Let's say you receive an invoice for $1000 and the supplier forgets to charge you the GST. To correct this, the supplier sends you a second invoice, only for the GST.

Here's what to do.

To record GST only transactions from suppliers

Go to the Banking menu and choose Spend money.

In the Bank account field, select the bank or credit card category you're paying from.

In the Contact field, select the applicable supplier.

In the Description of transaction field, describe this transaction, e.g. "GST only on purchase number xxxxx" (or similar).

Enter the Date of the transaction, or click the calendar icon to choose the date.

In the Amounts are field, select Tax inclusive or Tax exclusive.

On the first line of the transaction:

select the required expense category

enter the original dollar amount of the expense

enter a description

select GST as the Tax code.

On the second line of the transaction:

select the same expense category as the first line

enter the original dollar amount of the expense as a negative value

enter a description

select N-T as the Tax code.

Click Record.

Note that this process will also work for receiving GST only amounts, but you'd use a Receive money transaction instead (Banking menu > Receive money).

If your Tax Codes (Australia) or GST codes (New Zealand) are set up correctly, AccountRight will take care of GST calculations.

Where applicable, the standard amount of GST is 10% (in Australia) or 15% (in New Zealand). But sometimes a transaction comes along where the GST isn't a standard amount.

These transactions need to be recorded in a particular way to ensure:

the right amount of GST is reflected in the transaction, and

GST is reported correctly on your BAS/GST Return.

Avoid changing the calculated Tax/GST

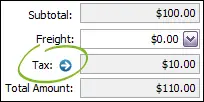

If you change a transaction's calculated tax/GST using the zoom arrow next to the Tax/GST field, BASlink and GST Return calculations could be affected.

Let's look at two example transactions where GST isn't a standard amount. The methods described can be applied to lots of scenarios, but if in doubt - an accounting advisor might be your best option.

Full payment of GST on first instalment

Example

A company's annual advertising costs are $3000 (including GST) which are paid using 6 X $500 instalments. The first instalment includes the total GST payable for the year.

To record the first instalment and include the full GST payable for the year, the transaction will include 3 lines:

One line for the first instalment amount (using a tax/GST code which won't calculate GST)

One line for the full annual fee (using a tax/GST code to calculate the full GST payable)

One line to negate the previous line (using a tax/GST code which won't calculate GST)

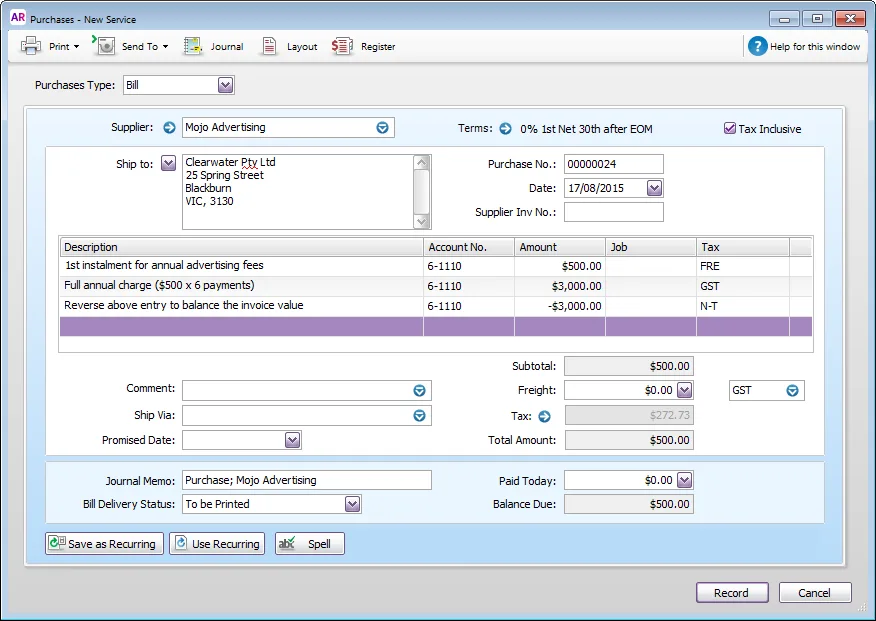

Here's our example of recording the bill and making the payment for the first installment. You might need to check with your accounting advisor for the applicable tax/GST codes to use in your scenario.

