After validating and approving the activity statement, you need to get your client to approve it before lodgment. They can approve with a signature on a paper form, or with a digital signature.

To send an activity statement via the portal, you'll need to have a portal for your client first. If you haven't created a portal for your client yet, see Create client portals.

To send an activity statement to a client via the portal

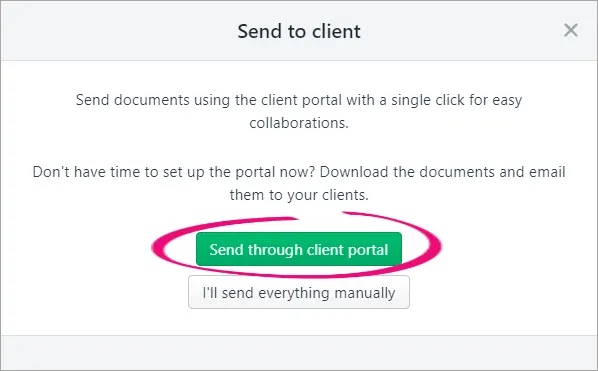

In the client's page, click Send to client.

Click Send through client portal.

The Send to the client portal window appears.

Fill in the details and click Send to client. A task is created with the tax statement attached. This task is assigned to your client in their portal. The status of the activity statement updates to Pending client signature.

Your client will get an email notification with the activity statement. This is an invite for your client to log in and view the activity statement.

After your client digitally signs the documents, you'll be notified that the task is done.

The status of the activity statement changes to Ready to lodge.

To send an activity statement to a client manually

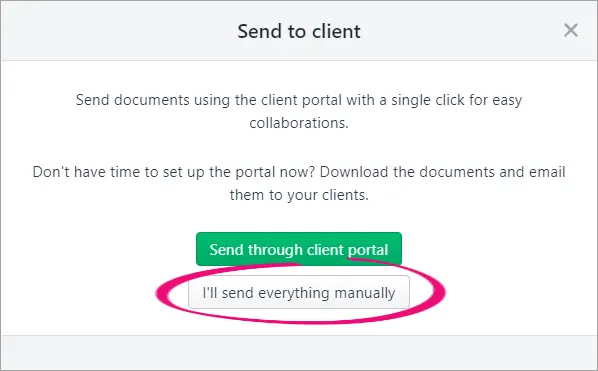

In the client's activity statement page, click Send to client.

Can't see this button? Make sure the status of the return is Ready for client.

Click I'll send everything manually.

The status of the tax return changes to Pending client signature.

On the right of the tax return, click the Download document drop-down and choose Activity statement. The pdf document opens in a new browser tab.

Download the pdf and attach it to an email or print and mail the tax return to your client.

Once your client signs and approves the activity statement, click Client approved and signed. The status changes to Lodge to ATO.