If you provide a service on a prepaid hourly basis, you'll need to set up your company file to track the prepayments and accurately record the sale when the service is performed.

First, you'll create a liability account and two new inventory items: one item for tracking the sale of prepaid hours, and one item for tracking the income generated when prepaid hours are consumed.

Let's take you through the details using the following example:

Example

A business offers piano lessons in prepaid hourly blocks, and students need to pay for 5 hours in advance. Chris, a valued customer, wants to purchase 5 prepaid hours of piano lessons.

But no matter your business' specifics, these steps and principles will work for your prepaid hourly service.

Before you begin

Before recording your prepayments, you first have to create a liability account and two new inventory items.

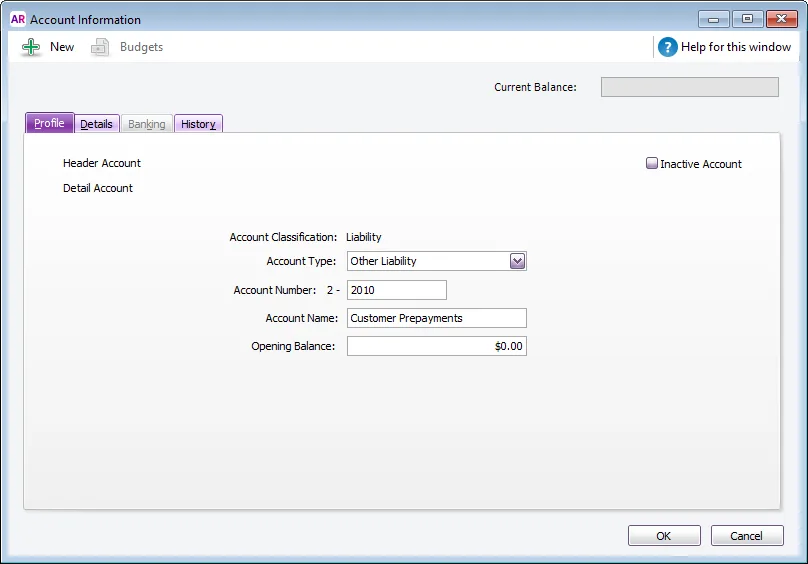

1. Create a prepayment liability account

A customer prepayment represents a value in sales for which the business is liable to supply the customer, so prepayments are recorded as a liability.

Create a new liability account (Lists > Accounts > Liability > New). In the Account Type field, choose Other Liability, and enter an account number that best suits your account list.

2. Set up two inventory items

To record the prepayments, and for automating the general ledger postings, two inventory items need to be created. These items are also used for reporting the prepayment balances.

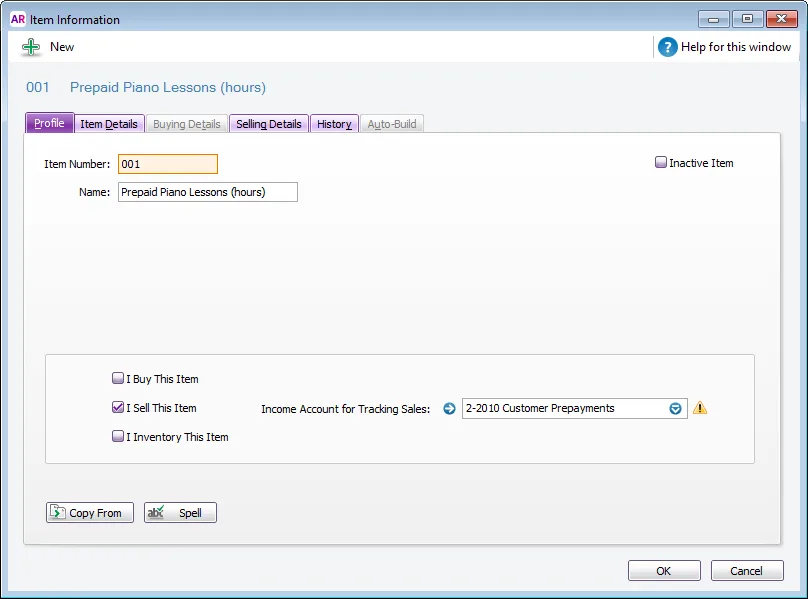

Create an item for tracking the prepayments (Lists > Items > New).

Select the option I Sell This Item and select the liability account created earlier as the Income Account for Tracking Sales (ignore the warning about the type of account selected).

