You can make the default accounts list supplied with your company file more accurately reflect your business.

What accounts do I need in my accounts list?

When you create your company file, AccountRight supplies you with a list of all the basic accounts you need to track your business's finances.

For more information about how accounts work, see Set up accounts.

To make this basic list fit your business, you need to add, remove or edit accounts to reflect the particular way cash moves in and out of your business.

When creating accounts, think about what your business buys and sells. For example, if you're a service-based business, you won't likely need any inventory accounts, but you will need to track your services income.

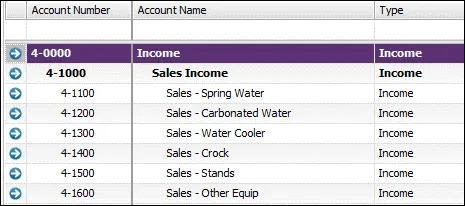

You might want to break down your income streams to track the profitability of particular services or product lines.

You probably also want to break down your expenses to accurately monitor the particular costs impacting your business.

Many of the accounts you need will already be in your accounts list – you just need to tweak the list by creating additional accounts and editing or deleting existing ones.

You should also ensure that your accounts are well defined with specific, descriptive names and that they're grouped correctly to generate the most useful reporting – your accountant or bookkeeper can help you out with all of this.

Invite your accountant or bookkeeper into your file – then, they can customise your accounts list for you.

There are also experts on the community forum who can help you out.

To review your accounts list

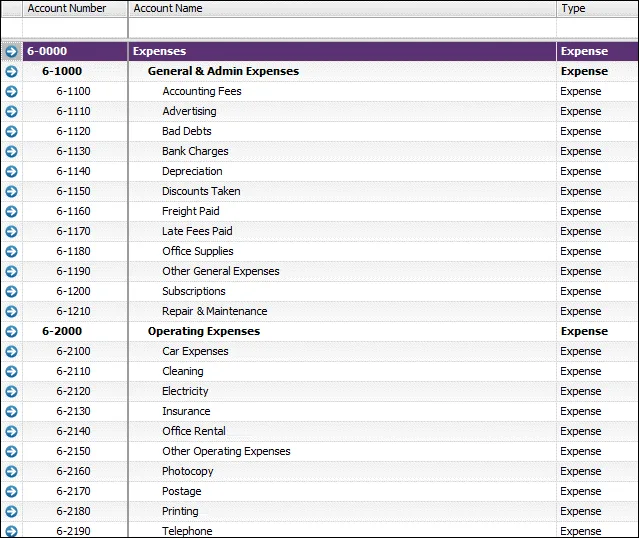

To see all of your accounts at a glance, go to the Accounts command centre > Accounts List, then click Print to print the Accounts List Summary report

This report enables you to:

change the report level to show the account level you want

drill into an account and edit it on the spot.

See how (click the animation to expand it):

