At a glance

-

Inland Revenue (IR) will send you a child support deduction notice if you need to deduct child support from an employee’s pay

-

IR will let you know how much to deduct

-

You can only stop deducting child support payments if IR tells you to

-

Learn more about child support deductions at ird.govt.nz

There's a child support deduction in MYOB that's been created for you. All you need to do is assign it to the employee and enter the amount to be deducted each pay.

To set up an employee's child support deduction

Go to the Payroll menu > Employees.

Click an employee who requires this new earning. Need to add an employee?

Click the Standard pay tab.

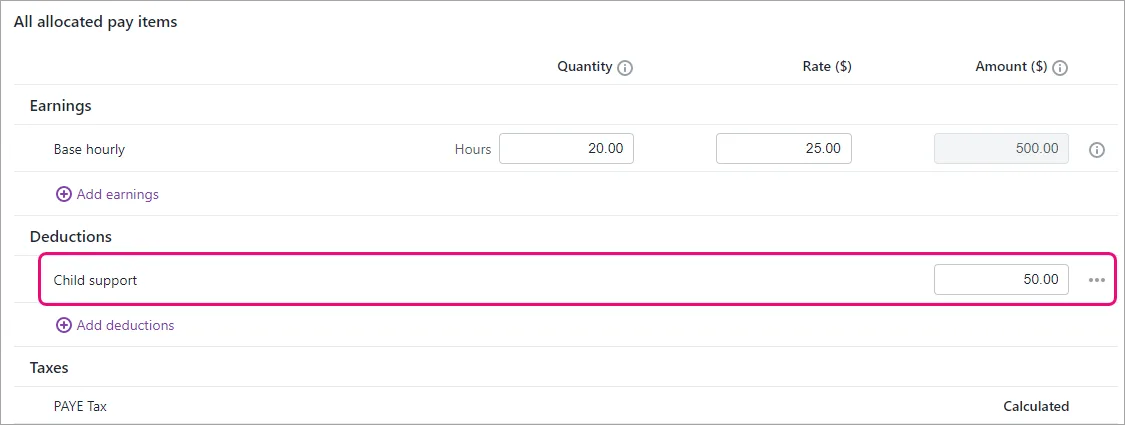

Under Deductions, click Add deductions and choose Child support.

Enter the amount to be deducted each pay. This amount will only apply to this employee.

Click Save.

