This feature is currently in Beta and is being rolled out progressively

Smart Reconciliation lightens the load of reconciliation by automatching transactions and making smart suggestions as you go. When it’s time to reconcile, your books are already prepared — you review, finalise and get an accurate account of your financial position quicker.

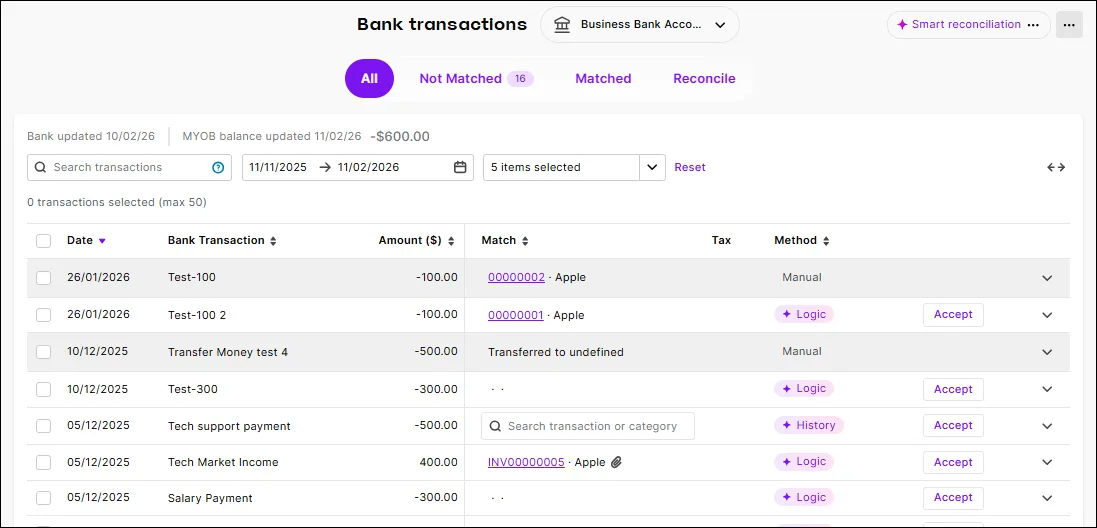

If your Bank transactions page doesn't look like the image below, you're either:

not part of the Beta – your help is here.

or you haven't activated Smart Reconciliation – see ‘Turning on Smart Reconciliation’, below..

Turning on Smart Reconciliation

To start getting the benefits of Smart Reconciliation, you need to switch it on. Click below to see how:

To turn Smart Reconciliation on

Go to the Banking menu > Bank transactions. If Smart Reconciliation is available for your business, you’ll see either:

a Smart Reconciliation option at the top right of the Bank transactions page, or

a banner inviting you to try the new experience.

Switch the Smart Reconciliation option on, or click Get started on the banner.

Review the short onboarding screen, then click Let’s go.

