If your business is registered for GST (and you've reflected this in your GST settings), you'll use GST codes to track the GST paid to or by your business. Each GST code represents a particular type of GST.

GST codes are only available in MYOB if your business is registered for GST. Also note that you can't yet delete existing ones.

MYOB has an extensive list of GST codes that can be used in a variety of situations—for example, when doing business with overseas customers, when tracking capital acquisitions, and so on.

You can edit GST codes, create new GST codes (except consolidated GST codes), delete some GST codes, combine some GST codes and assign GST codes to items or accounts.

Create a GST code

You're not able to create a new consolidated GST code.

Go to the Accounting menu and click GST codes to open the GST codes list.

Click Create.

Complete the details of the tax code — these will vary depending on the GST type you've chosen. Any fields marked * , such as GST code, are mandatory. You may also need to choose a linked category for tax paid or collected (learn more about linked categories).

Click Save.

Edit a GST code

What you can edit in tax codes

Only users with the Accountant/Bookkeeper or Administrator user roles and permissions can edit GST codes. See Users.

In most tax codes, you can edit all of the fields in a tax code except the Tax type.

If you change the rate for a GST code, it won't change the rate for existing transactions which used that GST code.

You can also change or create a new Linked contact for tax authority.

In the N-T tax code, you're not able to change the Tax code, Tax type or Rate.

Go to the Accounting menu and click GST codes to open the GST codes list.

Click the GST code you want to edit.

Make your changes.

You can only enter a maximum of 3 letters in the GST code field.

Click Save to save your changes.

Delete a GST code

You can delete a GST code if it has never been used in a transaction or has not been assigned to an account, contact or item. If the GST code has been used in a transaction, you will not be able to delete it, even after deleting any associated transactions. This makes sure you keep a history of records used in transactions for auditing reports. If it's never been used, make sure it isn't assigned to an account, contact or item before you delete it.You are also not able to delete the S15 or N-T GST codes.

Go to the Accounting menu and click GST codes to open the GST codes list.

Click the GST code you want to delete.

Click Delete.

Click Delete again in the confirmation message that appears.

Combine GST codes

Merge two GST codes to remove any unused codes.

You can only combine GST codes that have the same:

rate

linked categories

linked contacts (if a linked contact has been chosen).

You can't combine consolidated GST codes.

Choose the GST code to delete, and which GST code to move the deleted GST code's history to. All contacts, categories and other records update to the new GST code.

If you use AccountRight, we recommend making a backup in AccountRight before combining GST codes.

Go to the Accounting menu and click GST codes to open the GST codes list.

Click Combine GST Codes.

Choose the GST code you want to keep from the Move transaction history to list. This is the code the deleted code’s history moves to.

Choose the GST code to delete from the Delete this GST code list.

The next action cannot be undone

Before continuing, check you’ve selected the correct GST codes to combine. If you're not sure, click Go back.

Once you combine GST codes, the only way you can go back to the old GST codes is to restore from a backup (if you have AccountRight installed) and re-enter transactions posted using these codes since the backup. If you're not an AccountRight user and haven't created a backup before combining GST codes then this is not an option.

You can also edit some details of the combined GST code, such as the name, rate or linked accounts.

Click Combine.

Assign a GST code to a category

You can assign a GST code to any detail category in your category list. The GST code you assign will appear as the default GST code when you post a transaction to this category.

For example, you have assigned the standard code (S15) to your electricity expense category. When you settle your electricity bill in the Create spend money transaction page and allocate it to this category, the standard code will appear in this window by default.

You can allocate a GST code to a category. To open this window, go to the Accounting menu > Categories (Chart of accounts), and click the applicable category.

Assign a GST code to an item

When you set up an item, you must assign a GST code to use when selling it.

These item GST codes will appear by default when buying and selling your items unless you have specified that the customer or supplier GST code is to be used instead.

You assign GST codes to items in the following tabs of the item:

Buying and Selling section

Profile section.

For more information, see Creating items.

GST codes are used to track GST paid to or by your business. Each GST code represents a particular type of GST.

AccountRight has an extensive list of GST codes that can be used in a variety of situations—for example, when doing business with overseas customers, when tracking capital acquisitions, and so on. To see the GST codes that come with AccountRight, open your company file and go to the Lists menu and choose GST Codes.

To create a GST code

Go to the Lists menu and choose GST Codes. The GST Code List window appears.

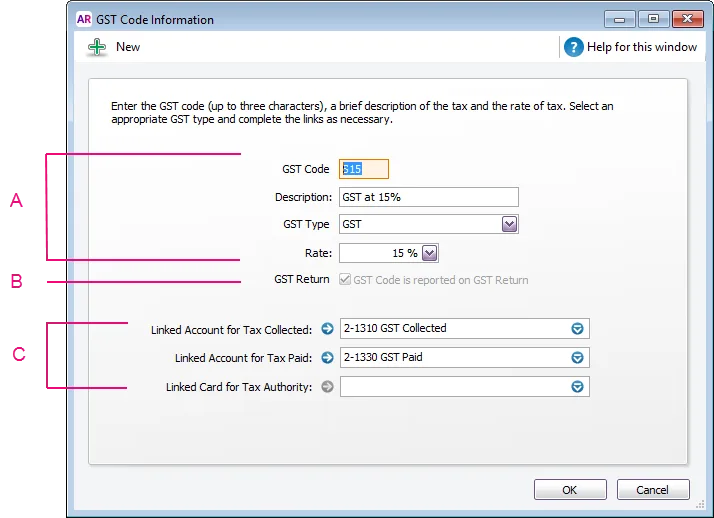

Click New. The GST Code Information window appears.

