Customise solutions to suit your needs

Choose from a selection of modules to help you manage your business:

Manage and view your clients’ accounting in one place

Share a common ledger – connect with your business clients online over a ‘Common Ledger’ to produce Workpapers, Asset Registers and Financial statements.

Online access to your clients – access to real-time MYOB Business data means you no longer need to transfer files between your client and your office.

Compliant reporting – create quick and easy statutory reports from client data. Most of the account codes and notes are allocated for you.

Integrated assets – make the day-to-day work of managing assets fast and straightforward. Create new assets in the previous year and automatically reflect purchases, sales and adjustments.

Comprehensive tax management software

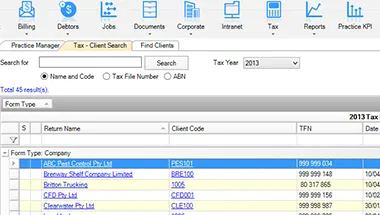

Streamline compliance – keep Inland Revenue (IR) happy with seamless compliance and accurate data. You can file all major tax returns through the IR gateway and check that client payments are on time – every time.

Get it right the first time – New Zealand accounting professionals use MYOB Practice Tax to file over 500,000 tax forms every year. Clever validation audit tools highlight potential errors making it easy to resolve problems quickly.

Remote tax management – with secure client e-signatures, a simple view of IR and MYOB transactions, and the ability to reconcile transactions on the spot, you can enjoy paperless tax management with MYOB Practice Tax software.

Never lose sight – fully customisable homepages help you and your team monitor tax return lodgements with ease.

Reporting made easy – a flexible and easy-to-use tool for reporting across your tax database. A range of standard and customisable reports to track lodgements and data mine the most common income and expense items.

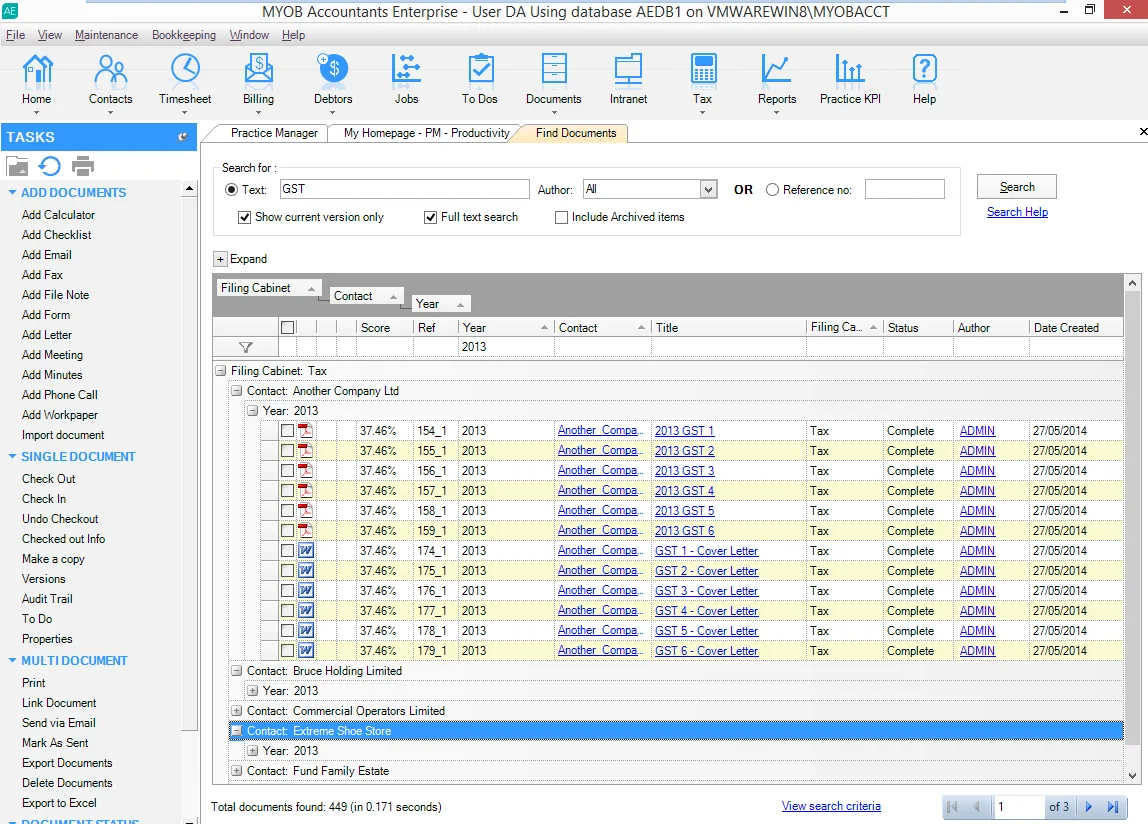

Secure access to client documents with version control

Secure documentation, in one place – built to help accounting practices go digital. Create, file and retrieve documents, email, letters and more in one organised, searchable and secure space.

Take control of your email – Document Manager allows you to search and review emails and manage them like any other secure document quickly and easily.

Set high standards – Document Manager takes the client information from your database and enters it into your standard letters and documents, so you don’t have to. You’ll have confidence that your documents reflect your brand.