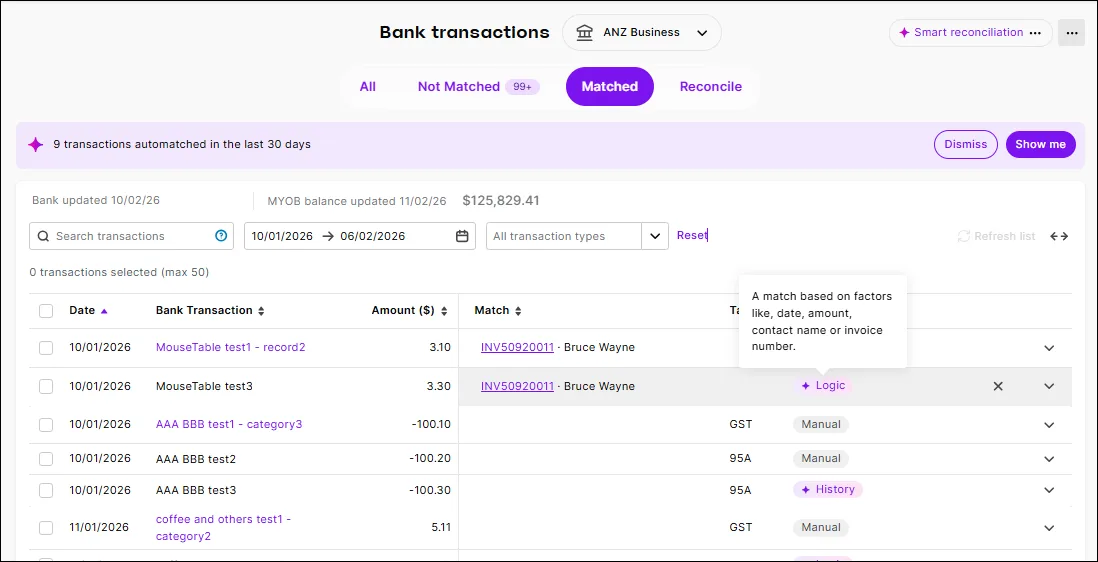

Once it’s on, you’ll see the new Smart Reconciliation view and a Reconcile tab on the Bank transactions page.

If you want to turn off Smart Reconciliation, click the menu next to Smart Reconciliation at the top right of Bank transactions page and choose Back to classic view. Note that if you do this, you'll lose its benefits, like the cleaner design, matching suggestion method insights, and bulk acceptance of matches. You’ll also miss out on future improvements.

Reconciling starts with matching transactions

Reconciling is about matching the balances in your bank accounts with the balances in your MYOB records. Doing this gives you an accurate picture of the cashflow position of your business. Before you can match account balances, you need to match the bank transactions coming into MYOB with what you’ve recorded. Smart Reconciliation makes this process much easier.

