In this article

Expense reports help you manage business spending. They're used to monitor and reimburse employee spending and to categorise, track, and claim general business expenses.

In this guide, we look at how expense reports work, why they're useful, and what to include.

What is an expense report?

An expense report shows spending made by either your business or employees. Key details include the date of the purchase, the amount, the expense category, the merchant or vendor involved, along with tax receipts, invoices or other documentation. Reports may be written on paper, in a simple Word document or through your online accounting software.

What is the purpose of an expense report?

The purpose of an expense report is to track business expenses. If you're a business owner, you may use these reports to record expenses that can be claimed on your tax return to ensure that you don't miss potential deductions.

Expense reports can also be used when your employees pay business expenses out of their own pockets – for example, petrol costs for a work trip or the cost of a client lunch. Employees fill in an expense report, attach receipts or other documentation, then your accounting team reimburses them.

Why do you need to use expense reports?

Using expense reports is a crucial part of tracking expenses in your business. Expense reports give you greater visibility and control, simplify tax time, ensure that employees are reimbursed correctly, and help you monitor costs associated with specific clients or projects.

Efficient expense tracking and control

Expense reports make it simpler to track business spending efficiently, improving visibility and control. Rather than estimating costs or trawling through bank statements to calculate expenses, there is clear documentation of spending throughout the year.

Simplify tax deductions

By simplifying tracking, expense reports can make it easier to claim tax deductions. Instead of having to go back and find receipts or bills after the fact, you record and monitor as you go, saving time and reducing the risk of missed deductions.

