Setting up payroll might seem daunting, but we'll take you through it one step at a time. Once you're set up, paying your employees and staying on top of your Kiwisaver and Inland Revenue reporting will be a breeze.

If you're new to paying employees, you'll find lots of helpful resources on the Employment New Zealand website.

Every business's payroll setup is different. So if you need specific advice beyond what's covered below, our community forum is a great place to start. For more tailored help, speak with an accounting advisor.

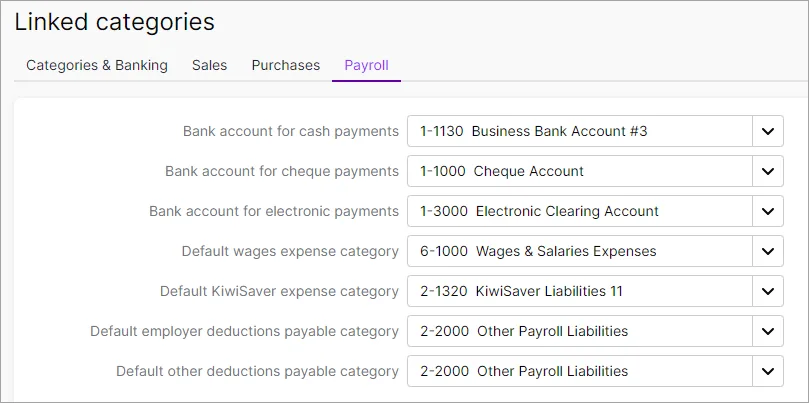

Check your payroll linked categories

There are default categories in MYOB that help group your payroll amounts for accounting purposes. For example, there are categories that group your cash, cheque and electronic wage payments. There are also categories to keep track of things like KiwiSaver expenses and employee deductions.

In MYOB these are known as linked categories, and they'll be specific to your business. Your payroll officer, bookkeeper or accounting advisor likely set them up when you started using MYOB.

Tell me more about linked categories.

To check which payroll linked categories have been set up for your business, go to the Accounting menu > Manage linked categories > Payroll tab. To change a linked category, click the dropdown arrow and choose a different category. If needed, you can create new categories.

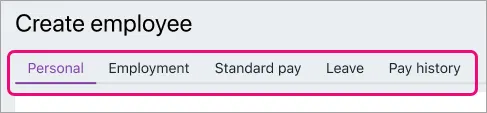

Add your employees

Add each of your employees by going to the Create menu > Employee.

Use the tabs across the top to record details about who they are, how much they're paid, their leave entitlements, and any amounts they've already been paid (pay history).

For all the details, see Add an employee.

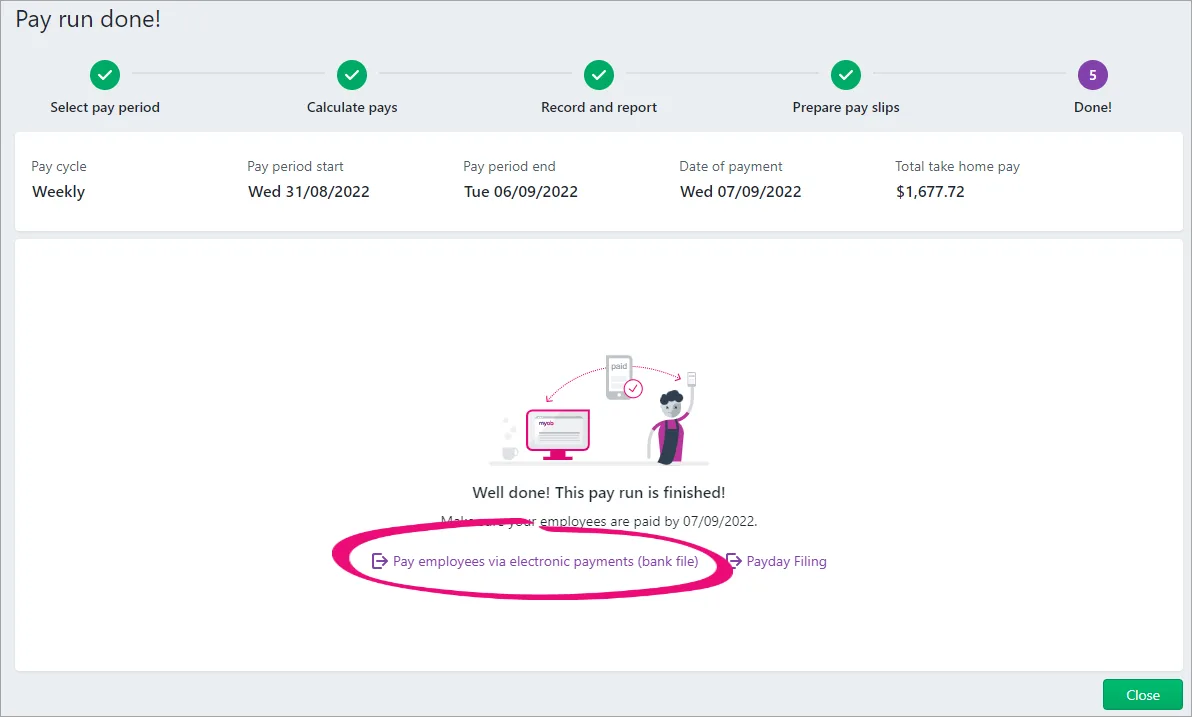

Set up employee bank account payments

The quickest and easiest way to pay your employees is straight into their bank accounts. If you bank with ASB, ANZ, BNZ, Westpac, Kiwibank, TSB or Rabobank, you can create a bank file after each pay run to upload to your bank for processing.