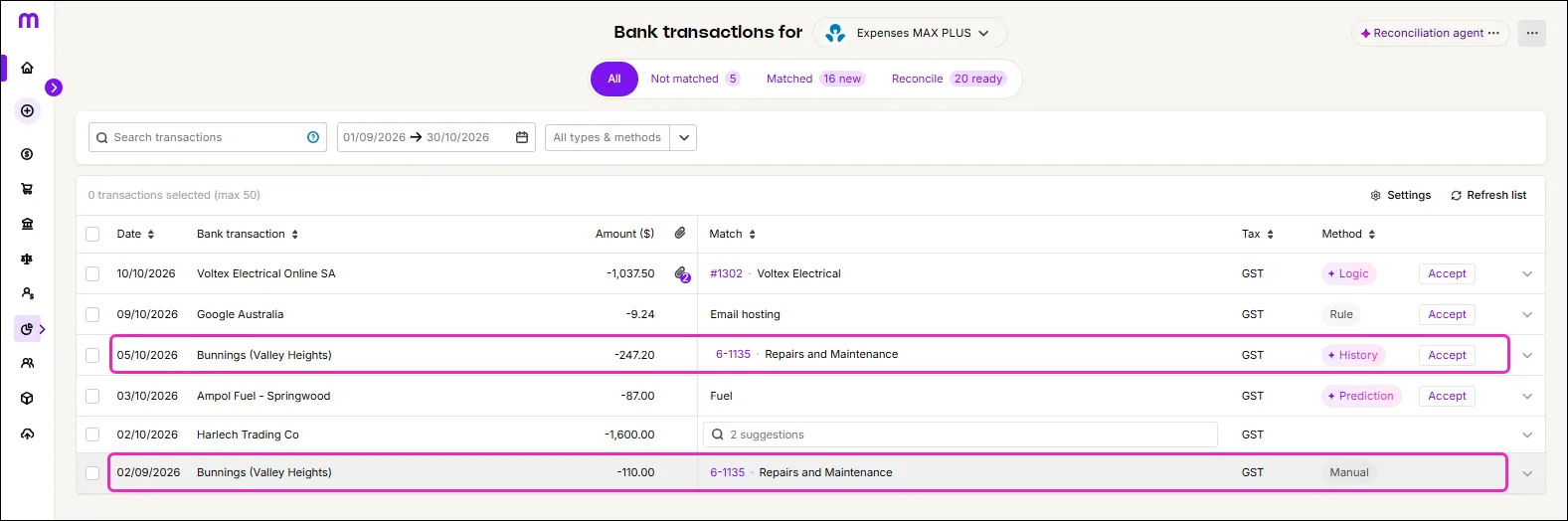

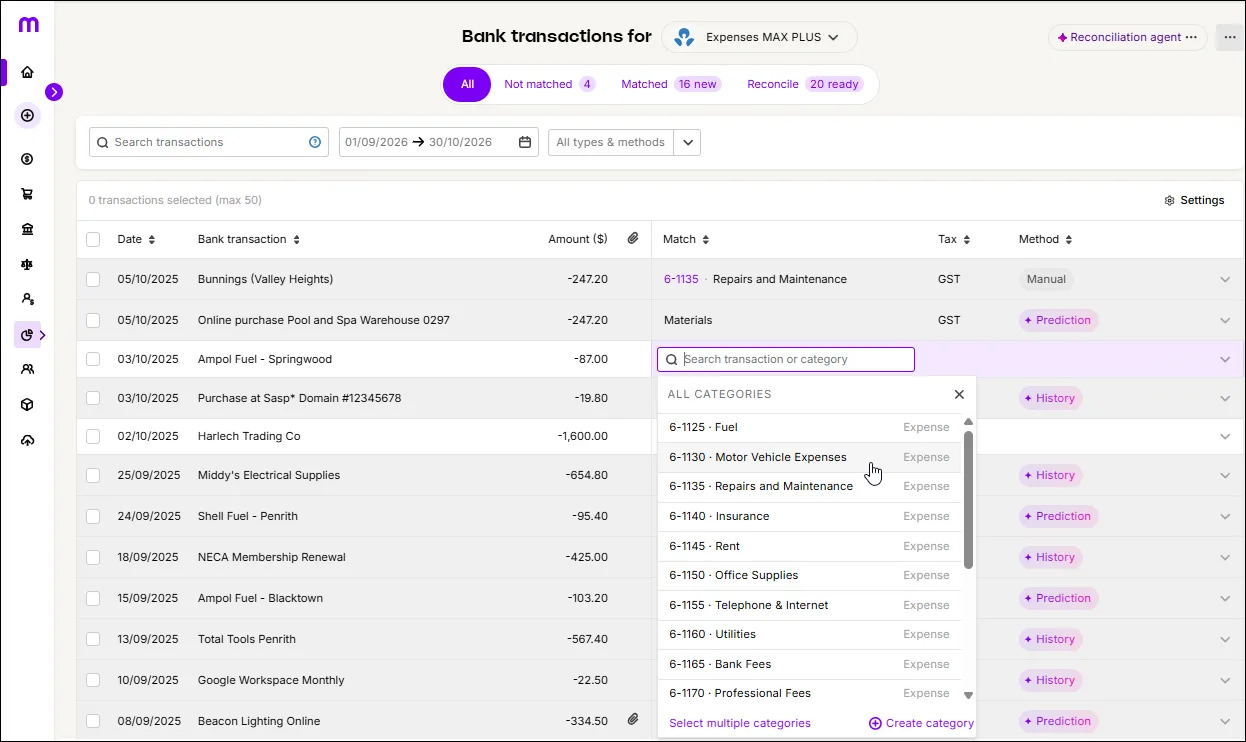

Navigating the Bank transactions page

The Bank transactions page is your starting point. It's where you'll see your bank transactions, brought into MYOB Business via bank feeds or importing a bank statement. Choose the account you want to match from the drop-down list at the top of the page. See the actual transactions going into the account and where MYOB has organised them into Matched, Not Matched and ready to Reconcile:

All - View all transactions for the selected account in one place, across matched (ready-to-reconcile) and unmatched.

Not matched - Transactions that need attention. Review suggestions or manually match where required.

Matched - Transactions that have already been automatched or matched by you. Do a quick review and confirm everything looks right.

Reconcile - Bring it all together. Confirm balances and finalise reconciliation with matched transactions visible as you go.