Record a bill for the first instalment. In our example, note the following:

The second line calculates GST on the full amount owing for the year

The Balance Due equals the amount owing for the first instalment

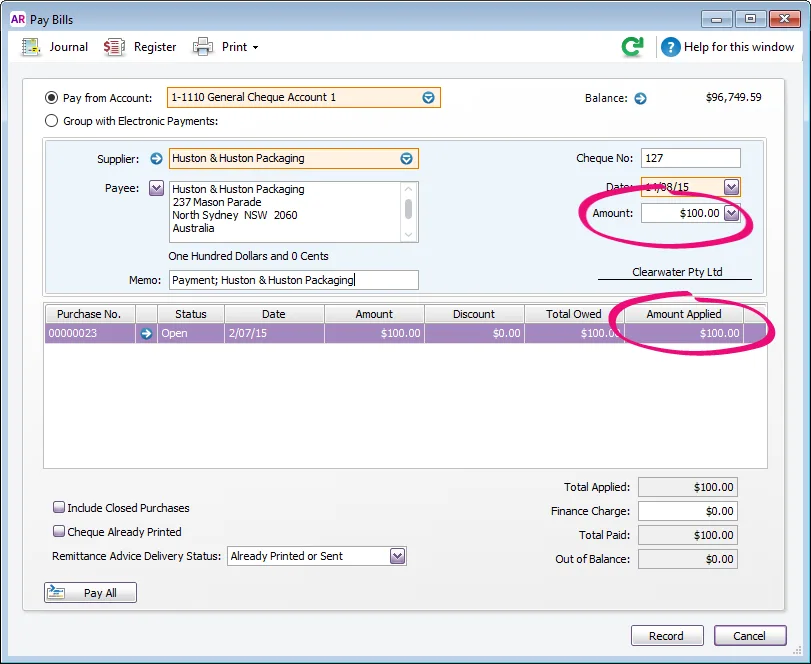

Record a payment for the first instalment. In our example this would be $500.

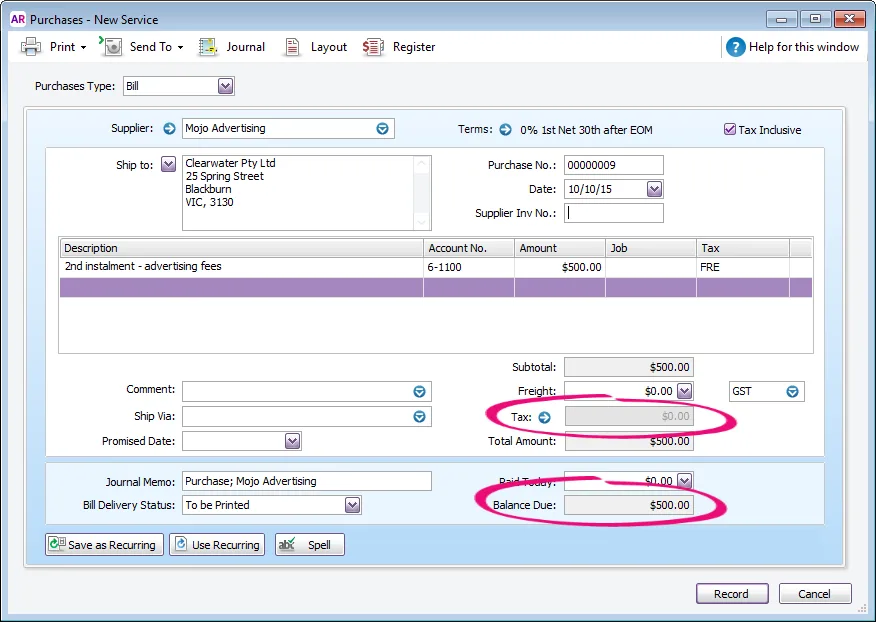

Record a bill for each subsequent instalment. In our example, note the following:

The tax/GST code used won't calculate GST.