Manage your own business admin and accounting staff

Run your practice with maximum productivity and profitability – tailored control over jobs, time, costs and processes to run your practice with maximum productivity and profitability. You can customise it to further define KPIs and streamline approval processes.

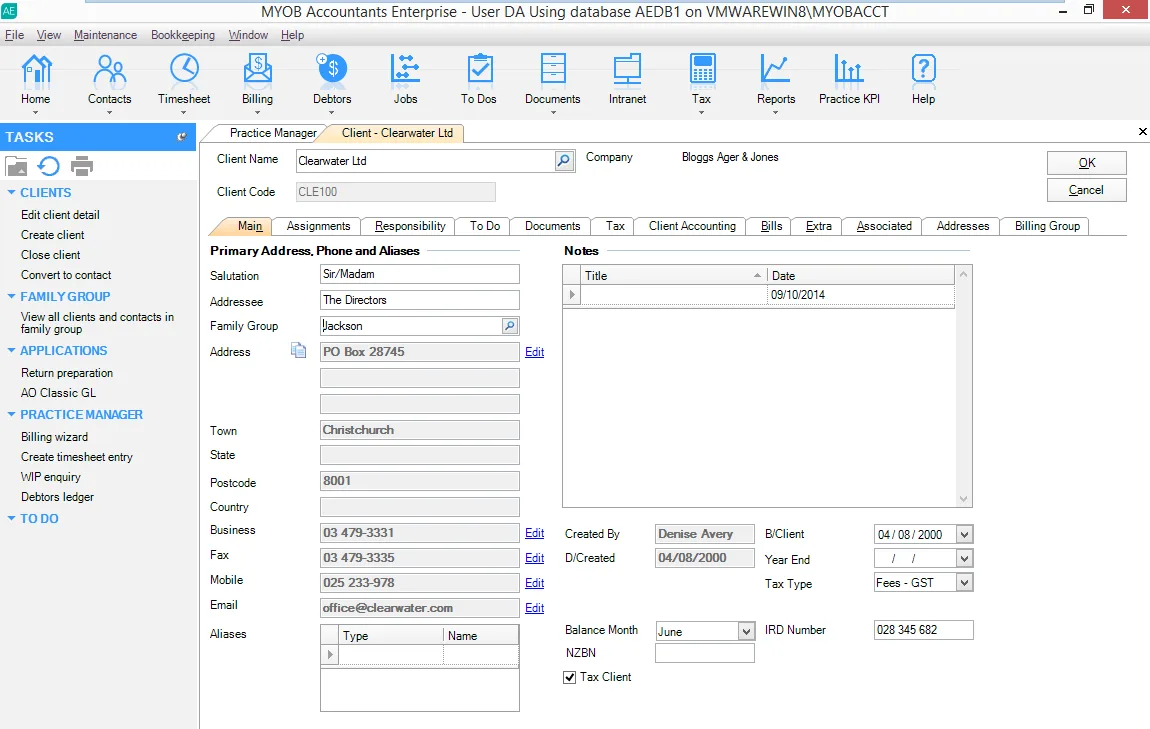

Effortless client management – as well as storing contact details, including multiple addresses and phone numbers, relationships and notes, you can create custom fields and lists to help categorise this important and valuable data.

Deliver outstanding client service – Practice Manager can help you streamline processes by allocating jobs and managing your milestones.

More valuable insights – gain better insight into your practice’s financial performance and the output of individual staff. Practice Manager can help you produce detailed reports on any aspect of your practice.

Easy billing and invoicing – enjoy the flexibility to bill at the client or assignment level, and the choice of multiple legal entities to suit your specific practice needs. Bulk invoicing options, automatic standard paragraphs and the ability to copy wording from a previous invoice save time and improve cash flow. Approval processes are user friendly and highly efficient.

Understand the true worth of every client – Family Groups are recognised by all Accountants Enterprise modules, which allows you to see the true worth of a client to your practice. Instantly see a client’s true position in WIP, Debtors and Billing Reports as well as ensuring all related jobs are completed before signing off on client work.

Do more with Accountants Enterprise

Manage your documents

Keep work flowing and manage quality control with the electronic document approval system. Best of all – sensitive documents don’t leave the practice without sign-off.

Customise for your needs

Fully customisable so you can further define KPIs, implement approval processes and collaborate on reports.

Help your clients plan

Offer clients higher value services using our ‘What if’ calculator. You can create scenarios for this financial year and the next one, and help your clients plan for the future.

"It’s a fantastic product, a fabulous system. It’s improved our processes and our turnaround timeframes"

Mike Davies, OnTax Business Centre Ltd

Here's how Accountants Office and Enterprise benefits our customers

Online Workpapers improves accuracy and efficiency for Mead Partners

Find out how adding Online Workpapers to MYOB Client Accounting helped Mead Partners grow their practice.

MYOB portal helps Palfreyman Chartered Accountants bridge the client-advisor gap

Discover how streamlined collaboration and MYOB enables Palfreyman Chartered Accountants to deliver enhanced client services.

Abraham & Soloman Accountants reduce admin tasks by 25%

Abraham & Soloman Accountants Ltd has celebrated its 25th anniversary in business by moving to Accountants Office, saving on admin in the process.