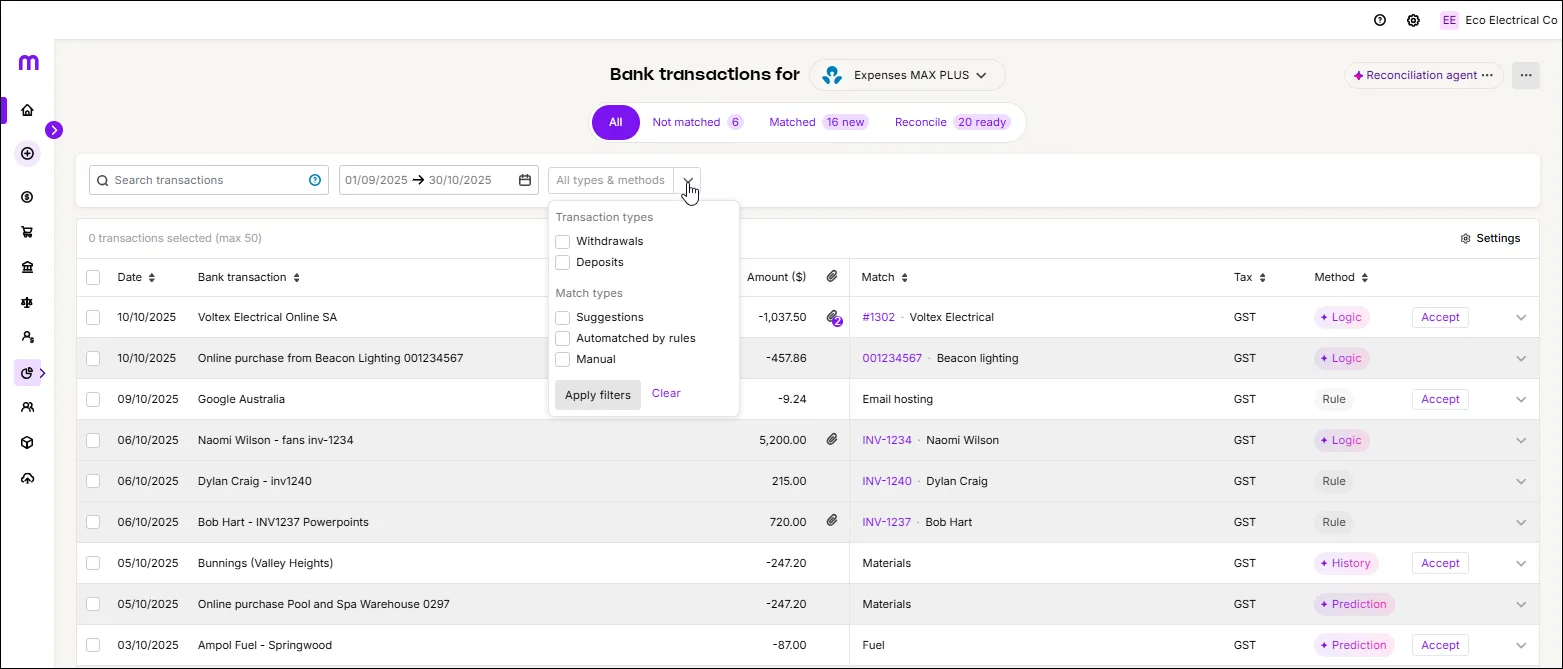

Use the filters to find specific transactions

Use the types and methods filters to declutter the Bank transactions page so you can focus on specific transaction types, suggestions, matching methods, or transactions that have been manually matched.

Working with automatches and suggestions

MYOB uses automatching and AI suggestions to match or suggest categories for transactions as they’re processed. You just need to review and confirm the results. Below are the methods that MYOB works through to automatch or suggest transactions. These methods are sequential, meaning that MYOB will work through each method to try and find an automatch or a suggestion. If a transaction can’t be automatched through these methods, it will be up to you to manually categorise the transaction.

Automatching: First, MYOB matches bank transactions to existing records using criteria such as amount, date and contact name. Accept or change them as needed. You can select multiple matches and accept them.

Rules application: Then, if you've created your own rules, MYOB automatically applies them to create transaction records to match bank transactions for spend and receive monies. For invoices and bill rules these will be shown as suggestions. Check that your rules are working as intended.

Category suggestions: MYOB automatches bank transactions to categories or suggests matching categories using AI, according to a confidence rating it assigns (see 'Catetory suggestions based on confidence', below). The confidence rating is based on how you've previously matched similar transactions in your file. If it doesn't suggest a match, you'll need to assign it to a category yourself. You can accept automatches and suggestions or choose alternative categories.

Record suggestions: Similar, but not exactly matching, transaction records are suggested as possible matches. Accept them or find other matches.

Predictions: MYOB uses AI to suggest matching categories according to a confidence rating it assigns (see 'Catetory suggestions based on confidence', below), based on how other MYOB businesses have matched similar transactions. You can choose to accept or reject the suggestions.