In the GST Code field, type a code (up to three characters) for the new GST code and press Tab.

Complete the other fields in this window.

A | Enter a description, type and rate. |

B | If the GST code is zero-rated, select the

GST Code is Reported on GST Return

option. Deselect this option for exempt GST codes. |

C | Select the linked account for GST collected and for GST paid. These fields are only available for some GST types. Select a card, if applicable. |

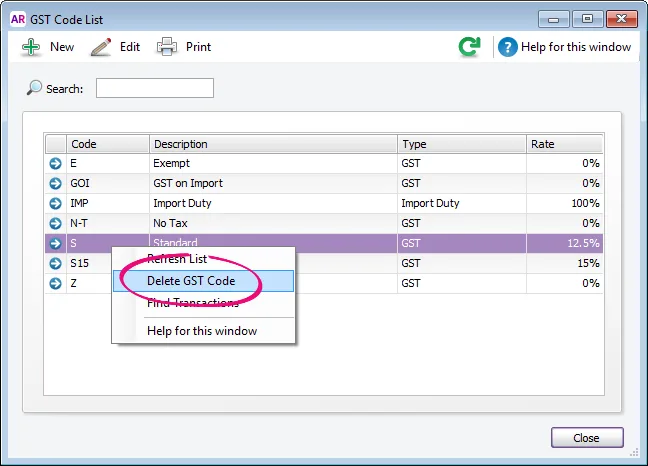

To delete a GST code

You can delete a GST code if it has never been used in a transaction or has not been assigned to an account, card or item. If the GST code has been used in a transaction, you will not be able to delete it, even after deleting any associated transactions. This makes sure you keep a history of records used in transactions for auditing reports. If it's never been used, make sure it isn't assigned to an account, card or item before you delete it.

To delete a GST code:

Go to the Lists menu and choose GST Codes. The GST Code List window appears.

Right-click the GST code to be deleted and choose Delete GST Code.

To assign GST codes to accounts

You can assign a GST code to any detail account in your accounts list. The GST code you assign will appear as the default GST code when you post a transaction to this account.

For example, you have assigned the standard code (S15) to your electricity expense account. When you settle your electricity bill in the Spend Money window and allocate it to this account, the standard code will appear in this window by default.

You can allocate a GST code to an account in the Account Information window. To open this window, go to the Accounts command centre, click Accounts List, double-click the required account, and click the Details tab.

To assign GST codes to items

When you set up an item, you must assign a GST code to use when selling it. If you use AccountRight Standard, Plus or Premier, you’ll also need to assign a GST code to use when buying the item.

These item GST codes will appear by default when buying and selling your items unless you have specified that the customer or supplier GST code is to be used instead (see below).

You assign GST codes to items in the following tabs of the Item Information window:

Buying and Selling tabs (Not Basics)

Profile tab (Basics).

For more information, see Creating items.

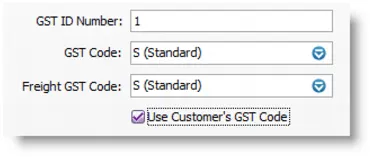

To assign GST codes to cards

You can define a default GST code for a customer or supplier (Not Basics). You would only need to select a default GST code if the customer’s or supplier’s GST status takes precedence over that of the item or service being sold or purchased.

For example, if a customer is one to whom you only ever make zero-rated export sales, you should assign the zero-rated GST code (Z) to that customer’s card.

When you create a quote, order or invoice, the GST code assigned to the customer will be used as the default. This GST code will override the item’s GST code in an item sale, and the allocation account’s GST code in a non-item sale.

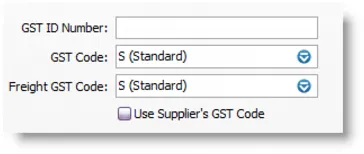

GST codes are assigned to customers in the Selling Details tab of their Card Information window (Card File > Cards List > Customer tab > open the card > Selling Details tab > GST Code).

Make sure you select the Use Customer’s GST Code option. (If this is not selected, the customer’s GST code will not be used, even if one has been assigned.)

Similarly, in AccountRight Standard, Plus and Premier, when you create a purchase quote, order or bill, the GST code assigned to the supplier will be used as the default. GST codes are assigned to suppliers in the Buying Details tab of their Card Information window.

Make sure you select the Use Supplier’s GST Code option. (If this option is not selected, the supplier’s GST code will not be used, even if one has been assigned.)