There are some one-off setup tasks you'll need to complete, like adding your employees' bank account details and the details of the bank account your payments will come from.

For all the details on getting set up, see Paying suppliers and employees electronically.

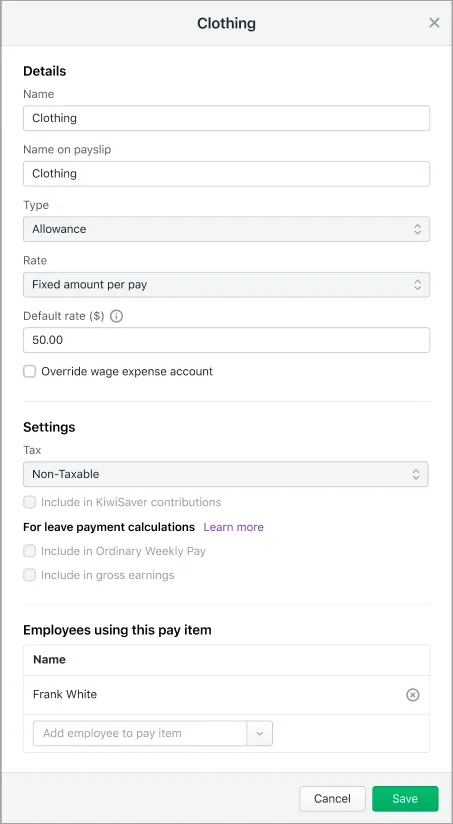

Create earnings and deductions

Earnings and deductions are the amounts in an employee's pay, on top of their normal salary or wages. For example, you might create an earning for overtime or an allowance, or a deduction for social club fees.

Each business is different, so the earnings and deductions you'll need will be specific to your employees' needs. When you create an earning or deduction, you can reuse it for all the employees it applies to. Or you can create employee-specific ones.

For all the details, see Creating earnings and deductions.

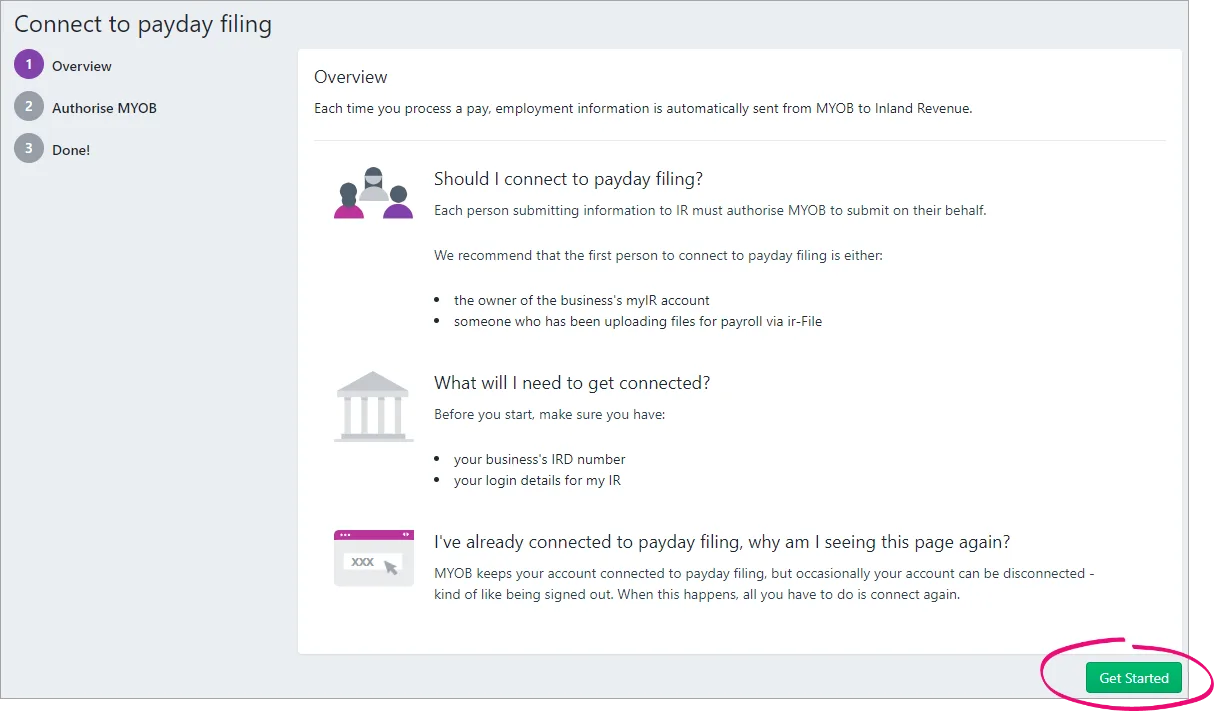

Set up payday filing

You'll need to set up payday filing to stay on top of your Inland Revenue (IR) reporting obligations. Once you're connected, employment information will be sent to IR each time you process a pay. Your new employees' details will also be automatically sent to IR.

To begin, go to the Payroll menu > Payday filing > Get started.

For all the details, see Setting up payday filing.

What's next?

That's it – you're now ready to pay your employees! To keep track of your payroll information, take a look at your payroll reports (Reporting menu > Reports > Payroll tab).

Need some help?

If you need help using payroll or anything in MYOB, click the chat bubble below and ask MOCA, our virtual assistant, for help. If MOCA can't help, you'll be guided to our other support options, including live chat. You can also submit a support request to get help from our team.