You must use this workpaper to complete Business income and expenses – Non-primary production, including Trading account.

To add this workpaper:

From the Tax workpapers & schedules drop-down, select Business – Non Primary Production.

This workpaper has 3 sections

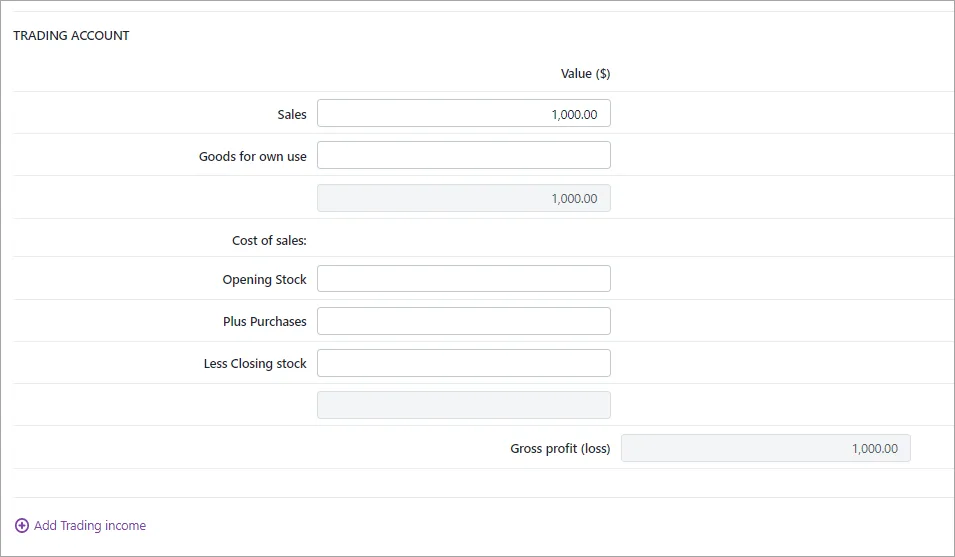

Trading income

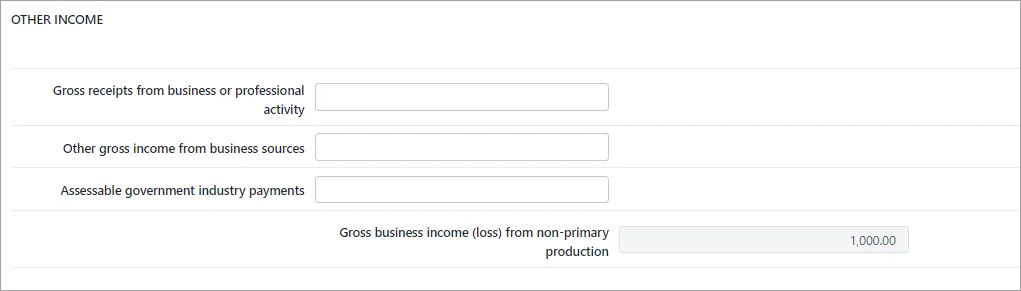

Other income

Deductions

Complete the deductions related to the income above.

Integration

Individual

Workpaper label | Main return (Item) |

|---|---|

NPP income |

|

Gross receipts from business or professional activity | P8 - Label J |

Other gross income from business sources | P8 - Label J |

Assessable Government Industry payments | P8 - Label H |

Trading Sales | P8 - Label J |

Trading - Goods for own use | P8 - Label J |

Trading - Opening Stock | P8 - Label K Non primary production (See Expenses) |

Trading - Purchases | P8 - Label L Non primary production (See Expenses) |

Trading - Closing Stock | P8 - Label M - Non primary production (See Expenses) |

Deductions |

|

Foreign resident withholding expenses (excluding capital gains) | P8 - Label U |

Contractor, sub-contractor & commission expenses | P8 - Label F |

Superannuation expenses | P8 - Label G |

Bad debts | P8 - Label I |

Lease expenses | P8 - Label J |

Rent expenses | P8 - Label K |

Interest expenses within Australia | P8 - Label Q |

Interest expenses overseas | P8 - Label R |

Depreciation expenses | P8 - Label M |

Motor vehicle expenses | P8 - Label N |

Repairs and maintenance | P8 - Label O |

All other expenses (Not listed above) | P8 - Label P |

Partnership

Workpaper label | Main return (Item) |

|---|---|

NPP income |

|

Trading Sales | 5H - Other business income |

Trading - Goods for own use | 5H - Other business income |

Trading - Opening Stock (Cost of sales) | 5E Expenses Cost of sales, 39C Opening stock |

