The Accounting Income Method (AIM) is a new way of calculating provisional tax for small businesses in New Zealand.

This page covers AIM eligibility and set up. For more information on filing an AIM statement of activity, see Filing an AIM statement of activity.

Businesses choosing to use AIM will make more frequent provisional tax payments based on their actual current earnings rather than calculations on last year's income. This makes AIM a great 'pay as you go' option for growing businesses or businesses with fluctuating, seasonal income.

How does AIM work?

When it comes time to pay provisional tax, MYOB will use AIM to calculate what you owe straight from your categories (chart of accounts) and gather the info into your statement of activity. This is then sent to Inland Revenue.

Note that a statement of activity isn't an income tax return and isn't processed as one. This means if you make a mistake you can simply fix it in the next statement.

AIM eligibility

You first need to check that your business is eligible to use AIM. See the table below for the AIM requirements. If you have any questions, please see the Inland Revenue website or speak with your accountant.

If you... | then... |

|---|---|

have turnover under $5 million and opt in before your first provisional tax date for the year | You can use AIM |

have investments in foreign investment funds (FIF) or controlled foreign companies (CFC) for the income year, or | Sorry, you can't use AIM |

are in a transitional year (a year in which you've changed your balance date), or | Sorry, you can't use AIM |

are any of the following: | Sorry, you can't use AIM |

Setting up AIM in MYOB

After confirming your eligibility, you need to map each category in MYOB to the AIM statement of activity. This is done from within the GST and provisional tax page in MYOB.

Mapping your categories

Go to the Accounting menu and choose Prepare GST return.

Click Get started.

If prompted, enter your MYOB account details (email address and password).

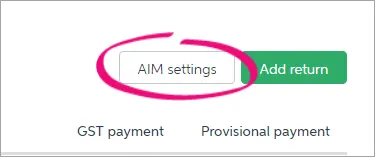

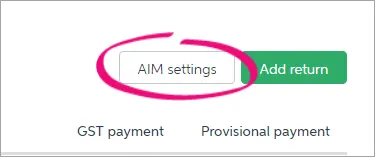

Click AIM settings.

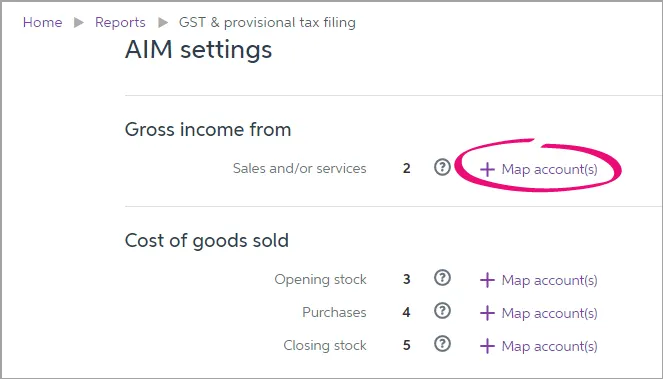

The AIM settings page lists every field on the AIM statement of activity. You need to map all of your categories to a field.

Note that not every field will be mapped to a category, but all of your categories must be mapped before lodging your provisional tax return using AIM.Starting from the topmost field (Gross income from sales and/or services) and working your way down, click +Map category and select all applicable categories for each field.

If you're unsure about where to map your categories, please speak with your accounting advisor.

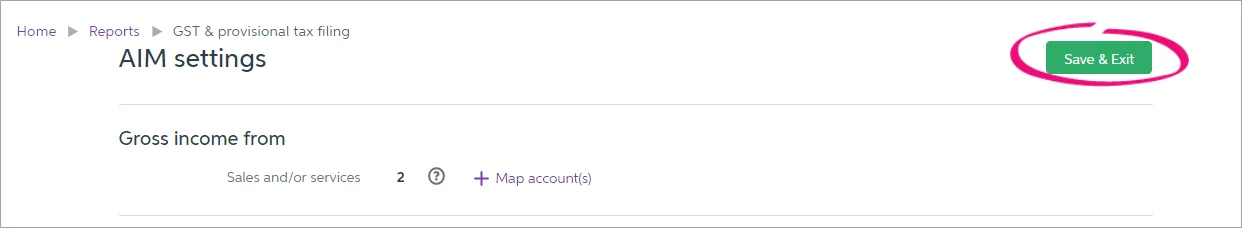

When you've finished mapping your categories, click Save & Exit. You can come back to this page to finish mapping your categories or to map a newly created category.

The Accounting Income Method (AIM) is a new way of calculating provisional tax for small businesses in New Zealand.

This page covers AIM eligibility and set up. For more information on filing an AIM statement of activity, see Filing an AIM statement of activity (New Zealand).

Businesses choosing to use AIM will make more frequent provisional tax payments based on their actual current earnings rather than calculations on last year's income. This makes AIM a great 'pay as you go' option for growing businesses or businesses with fluctuating, seasonal income.

How does AIM work?

When it comes time to pay provisional tax, AccountRight will use AIM to calculate what you owe straight from your chart of accounts and gather the info into your statement of activity. This is then sent to Inland Revenue.

Note that a statement of activity isn't an income tax return and isn't processed as one. This means if you make a mistake you can simply fix it in the next statement.

More of a visual learner? Check out this short video on how AIM works with AccountRight.

Sounds great! Where do I start?

You first need to check that your business is eligible to use AIM. See the table below for the AIM requirements. If you have any questions, please see the Inland Revenue website or speak with your accountant.

If you... | then... |

|---|---|

have turnover under $5 million and opt in before your first provisional tax date for the year | You can use AIM |

have investments in foreign investment funds (FIF) or controlled foreign companies (CFC) for the income year, or | Sorry, you can't use AIM |

are in a transitional year (a year in which you've changed your balance date), or | Sorry, you can't use AIM |

are any of the following: | Sorry, you can't use AIM |

Setting up AIM in your AccountRight company file

After confirming your eligibility, you need to map each account in your ledger to the AIM statement of activity. This is done from within the GST & Provisional Tax window in the Accounts command centre.

Mapping your accounts

In your online company file, go to the Accounts command centre and click GST & Provisional Tax. The GST & Provisional Tax window appears.

In the File Online tab, click Get Started and a browser window will appear. If the Get Started button can't be clicked, ensure you're working on an online company file.

Enter your MYOB account details (these are the same details you use to sign into My Account).

If prompted, enter your company file User ID and Password (these are the same details you use to sign on to your company file).

Click AIM settings.

The AIM settings page lists every field on the AIM statement of activity. You need to map all of your ledger accounts to a field.

Note that not every field will be mapped to an account, but all of your accounts must be mapped before lodging your provisional tax return using AIM.Starting from the topmost field (Gross income from sales and/or services) and working your way down, click +Map account(s) and select all applicable accounts for each field.

If you're unsure about where to map your categories, please speak with your accounting advisor.

When you've finished mapping your accounts, click Save & Exit. You can come back to this page to finish mapping your accounts or to map a newly created account.