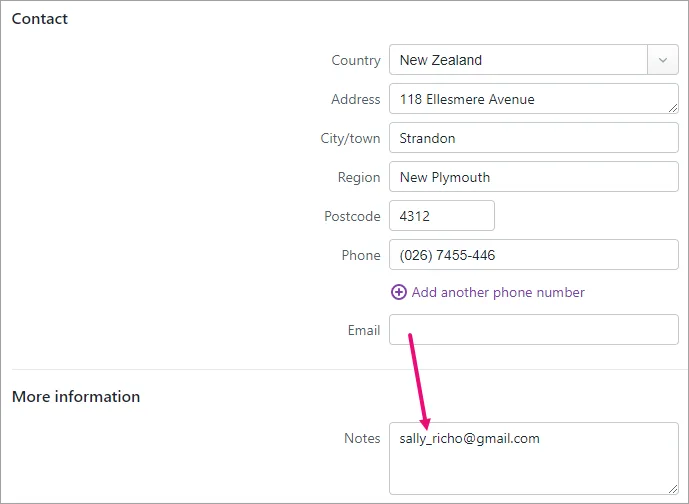

Click the Personal tab.

Remove their Email. We suggest copying and pasting the email address into the Notes field so you can copy it back into the Email field when the employee returns to work.

Click Save.

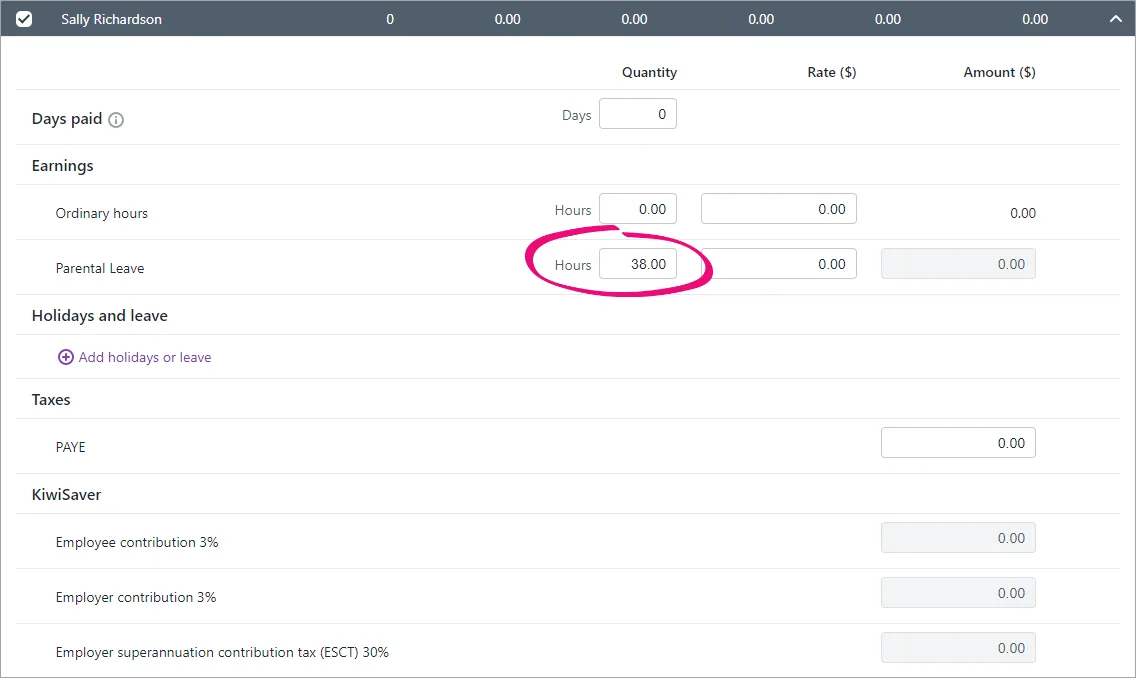

When you do a pay run for the employee during their parental leave, use the Parental Leave earning to record the hours they would otherwise have worked.

When the employee returns to work

When the employee returns from their parental leave, you'll need to revert the changes you made to their employee record. So if you added a termination date, you can now remove it (Payroll menu > Employees > click the employee > Employment tab > Termination date).

If you followed the steps above to include the employee in pay runs during their parental leave, you'll need to:

Enter the employee's Hours worked per week and Annual salary or Hourly rate (Payroll menu > Employees > click the employee > Standard pay tab).

Unlink the Parental Leave earning from the employee (Payroll menu > Employees > click the employee > Standard pay tab > click the ellipsis (...) for the Parental Leave earning > Unlink from employee).

Enter the employee's email address (Payroll menu > Employees > click the employee > Personal tab > Email).

Paying leave at AWE

There is a section in the parental leave act that states any annual leave entitlement given either during, or within 12 months of an employee returning from parental leave, is to be paid at the average weekly earnings (AWE) rate only. But you can choose to still pay at the higher of AWE and ordinary weekly pay (OWP).

Any entitled leave owed on the parental leave commencement date is paid normally. This means you can have scenarios where an employee has a leave balance of 180 hours, 20 of which is paid at the greater of OWP and AWE (owed prior to parental leave), and 160 hours which can be paid at AWE only.

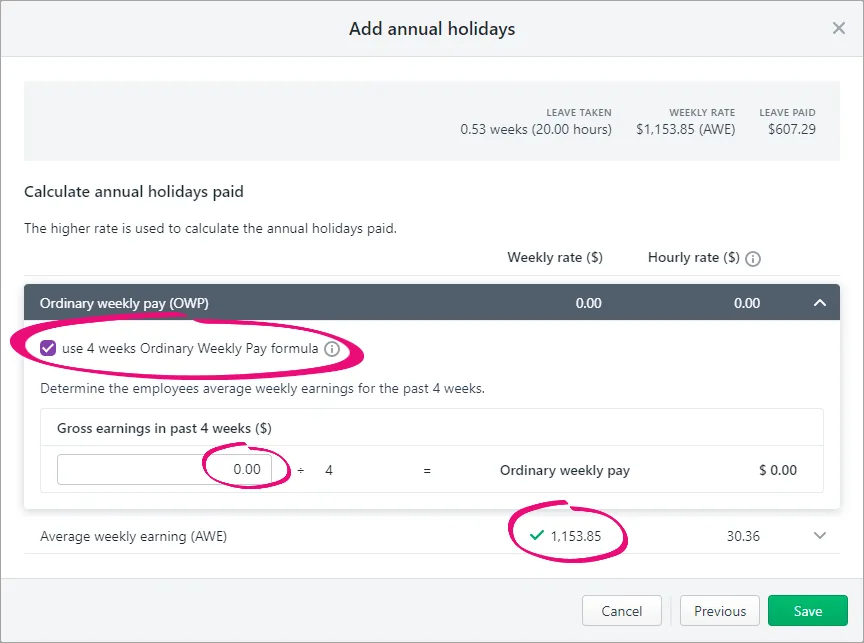

To adjust the annual holiday rate for AWE only:

If the AWE is already the greater of OWP and AWE, you don’t need to do anything. Otherwise, complete these steps:

When adding annual holidays to an employee's pay, click the dropdown arrow for Ordinary weekly pay (OWP).

Select the option Use 4 weeks Ordinary Weekly Pay formula.

Enter 0.00 for Gross earnings in past 4 weeks. The green tick now appears beside the Average weekly earnings Weekly rate.

Click Save and continue the pay run as normal.