To create an account

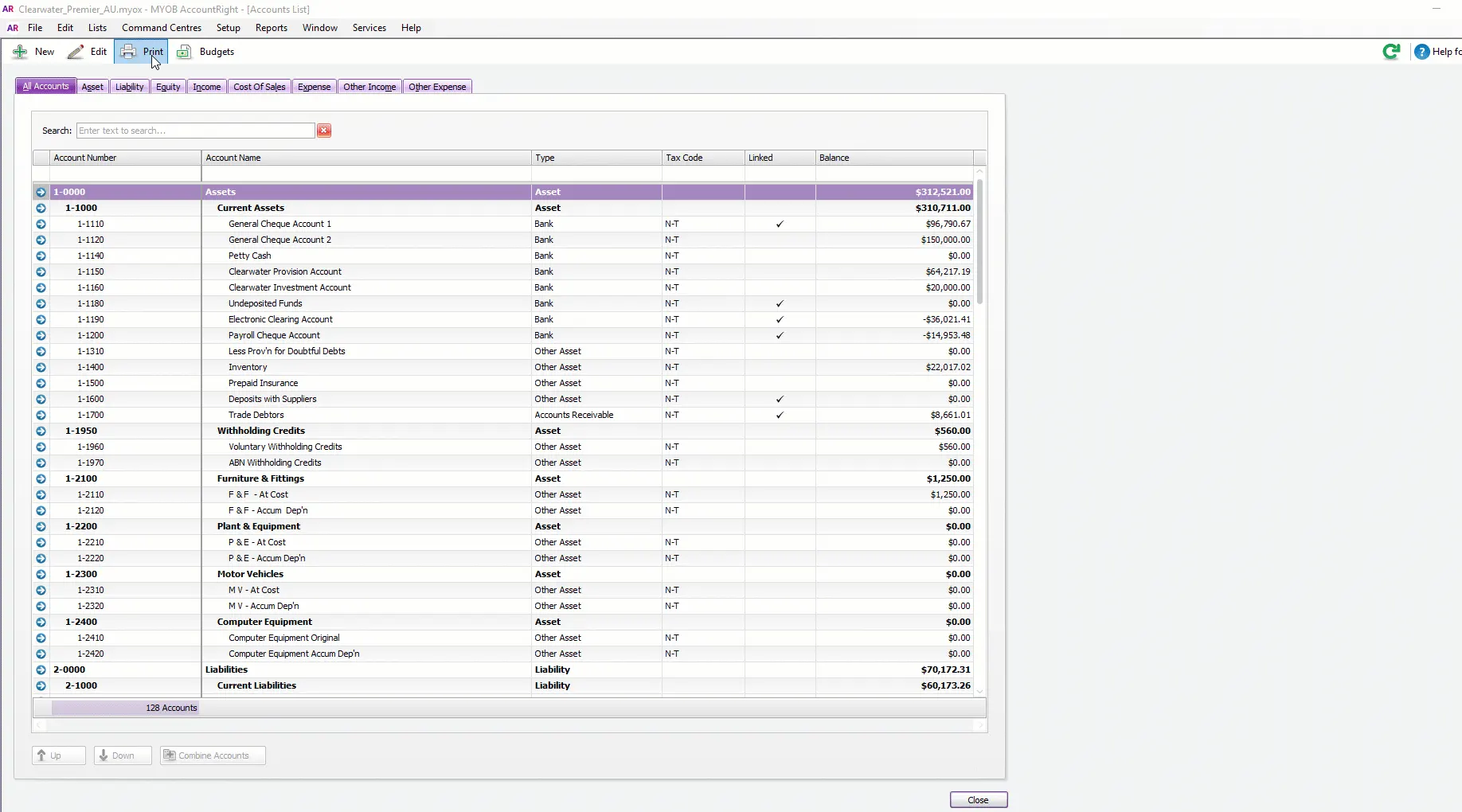

Go to the Accounts command centre and click Accounts List. The Accounts List window appears.

Click the tab for the account classification you want to create, such as Asset, Liability, etc. See Set up accounts for more information on account classifications.

Click New. The Account Information window appears.

If you want to create a header account, select the Header Account option or if you want to create a detail account, select Detail.

Select the account type from the Account Type list. The types available vary depending on the on the Account Classification. Note that only Bank and Credit Card account types will be selectable in the Pay from Account field when recording transactions.

Enter a four-digit number for the account in the Account Number field. The number must be unique within each account classification.

Press Tab and type a name for the account.

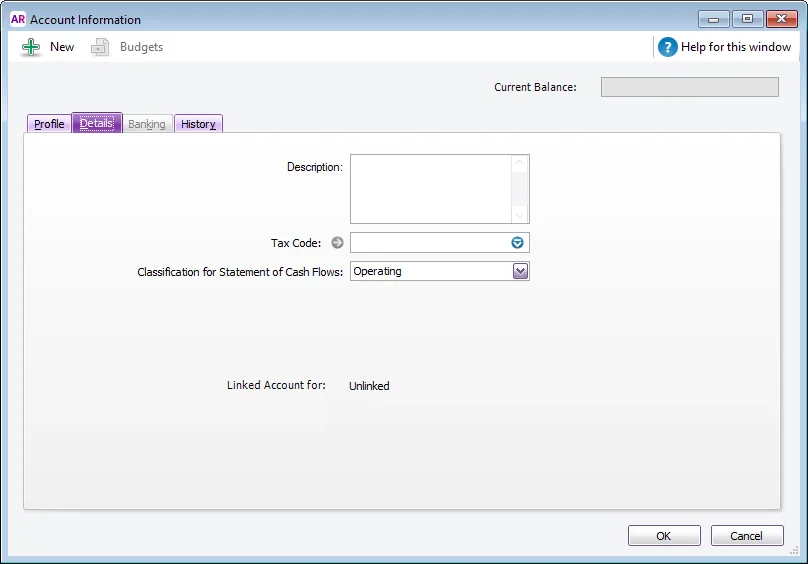

Click the Details tab.