Click the Selling Details tab and specify the Tax/GST Code When Sold. Speak to your accounting advisor if unsure about what to choose for your situation.

Here's our example:

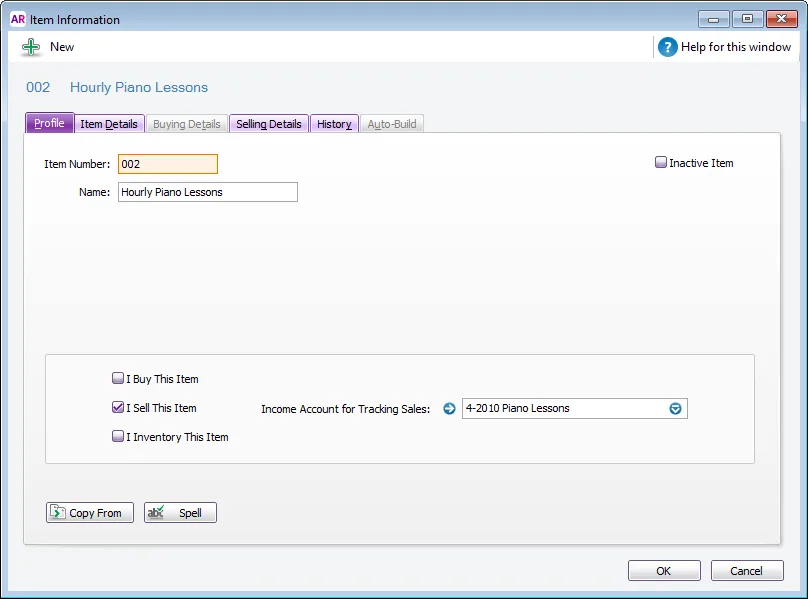

Create an item which will be used to record the income.

Select the option I Sell This Item and select the relevant income account as the Income Account for Tracking Sales. You may need to create this account if it doesn't already exist.

Click the Selling Details tab and specify the Tax/GST Code When Sold. Speak to your accounting advisor if unsure about what to choose for your situation.

Here's our example:

Recording the prepayments

OK, you're all set to record the prepayments. First, you'll invoice the customer prepayment, then when your customer uses their prepaid service. you'll reduce their liability with another item invoice.

To record a prepayment

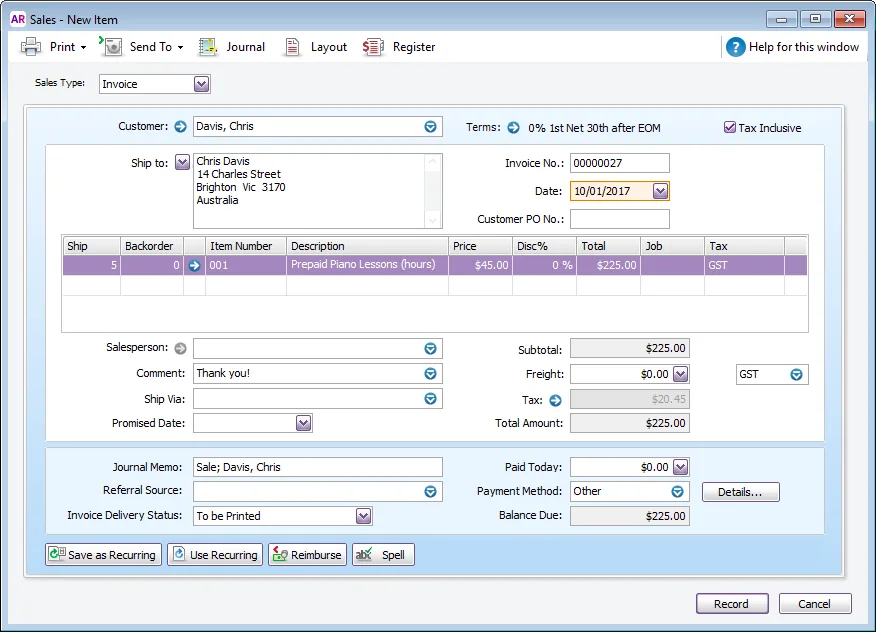

To record the prepayment, create an invoice.

Use the Item layout.

Select the prepayment item.

Enter the prepaid hours in the Ship field.

Here's our example:

Recording this invoice will credit the prepaid item's linked liability account because it represents an amount owed by the business to the customer.