Manually match transactions to categories: If there isn't an automatch or suggestion in MYOB Business, manually match a bank transaction to the appropriate category. This automatically creates a matching transaction record in MYOB.

For automatching and suggestions to work, some options need to be on. They’re on by default, but if you want to check them or understand how they work, see ‘Check that automatching and suggestions are turned on’, below.

Category automatching and suggestions based on confidence

MYOB checks the details in the bank transaction and how you (or other MYOB businesses) have matched similar transactions, and, in the background, assigns a confidence rating. This rating determines if MYOB automatches to a category, suggests a match, or doesn't suggest a match.

High: confidence rating is greater than 90%. If automatching is turned on then MYOB Business will automatch the bank transaction to a category (if automatching is turned off, you’ll see a suggested match). You can review and accept, or match to another category.

Medium: rating is below the High threshold (between 70% to 90%) but still strong enough to suggest a match. You can accept the suggestion or choose a different category.

Low: The rating is too low to trust, so no suggestion is shown. You'll need to select the appropriate category.

Automatching and suggestions help, but you remain in control

You can choose to accept or reject any automatches or suggestions.

Method explains how transactions have been matched

In the Method column, hover over a method for a description about how a transaction has been matched:

Logic. An automatch based on amount and date.

Rule. An automatch based on a set of instructions that tells MYOB how to handle certain transactions that regularly appear in the bank feed. More about rules

History. An automatch or suggested match to a category, using AI, based on how you previously matched a similar transaction.

Prediction. A suggested match to a category using AI, based on how other MYOB businesses have matched similar transactions.

Manual. Manually matched to a category (when there aren't any matches or suggestions, if the automatch or suggested match is changed). Matching to a category creates the matching transaction record.

Review automatches

A bank transaction and MYOB record are automatically matched if:

they have the same amount and it is a unique record

and the MYOB record is the correct transaction type (like spend money for a withdrawal).

MYOB may also compare other details, like invoice or bill numbers, transaction descriptions and contact names. If there’s any ambiguity (for example, multiple possible matches or dates that don’t line up), you'll only see a suggested match for you to accept or reject.

Example: A payment for Metropolitan Electricity of $400 comes out of your bank account on May 21. When this payment appears in your bank feed, it is automatched to a spend money for $400 recorded on May 21.

An automatch is identified by Logic in the Method column. You can accept or reject the match.

What if there isn't an automatch?

There won't be an automatch if:

there isn't a matching record in MYOB, or

there is a transaction record, but it doesn't meet automatching criteria:

the amount does not match and it is not a unique record

there are rounding differences in amounts – if this is the case, select the transaction, click 'Add adjustment,' and record a transaction to bring the out-of-balance amount to $0.00.

or because a single bank transaction needs to be matched to multiple MYOB records.

If the transaction record may exist in MYOB, but isn't automatching, try searching for it. Expand the bank transaction and use the filters to search for a record to match it to.

You can also try adjusting the filters at the top of the Bank transactions page, especially the date filters.

If there isn't a matching transaction record in MYOB, see 'Manually match to a category', below.

Bank transfers are automatched

A bank transfer in a bank feed will be automatically matched to a bank transfer record in MYOB if there are a deposit and withdrawal for the same amount within seven days of each other, and the descriptions contain matching keywords. If you've set up bank feeds on both the bank account you're transferring from and the bank account you're transferring to, the transfer will be automatched for both accounts (you might need to wait until the bank feeds for both accounts have been updated, as some bank feeds update more frequently than others).

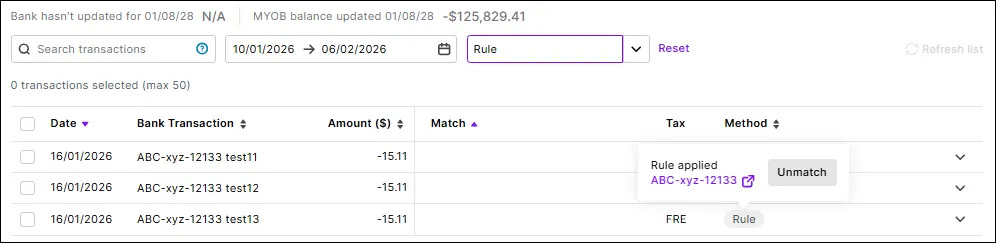

Check that your rules are being applied

You can set up rules to manage regularly occurring bank transactions that always have a particular description (such as BANK INTEREST). Rules automatically create matching transaction records in MYOB Business – more about rules.

