Key points

-

From 2020 onwards, you can roll over a simple individual tax return in Tax. Just make sure the previous year's tax return has a tax contact and tax agent present in the return properties.

-

You'll see an Assets tab when the individual tax return opens in Practice Compliance. You can import depreciation assets into Assets online, but the data from Assets won't integrate into the return.

Entering data into a tax return

When moving a tax return from MYOB AE/AO into MYOB Practice Compliance, we roll over some fields to reduce your data entry time.

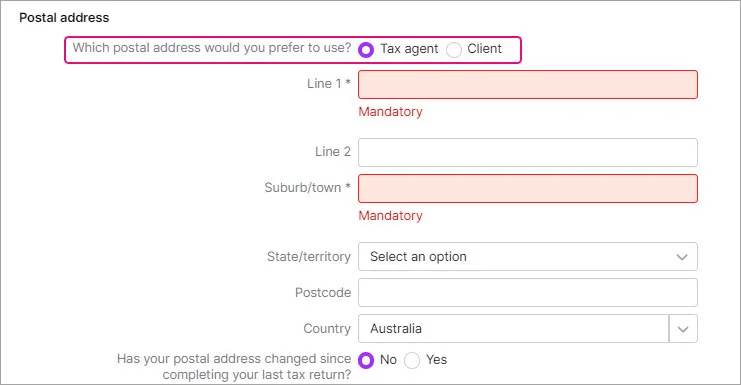

Front cover postal address

This feature is available only for tax returns that are created after 12 December 2023.

For any existing returns, you'll need to manually enter the address.

For the ATO communications, you can choose to send it either to the tax agent or client's address. Select Tax agent or client at the Which postal address would you prefer to use? question.

The Client address is integrated from AE?AO to the front cover of the tax return.

The Tax agent is integrated from Settings > ATO settings > select the Agent.

Electronic funds transfer (EFT) details

Choose the bank account details for the Tax agent or client for refunds.

The Client address is integrated from AE?AO to the front cover of the tax return.

The Tax agent is integrated from Settings > ATO settings > select the Agent.

General data entry

Use the navigation options on the left of the Tax return page to jump straight to the section where you want to enter data into some fields.

If a label is greyed out, it means that you need to use a schedule or a workpaper to enter data into that label. To access them, select the Related schedule/worksheets link to view the schedule or worksheets you need to complete the label.

Use the ATO lodgable schedules to enter values in a label. These schedules are lodged with the tax return.

Use tax worksheets to enter values in a label. These are specific to each tax return type are not lodged with the tax return.

Individual tax returns to let you automatically populate spouse association details.

To open the schedules and worksheets

In the panel on the left of the page, in the Add schedule or worksheets drop-down, type the name of the schedule you want, or select the schedule or worksheet from the list.

Enter the details in the labels you want to complete.

Completing the tax return

Once you've entered the data in the tax return, follow the workflow to validate, review, complete, and lodge the tax return.