The Balance Due equals the instalment amount.

Record a payment for each subsequent instalment.

A transaction that is all GST

Example

An invoice or bill is accidentally issued without GST. To make up for this, a subsequent invoice or bill is issued which is all GST.

There's a few variations to this scenario, but the principle is the same. When recording the second transaction, use two lines:

one line for the original transaction amount to calculate the GST

one line to negate the original transaction amount to leave just the GST

This approach can also be used to add GST which might have been omitted from a previous transaction.

Let's take you through recording a transaction which is all GST.

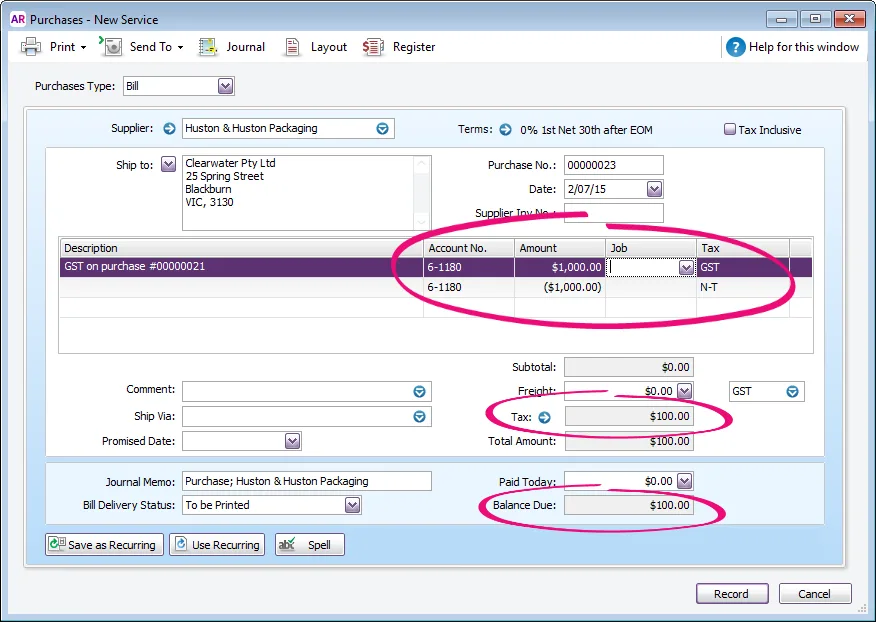

Record the bill or invoice with the following details:

Deselect the Tax/GST Inclusive option.

On the first line use the Account No. and Amount from the original transaction, and apply the applicable Tax/GST code to calculate the GST.

On the second line, enter:

the same Account No. as the first line

the Amount of the original transaction as a negative value (to negate the remaining value of the first line to leave only the GST amount)

the applicable Tax/GST code to calculate NO GST

Using the Item layout?

On the first line, select any stock item and enter a quantity of 1. On the second line, select the same stock item and enter a quantity of -1. This ensures stock quantities and values won't be affected.

Here's our example of a bill which is all GST:

Apply payment to the bill or invoice as normal.

This will close the transaction.

Want to learn more?

We might not be experts in GST, but our community forum is a great place to connect with business professionals who are happy to share their insights.

FAQs

How do I work out the 'grossed-up GST' value?

Grossed-up GST is simply a tax inclusive value calculated from a known GST amount.

If the known amount of GST is $15, the grossed-up GST calculated as follows:

($15 X 23) / 3 = $115

How do I fix a transaction recorded with the wrong tax/GST code?

If you've recorded a transaction with the wrong tax/GST code, the easiest solution is to either change the transaction, or delete the transaction and re-enter it.

If the transaction is in a locked period or can't be changed, how you fix it depends on the original transaction. Your accounting advisor will be able to suggest the best course of action for your scenario, or ask the MYOB Community for advice.