If you want, type a brief description of the account in the Description field.

(Header accounts only) If applicable, select the option When Reporting, Generate a Subtotal for This Section. Selecting this option will include a subtotal line for this header in the Balance Sheet and Profit and Loss reports.

In the Tax Code (Australia) or GST Code (New Zealand) field, enter the tax code that you use most often with transactions that will be posted to this account.

If you're creating an asset, liability or equity account (other than an asset with the account type of Bank), select an option from the Classification for Statement of Cash Flows list.

Classifying the accounts allows you to generate a statement of cash flows. This report shows how your cash position has changed over time, profit earned and where your cash was spent.

Classifications:

-

Financing – Balance sheet items that are to do with borrowing money or the repayment on borrowings. For example, hire purchase, leases, and bank loans. In some cases, this may also include directors' or shareholders' loans.

-

Investing – Balance sheet items that are used for the acquisition of fixed assets, plant and equipment, and investments. The sale of these assets or the redemption of investments into cash is also an investing activity.

-

Operating – All other balance sheet items where it is effectively a timing issue that creates the transaction, for example, accruals and prepayments. Accumulated depreciation is classified as operating so that it offsets the depreciation expense in the profit and loss report.

If you’re unsure about which classification to use, consult your accountant or an MYOB Certified Consultant/Approved Partner.

-

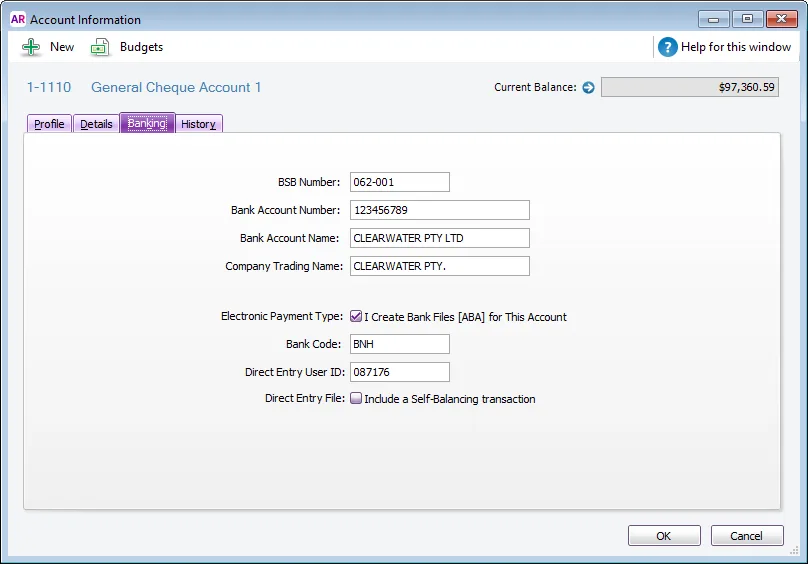

If you're creating a bank or credit card account, and you want to keep a record of your bank account details, or make electronic payments, click the Banking tab and enter your account details. For more info see Enter your account details.