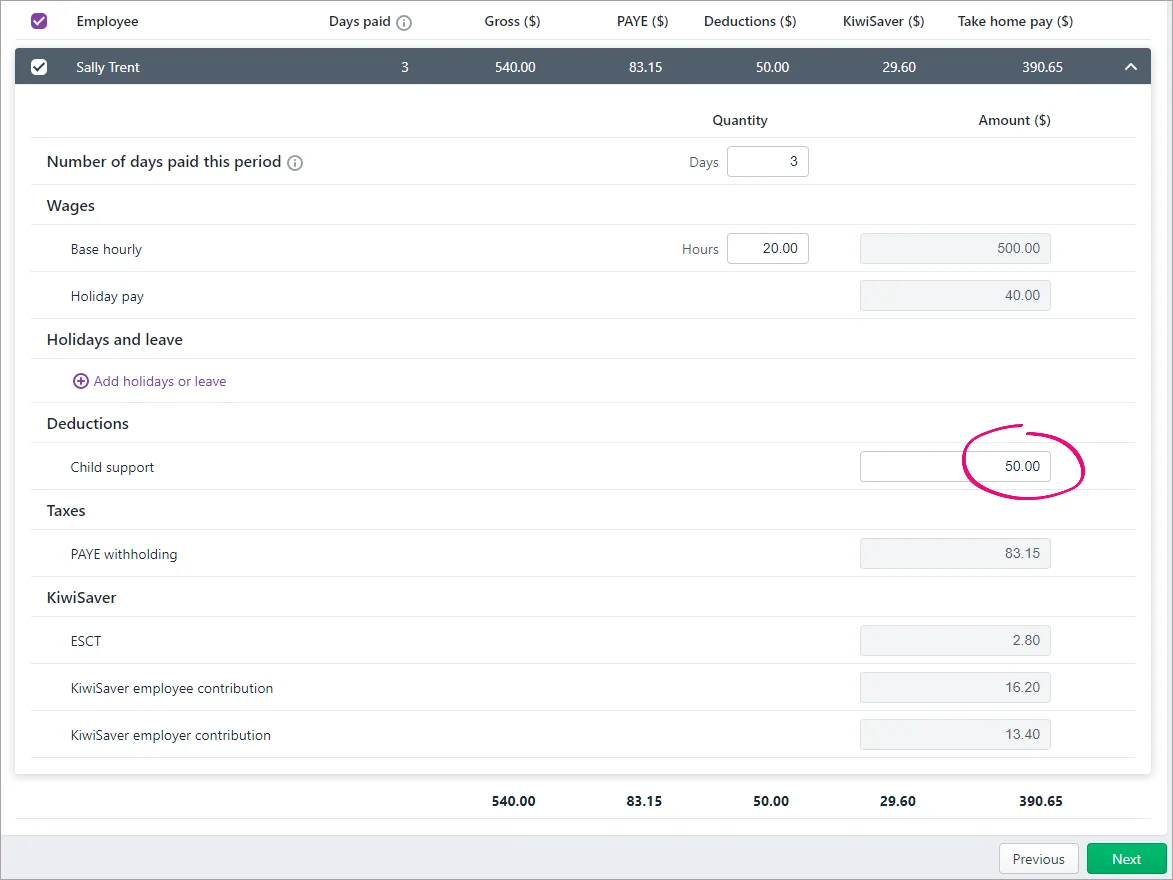

Next time you do a pay run for the employee, the child support deduction will be included.

Protected net earnings

Employees who are required to pay child support are entitled to keep 60% of their net (after-tax) earnings. If a child support deduction will leave the employee with less than 60% of their net pay, the child support deduction will be adjusted automatically to comply with the protected net earnings rule. For more information visit the Inland Revenue website.

FAQs

What do I do when the deductions need to stop?

To remove the child support deduction from the employee's pay, you just need to unlink it from the employee:

Go to the Payroll menu > Employees.

Click the employee's name.

Click the Standard pay tab.

Click the ellipsis ( ) button for the child support deduction and choose Unlink from employee.

Click Save. The deduction is removed from the employee and will no longer appear in their pay.

What happens to the deducted money?

Child support deductions must be paid to Inland Revenue, and they'll provide you with payment details. For more information visit ird.govt.nz/childsupport

