This information applies to 2021 tax returns onwards.

To reduce data entry and maintain accuracy, you can share the income details between spouses' tax returns. If your client's spouse's details are in the database then you can share the details and automate the completion of all the spouse's details and income.

The way of sharing spouse details is different in MYOB Practice Compliance compared to MYOB AE/AO. In AE/AO, you select the spouse from the current tax return and pull the data into the return. In Practice Compliance, you will be pushing the data from the current tax return into the spouse's return.

Sharing the spouse data

If you've created a tax return for both spouses in your database, you'll be able to share the income details from one tax return to another and vice versa.

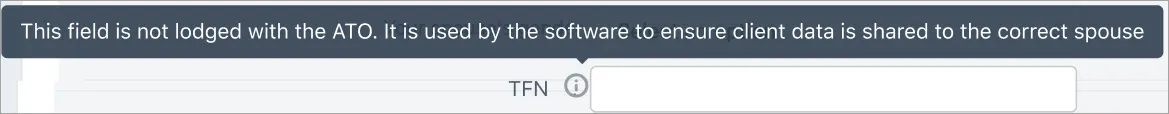

We've used the tax file number to link the 2 spouse's tax returns. This tax file number will not be printed or lodged to the ATO.

What data will be shared between the tax returns?

The following data will be shared into the spouse's tax return:

Spouse's name

Date of birth

Tax file number

From this label | To this label (into the Spouse's return) |

|---|---|

Taxable income or loss | O - Your spouse's taxable income |

NA (enter amount manually) | T - Your spouse share of trust income on which trustee is assessed under section 98 |

IT1 - Employers exempt from FBT under section 57A | R - Employers exempt from FBT under section 57A |

A5 - X Amount on which family trust distribution tax has been paid | U Distributions to your spouse on which family trust distribution tax has been paid |

IT2 - Employers not exempt from FBT under section 57A | S - Employers not exempt from FBT under section 57A |

Item 6 B - Australian Government pensions and allowances | P - Amount of Australian government pensions and allowances. |

Sum of Item D12 Personal Super Contributions and IT2 Super Contributions | A - Amount of your spouse's reportable super contributions |

IT3 U Tax-free government pensions | B Other specified exempt payments |

IT4 V Target foreign income | C Your spouse’s target foreign income |

Sum of Item IT5 Financial Investment Loss and Item IT6 Property Loss | D - Your spouse's total net investment loss |

IT7 Z Child support you paid | E - Child support your spouse paid |

To share the spouse data

Make sure you've created the tax return you're going to share the data with.

Go the Spouse details - Married or Defacto item and answer the question: Did you have a spouse - married or defacto during the year 2020 to 2021?

Select Yes or No at Is the spouse a client

If the spouse is not in your database, select No and enter the details manually.

If you've selected Yes, enter the spouse's tax file number in the TFN field. The information will be shared with their tax return.

Click Share to spouse's return.

In the Share spouse data window, select the Client name and click Share.

The spouse's details are now shared.If you're updating any information in the tax return you're sharing from, make sure you select Share to spouse's return after making the change so the data is updated on the other tax return.

New labels in the spouse details

We've added 3 new calculated labels added to the spouse details income section. You can use this information to calculate the tax offsets and other eligibilities for the client.

Your spouse's ATI amount.

Your spouse's rebate amount: Use this amount to work out the eligibility for the Seniors and Pensioners tax offset.

Your spouse's assessable income.