To reduce a prepayment balance

As the customer uses their prepaid service, the prepaid units and its liability need to be reduced and the income for the provided service (piano lessons) needs to be recorded.

To do this, create another Item invoice.

Enter a negative quantity in the Ship field for the prepaid item to represent the number of hours being consumed.

Enter a corresponding positive quantity in the Ship field for the income item.

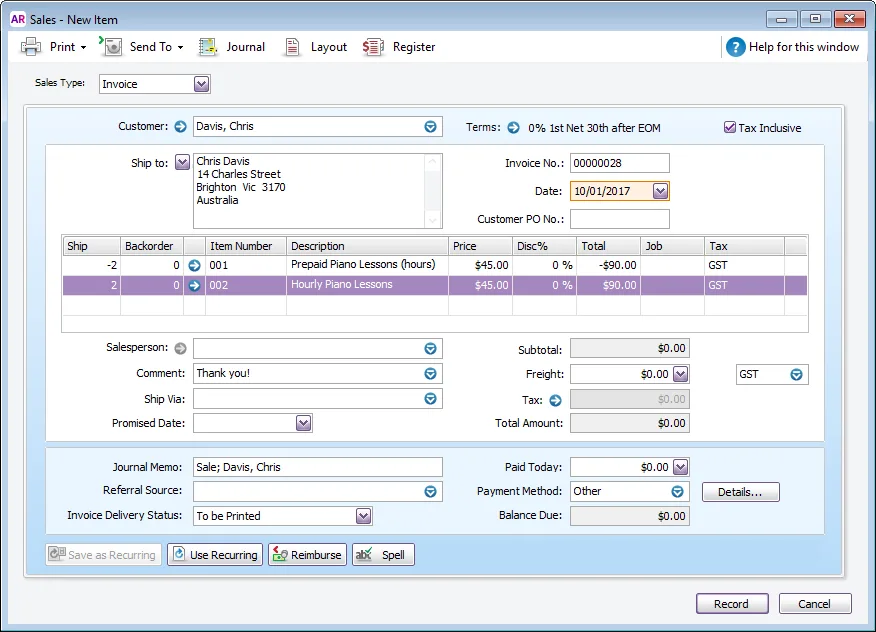

Here's our example where 2 hours of prepaid service is being consumed:

The quantity and dollar amount will then be transferred from the prepaid item to the income item.

Reporting on prepayment balances

If you're ever wondering how many units of prepayment a customer has or owes, or you're after your company liability, all you need to do is create a sales report.

To report on prepayment balances

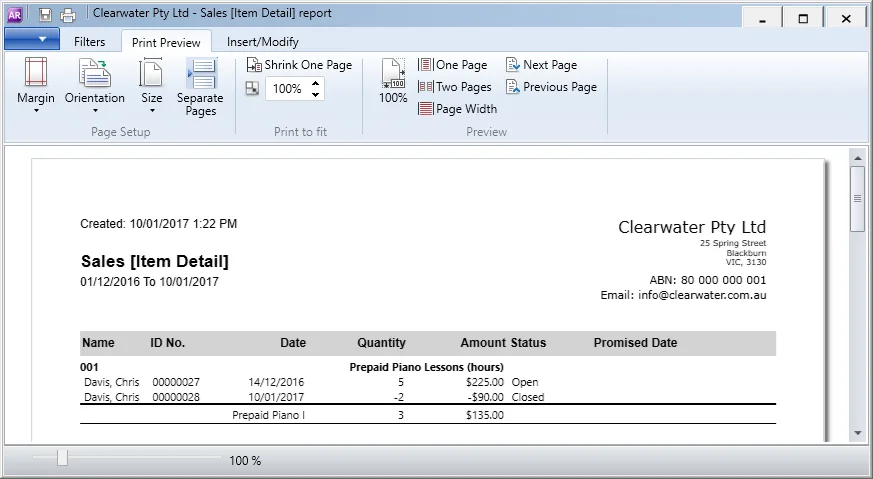

Run the Sales (Item Detail) report (Reports > Index to Reports > Sales > Item > Sales (Item Detail)).

Filter the report as follows:

Specify the applicable date range.

Select the prepayment item from the Items dropdown list.

Select Closed from the Sale Status dropdown list.

Here's our example:

This example report shows:

5 prepaid hours were purchased on 14/12/2016

2 hours were used and have been invoiced on 10/01/2017

There is a balance of 3 prepaid hours resulting in a liability of $135.00.