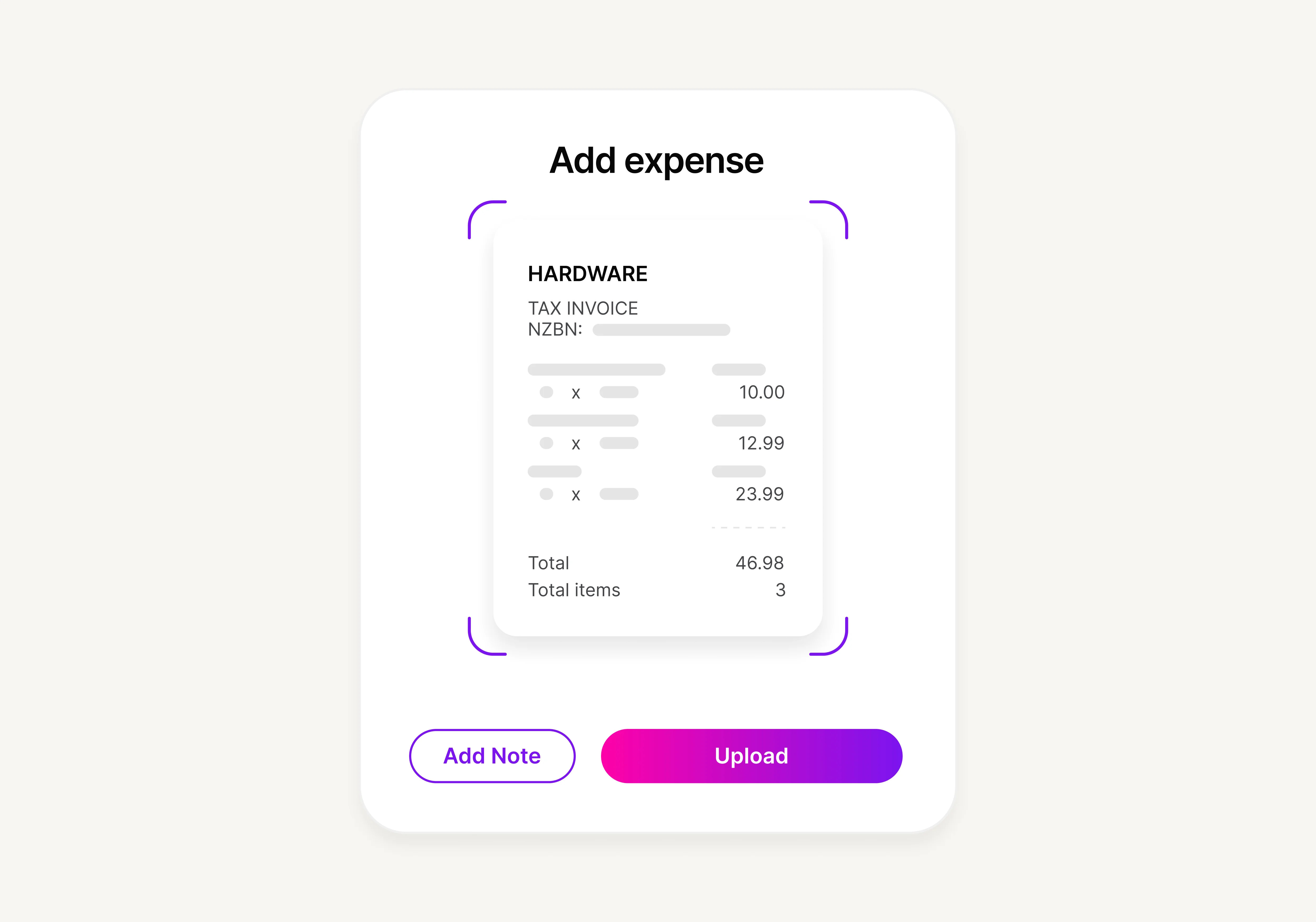

MYOB's Capture App makes it even simpler – you upload photos of receipts, and the tool auto-populates the details into an expense report.

Improved budget control

Improved budget control is another benefit of expense reporting. With real-time insight into employee claims and overall business costs, it's easier to flag overspending and spot budget anomalies before they have a major impact on your annual costs.

Accurate employee reimbursements

Accurate employee reimbursement for their out-of-pocket costs is crucial to employee wellbeing. Additionally, you don't want people spending outside your guidelines. When expenses are recorded automatically, you can monitor reports to ensure that employees aren't claiming luxury meals or buying equipment for home, rather than the office.

Better monitoring of project and client-related costs

Monitoring project and client-related costs is another benefit of effective expense reporting. Real-time reporting not only helps you monitor overall spending but also enables you to assign costs to specific clients or projects.

With MYOB expense management software, you can on-charge costs to a client or project with one click. This improves visibility, giving you insight into the clients and project types that tend to blow budgets or accumulate significant costs.

Types of expense reports

The key types of expense reports are one-time reports, recurring reports and long-term expense reports.

One-time expense reports

One-time expense reports are the most straightforward. As the name suggests, this type of report is made for occasional purchases – for example, tickets for a work trip or new equipment for the office. The form should include the date of the purchase, the relevant pay period and the expense category.

Recurring expense reports

Recurring expense reports are a way to record expenses that happen regularly. Instead of manually listing each expense on its own line, as you would on a one-off report, repeated expenses are listed under set categories – for example, 'meals', 'transport' or 'entertainment'. You'll usually create this kind of report monthly or quarterly.

Long-term expense reports

Long-term expense reports are designed to gather information about the overall cost of a particular project, team or client. Unlike a recurring expense report, this document lays costs out month-by-month, with the total for each month recorded.

What to include on an expense report

Here are the details included on a typical expense report.

Date of expense

When each item or service was paid for – not when the item or service was purchased or delivered

Amount of each expense

The amount paid for each item or service

Category/nature of expense

The category the expense falls under for example: insurance payments, transport, payroll or rent

Associated project or client

The specific project or client that the expense relates to – if any. This should include the client or project number if your business uses them

Merchant or vendor

The supplier or business that provided the product or service, along with their contact information

Total payment amount including any associated charges

The full amount paid, including taxes and any other charges

Receipt of the transaction

The receipt, invoice or bill associated with the purchase

Common business expense categories

Common business expense categories include payroll, office supplies, advertising, insurance, and bank fees. Different expense categories come with different tax deductibles, so getting them right is important.

Payroll expenses

Payroll expenses are all the costs involved in paying employees. Generally, you can claim deductions for net pay, not money that's withheld for tax, super contributions or Kiwisaver payments. Your payroll accounting system should help you calculate expenses and withholdings so you can work out what to claim as a deduction.