Trading - Purchases (Cost of sales) | 5E Expenses Cost of sales |

Trading - Closing Stock (Cost of sales) | 5E Expenses Cost of sales, 41D Closing stock |

Gross receipts from business or professional activity | 5H - Other business income |

Other gross income from business sources | 5H - Other business income |

Assessable Government Industry payments | 5F - Assessable government industry payments |

Deductions |

|

Foreign resident withholding expenses | 5P Foreign resident withholding expenses (excluding capital gains) |

Commission paid, Sub-contract, contract labour | 5C Contractor, sub-contractor & commission expenses |

Superannuation expenses | 5D Superannuation expenses |

Bad debts | 5F Bad debts |

Lease expenses | 5G Lease expenses |

Rent expenses | 5H Rent expenses |

Interest - domestic, Interest - overseas | 5I Total interest expenses |

Royalties | 5J Total royalty expenses |

Depreciation expenses | 5K Depreciation expenses |

Motor vehicle expenses | 5L Motor vehicle expenses |

Repairs and maintenance | 5M Repairs and maintenance |

Accounting, Advertising and marketing, Bank fees, Borrowing expenses, Capital works, Cleaning and rubbish removal, Donations, Electricity and gas, Freight and courier, Fuel and oil, Government charges/fees/levies/licences etc, Hire and rent of plant and equipment, Hire purchase charges, Home office expenses, Insurance expenses, Legal fees, Materials and supplies, Postage, Printing and stationery, Protective clothing, Rates and land taxes, Replacements - tools etc, Salaries - associated persons, Salaries - other persons, Subscriptions, Sundry expenses, Telephone, Travel, accommodation and conference expenses, Other expenses | 5N All other expenses (Not listed above) |

Salaries - associated persons, | 44L Total salary and wage expenses |

Trust

Workpaper label | Main return (Item) |

|---|---|

NPP income |

|

Trading Sales | 5H - Other business income |

Trading - Goods for own use | 5H - Other business income |

Trading - Opening Stock (Cost of sales) | 5E Expenses Cost of sales, 39C Opening stock |

Trading - Purchases (Cost of sales) | 5E Expenses Cost of sales |

Trading - Closing Stock (Cost of sales) | 5E Expenses Cost of sales, 41D Closing stock |

Gross receipts from business or professional activity | 5H - Other business income |

Other gross income from business sources | 5H - Other business income |

Assessable Government Industry payments | 5F - Assessable government industry payments |

Deductions |

|

Foreign resident withholding expenses | 5P Foreign resident withholding expenses (excluding capital gains) |

Commission paid, Sub-contract, contract labour | 5C Contractor, sub-contractor & commission expenses |

Superannuation expenses | 5D Superannuation expenses |

Bad debts | 5F Bad debts |

Lease expenses | 5G Lease expenses |

Rent expenses | 5H Rent expenses |

Interest - domestic, Interest - overseas | 5I Total interest expenses |

Royalties | 5J Total royalty expenses |

Depreciation expenses | 5K Depreciation expenses |

Motor vehicle expenses | 5L Motor vehicle expenses |

Repairs and maintenance | 5M Repairs and maintenance |

Accounting, Advertising and marketing, Bank fees, Borrowing expenses, Capital works, Cleaning and rubbish removal, Donations, Electricity and gas, Freight and courier, Fuel and oil, Government charges/fees/levies/licences etc, Hire and rent of plant and equipment, Hire purchase charges, Home office expenses, Insurance expenses, Legal fees, Materials and supplies, Postage, Printing and stationery, Protective clothing, Rates and land taxes, Replacements - tools etc, Salaries - associated persons, Salaries - other persons, Subscriptions, Sundry expenses, Telephone, Travel, accommodation and conference expenses, Other expenses | 5N All other expenses (Not listed above) |

Salaries - associated persons, | 44L Total salary and wage expenses |