If you've set up rules, verify that they are being applied and automatched to the specified categories.

A bank transaction that has a rule applied to it will display Rule in the Method column. Hover over it to see the rule applied, click into the rule to see its details. If you don't want the rule to apply to this transaction, click Unmatch.

If you think a rule might have missed a transaction, use the Not matched filter and other filters to find it. Edit the rule if necessary.

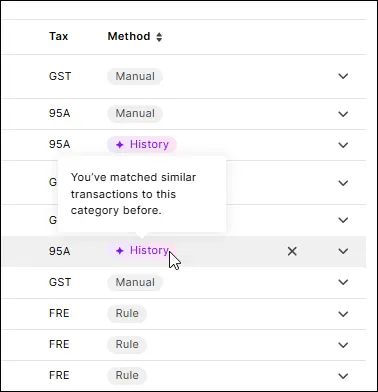

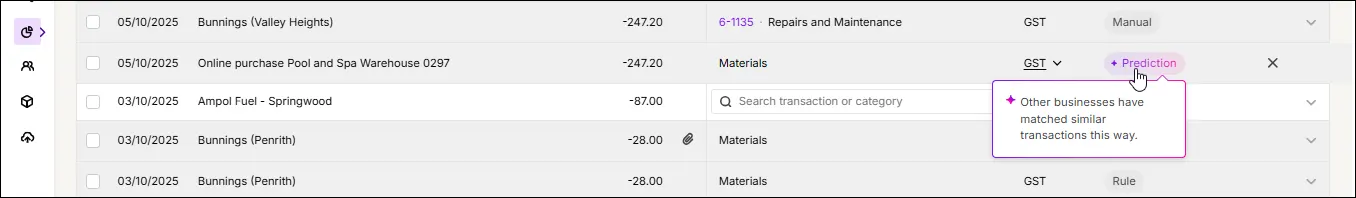

Review category suggestions

MYOB Business learns from how transactions were previously matched to a category to suggest a matching category the next time a similar transaction comes in. This saves you from searching for a category to match it to.

Example: You match a payment to Bunnings to the Repairs and Maintenance expense category. When another payment to Bunnings appears in your bank feed, there is a suggested match to that category:

History in the Method column indicates a suggested category based on how you previously matched the transaction. You can accept the match or reject it if you want to match it to a different category or transaction record.

A Prediction is a suggested match based on artificial intelligence and a confidence rating. MYOB's AI suggests a category to match a bank transaction based on how other MYOB businesses have coded similar transactions. If there isn't a confident History match or suggested match in your own business file, the prediction model looks at similar transactions across the MYOB customer base and automatches to a category if it detects a pattern with a high confidence rating. If it has a medium confidence rating, it will suggest a matching matching category and if the confidence rating is low, there will be no suggestion and you'll need to manually match the transaction (see 'Category suggestions based on confidence', above).

The more suggested category matches you accept or edit, the more accurate category suggestions become, and the more time it saves you.

As with autmatches, you're free to accept a prediction, or reject it and match the transaction to another category.

If you've got rules set up, they'll take precedence over category suggestions.

If the rule type is:

-

Spend money transaction or Receive money transaction: Suggested categories will not appear when these rules are applied.

-

Invoice or Bill: Suggested categories may still appear alongside invoice or bill rule suggestions.