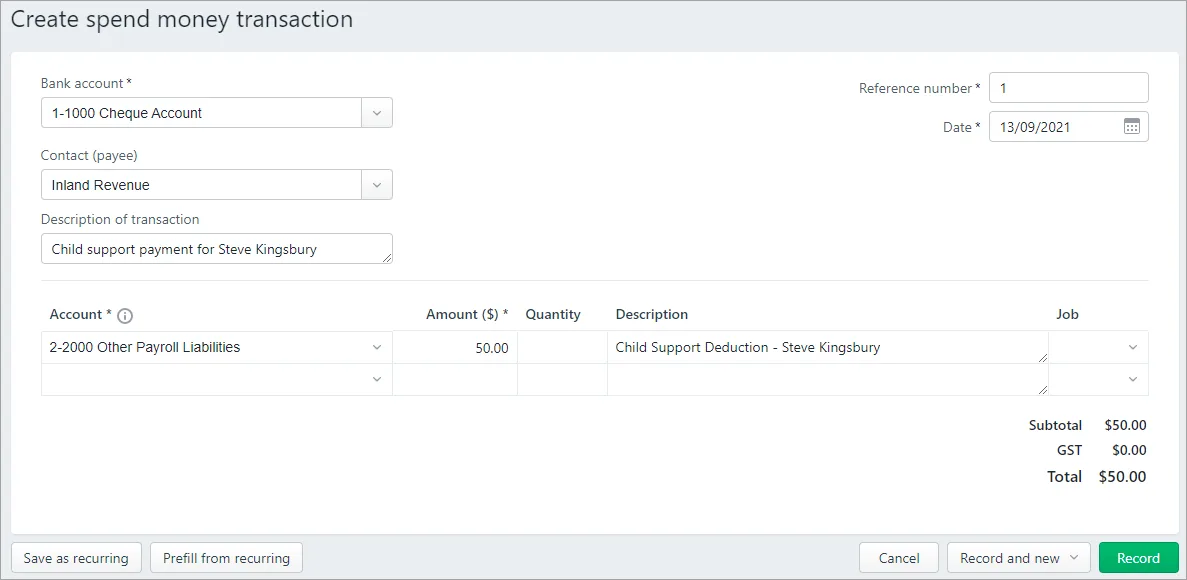

You can make a record of these payments in MYOB using a spend money transaction (Banking menu > Spend money).

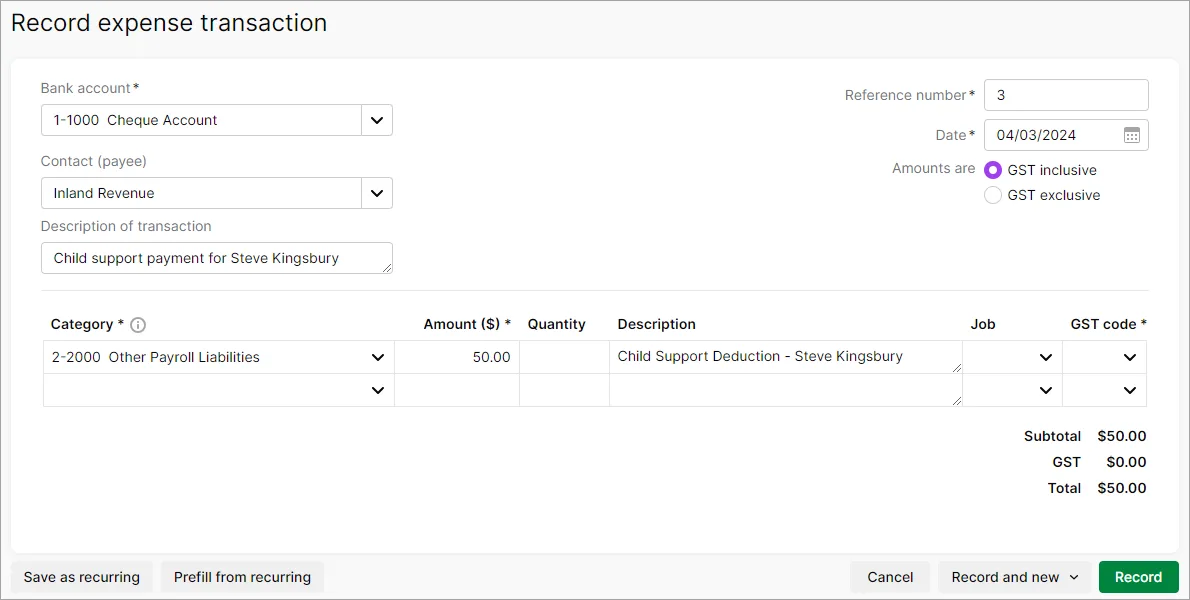

Here's an example spend money transaction for a child support payment. Note the following:

For the Bank account we've chosen the MYOB bank account the payment is coming from.

For the Contact (payee) we've set up a supplier record for Inland Revenue so we can choose them here.

We've entered a Description of transaction to help identify this payment.

In the Category field on the first line we've chosen MYOB category that's linked to our payroll deductions. Learn about your payroll linked categories

Can I change the category my deductions are allocated to?

Child support deductions withheld from pays are allocated to the linked category you've set in MYOB for your payroll deductions (Accounting menu > Manage linked categories > Payroll tab).

If you'd like your deductions to be allocated to a different category, you'll need to change this linked category. This affects the accounting side of MYOB so you might want help from your accounting advisor before doing this. They can also help work out if you should create another liability category for this purpose.

What if the deduction amount varies between employees?

Follow the steps above to assign the child support deduction to each employee, and enter a different amount for each employee.