Office expenses

Office expenses include the cost of minor, consumable office items like coffee and tea, pens, printer ink, cleaning products and paper. These costs are usually recorded when the items are purchased. Some businesses use separate office supplies expense reports for each team or department, so they're easier to monitor.

Utilities

Utilities are the services that keep your office running – including electricity, water, rubbish collection and internet service. Because these are recurring expenses, they're usually recorded as part of your monthly or quarterly expense reporting.

Advertising

The advertising expense category includes costs involved with promoting and marketing your brand, product or service. For example, the cost of online ads or social media posts, brochures or other marketing materials, or even the cost of designing and running your website.

Bank fees

Bank fees are any costs charged by your bank or financial institution, from account set-up fees and monthly account charges to transaction or ATM fees. While individual bank fees are minor, they can add up over time, so it's worth tracking them.

Insurance

Some insurance expenses are tax deductible, so the cost of premiums should be recorded in your expense reporting. Generally, in Australia and New Zealand, insurance that covers the cost of business operations may be deductible – for example, liability insurance or income protection insurance.

Motor vehicle and travel expenses

Vehicle and travel expenses are notoriously complicated to calculate. If you have a vehicle or vehicles used for business purposes only, for example, for deliveries or staff transport, you can usually claim petrol, diesel or EV charging costs as deductible expenses.

However, if you also use your work vehicle in your personal time, you can only claim a portion of the total running cost. You can choose to keep a logbook of work-related travel for a three-month period and calculate your claim based on that estimate, or track the distance you travel for work and claim based on a per-kilometre rate.

Software and subscriptions

Software and other subscriptions are another common recurring expense. This category includes subscription costs for software services or apps you use to manage your business, for example, accounting or ecommerce software.

Expense reporting process

The expense reporting process varies depending on the way you run your business. For example, if you use accounting software or an ERP system to manage your finances, you may use virtual or auto-generated expense reports. If you still use a manual accounting system, you may record expenses on a form or spreadsheet.

Here's a look at key steps in the employee expense reporting process:

Enter name, title and date of the report.

Fill in details for each expense – including date of purchase, expense category and amount.

Provide a brief description of the reason for the expense – for example, business travel costs.

Attach receipts or photos of receipts.

Calculate total expenses, including taxes or other additional charges.

Subtract any cash advances or personal spending.

Record the total due for reimbursement.

Sign the report – this may be a digital signature if you use an online platform.

Submit the report.

The reimbursement process includes these key steps:

Receive the expense report.

Compare the reimbursement claim to the submitted receipts.

Check that expenses fit into your reimbursement policy – for example, you may only reimburse meal costs up to a certain limit, or pay for meals but not alcoholic beverages.

Accept the reimbursement claim and process the payment.

Expense report FAQs

Are expense reports necessary for employees?

Expense reports are necessary if your employees use their own money to cover company expenses. They ensure that you keep a record of what has been spent and that employees are reimbursed accurately. If you don't have a clear expense reporting process, you could end up missing a legitimate claim or reimbursing an employee for an invalid claim.

Can expenses be claimed without an invoice?

To claim a business expense on your tax return, you generally need a clear record of the expense in the form of a tax receipt or invoice. That's why keeping copies of receipts and tracking your expenses throughout the year is crucial.

Most employers have a similar policy for employee expense claims, although some let employees submit credit card statements as part of their expense reports.

What are expenses paid but not recorded?

Expenses paid but not recorded are expenses that are paid in one accounting period and recorded in another. The way you record these expenses on a balance sheet depends on whether you use accrual accounting or another method.

All eyes on expense reports with MYOB

If you want to streamline employee reimbursements, simplify tax deductions, and monitor costs for specific projects or clients – expense reporting is a no-brainer. This is the easiest way to keep a clear record of costs, receipts, and the employees, suppliers and clients involved.

With MYOB accounting software, the expense claim process is clear and concise. Instead of using spreadsheets or paper forms to manage claims, it's all recorded and managed through your online platform. It's just one of the ways MYOB makes it easier to keep things organised in your business.

Check out our latest offers and get started with MYOB today!

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.