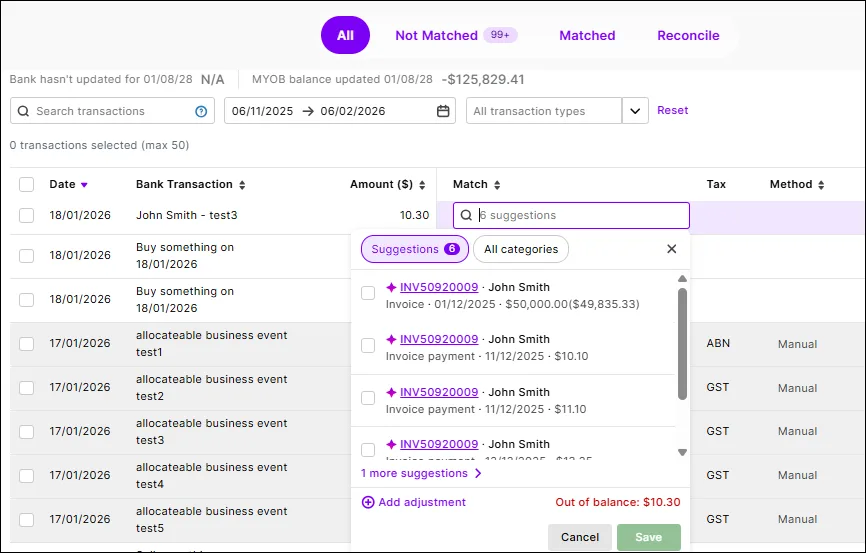

Choose from multiple suggestions

If there are one or more records like the bank transaction (for example, they have the same amount as the bank transaction but are recorded on a different date), they'll be suggested as possible matches. Click the dropdown to see the details.

Choose from the suggestions and hit Save.

Manually matching a transaction

If a bank transaction doesn't have an automatch or acceptable suggestion in MYOB Business, or if you’ve turned off automatching options, you can manually match it to an appropriate category. This creates the matching record – such as a spend money record for a withdrawal, or a receive money record for a deposit.

If you're unsure which categories to match bank transactions to, consult your bookkeeper or accountant.

MYOB Business remembers the category you match to a bank transaction. When a similar transaction appears in your bank feed, it suggests the previously used category, helping you save time. These suggestions will be marked as History in the Method column. See 'Review category suggestions', above.

To match a transaction to a single category, click in the Match column and select it:

To match multiple categories (which will split the transaction amount over multiple transaction lines), click Select multiple categories. Choose your categories, how the amounts are split, add any other details and click Save.

More about matching bank transactions to categories

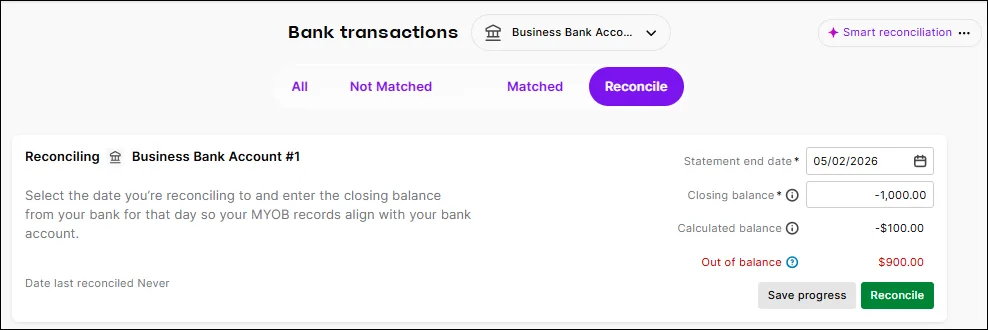

Reconcile your accounts

Reconciling your bank accounts ensures that the bank account balances in MYOB match those in your bank’s records. While matching transactions makes sure each individual transaction is coded correctly, reconciling proves that your overall MYOB balance matches the bank and gives you your true cash position and ensures accurate business reporting.

As automatching and AI suggestions help make your accounts much more reconcile-ready, we've included the ability to reconcile accounts on the Bank transactions page. This also makes it easy to check your transaction matching when you're reconciling.

Let's look at how to reconcile an account.

To reconcile an account

If you’re reconciling an account that isn’t included in the smart reconciliation beta or isn't set up with bank feeds, you can still reconcile from Banking > Reconcile accounts instead (if you are in the Smart Reconciliation beta you can also access the Reconcile tab this way). See Reconciling your bank accounts

Go to Banking > Bank transactions.

If required, choose the account you want to reconcile from the drop-down list.

Click the Reconcile tab. These details appear:

Bank account, Statement end date, Closing balance, Calculated balance and Out of balance

a list of all matched and unmatched transactions for the selected account and date.

Check that you’ve received and processed all bank transactions for the period.

Confirm or enter the Statement end date and Closing balance.

Select each transaction that appears on your bank statement.

Check that the Calculated balance matches the Closing balance and that the Out of balance is zero.

Click Reconcile.

When prompted, export or save a bank reconciliation report for your records.

