Key points

-

You can pre-fill from the tax year 2020 onwards for an individual tax return.

-

Tax returns that are created after 1 December 2023 can prefilled multiple times. The Pre-fill from ATO button will always be active. For returns created before 1 December 2023, you can enable pre-filling multiple times by deleting and adding the tax return again.

-

During the pre-fill, the schedules will be auto-created. The pre-fill data will be populated in the income details schedule and then into the respective tax return items.

-

You can edit the pre-fill data if required.

What data pre-fills into the tax return?

Label | Item numbers |

|---|---|

Salary and wages | Item 1 |

Employment Termination Payment (ETP) | Item 4 - Income Details schedule (INCDTLS) |

Government Payments | Item 1, Item 5, Item 6, Item 24 Label V, Item IT3 depending on the benefit description |

Superannuation lump sum | Item 9 - Income Details schedule (INCDTLS) |

Bank Interest | Item 10 |

ATO interest | Item 10 - Item 24X |

Dividends | Item 11 |

Employee Share Scheme | Item 12 - Income details schedule - INCDTLS |

First home super saver (FHSS) | Items 24R, Item 24S |

Private health insurance | PHI labels |

Personal Superannuation contributions deduction | Item D12 - Deductions schedule - DDCTNS |

PAYGW - Union / Professional Association Fees | Item D5 - Deductions schedule - DDCTNS |

PAYGW - Workplace Giving | Item D9 - Deductions schedule - DDCTNS |

ATO Interest: Interest Charge Debit | Item D10 - Deductions schedule - DDCTNS |

PAYGW - Deductible amount of UPP of the annuity to INCDTLS Annuity deductible amount of undeducted purchase price |

|

Early Stage Innovation Companies (ESIC) | Item T8 - Early stage investor (ESIC) workpaper. |

Foreign Employment payments | Item 1 - Salary or wages and Foreign employment income in INCDTLS schedule |

To pre-fill the data into the tax return

On the Compliance page, click to open the return you want to pre-fill.

On the right side of the tax return, click Pre-fill from ATO.

For a successful pre-fill, you'll see the Pre-fill successful! message and date/time of pre-fill.

You can pre-fill the tax return as many times as you need. But if you have manually edited the previously pre-filled data, it will be over-written.

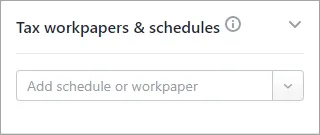

To view the pre-fill data, open the Income details schedule from Tax workpapers & schedules on the right panel.

If you need to pre-fill again, select the Pre-fill from ATO button. This will overwrite any previously edited ATO pre-fill amounts. Confirm the details and then select Pre-fill from ATO again.

You can edit or delete the pre-fill data if required.

After you've checked all the details, the return is ready to validate.

Pre-filling multiple times

You can pre-fill ATO data multiple times for any tax returns created after 1 December 2023. Returns created before this date can be deleted and recreated to enable pre-filling multiple times.

When you pre-fill for the first time, the pre-fill data will be available in the schedules and integrated into the tax return labels.

If you pre-fill for the second time, it will overwrite any previously ATO pre-filled data that you've changed. Any new pre-fill data will be added as a new record. Manually entered data in the schedule will be retained.

Auto creation of schedules

After the pre-fill data is downloaded, the relevant schedules are created automatically and pre-filled with the data from the ATO.

For example, if there's interest income from the ATO pre-fill report, the Income details schedule will be created and the data will be populated in the label in the tax return.

ATO pre-fill report

You can now view the ATO prefill data in a report. We'll save the ATO prefill report in your client's Documents folder for quick access. Note that we don't prefill all the data that is in the report.

Each time you click Prefill from ATO, a new version of the report (including the date and time) will be saved in Documents. If the prefill is not successful, you can't see the report.

FAQs

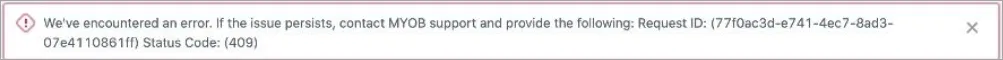

What if the pre-fill fails?

If the pre-fill fails, you'll see an error and need to contact our team for support.