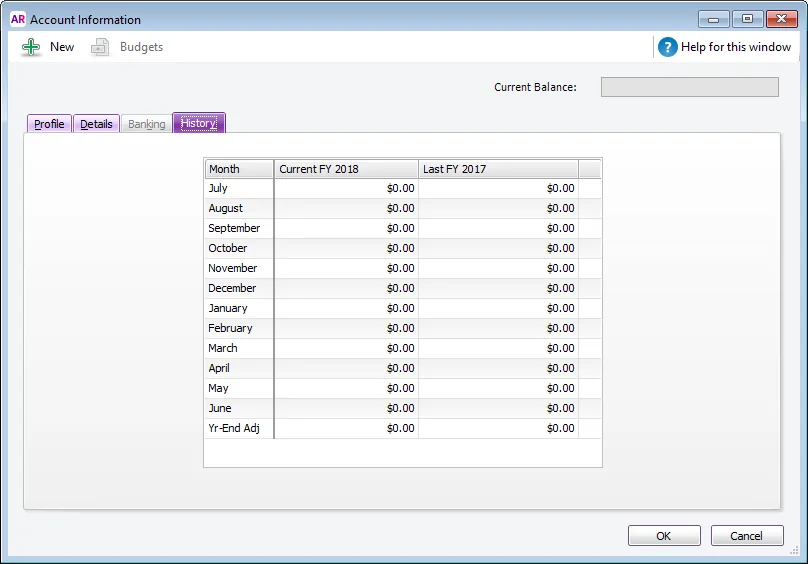

[Detail accounts only] If it's your first financial year using AccountRight, click the History tab.

In this tab you can enter historical balances for:

the months prior to you starting to use AccountRight: Enter the closing monthly balances in the Current FY column. That way you can compare the monthly account balances for this year and last year.

Note that the closing balance for the month prior to your conversion month must be entered in the Account Opening Balances window, so you won't be able to enter it here. For example, if your conversion month is September, the August closing balance must be entered in the Account Opening Balances window.the last financial year: Enter the closing monthly balances in the Last FY column.

Click OK when you have finished. The account now appears in your accounts list.

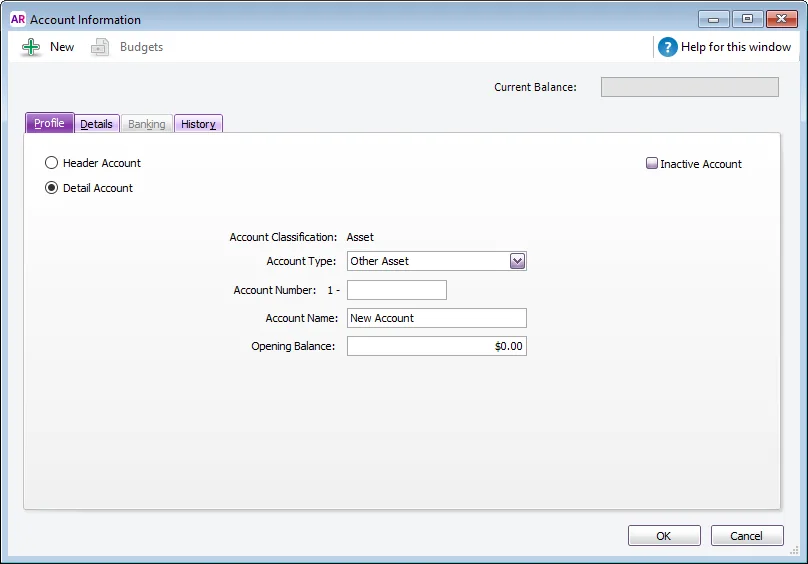

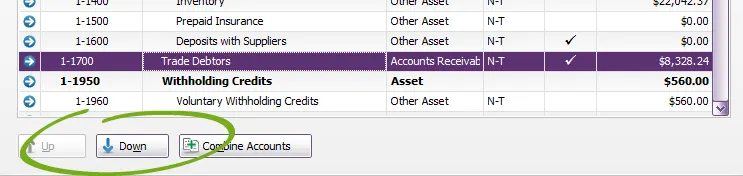

To group detail accounts with a header account

You group accounts by indenting the accounts located below a header account.

Go to the Accounts command centre and click Accounts List. The Accounts List window appears.

Select the detail account you want to group.

Click the Down button at the bottom of the window to group the account with the header located above it.

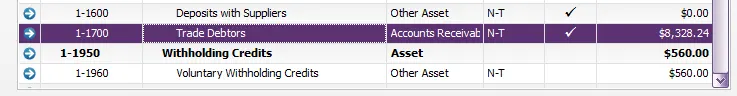

In the example above, the 1-1700 Trade Debtors account will move to the right, in line with the other accounts above it, as shown below.

To delete an account

You can delete accounts that you don't need, provided that it has:

never been used in a transaction

not been linked to another record, such a card, item or tax code – you first need to unlink it from the record.

For more information, see Deleting an account.

To change an account name

Go to the Accounts command centre and click Accounts List. The Accounts List window appears.

Click the zoom arrow next to the account to be edited.

Change the Account Name.

Click OK.