Repeat these steps for all the accounts you want to reconcile.

Still getting an Out of balance amount after checking your transactions? See these tips on how to fix it

Check that automatching and suggestions are turned on

To make matching bank transactions and reconciling your accounts as easy as possible, you should have the automatch settings turned on. Settings are turned on by default.

To review your settings at anytime go to the Banking menu > Bank rules.

To check that automatching and suggestions are turned on

Click the three dots on the right of the Bank transactions page to see automatching and suggestion options:

Match to MYOB records – MYOB will match bank transactions to the following transaction types:

Electronic payments

Invoice or bill payments

Payroll payments

Receive money

Spend money

Transfers

Also, turning on this option automatically applies any custom rules you set up. When a bank transaction matching the rule's criteria appears in your bank feed, this automatically creates a matching spend or receive money record in MYOB. Invoice and bill custom rules will only show as a suggestion. More about creating rules

Note that if you turn Match to MYOB records off, this also turns off Matches to invoices and bills. This means any payments for customer or supplier invoices won't be automatically matched. You'll still see suggested matches to invoices and bills.

Match to invoices and bills – Automatically match payments from customers and payments to suppliers to recorded invoices and bills. When an open invoice or bill is automatched, the payment is recorded against it, and the invoice or bill is closed. This option can only be selected if Match to MYOB records is also selected.

Match to a category – Automatically assign a category based on past matches you've made for similar transactions. When the category is assigned, a record matching the bank transaction is automatically created in MYOB. MYOB uses AI to assign a confidence score to decide if it will automatically match to a category, or provide a suggested match – see 'Category automatching and suggestions based on confidence', above.

Suggest category – Get category suggestions for an unmatched transaction based on the previous category chosen for a similar transaction. If there is no history, MYOB will use AI to suggest a category based on how other MYOB businesses have matched similar transactions. A confidence score is assigned to decide if it will automatically match the transaction to a category, or provide a suggested match – see 'Category automatching and suggestions based on confidence', above.

If you accept the suggestion or select a different category, this category will be remembered for suggesting or automatching the next time this bank transaction appears in your feed.

FAQs

Do I have to use Smart Reconciliation?

No. Smart Reconciliation is optional and can be turned on or off at any time in your settings.

What gets matched automatically?

There are a range of automatch settings in MYOB, all can be turned on – and off – by you. What’s new is automatching to categories. Transactions are only automatched when there’s a high confidence score of 90% or more.

Matches are based on your past behaviour and a new prediction method, which uses AI, to learn from common patterns across similar customer files. A match will be made where the system has high confidence it's correct (greater than 90%). If the system has a confidence rating of between 70 and 90% it will provide a category suggestion instead of a match. If the system has a confidence rating of below 70%, you'll need to manually match the transaction to the appropriate category.

How do I know why something was matched?

Every match or suggestion includes a label that shows how MYOB arrived at it. There are four methods that MYOB uses for matching: rule-based, historical behaviour, logic or manual. This gives you useful context as you review transactions.

Can I still review everything?

Yes. Even when automatching is on, you’re always able to review in the “matched” tab or before finalising reconciliation.

How does Smart Reconciliation align with responsible AI principles?

Smart Reconciliation is aligned to the principals in the Australian Government’s Guidance for AI Adoption, with a focus on transparency, human oversight and accountability.

Smart Reconciliation uses AI to assist with matching and suggestions – not to make unchecked decisions on your behalf.

Does AI make final decisions in my file?

No. When there are no applicable rules, logic or history to help categorise the transaction, Smart Reconciliation uses AI to to help identify and suggest likely matches. You remain in control. You are still required to review transactions on the Reconcile view of the Bank transactions page. Here you can edit matches before finalising the reconciliation.

How is transparency provided?

Each automatch or suggestion clearly shows why it was made. You’ll see labels in the Method column that explain the logic behind the match, so you can understand and trust what’s happening in your books.

Is my data used to train AI models outside my business?

MYOB uses data responsibly and securely. Smart Reconciliation learns from patterns within your file and similar behaviour to improve accuracy, without exposing your business data to other customers.

Can I opt out if I’m not comfortable using AI?

Yes. Smart Reconciliation is optional, and you can disable it at any time. Your existing reconciliation workflow will continue to work as it does today.